-

Scheffler wins fourth straight PGA Tour Player of the Year

Scheffler wins fourth straight PGA Tour Player of the Year

-

Security beefed up for Ashes Test after Bondi shooting

-

Wembanyama blocking Knicks path in NBA Cup final

Wembanyama blocking Knicks path in NBA Cup final

-

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

-

Man Utd blow lead three times in 4-4 Bournemouth thriller

Man Utd blow lead three times in 4-4 Bournemouth thriller

-

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

-

Trump 'considering' push to reclassify marijuana as less dangerous

Trump 'considering' push to reclassify marijuana as less dangerous

-

Chiefs coach Reid backing Mahomes recovery after knee injury

-

Trump says Ukraine deal close, Europe proposes peace force

Trump says Ukraine deal close, Europe proposes peace force

-

French minister urges angry farmers to trust cow culls, vaccines

-

Angelina Jolie reveals mastectomy scars in Time France magazine

Angelina Jolie reveals mastectomy scars in Time France magazine

-

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

-

Chile president-elect dials down right-wing rhetoric, vows unity

Chile president-elect dials down right-wing rhetoric, vows unity

-

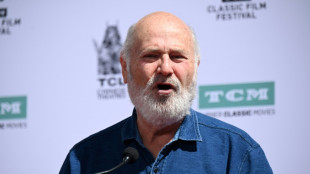

Five Rob Reiner films that rocked, romanced and riveted

-

Rob Reiner: Hollywood giant and political activist

Rob Reiner: Hollywood giant and political activist

-

Observers say Honduran election fair, but urge faster count

-

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

-

Trump condemned for saying critical filmmaker brought on own murder

-

US military to use Trinidad airports, on Venezuela's doorstep

US military to use Trinidad airports, on Venezuela's doorstep

-

Daughter warns China not to make Jimmy Lai a 'martyr'

-

UK defence chief says 'whole nation' must meet global threats

UK defence chief says 'whole nation' must meet global threats

-

Rob Reiner's death: what we know

-

Zelensky hails 'real progress' in Berlin talks with Trump envoys

Zelensky hails 'real progress' in Berlin talks with Trump envoys

-

Toulouse handed two-point deduction for salary cap breach

-

Son arrested for murder of movie director Rob Reiner and wife

Son arrested for murder of movie director Rob Reiner and wife

-

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

-

Athletes to stay in pop-up cabins in the woods at Winter Olympics

Athletes to stay in pop-up cabins in the woods at Winter Olympics

-

England seek their own Bradman in bid for historic Ashes comeback

-

Decades after Bosman, football's transfer war rages on

Decades after Bosman, football's transfer war rages on

-

Ukraine hails 'real progress' in Zelensky's talks with US envoys

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

-

Iran Nobel winner unwell after 'violent' arrest: supporters

Iran Nobel winner unwell after 'violent' arrest: supporters

-

'Angry' Louvre workers' strike shuts out thousands of tourists

-

EU faces key summit on using Russian assets for Ukraine

EU faces key summit on using Russian assets for Ukraine

-

Maresca committed to Chelsea despite outburst

-

Trapped, starving and afraid in besieged Sudan city

Trapped, starving and afraid in besieged Sudan city

-

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

-

Flash flood kills dozens in Morocco town

Flash flood kills dozens in Morocco town

-

'We are angry': Louvre Museum closed as workers strike

Asset flight challenges US safe haven status

The US has long been considered a financial safe haven. The sell-off of the dollar, stocks and Treasury bonds in a spree sparked by panic at President Donald Trump's trade war is starting to raise questions about if that's still true.

- What happened this week to US assets? -

US equities and the greenback have been under pressure for weeks. This week, the volatility spread to the US Treasury market, long considered by global investors to be a refuge.

On Wednesday morning before Trump announced he was pausing many of his most onerous tariffs for 90 days, yields on both the 10-year and 30-year US Treasury bonds spiked suddenly.

Trump's pivot -- which sparked a mammoth equity market rally Wednesday afternoon -- also provided temporary relief to the US Treasury market. But yields began rising again on Thursday.

"There's clearly a flight from US bonds," said Steve Sosnick of Interactive Brokers. "That money is flowing out of the US bond market and doing so very quickly."

JPMorgan Chase CEO Jamie Dimon rejected the notion that US Treasuries were no longer a haven, but acknowledged an impact from recent market volatility.

"It does change the nature a little bit from the certainty point of view," Dimon said Friday, while adding that the United States still stands out as safe "in this turbulent world."

- Why are investors fleeing US bonds? -

The most obvious reason is that the near-term outlook on the US economy has deteriorated, with more economists betting on a recession due to tariff-related inflation and a slowdown in business investment amid policy uncertainty.

That's a big shift from just 80 days ago at the World Economic Forum where "everyone talked about US supremacy," BlackRock CEO Larry Fink said Friday.

Analysts also see the reaction as stemming from Trump's policies such as his "America First" agenda that frays ties with other countries and his proposed tax cuts that could mean bigger US deficits.

"Unconventional policies that gamble with a country's public finances and/or its growth outlook can cause bond investors to question the assumption that government debt is risk free," said a note from Berenberg Economics.

"The breakdown in the relationship between US Treasury yields and the dollar highlights the concerns of investors about Donald Trump's policy agenda," Berenberg said.

Analysts have said some of the selling in US Treasuries is likely from equity investors who need to raise cash quickly. There has also been speculation that the Chinese government could liquidate US Treasury holdings in the US-China trade war, although such a move would also badly hit Beijing.

- What will happen next? -

The safe nature of US Treasury bonds is connected to the reserve currency status of the dollar, a feature that allows the United States to operate with much larger fiscal deficits than other countries.

Since Trump's inauguration, the euro has risen 10 percent against the greenback.

Still there is very little talk of a shift in the dollar's status anytime soon. The greenback is the currency in which oil and other global commodities trade. Central banks around the world will continue to hold assets in dollars and US Treasuries.

"There will be scarring impacts from this, but I don't think it's going to dislocate the dollar as the de facto global currency," said Will Compernolle of FHN Financial. "I just don't see any other alternative for now."

BlackRock's Fink remains bullish on the United States long-term, noting planned investments in artificial intelligence and infrastructure that will fuel growth.

Trump policies such as tax cuts and deregulation will "unlock an amazing amount of private capital," predicted Fink, who believes this upbeat future has been "obscured" by tariffs.

Morgan Stanley CEO Ted Pick said corporate deals could soon pick up, viewing Trump's proposed tax cuts and deregulation as catalysts that may allow clients to say "we will go forward."

P.Cavaco--PC