-

Several wounded in clashes at Albania opposition rally

Several wounded in clashes at Albania opposition rally

-

Chelsea's draw with Leeds 'bitter pill' for Rosenior

-

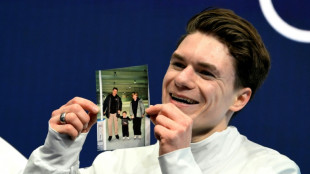

'On autopilot': US skate star Malinin nears more Olympic gold

'On autopilot': US skate star Malinin nears more Olympic gold

-

Carrick frustrated by Man Utd's lack of sharpness in West Ham draw

-

Frank confident of keeping Spurs job despite Newcastle defeat

Frank confident of keeping Spurs job despite Newcastle defeat

-

James's All-NBA streak ends as Lakers rule superstar out of Spurs clash

-

Anti-Khamenei slogans in Tehran on eve of revolution anniversary: social media footage

Anti-Khamenei slogans in Tehran on eve of revolution anniversary: social media footage

-

Colombian senator kidnapped, president targeted in election run-up

-

Britney Spears sells rights to her music catalog: US media

Britney Spears sells rights to her music catalog: US media

-

West Ham end Man Utd's winning run, Spurs sink to 16th

-

US skate star Malinin leads after short programme in Olympics

US skate star Malinin leads after short programme in Olympics

-

Man Utd's Sesko strikes late to rescue West Ham draw

-

Shiffrin flops at Winter Olympics as helmet row grows

Shiffrin flops at Winter Olympics as helmet row grows

-

Celtics' Tatum practices with G League team but injury return uncertain

-

Gisele Pelicot publishes memoirs after rape trial ordeal

Gisele Pelicot publishes memoirs after rape trial ordeal

-

Newcastle beat sorry Spurs to leave Frank on the brink

-

'Outrage' as LGBTQ Pride flag removed from Stonewall monument

'Outrage' as LGBTQ Pride flag removed from Stonewall monument

-

Chappell Roan leaves agency headed by embattled 2028 Olympic chief

-

Venezuelan authorities move Machado ally to house arrest

Venezuelan authorities move Machado ally to house arrest

-

YouTube rejects addiction claims in landmark social media trial

-

Google turns to century-long debt to build AI

Google turns to century-long debt to build AI

-

'I felt guided by them': US skater Naumov remembers parents at Olympics

-

Till death do us bark: Brazilian state lets pets be buried with owners

Till death do us bark: Brazilian state lets pets be buried with owners

-

'Confident' Pakistan ready for India blockbuster after USA win

-

Latam-GPT: a Latin American AI to combat US-centric bias

Latam-GPT: a Latin American AI to combat US-centric bias

-

Gauff dumped out of Qatar Open, Swiatek, Rybakina through

-

Paris officers accused of beating black producer to stand trial in November

Paris officers accused of beating black producer to stand trial in November

-

Istanbul bars rock bands accused of 'satanism'

-

Olympic bronze medal biathlete confesses affair on live TV

Olympic bronze medal biathlete confesses affair on live TV

-

US commerce chief admits Epstein Island lunch but denies closer ties

-

Mayor of Ecuador's biggest city arrested for money laundering

Mayor of Ecuador's biggest city arrested for money laundering

-

Farhan, spinners lead Pakistan to easy USA win in T20 World Cup

-

Stocks mixed as muted US retail sales spur caution

Stocks mixed as muted US retail sales spur caution

-

Macron wants more EU joint borrowing: Could it happen?

-

Shiffrin flops at Winter Olympics as helmet row simmers

Shiffrin flops at Winter Olympics as helmet row simmers

-

No excuses for Shiffrin after Olympic team combined flop

-

Pool on wheels brings swim lessons to rural France

Pool on wheels brings swim lessons to rural France

-

Europe's Ariane 6 to launch Amazon constellation satellites into orbit

-

Could the digital euro get a green light in 2026?

Could the digital euro get a green light in 2026?

-

Spain's Telefonica sells Chile unit in Latin America pullout

-

'We've lost everything': Colombia floods kill 22

'We've lost everything': Colombia floods kill 22

-

Farhan propels Pakistan to 190-9 against USA in T20 World Cup

-

US to scrap cornerstone of climate regulation this week

US to scrap cornerstone of climate regulation this week

-

Nepal call for India, England, Australia to play in Kathmandu

-

Stocks rise but lacklustre US retail sales spur caution

Stocks rise but lacklustre US retail sales spur caution

-

Olympic chiefs let Ukrainian athlete wear black armband at Olympics after helmet ban

-

French ice dancers poised for Winter Olympics gold amid turmoil

French ice dancers poised for Winter Olympics gold amid turmoil

-

Norway's Ruud wins error-strewn Olympic freeski slopestyle

-

More Olympic pain for Shiffrin as Austria win team combined

More Olympic pain for Shiffrin as Austria win team combined

-

Itoje returns to captain England for Scotland Six Nations clash

The Trump adviser who wants to rewrite the global financial system

One of the architects of US President Donald Trump's tariff blitz has advocated a shake-up of the global trade and financial systems, centred on a radical strategy to weaken the dollar.

Stephen Miran, chairman of the White House Council of Economic Advisers, outlined his idea in a 41-page essay titled "A User's Guide to Restructuring the Global Trading System".

Little known until now, the Harvard-trained economist's paper -- published in November after Trump's election win -- has garnered attention in recent weeks due to its emphasis on tariffs and a weak dollar.

Some analysts say the essay provides the intellectual rationale for Trump's trade war.

- 'Mar-a-Lago Accord' -

For Miran, tariffs and moving away from a strong dollar could have "the broadest ramifications of any policies in decades, fundamentally reshaping the global trade and financial systems".

Miran's essay argues that a strong dollar makes US exports less competitive and imports cheaper, while handicapping American manufacturers as it discourages investing in building factories in the United States.

"The deep unhappiness with the prevailing economic order is rooted in persistent overvaluation of the dollar and asymmetric trade conditions," Miran wrote.

The dollar is traditionally a safe haven currency for investors in the event of war or crisis, and it has slumped in recent days over concerns about Trump's trade policies.

It is used by used by foreign companies and governments to buy oil, aircraft and other goods at dollar-denominated prices.

The strong dollar tends to make US government bonds attractive to foreign investors, giving the United States an almost unlimited capacity to borrow.

Miran called for a pact similar to that of the 1985 Plaza Accord, signed in New York by the United States, Britain, France, West Germany and Japan.

The landmark agreement, named after the New York hotel where it was inked, allowed for a controlled weakening of the then-overvalued dollar to reduce the US trade deficit.

Miran said the new agreement could be called the "Mar-a-Lago Accord", after Trump's Florida resort.

"President Trump views tariffs as generating negotiating leverage for making deals," Miran wrote.

"It is easier to imagine that after a series of punitive tariffs, trading partners like Europe and China become more receptive to some manner of currency accord in exchange for a reduction of tariffs."

- Replenish government coffers -

To lower the value of the US currency, Miran said US partners could sell dollars in their possession.

Another proposal would be to swap the Treasury bonds held by creditors -- usually borrowed over a few years -- for 100-year debt.

As a result, the US would not have to repay them regularly, and would limit the potential rise in interest rates caused by fears over such a financial upheaval on the markets, Miran said.

He also suggested imposing a "user fee" on foreign official holders of Treasury securities, as a way to replenish government coffers.

Countries that cooperate could see their tariffs lowered and could continue to rely on the US military umbrella, he said.

- 'De facto default' -

Vicky Redwood, senior economic adviser at UK-based Capital Economics, said forcing US lenders to swap bonds would amount to a "de facto default on US debt".

Charging a user fee on Treasury repayments abroad seemed "highly unrealistic", experts at Swiss bank Pictet said in a note, and "could be interpreted as breach of contract, or akin to a default".

For Eric Monnet, professor at the Paris School of Economics, it all depends on the content of the contract.

"If the US manages to get (other) countries to agree, legally it can be done without default," he said at a recent conference.

- A risky plan -

Economists have largely been very critical of Miran's ideas.

"If the US really does want to reduce its trade deficit, there are better ways to do it," Redwood said.

She also pointed to the risk of soaring US borrowing rates, which have taken off in recent days, a sign of growing concern about US economic policy.

The potential "Mar-a-Lago Accord is misguided from both a theoretical and practical perspective", Pictet experts wrote in their note, questioning Miran's thinking on the origins of the dollar's overvaluation.

Adam Slater, an economist at British firm Oxford Economics, told AFP that in order to significantly narrow the trade deficit, the dollar would likely have to depreciate by more than 20 percent.

P.Serra--PC