-

Indonesians reeling from flood devastation plea for global help

Indonesians reeling from flood devastation plea for global help

-

Timeline: How the Bondi Beach mass shooting unfolded

-

On the campaign trail in a tug-of-war Myanmar town

On the campaign trail in a tug-of-war Myanmar town

-

Bondi Beach suspect visited Philippines on Indian passport

-

Kenyan girls still afflicted by genital mutilation years after ban

Kenyan girls still afflicted by genital mutilation years after ban

-

Djokovic to warm up for Australian Open in Adelaide

-

Man bailed for fire protest on track at Hong Kong's richest horse race

Man bailed for fire protest on track at Hong Kong's richest horse race

-

Men's ATP tennis to apply extreme heat rule from 2026

-

10-year-old girl, Holocaust survivors among Bondi Beach dead

10-year-old girl, Holocaust survivors among Bondi Beach dead

-

Steelers edge towards NFL playoffs as Dolphins eliminated

-

Australian PM says 'Islamic State ideology' drove Bondi Beach gunmen

Australian PM says 'Islamic State ideology' drove Bondi Beach gunmen

-

Canada plow-maker can't clear path through Trump tariffs

-

Bank of Japan expected to hike rates to 30-year high

Bank of Japan expected to hike rates to 30-year high

-

Cunningham leads Pistons past Celtics

-

Stokes tells England to 'show a bit of dog' in must-win Adelaide Test

Stokes tells England to 'show a bit of dog' in must-win Adelaide Test

-

EU to unveil plan to tackle housing crisis

-

EU set to scrap 2035 combustion-engine ban in car industry boost

EU set to scrap 2035 combustion-engine ban in car industry boost

-

Australian PM visits Bondi Beach hero in hospital

-

'Easiest scam in the world': Musicians sound alarm over AI impersonators

'Easiest scam in the world': Musicians sound alarm over AI impersonators

-

'Waiting to die': the dirty business of recycling in Vietnam

-

Asian markets retreat ahead of US jobs as tech worries weigh

Asian markets retreat ahead of US jobs as tech worries weigh

-

Famed Jerusalem stone still sells despite West Bank economic woes

-

Trump sues BBC for $10 billion over documentary speech edit

Trump sues BBC for $10 billion over documentary speech edit

-

Chile follows Latin American neighbors in lurching right

-

Will OpenAI be the next tech giant or next Netscape?

Will OpenAI be the next tech giant or next Netscape?

-

Khawaja left out as Australia's Cummins, Lyon back for 3rd Ashes Test

-

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

-

Scheffler wins fourth straight PGA Tour Player of the Year

-

New APAC Partnership with Matter Brings Market Logic Software's Always-On Insights Solutions to Local Brand and Experience Leaders

New APAC Partnership with Matter Brings Market Logic Software's Always-On Insights Solutions to Local Brand and Experience Leaders

-

Security beefed up for Ashes Test after Bondi shooting

-

Wembanyama blocking Knicks path in NBA Cup final

Wembanyama blocking Knicks path in NBA Cup final

-

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

-

Man Utd blow lead three times in 4-4 Bournemouth thriller

Man Utd blow lead three times in 4-4 Bournemouth thriller

-

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

-

Trump 'considering' push to reclassify marijuana as less dangerous

Trump 'considering' push to reclassify marijuana as less dangerous

-

Chiefs coach Reid backing Mahomes recovery after knee injury

-

Trump says Ukraine deal close, Europe proposes peace force

Trump says Ukraine deal close, Europe proposes peace force

-

French minister urges angry farmers to trust cow culls, vaccines

-

Angelina Jolie reveals mastectomy scars in Time France magazine

Angelina Jolie reveals mastectomy scars in Time France magazine

-

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

-

Chile president-elect dials down right-wing rhetoric, vows unity

Chile president-elect dials down right-wing rhetoric, vows unity

-

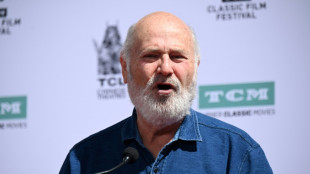

Five Rob Reiner films that rocked, romanced and riveted

-

Rob Reiner: Hollywood giant and political activist

Rob Reiner: Hollywood giant and political activist

-

Observers say Honduran election fair, but urge faster count

-

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

-

Trump condemned for saying critical filmmaker brought on own murder

-

US military to use Trinidad airports, on Venezuela's doorstep

US military to use Trinidad airports, on Venezuela's doorstep

-

Daughter warns China not to make Jimmy Lai a 'martyr'

-

UK defence chief says 'whole nation' must meet global threats

UK defence chief says 'whole nation' must meet global threats

-

Rob Reiner's death: what we know

Wall Street rally fizzles as tariff worries resurface

Wall Street shares fell Thursday as a rally faded over lingering concerns about the economic fallout from President Donald Trump's trade war despite his U-turn on steep new tariffs.

A larger-than-expected drop in US consumer inflation in March added to the pessimistic outlook, as it suggested that uncertainty over Trump's tariff plans has already taken a toll on the world's largest economy.

Investors in response sold off the dollar, which had already taken a hit from the trade war worries, even though slowing inflation would give the Federal Reserve more room to cut interest rates to spur growth.

"Is inflation moving sustainably lower or did businesses and consumers pull in the reins as they brace for an economic slowdown?" said Bret Kenwell, US investment analyst at the eToro trading platform.

"Getting lower inflation due to a material drop in economic activity -- and thereby jeopardising the economy -- isn't the best route to take," he added.

Wall Street indices on Wednesday had posted their biggest one-day gains since 2008 after Trump announced the tariff pause, which had sent stocks lower around the globe in recent sessions.

Asian and European markets staged their own rallies on Thursday.

The shock decision to delay bigger levies on goods from scores of countries by 90 days drove the European Union to put its counter-tariffs on hold.

The trade war fears had also pummelled US Treasuries -- normally considered the safest option in times of crisis -- a sign of how nervous investors had become.

"The bottom line is that the tariff narrative still remains too volatile for comfort, and markets are searching for equilibrium in a sea of uncertainty," said Fawad Razaqzada, a market analyst at StoneX.

Trump nonetheless kept a baseline 10 percent tariff intact and ramped up his trade war with Beijing by hiking duties Chinese goods to 125 percent after facing strong retaliation.

But Chinese markets still benefitted from the relief rally across Asia and Europe on Thursday, also gaining support from optimism that Beijing will unveil fresh stimulus measures to support its economy.

Hong Kong rose more than two percent -- a third day of gains after collapsing more than 13 percent on Monday, its worst trading day since the Asian financial crisis in 1997.

"Crucially, we are currently still on course for a disorderly economic decoupling between the world's two largest economies, with no immediate signs of either US or China backing down," said Jim Reid, an analyst at Deutsche Bank.

US Treasury yields have edged down after a successful auction of $38 billion in notes.

That eased pressure on the bond market, which had fanned worries that investors were losing confidence in the United States.

Tech firms were the standout performers, with Sony, Sharp, Panasonic and SoftBank chalking up double-digit gains, while airlines, car makers and casinos also enjoyed strong buying.

Gold climbed two percent to $3,140 an ounce -- closing in on its record touched last month -- thanks to the weaker dollar and the metal's safe-haven status.

Oil prices dropped after bouncing more than four percent Wednesday, again under pressure from concerns about the global economy and its impact on demand.

- Key figures around 1350 GMT -

New York - Dow: DOWN 1.8 percent at 39,878.20

New York - S&P 500: DOWN 2.1 percent at 5,339.21

New York - Nasdaq: DOWN 2.8 percent at 16,641.78

London - FTSE 100: UP 3.9 percent at 7,979.04 points

Paris - CAC 40: UP 4.9 percent at 7,200.24

Frankfurt - DAX: UP 5.3 percent at 20,704.23

Tokyo - Nikkei 225: UP 9.1 percent at 34,609.00 (close)

Hong Kong - Hang Seng Index: UP 2.1 percent at 20,681.78 (close)

Shanghai - Composite: UP 1.2 percent at 3,223.64 (close)

Euro/dollar: UP at $1.1130 from $1.0948

Dollar/yen: DOWN at 144.80 yen from 147.82 yen on Wednesday

Pound/dollar: UP at $1.2928 from $1.2810

Euro/pound: UP at 86.12 pence from 85.45 pence

West Texas Intermediate: DOWN 4.5 percent at $59.51 per barrel

Brent North Sea Crude: DOWN 4.2 percent at $62.73 per barrel

A.Aguiar--PC