-

Seahawks soar to Super Bowl win over Patriots

Seahawks soar to Super Bowl win over Patriots

-

'Want to go home': Indonesian crew abandoned off Africa demand wages

-

Asian stocks track Wall St rally as Tokyo hits record on Takaichi win

Asian stocks track Wall St rally as Tokyo hits record on Takaichi win

-

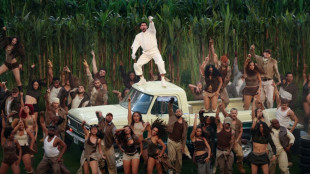

Bad Bunny celebrates Puerto Rico in joyous Super Bowl halftime show

-

Three prominent opposition figures released in Venezuela

Three prominent opposition figures released in Venezuela

-

Israeli president says 'we shall overcome this evil' at Bondi Beach

-

'Flood' of disinformation ahead of Bangladesh election

'Flood' of disinformation ahead of Bangladesh election

-

Arguments to begin in key US social media addiction trial

-

Gotterup tops Matsuyama in playoff to win Phoenix Open

Gotterup tops Matsuyama in playoff to win Phoenix Open

-

New Zealand's Christchurch mosque killer appeals conviction

-

Leonard's 41 leads Clippers over T-Wolves, Knicks cruise

Leonard's 41 leads Clippers over T-Wolves, Knicks cruise

-

Trump says China's Xi to visit US 'toward the end of the year'

-

Real Madrid edge Valencia to stay on Barca's tail, Atletico slump

Real Madrid edge Valencia to stay on Barca's tail, Atletico slump

-

Malinin keeps USA golden in Olympic figure skating team event

-

Lebanon building collapse toll rises to 9: civil defence

Lebanon building collapse toll rises to 9: civil defence

-

Real Madrid keep pressure on Barca with tight win at Valencia

-

PSG trounce Marseille to move back top of Ligue 1

PSG trounce Marseille to move back top of Ligue 1

-

Hong Kong to sentence media mogul Jimmy Lai in national security trial

-

Lillard will try to match record with third NBA 3-Point title

Lillard will try to match record with third NBA 3-Point title

-

Vonn breaks leg as crashes out in brutal end to Olympic dream

-

Malinin enters the fray as Japan lead USA in Olympics team skating

Malinin enters the fray as Japan lead USA in Olympics team skating

-

Thailand's Anutin readies for coalition talks after election win

-

Fans arrive for Patriots-Seahawks Super Bowl as politics swirl

Fans arrive for Patriots-Seahawks Super Bowl as politics swirl

-

'Send Help' repeats as N.America box office champ

-

Japan close gap on USA in Winter Olympics team skating event

Japan close gap on USA in Winter Olympics team skating event

-

Liverpool improvement not reflected in results, says Slot

-

Japan PM Takaichi basks in election triumph

Japan PM Takaichi basks in election triumph

-

Machado's close ally released in Venezuela

-

Dimarco helps Inter to eight-point lead in Serie A

Dimarco helps Inter to eight-point lead in Serie A

-

Man City 'needed' to beat Liverpool to keep title race alive: Silva

-

Czech snowboarder Maderova lands shock Olympic parallel giant slalom win

Czech snowboarder Maderova lands shock Olympic parallel giant slalom win

-

Man City fight back to end Anfield hoodoo and reel in Arsenal

-

Diaz treble helps Bayern crush Hoffenheim and go six clear

Diaz treble helps Bayern crush Hoffenheim and go six clear

-

US astronaut to take her 3-year-old's cuddly rabbit into space

-

Israeli president to honour Bondi Beach attack victims on Australia visit

Israeli president to honour Bondi Beach attack victims on Australia visit

-

Apologetic Turkish center Sengun replaces Shai as NBA All-Star

-

Romania, Argentina leaders invited to Trump 'Board of Peace' meeting

Romania, Argentina leaders invited to Trump 'Board of Peace' meeting

-

Kamindu heroics steer Sri Lanka past Ireland in T20 World Cup

-

Age just a number for veteran Olympic snowboard champion Karl

Age just a number for veteran Olympic snowboard champion Karl

-

England's Feyi-Waboso out of Scotland Six Nations clash

-

Thailand's pilot PM lands runaway election win

Thailand's pilot PM lands runaway election win

-

Sarr strikes as Palace end winless run at Brighton

-

Olympic star Ledecka says athletes ignored in debate over future of snowboard event

Olympic star Ledecka says athletes ignored in debate over future of snowboard event

-

Auger-Aliassime retains Montpellier Open crown

-

Lindsey Vonn, skiing's iron lady whose Olympic dream ended in tears

Lindsey Vonn, skiing's iron lady whose Olympic dream ended in tears

-

Conservative Thai PM claims election victory

-

Kamindu fireworks rescue Sri Lanka to 163-6 against Ireland

Kamindu fireworks rescue Sri Lanka to 163-6 against Ireland

-

UK PM's top aide quits in scandal over Mandelson links to Epstein

-

Reed continues Gulf romp with victory in Qatar

Reed continues Gulf romp with victory in Qatar

-

Conservative Thai PM heading for election victory: projections

US stocks flat as Fed keeps rates steady, oil prices gyrate

Wall Street stocks treaded water Wednesday after the Federal Reserve met expectations and kept interest rates steady while oil prices nudged higher following a volatile session amid ongoing clashes between Iran and Israel.

The Fed held interest rates unchanged for a fourth consecutive meeting, as Chair Jerome Powell said more time was needed to monitor the inflationary effects of President Donald Trump's tariffs.

Powell maintained the Fed is well-positioned to wait to learn more, before considering changes to interest rates.

"Because the economy is still solid," the central bank can take time to see what happens, Powell told reporters at a press conference. "We'll make smarter and better decisions if we just wait a couple of months."

US indices spent part of the day in positive territory before concluding the session essentially flat.

Earlier in Europe, the London stock market rose but Paris and Frankfurt ended the day down. Asian equities closed mixed as well.

The market's ability to avoid major losses amid the Middle East turmoil is "extremely bullish," said Adam Sarhan of 50 Park Investments, while still pointing to trade talk uncertainty as a worry.

The market believes that "most likely cooler heads will prevail on the trade front and on the Middle East front," said Sarhan, who described Wednesday's Fed meeting outcome as in line with expectations.

Israel and Iran exchanged fire again, the sixth day of strikes in their most intense confrontation in history.

Oil prices initially rose Wednesday after Iran's supreme leader Ali Khamenei rejected Trump's demand for an "unconditional surrender," adding to sharp gains made the previous day.

But oil prices fell later in the day after Trump indicated he was still considering whether the United States would join Israeli strikes and indicated that Iran had reached out to seek negotiations.

At the end of the day, prices ticked up again with both major futures crude contracts finishing higher.

Robert Yawger of Mizuho Americas described the market as "hypersensitive" to headlines, having shown "extreme volatility in the last 24 hours."

The Fed is not the only central bank to meet this week.

On Wednesday, Sweden's central bank cut its key interest rate to try and boost the country's economy, as it cited risks linked to trade tensions and the escalating conflict in the Middle East.

The Bank of England is expected to keep its key rate steady Thursday, especially after official data Wednesday showed UK annual inflation fell less than expected in May.

The Bank of Japan on Tuesday kept interest rates unchanged and said it would taper its purchase of government bonds at a slower pace, as trade uncertainty threatens to weigh on the world's number four economy.

- Key figures at around 2030 GMT -

New York - Dow: DOWN 0.1 percent at 42,171.66 (close)

New York - S&P 500: DOWN less than 0.1 percent at 5,980.87 (close)

New York - Nasdaq Composite: UP 0.1 percent at 19,546.27 (close)

London - FTSE 100: UP 0.1 at 8,843.47 (close)

Paris - CAC 40: DOWN 0.4 percent at 7,656.12 (close)

Frankfurt - DAX: DOWN 0.5 percent at 23,317.81 (close)

Tokyo - Nikkei 225: UP 0.9 percent at 38,885.15 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 23,710.69 (close)

Shanghai - Composite: FLAT at 3,388.81 (close)

Euro/dollar: UP at $1.1485 from $1.1480 on Tuesday

Pound/dollar: DOWN at $1.3420 from $1.3429

Dollar/yen: DOWN at 145.09 yen from 145.29 yen

Euro/pound: UP at 85.55 pence from 85.48 pence

Brent North Sea Crude: UP 0.3 percent at $76.70 per barrel

West Texas Intermediate: UP 0.4 percent at $75.14 per barrel

burs-jmb/acb

V.F.Barreira--PC