-

Several wounded in clashes at Albania opposition rally

Several wounded in clashes at Albania opposition rally

-

Chelsea's draw with Leeds 'bitter pill' for Rosenior

-

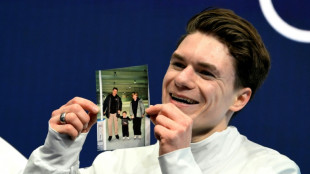

'On autopilot': US skate star Malinin nears more Olympic gold

'On autopilot': US skate star Malinin nears more Olympic gold

-

Carrick frustrated by Man Utd's lack of sharpness in West Ham draw

-

Frank confident of keeping Spurs job despite Newcastle defeat

Frank confident of keeping Spurs job despite Newcastle defeat

-

James's All-NBA streak ends as Lakers rule superstar out of Spurs clash

-

Anti-Khamenei slogans in Tehran on eve of revolution anniversary: social media footage

Anti-Khamenei slogans in Tehran on eve of revolution anniversary: social media footage

-

Colombian senator kidnapped, president targeted in election run-up

-

Britney Spears sells rights to her music catalog: US media

Britney Spears sells rights to her music catalog: US media

-

West Ham end Man Utd's winning run, Spurs sink to 16th

-

US skate star Malinin leads after short programme in Olympics

US skate star Malinin leads after short programme in Olympics

-

Man Utd's Sesko strikes late to rescue West Ham draw

-

Shiffrin flops at Winter Olympics as helmet row grows

Shiffrin flops at Winter Olympics as helmet row grows

-

Celtics' Tatum practices with G League team but injury return uncertain

-

Gisele Pelicot publishes memoirs after rape trial ordeal

Gisele Pelicot publishes memoirs after rape trial ordeal

-

Newcastle beat sorry Spurs to leave Frank on the brink

-

'Outrage' as LGBTQ Pride flag removed from Stonewall monument

'Outrage' as LGBTQ Pride flag removed from Stonewall monument

-

Chappell Roan leaves agency headed by embattled 2028 Olympic chief

-

Venezuelan authorities move Machado ally to house arrest

Venezuelan authorities move Machado ally to house arrest

-

YouTube rejects addiction claims in landmark social media trial

-

Google turns to century-long debt to build AI

Google turns to century-long debt to build AI

-

'I felt guided by them': US skater Naumov remembers parents at Olympics

-

Till death do us bark: Brazilian state lets pets be buried with owners

Till death do us bark: Brazilian state lets pets be buried with owners

-

'Confident' Pakistan ready for India blockbuster after USA win

-

Latam-GPT: a Latin American AI to combat US-centric bias

Latam-GPT: a Latin American AI to combat US-centric bias

-

Gauff dumped out of Qatar Open, Swiatek, Rybakina through

-

Paris officers accused of beating black producer to stand trial in November

Paris officers accused of beating black producer to stand trial in November

-

Istanbul bars rock bands accused of 'satanism'

-

Olympic bronze medal biathlete confesses affair on live TV

Olympic bronze medal biathlete confesses affair on live TV

-

US commerce chief admits Epstein Island lunch but denies closer ties

-

Mayor of Ecuador's biggest city arrested for money laundering

Mayor of Ecuador's biggest city arrested for money laundering

-

Farhan, spinners lead Pakistan to easy USA win in T20 World Cup

-

Stocks mixed as muted US retail sales spur caution

Stocks mixed as muted US retail sales spur caution

-

Macron wants more EU joint borrowing: Could it happen?

-

Shiffrin flops at Winter Olympics as helmet row simmers

Shiffrin flops at Winter Olympics as helmet row simmers

-

No excuses for Shiffrin after Olympic team combined flop

-

Pool on wheels brings swim lessons to rural France

Pool on wheels brings swim lessons to rural France

-

Europe's Ariane 6 to launch Amazon constellation satellites into orbit

-

Could the digital euro get a green light in 2026?

Could the digital euro get a green light in 2026?

-

Spain's Telefonica sells Chile unit in Latin America pullout

-

'We've lost everything': Colombia floods kill 22

'We've lost everything': Colombia floods kill 22

-

Farhan propels Pakistan to 190-9 against USA in T20 World Cup

-

US to scrap cornerstone of climate regulation this week

US to scrap cornerstone of climate regulation this week

-

Nepal call for India, England, Australia to play in Kathmandu

-

Stocks rise but lacklustre US retail sales spur caution

Stocks rise but lacklustre US retail sales spur caution

-

Olympic chiefs let Ukrainian athlete wear black armband at Olympics after helmet ban

-

French ice dancers poised for Winter Olympics gold amid turmoil

French ice dancers poised for Winter Olympics gold amid turmoil

-

Norway's Ruud wins error-strewn Olympic freeski slopestyle

-

More Olympic pain for Shiffrin as Austria win team combined

More Olympic pain for Shiffrin as Austria win team combined

-

Itoje returns to captain England for Scotland Six Nations clash

Stocks retreat as US hits Nvidia chip export to China

European and Asian stock markets mostly retreated Wednesday after the US government imposed restrictions on exports of a key Nvidia chip to China, the latest trade war salvo between the world's biggest economies.

Nvidia late Tuesday notified regulators that it expects a $5.5 billion hit this quarter owing to a new US licensing requirement on the chip it can legally sell in the Asian country.

The company at the heart of helping to power artificial intelligence said it must obtain licenses to export its H20 chips to China because of concerns they may be used in supercomputers there.

President Donald Trump's decision over Nvidia is "signalling a tech-led decline for US equities" when Wall Street opens, noted Joshua Mahony, analyst at trading group Scope Markets.

After a relatively peaceful couple of days on markets following last week's tariff-fuelled ructions, investors were once again on the defensive, sending safe haven gold above $3,300 an ounce for the first time.

Nvidia shares tumbled around six percent in after-market trade, and its Asian suppliers were also hit.

Trump has also kicked off an investigation that could see tariffs imposed on critical minerals such as rare earths, which are used in a wide range of products including smartphones, wind turbines and electric vehicle motors.

"Nvidia dropped the mic, revealing fresh export curbs on AI gear headed to China," said Stephen Innes at SPI Asset Management.

"Then came the other shoe: Trump ordering a new probe into tariffs on critical minerals. Boom -- just like that, we're back in whiplash mode.

"Welcome to the new normal: one step forward, two tariff probes back," added Innes.

In Europe, London's benchmark FTSE 100 stocks index was down about 0.5 percent around midday, even as official data showed UK inflation slowed more than expected in March.

Paris and Frankfurt shed a similar amount.

The dollar slid once more against main rivals, helping gold to reach yet another fresh record high, this time at $3,317.75.

Oil prices rose nearly one percent after recent sharp falls on fears that the tariffs will dampen global economic growth.

However, cheaper oil could help put on lid on inflation, analysts said.

Trump's most recent moves mark the latest salvo in an increasingly nasty row that has seen Washington and Beijing hit each other with eye-watering tariffs.

China did little to soothe worries Wednesday by saying US levies were putting pressure on its economy, even if official data showed it expanded more than expected in the first quarter.

Beijing told Washington to "stop threatening and blackmailing".

A decision by Hong Kong's postal service to stop shipping US-bound goods in response to "bullying" levies added to the unease.

- Key figures around 1035 GMT -

London - FTSE 100: DOWN 0.4 percent at 8,220.27 points

Paris - CAC 40: DOWN 0.5 percent at 7,295.34

Frankfurt - DAX: DOWN 0.5 percent at 21,150.31

Tokyo - Nikkei 225: DOWN 1.0 percent at 33,920.40 (close)

Hong Kong - Hang Seng Index: DOWN 1.9 percent at 21,056.98 (close)

Shanghai - Composite: UP 0.3 percent at 3,276.00 (close)

New York - Dow: UP 0.4 percent at 40,368.96 (close)

Euro/dollar: UP at $1.1369 from $1.1291 on Tuesday

Pound/dollar: UP at $1.3272 from $1.3232

Dollar/yen: DOWN at 142.66 yen from 143.18 yen

Euro/pound: UP at 85.69 pence from 85.30 pence

Brent North Sea Crude: UP 0.9 percent at $65.23 per barrel

West Texas Intermediate: UP 0.9 percent at $61.87 per barrel

burs-bcp/lth

S.Pimentel--PC