-

Japan restarts world's biggest nuclear plant again

Japan restarts world's biggest nuclear plant again

-

Bangladesh poll rivals rally on final day of campaign

-

Third impeachment case filed against Philippine VP Duterte

Third impeachment case filed against Philippine VP Duterte

-

Wallaby winger Nawaqanitawase heads to Japan

-

Thailand's Anutin rides wave of nationalism to election victory

Thailand's Anutin rides wave of nationalism to election victory

-

Venezuela's Machado says ally kidnapped by armed men after his release

-

Maye longs for do-over as record Super Bowl bid ends in misery

Maye longs for do-over as record Super Bowl bid ends in misery

-

Seahawks' Walker rushes to Super Bowl MVP honors

-

Darnold basks in 'special journey' to Super Bowl glory

Darnold basks in 'special journey' to Super Bowl glory

-

Japan's Takaichi may struggle to soothe voters and markets

-

Seahawks soar to Super Bowl win over Patriots

Seahawks soar to Super Bowl win over Patriots

-

'Want to go home': Indonesian crew abandoned off Africa demand wages

-

Asian stocks track Wall St rally as Tokyo hits record on Takaichi win

Asian stocks track Wall St rally as Tokyo hits record on Takaichi win

-

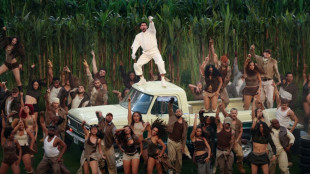

Bad Bunny celebrates Puerto Rico in joyous Super Bowl halftime show

-

Three prominent opposition figures released in Venezuela

Three prominent opposition figures released in Venezuela

-

Israeli president says 'we shall overcome this evil' at Bondi Beach

-

'Flood' of disinformation ahead of Bangladesh election

'Flood' of disinformation ahead of Bangladesh election

-

Arguments to begin in key US social media addiction trial

-

UK-Based Vesalic Limited Emerges from Stealth with Landmark Discovery of Potential Non-CNS Driver of Motor Neuron Diseases, including ALS, and Breakthrough Therapeutic and Diagnostic Opportunities

UK-Based Vesalic Limited Emerges from Stealth with Landmark Discovery of Potential Non-CNS Driver of Motor Neuron Diseases, including ALS, and Breakthrough Therapeutic and Diagnostic Opportunities

-

Gotterup tops Matsuyama in playoff to win Phoenix Open

-

New Zealand's Christchurch mosque killer appeals conviction

New Zealand's Christchurch mosque killer appeals conviction

-

Leonard's 41 leads Clippers over T-Wolves, Knicks cruise

-

Trump says China's Xi to visit US 'toward the end of the year'

Trump says China's Xi to visit US 'toward the end of the year'

-

Real Madrid edge Valencia to stay on Barca's tail, Atletico slump

-

Malinin keeps USA golden in Olympic figure skating team event

Malinin keeps USA golden in Olympic figure skating team event

-

Lebanon building collapse toll rises to 9: civil defence

-

Real Madrid keep pressure on Barca with tight win at Valencia

Real Madrid keep pressure on Barca with tight win at Valencia

-

PSG trounce Marseille to move back top of Ligue 1

-

Hong Kong to sentence media mogul Jimmy Lai in national security trial

Hong Kong to sentence media mogul Jimmy Lai in national security trial

-

Lillard will try to match record with third NBA 3-Point title

-

Vonn breaks leg as crashes out in brutal end to Olympic dream

Vonn breaks leg as crashes out in brutal end to Olympic dream

-

Malinin enters the fray as Japan lead USA in Olympics team skating

-

Thailand's Anutin readies for coalition talks after election win

Thailand's Anutin readies for coalition talks after election win

-

Fans arrive for Patriots-Seahawks Super Bowl as politics swirl

-

'Send Help' repeats as N.America box office champ

'Send Help' repeats as N.America box office champ

-

Japan close gap on USA in Winter Olympics team skating event

-

Liverpool improvement not reflected in results, says Slot

Liverpool improvement not reflected in results, says Slot

-

Japan PM Takaichi basks in election triumph

-

Machado's close ally released in Venezuela

Machado's close ally released in Venezuela

-

Dimarco helps Inter to eight-point lead in Serie A

-

Man City 'needed' to beat Liverpool to keep title race alive: Silva

Man City 'needed' to beat Liverpool to keep title race alive: Silva

-

Czech snowboarder Maderova lands shock Olympic parallel giant slalom win

-

Man City fight back to end Anfield hoodoo and reel in Arsenal

Man City fight back to end Anfield hoodoo and reel in Arsenal

-

Diaz treble helps Bayern crush Hoffenheim and go six clear

-

US astronaut to take her 3-year-old's cuddly rabbit into space

US astronaut to take her 3-year-old's cuddly rabbit into space

-

Israeli president to honour Bondi Beach attack victims on Australia visit

-

Apologetic Turkish center Sengun replaces Shai as NBA All-Star

Apologetic Turkish center Sengun replaces Shai as NBA All-Star

-

Romania, Argentina leaders invited to Trump 'Board of Peace' meeting

-

Kamindu heroics steer Sri Lanka past Ireland in T20 World Cup

Kamindu heroics steer Sri Lanka past Ireland in T20 World Cup

-

Age just a number for veteran Olympic snowboard champion Karl

Oil prices fall even as Israel-Iran strikes extend into fourth day

Oil prices retreated on Monday as fears of a wider Middle East conflict eased even as Israel and Iran pounded each other with missiles for a fourth day and threatened further attacks.

Gold prices rose back towards a record high thanks to a rush into safe havens but equities were mixed amid hopes that the conflict does not spread.

Investors were also gearing up for key central bank meetings this week, with a particular eye on the US Federal Reserve and Bank of Japan, as well as talks with Washington aimed at avoiding Donald Trump's sky-high tariffs.

Israel's surprise strike against Iranian military and nuclear sites on Friday -- killing top commanders and scientists -- sent crude prices soaring as much as 13 percent at one point on fears about supplies from the region. However, concerns over the conflict spreading appeared to have eased, with prices retreating in Asian trade.

Analysts had warned that the spike could send inflation surging globally again, dealing a blow to long-running efforts by governments and central banks to get it under control and fanning concerns about the impact on already fragile economies.

"The knock-on impact of higher energy prices is that they will slow growth and cause headline inflation to rise," said Tony Sycamore, a market analyst at IG.

"While central banks would prefer to overlook a temporary spike in energy prices, if they remain elevated for a long period, it may feed through into higher core inflation as businesses pass on higher transport and production costs.

"This would hamper central banks' ability to cut interest rates to cushion the anticipated growth slowdown from President Trump's tariffs, which adds another variable for the Fed to consider when it meets to discuss interest rates this week."

Both main oil contracts were down, giving up earlier gains in Asian trade.

- Fed, BoJ in focus -

"Oil markets remain amply supplied with OPEC set on increasing production and demand soft. US production growth has been slowing, but could rebound in the face of sustained higher prices," Morningstar director of equity research Allen Good said.

"Meanwhile, a larger war is unlikely. The Trump administration has already stated it remains committed to talks with Iran.

"Ultimately, fundamentals will dictate price, and they do not suggest much higher prices are necessary. Although the global risk premium could rise, keeping prices moderately higher than where they've been much of the year."

Tokyo closed 1.3 percent higher, boosted by a weaker yen, while Hong Kong reversed early losses and Shanghai, Seoul and Wellington also advanced.

Taipei, Jakarta, Bangkok and Manila retreated while Sydney was flat.

London, Paris and Frankfurt were all higher.

Gold, a go-to asset in times of uncertainty and volatility, rose to around $3,450 an ounce and close to its all-time high of $3,500.

There was little major reaction to data showing China's factory output grew slower than expected last month as trade war pressures bit, while retail sales topped forecasts.

Also in focus is the Group of Seven summit in the Canadian Rockies, which kicked off on Sunday, where the Middle East crisis will be discussed along with trade after Trump's tariff blitz.

Investors are also awaiting bank policy meetings, with the Fed and BoJ the standouts.

Both are expected to stand pat for now but traders will be keeping a close watch on their statements for an idea about the plans for interest rates, with US officials under pressure from Trump to cut.

The Fed meeting "will naturally get the greatest degree of market focus", said Chris Weston at Pepperstone.

"The Fed should remain sufficiently constrained by the many uncertainties to offer anything truly market-moving and the statement should stress that policy is in a sound place for now," he said.

In corporate news, Nippon Steel rose more than three percent after Trump signed an executive order on Friday approving its $14.9 billion merger with US Steel, bringing an end to the long-running saga.

- Key figures at around 0820 GMT -

West Texas Intermediate: DOWN 0.2 percent at $72.82 per barrel

Brent North Sea Crude: DOWN 0.4 percent at $73.95 per barrel

Tokyo - Nikkei 225: UP 1.3 percent at 38,311.33 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 24,060.99 (close)

Shanghai - Composite: UP 0.4 percent at 3,388.73 (close)

London - FTSE 100: UP 0.3 percent at 8,874.0

Euro/dollar: UP at $1.1581 from $1.1540 on Friday

Pound/dollar: UP at $1.3583 from $1.3560

Dollar/yen: UP at 144.26 yen from 144.04 yen

Euro/pound: UP at 85.26 pence from 85.11 pence

New York - Dow: DOWN 1.8 percent at 42,197.79 (close)

G.Machado--PC