-

Chelsea's draw with Leeds 'bitter pill' for Rosenior

Chelsea's draw with Leeds 'bitter pill' for Rosenior

-

'On autopilot': US skate star Malinin nears more Olympic gold

-

Carrick frustrated by Man Utd's lack of sharpness in West Ham draw

Carrick frustrated by Man Utd's lack of sharpness in West Ham draw

-

Frank confident of keeping Spurs job despite Newcastle defeat

-

James's All-NBA streak ends as Lakers rule superstar out of Spurs clash

James's All-NBA streak ends as Lakers rule superstar out of Spurs clash

-

Anti-Khamenei slogans in Tehran on eve of revolution anniversary: social media footage

-

Colombian senator kidnapped, president targeted in election run-up

Colombian senator kidnapped, president targeted in election run-up

-

Britney Spears sells rights to her music catalog: US media

-

West Ham end Man Utd's winning run, Spurs sink to 16th

West Ham end Man Utd's winning run, Spurs sink to 16th

-

US skate star Malinin leads after short programme in Olympics

-

Man Utd's Sesko strikes late to rescue West Ham draw

Man Utd's Sesko strikes late to rescue West Ham draw

-

Shiffrin flops at Winter Olympics as helmet row grows

-

Celtics' Tatum practices with G League team but injury return uncertain

Celtics' Tatum practices with G League team but injury return uncertain

-

Gisele Pelicot publishes memoirs after rape trial ordeal

-

Newcastle beat sorry Spurs to leave Frank on the brink

Newcastle beat sorry Spurs to leave Frank on the brink

-

'Outrage' as LGBTQ Pride flag removed from Stonewall monument

-

Chappell Roan leaves agency headed by embattled 2028 Olympic chief

Chappell Roan leaves agency headed by embattled 2028 Olympic chief

-

Venezuelan authorities move Machado ally to house arrest

-

YouTube rejects addiction claims in landmark social media trial

YouTube rejects addiction claims in landmark social media trial

-

Google turns to century-long debt to build AI

-

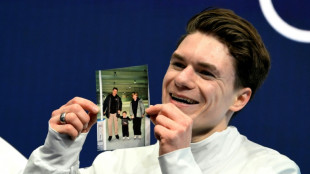

'I felt guided by them': US skater Naumov remembers parents at Olympics

'I felt guided by them': US skater Naumov remembers parents at Olympics

-

Till death do us bark: Brazilian state lets pets be buried with owners

-

'Confident' Pakistan ready for India blockbuster after USA win

'Confident' Pakistan ready for India blockbuster after USA win

-

Latam-GPT: a Latin American AI to combat US-centric bias

-

Gauff dumped out of Qatar Open, Swiatek, Rybakina through

Gauff dumped out of Qatar Open, Swiatek, Rybakina through

-

Paris officers accused of beating black producer to stand trial in November

-

Istanbul bars rock bands accused of 'satanism'

Istanbul bars rock bands accused of 'satanism'

-

Olympic bronze medal biathlete confesses affair on live TV

-

US commerce chief admits Epstein Island lunch but denies closer ties

US commerce chief admits Epstein Island lunch but denies closer ties

-

Mayor of Ecuador's biggest city arrested for money laundering

-

Farhan, spinners lead Pakistan to easy USA win in T20 World Cup

Farhan, spinners lead Pakistan to easy USA win in T20 World Cup

-

Stocks mixed as muted US retail sales spur caution

-

Macron wants more EU joint borrowing: Could it happen?

Macron wants more EU joint borrowing: Could it happen?

-

Shiffrin flops at Winter Olympics as helmet row simmers

-

No excuses for Shiffrin after Olympic team combined flop

No excuses for Shiffrin after Olympic team combined flop

-

Pool on wheels brings swim lessons to rural France

-

Europe's Ariane 6 to launch Amazon constellation satellites into orbit

Europe's Ariane 6 to launch Amazon constellation satellites into orbit

-

Could the digital euro get a green light in 2026?

-

Spain's Telefonica sells Chile unit in Latin America pullout

Spain's Telefonica sells Chile unit in Latin America pullout

-

'We've lost everything': Colombia floods kill 22

-

Farhan propels Pakistan to 190-9 against USA in T20 World Cup

Farhan propels Pakistan to 190-9 against USA in T20 World Cup

-

US to scrap cornerstone of climate regulation this week

-

Nepal call for India, England, Australia to play in Kathmandu

Nepal call for India, England, Australia to play in Kathmandu

-

Stocks rise but lacklustre US retail sales spur caution

-

Olympic chiefs let Ukrainian athlete wear black armband at Olympics after helmet ban

Olympic chiefs let Ukrainian athlete wear black armband at Olympics after helmet ban

-

French ice dancers poised for Winter Olympics gold amid turmoil

-

Norway's Ruud wins error-strewn Olympic freeski slopestyle

Norway's Ruud wins error-strewn Olympic freeski slopestyle

-

More Olympic pain for Shiffrin as Austria win team combined

-

Itoje returns to captain England for Scotland Six Nations clash

Itoje returns to captain England for Scotland Six Nations clash

-

Sahara celebrates desert cultures at Chad festival

Trump's tariff storm a threat to dollar's dominance?

As President Donald Trump's tariffs threaten the US economy, questions are being asked about how long the dollar can maintain its status as the world's key trading and reserve currency.

AFP examines the greenback's current situation and outook:

- Is the dollar still all-powerful? -

The dollar, whose strength is based on the economic and political power of the United States, is traditionally considered a preferred safe haven in times of crisis or conflict.

Almost 58 percent of foreign exchange reserves together held by the world's central banks were denominated in dollars as of the final quarter last year, according to the International Monetary Fund.

That compares with 71 percent in 1999, with the drop attributed to rising competition from smaller currencies.

Roughly half of all global transactions by value are currently in dollars, compared with around 22 percent for the euro, seven percent for the pound sterling, and four percent for the Chinese yuan, according February data from international payments facilitator Swift.

Many strategic commodities, such as oil, are quoted in the greenback, reinforcing its central role across global trade.

However, the recent decline in the dollar's value suggests its safe haven status "has at least temporarily disappeared" in favour of the Swiss franc, yen and gold, Ryan Chahrour, a professor of economics at Cornell University, told AFP.

- 'Exorbitant privilege'? -

Before the dollar took charge, sterling dominated international trade, driven by the UK's status as an industrial powerhouse beginning in the 19th century.

However, following the Second World War, a ruined Europe desperately needed liquidity, while the United States found itself in a position of strength.

The dollar emerged as the new reference currency under the Bretton Woods accords of 1944, which laid the foundations for the current international monetary system.

Many countries have since chosen to peg their currency to the US unit, while demand for dollars has allowed the world's biggest economy to borrow freely, theoretically without limits, with its debt largely owed to foreign investors.

Former French finance minister Valery Giscard d'Estaing described this economic advantage enjoyed by the United States as an "exorbitant privilege", ahead of becoming French president in the 1970s.

On the other hand, the relative strength of the greenback despite recent turmoil makes American exports more expensive.

To counter this, Trump advisor Stephen Miran is considering major global reform aimed at devaluing the US currency.

At the same time, several central banks have begun a process of "de-dollarising" their reserves.

By using the dollar extensively, countries and companies expose themselves to US sanctions -- as illustrated by the freezing of Russia's foreign exchange reserves abroad following its invasion of Ukraine in early 2022.

- Why is Trump shaking the dollar? -

The dollar initially gained on news of Trump's tariffs owing to concerns the levies will push up inflation.

However, that has given way to rising fears that global growth will be impacted, causing recent heavy falls for oil prices that in turn have reduced inflationary pressures.

Expectations that the US Federal Reserve could cut interest rates to prop up the economy are also weighing on the dollar.

Another fear is that the Fed is no longer fulfilling its role as lender of last resort, as it limits the availability of dollars to other central banks.

Trump is contributing to "undermining the foundations of dollar dominance", tarnishing the reputation of the United States, believes Mark Sobel, a former senior US Treasury official.

He argues that in addition to weakening the country's economic strength through his trade policy, Trump is challenging the rule of law.

"The United States is not acting like a reliable partner or trusted ally," he told AFP.

- What alternatives? -

Sobel said it is "premature to say dollar dominance is going away or the dollar has lost its kind of global status because there aren't alternatives".

Stefan Lewellen, assistant professor of finance at Pennsylvania State University, said it is not yet time to write the currency's "obituary".

Looking at why the euro is not ready to take the helm, he added that the European single currency is "fundamentally still governed by individual nations that have mixed incentives to cooperate".

Among other units, he said the Canadian and Australian dollars, as well as the Swiss franc, are limited by the modest size of their markets.

As for the yuan, it remains under Beijing's strict control, owing to the lack of free convertibility and restrictions on capital movements.

V.Fontes--PC