-

Trump sues BBC for $10 billion over documentary speech edit

Trump sues BBC for $10 billion over documentary speech edit

-

Chile follows Latin American neighbors in lurching right

-

Will OpenAI be the next tech giant or next Netscape?

Will OpenAI be the next tech giant or next Netscape?

-

Khawaja left out as Australia's Cummins, Lyon back for 3rd Ashes Test

-

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

-

Scheffler wins fourth straight PGA Tour Player of the Year

-

Security beefed up for Ashes Test after Bondi shooting

Security beefed up for Ashes Test after Bondi shooting

-

Wembanyama blocking Knicks path in NBA Cup final

-

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

-

Man Utd blow lead three times in 4-4 Bournemouth thriller

-

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

-

Trump 'considering' push to reclassify marijuana as less dangerous

-

Chiefs coach Reid backing Mahomes recovery after knee injury

Chiefs coach Reid backing Mahomes recovery after knee injury

-

Trump says Ukraine deal close, Europe proposes peace force

-

French minister urges angry farmers to trust cow culls, vaccines

French minister urges angry farmers to trust cow culls, vaccines

-

Angelina Jolie reveals mastectomy scars in Time France magazine

-

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

-

Chile president-elect dials down right-wing rhetoric, vows unity

-

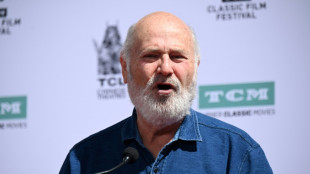

Five Rob Reiner films that rocked, romanced and riveted

Five Rob Reiner films that rocked, romanced and riveted

-

Rob Reiner: Hollywood giant and political activist

-

Observers say Honduran election fair, but urge faster count

Observers say Honduran election fair, but urge faster count

-

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

-

Trump condemned for saying critical filmmaker brought on own murder

Trump condemned for saying critical filmmaker brought on own murder

-

US military to use Trinidad airports, on Venezuela's doorstep

-

Daughter warns China not to make Jimmy Lai a 'martyr'

Daughter warns China not to make Jimmy Lai a 'martyr'

-

UK defence chief says 'whole nation' must meet global threats

-

Rob Reiner's death: what we know

Rob Reiner's death: what we know

-

Zelensky hails 'real progress' in Berlin talks with Trump envoys

-

Toulouse handed two-point deduction for salary cap breach

Toulouse handed two-point deduction for salary cap breach

-

Son arrested for murder of movie director Rob Reiner and wife

-

Stock market optimism returns after tech selloff but Wall Street wobbles

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

In Israel, Sydney attack casts shadow over Hanukkah

-

Athletes to stay in pop-up cabins in the woods at Winter Olympics

-

England seek their own Bradman in bid for historic Ashes comeback

England seek their own Bradman in bid for historic Ashes comeback

-

Decades after Bosman, football's transfer war rages on

-

Ukraine hails 'real progress' in Zelensky's talks with US envoys

Ukraine hails 'real progress' in Zelensky's talks with US envoys

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

Stock market optimism returns after tech sell-off

-

Iran Nobel winner unwell after 'violent' arrest: supporters

-

'Angry' Louvre workers' strike shuts out thousands of tourists

'Angry' Louvre workers' strike shuts out thousands of tourists

-

EU faces key summit on using Russian assets for Ukraine

-

Maresca committed to Chelsea despite outburst

Maresca committed to Chelsea despite outburst

-

Trapped, starving and afraid in besieged Sudan city

-

Messi mania peaks in India's pollution-hit capital

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

Fed official says 'absolutely' ready to intervene in financial markets

The US Federal Reserve is "absolutely" prepared to intervene to help calm nervous financial markets, a senior central bank official said Friday, after President Donald Trump's tariff plans roiled Wall Street.

The US president imposed sweeping import taxes on dozens of countries on April 2, only to abruptly, temporarily roll many of them back to 10 percent in response to turbulence in the stock and bond markets, while leaving China with new tariffs totaling 145 percent.

The Fed would "absolutely be prepared" to deploy its various tools to help stabilize the financial markets if the need arose, Boston Fed President Susan Collins told the Financial Times in an interview published Friday.

Any intervention by the Federal Reserve would depend on "what conditions we were seeing," added Collins, who is one of 12 voting members of the Fed's all-important rate-setting committee this year.

"The higher the tariffs are, the more the potential slowdown in growth as well as elevation and inflation that one would expect," Collins said in a separate interview with Yahoo Finance earlier Friday, adding that she expects inflation to rise "well above" three percent this year, but no "significant" economic downturn.

Her comments indicate she expects price growth to remain stuck firmly above the US central bank's long-term target of two percent, likely preventing the Fed from being able to cut interest rates in the coming months.

- Growth 'below one percent' -

Since Trump's tariffs came into effect earlier this month, Fed officials have been more outspoken than usual about the effects of the government's plans on inflation and growth.

Many have also voiced concerns about long-term inflation expectations, which can cause a vicious cycle of price increases if they are not kept in check.

A widely-referenced consumer sentiment survey published Friday by the University of Michigan noted a sharp drop in consumer confidence, and flagged another worrying rise in both short-term and longer-term inflation expectations.

"Year-ahead inflation expectations surged from 5.0 percent last month to 6.7 percent this month, the highest reading since 1981," the survey noted.

"Long-run inflation expectations climbed from 4.1 percent in March to 4.4 percent in April, reflecting a particularly large jump among independents," it added.

But for now, the University of Michigan's survey on inflation expectations remains an outlier, with financial market measures of inflation expectation still largely pricing in a long-term path closer to the Fed's two percent target.

In a speech in Hot Springs, Arkansas on Friday, St. Louis Fed President Alberto Musalem said "continued vigilance" and "careful monitoring" of the incoming data was needed.

Musalem, a voting member of the Fed's rate-setting committee this year, said that while he still expects a "moderate" pace of economic expansion, the near-term risks were "skewed" toward rising inflation, slower economic growth and a cooler labor market.

"I would be wary of assuming the impact of high tariffs on inflation would be only brief or limited," he said.

On a busy day of speeches from central bank officials, New York Fed President John Williams went further than his colleagues on the bank's rate-setting committee, putting out estimates of how he expects Trump's immigration and tariff policies -- and the uncertainty surrounding them -- to affect the US economy this year.

"I now expect real GDP growth will slow considerably from last year's pace, likely to somewhat below one percent," he told a conference in Puerto Rico.

"With this downshift in the pace of growth... I expect the unemployment rate to rise from its current level of 4.2 percent to between 4.5 and 5 percent over the next year," he said.

Williams added that he expected increased tariffs to "boost inflation this year to somewhere between 3.5 and 4 percent" -- well above the bank's long-term target.

Ferreira--PC