-

Munsey leads Scotland to 207-4 against Italy at T20 World Cup

Munsey leads Scotland to 207-4 against Italy at T20 World Cup

-

Japan restarts world's biggest nuclear plant again

-

Bangladesh poll rivals rally on final day of campaign

Bangladesh poll rivals rally on final day of campaign

-

Third impeachment case filed against Philippine VP Duterte

-

Wallaby winger Nawaqanitawase heads to Japan

Wallaby winger Nawaqanitawase heads to Japan

-

Thailand's Anutin rides wave of nationalism to election victory

-

Venezuela's Machado says ally kidnapped by armed men after his release

Venezuela's Machado says ally kidnapped by armed men after his release

-

Maye longs for do-over as record Super Bowl bid ends in misery

-

Seahawks' Walker rushes to Super Bowl MVP honors

Seahawks' Walker rushes to Super Bowl MVP honors

-

Darnold basks in 'special journey' to Super Bowl glory

-

Japan's Takaichi may struggle to soothe voters and markets

Japan's Takaichi may struggle to soothe voters and markets

-

Seahawks soar to Super Bowl win over Patriots

-

'Want to go home': Indonesian crew abandoned off Africa demand wages

'Want to go home': Indonesian crew abandoned off Africa demand wages

-

Asian stocks track Wall St rally as Tokyo hits record on Takaichi win

-

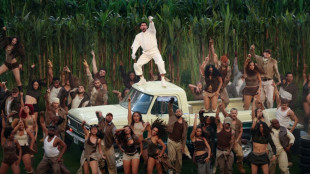

Bad Bunny celebrates Puerto Rico in joyous Super Bowl halftime show

Bad Bunny celebrates Puerto Rico in joyous Super Bowl halftime show

-

Three prominent opposition figures released in Venezuela

-

Israeli president says 'we shall overcome this evil' at Bondi Beach

Israeli president says 'we shall overcome this evil' at Bondi Beach

-

'Flood' of disinformation ahead of Bangladesh election

-

Arguments to begin in key US social media addiction trial

Arguments to begin in key US social media addiction trial

-

UK-Based Vesalic Limited Emerges from Stealth with Landmark Discovery of Potential Non-CNS Driver of Motor Neuron Diseases, including ALS, and Breakthrough Therapeutic and Diagnostic Opportunities

-

Gotterup tops Matsuyama in playoff to win Phoenix Open

Gotterup tops Matsuyama in playoff to win Phoenix Open

-

New Zealand's Christchurch mosque killer appeals conviction

-

Leonard's 41 leads Clippers over T-Wolves, Knicks cruise

Leonard's 41 leads Clippers over T-Wolves, Knicks cruise

-

Trump says China's Xi to visit US 'toward the end of the year'

-

Real Madrid edge Valencia to stay on Barca's tail, Atletico slump

Real Madrid edge Valencia to stay on Barca's tail, Atletico slump

-

Malinin keeps USA golden in Olympic figure skating team event

-

Lebanon building collapse toll rises to 9: civil defence

Lebanon building collapse toll rises to 9: civil defence

-

Real Madrid keep pressure on Barca with tight win at Valencia

-

PSG trounce Marseille to move back top of Ligue 1

PSG trounce Marseille to move back top of Ligue 1

-

Hong Kong to sentence media mogul Jimmy Lai in national security trial

-

Lillard will try to match record with third NBA 3-Point title

Lillard will try to match record with third NBA 3-Point title

-

Vonn breaks leg as crashes out in brutal end to Olympic dream

-

Malinin enters the fray as Japan lead USA in Olympics team skating

Malinin enters the fray as Japan lead USA in Olympics team skating

-

Thailand's Anutin readies for coalition talks after election win

-

Fans arrive for Patriots-Seahawks Super Bowl as politics swirl

Fans arrive for Patriots-Seahawks Super Bowl as politics swirl

-

'Send Help' repeats as N.America box office champ

-

Japan close gap on USA in Winter Olympics team skating event

Japan close gap on USA in Winter Olympics team skating event

-

Liverpool improvement not reflected in results, says Slot

-

Japan PM Takaichi basks in election triumph

Japan PM Takaichi basks in election triumph

-

Machado's close ally released in Venezuela

-

Dimarco helps Inter to eight-point lead in Serie A

Dimarco helps Inter to eight-point lead in Serie A

-

Man City 'needed' to beat Liverpool to keep title race alive: Silva

-

Czech snowboarder Maderova lands shock Olympic parallel giant slalom win

Czech snowboarder Maderova lands shock Olympic parallel giant slalom win

-

Man City fight back to end Anfield hoodoo and reel in Arsenal

-

Diaz treble helps Bayern crush Hoffenheim and go six clear

Diaz treble helps Bayern crush Hoffenheim and go six clear

-

US astronaut to take her 3-year-old's cuddly rabbit into space

-

Israeli president to honour Bondi Beach attack victims on Australia visit

Israeli president to honour Bondi Beach attack victims on Australia visit

-

Apologetic Turkish center Sengun replaces Shai as NBA All-Star

-

Romania, Argentina leaders invited to Trump 'Board of Peace' meeting

Romania, Argentina leaders invited to Trump 'Board of Peace' meeting

-

Kamindu heroics steer Sri Lanka past Ireland in T20 World Cup

US stocks rally fades after China trade framework, oil prices jump

Wall Street stocks mostly fell Wednesday despite positive movement in the US-China trade conflict, while oil prices rallied on growing tensions between Washington and Tehran.

Following two days of talks in London, top US and Chinese negotiators announced a "framework" agreement late Tuesday that included Chinese concessions on rare earth materials along with Washington allowing Chinese students to study at US universities.

But stocks fell in what Briefing.com called a "sell the news" response to the announcement, which it also dismissed as short of "groundbreaking."

"The two sides agreed to implement what was already agreed upon during a mid-May meeting in Switzerland," Briefing.com said.

Treasury Secretary Scott Bessent warned a broader deal with China would take a "longer process," saying it was possible to rebalance economic ties with Beijing only if Beijing proved a "reliable partner in trade negotiations."

And for partners "negotiating in good faith," Bessent told a congressional committee, there could be an extended pause before higher threatened tariff rates take effect in July.

The broad-based S&P 500, which rose the last three days, finished down 0.3 percent at 6,022.24.

Elsewhere, London edged higher, supported by the government laying out its spending plans. But Paris and Frankfurt couldn't hold on to early gains and closed modestly lower.

Asian stock markets also won a lift on the China-US progress, with Hong Kong among the best performers.

"Constructive talks between the US and China have put markets on a firmer footing, as investors hope that the worst of the tariff turbulence may have passed," said Richard Hunter, head of markets at Interactive Investor.

Meanwhile, data showed little impact of Trump's tariffs on US consumer prices in May. Some analysts said it was still too early to discern a hit to prices from tariffs.

Between April and May, the consumer price index (CPI) rose 0.1 percent. Analysts had expected it to continue at the 0.2 rate it rose in April.

Following the release of the data, Trump issued a fresh call for the Fed to lower interest rates.

Investors have worried that a tariff-driven surge in inflation could hinder the Federal Reserve from lowering interest rates to counter the slowdown in growth.

In other markets, oil prices shot up more than four percent as Iran threatened to target US military bases in the region if conflict breaks out.

Amid escalating tensions, a US official said staff levels at the embassy in Iraq were being reduced over security concerns, while the UK Maritime Trade Operations, run by the British navy, advised ships to transit the Gulf with caution.

- Key figures at around 2030 GMT -

New York - Dow: FLAT at 42,865.77 (close)

New York - S&P 500: DOWN 0.3 percent at 6,022.24 (close)

New York - Nasdaq Composite: DOWN 0.5 percent at 19,615.88 (close)

London - FTSE 100: UP 0.1 percent at 8,864.35 (close)

Paris - CAC 40: DOWN 0.4 percent at 7,775.90 (close)

Frankfurt - DAX: DOWN 0.2 percent at 23,948.90 (close)

Tokyo - Nikkei 225: UP 0.6 percent at 38,421.19 (close)

Hong Kong - Hang Seng Index: UP 0.8 percent at 24,366.94 (close)

Shanghai - Composite: UP 0.5 percent at 3,402.32 (close)

Euro/dollar: UP at $1.1489 from $1.1425 on Tuesday

Pound/dollar: UP at $1.3545 from $1.3500

Dollar/yen: DOWN at 144.62 yen from 144.87 yen

Euro/pound: UP at 84.79 pence from 84.62 pence

Brent North Sea Crude: UP 4.3 percent at $69.77 per barrel

West Texas Intermediate: UP 4.9 percent at $68.15 per barrel

burs-jmb/des

V.F.Barreira--PC