-

'Want to go home': Indonesian crew abandoned off Africa demand wages

'Want to go home': Indonesian crew abandoned off Africa demand wages

-

Asian stocks track Wall St rally as Tokyo hits record on Takaichi win

-

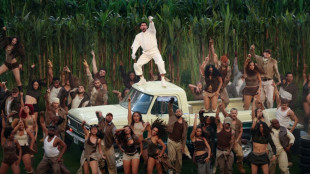

Bad Bunny celebrates Puerto Rico in joyous Super Bowl halftime show

Bad Bunny celebrates Puerto Rico in joyous Super Bowl halftime show

-

Three prominent opposition figures released in Venezuela

-

Israeli president says 'we shall overcome this evil' at Bondi Beach

Israeli president says 'we shall overcome this evil' at Bondi Beach

-

'Flood' of disinformation ahead of Bangladesh election

-

Arguments to begin in key US social media addiction trial

Arguments to begin in key US social media addiction trial

-

Gotterup tops Matsuyama in playoff to win Phoenix Open

-

New Zealand's Christchurch mosque killer appeals conviction

New Zealand's Christchurch mosque killer appeals conviction

-

Leonard's 41 leads Clippers over T-Wolves, Knicks cruise

-

Trump says China's Xi to visit US 'toward the end of the year'

Trump says China's Xi to visit US 'toward the end of the year'

-

Real Madrid edge Valencia to stay on Barca's tail, Atletico slump

-

Malinin keeps USA golden in Olympic figure skating team event

Malinin keeps USA golden in Olympic figure skating team event

-

Lebanon building collapse toll rises to 9: civil defence

-

Real Madrid keep pressure on Barca with tight win at Valencia

Real Madrid keep pressure on Barca with tight win at Valencia

-

PSG trounce Marseille to move back top of Ligue 1

-

Hong Kong to sentence media mogul Jimmy Lai in national security trial

Hong Kong to sentence media mogul Jimmy Lai in national security trial

-

Lillard will try to match record with third NBA 3-Point title

-

Vonn breaks leg as crashes out in brutal end to Olympic dream

Vonn breaks leg as crashes out in brutal end to Olympic dream

-

Malinin enters the fray as Japan lead USA in Olympics team skating

-

Thailand's Anutin readies for coalition talks after election win

Thailand's Anutin readies for coalition talks after election win

-

Fans arrive for Patriots-Seahawks Super Bowl as politics swirl

-

'Send Help' repeats as N.America box office champ

'Send Help' repeats as N.America box office champ

-

Japan close gap on USA in Winter Olympics team skating event

-

Liverpool improvement not reflected in results, says Slot

Liverpool improvement not reflected in results, says Slot

-

Japan PM Takaichi basks in election triumph

-

Machado's close ally released in Venezuela

Machado's close ally released in Venezuela

-

Dimarco helps Inter to eight-point lead in Serie A

-

Man City 'needed' to beat Liverpool to keep title race alive: Silva

Man City 'needed' to beat Liverpool to keep title race alive: Silva

-

Czech snowboarder Maderova lands shock Olympic parallel giant slalom win

-

Man City fight back to end Anfield hoodoo and reel in Arsenal

Man City fight back to end Anfield hoodoo and reel in Arsenal

-

Diaz treble helps Bayern crush Hoffenheim and go six clear

-

US astronaut to take her 3-year-old's cuddly rabbit into space

US astronaut to take her 3-year-old's cuddly rabbit into space

-

Israeli president to honour Bondi Beach attack victims on Australia visit

-

Apologetic Turkish center Sengun replaces Shai as NBA All-Star

Apologetic Turkish center Sengun replaces Shai as NBA All-Star

-

Romania, Argentina leaders invited to Trump 'Board of Peace' meeting

-

Kamindu heroics steer Sri Lanka past Ireland in T20 World Cup

Kamindu heroics steer Sri Lanka past Ireland in T20 World Cup

-

Age just a number for veteran Olympic snowboard champion Karl

-

England's Feyi-Waboso out of Scotland Six Nations clash

England's Feyi-Waboso out of Scotland Six Nations clash

-

Thailand's pilot PM lands runaway election win

-

Sarr strikes as Palace end winless run at Brighton

Sarr strikes as Palace end winless run at Brighton

-

Olympic star Ledecka says athletes ignored in debate over future of snowboard event

-

Auger-Aliassime retains Montpellier Open crown

Auger-Aliassime retains Montpellier Open crown

-

Lindsey Vonn, skiing's iron lady whose Olympic dream ended in tears

-

Conservative Thai PM claims election victory

Conservative Thai PM claims election victory

-

Kamindu fireworks rescue Sri Lanka to 163-6 against Ireland

-

UK PM's top aide quits in scandal over Mandelson links to Epstein

UK PM's top aide quits in scandal over Mandelson links to Epstein

-

Reed continues Gulf romp with victory in Qatar

-

Conservative Thai PM heading for election victory: projections

Conservative Thai PM heading for election victory: projections

-

Heartache for Olympic downhill champion Johnson after Vonn's crash

Swiss central bank cuts interest rates to zero percent

The Swiss National Bank cut interest rates to zero percent on Thursday as inflation cools and the franc strengthens, while the economic outlook has deteriorated.

The SNB, however, held off a decision to return to its era of negative rates -- a policy that helped to curb the Swiss franc's rise but was unpopular among pension funds and other investors.

The franc's movement is also under scrutiny in the United States, as the US Treasury Department added Switzerland to its watch list of countries likely to manipulate their currencies earlier this month.

The SNB says its interventions in the foreign exchange market aim to ensure price stability, not unduly increase the Swiss economy's competitiveness.

The Swiss currency is a safe haven investment that has climbed against the dollar since US President Donald Trump launched his tariff blitz in April.

In Thursday's statement, the SNB -- which has denied manipulating the franc -- said it "remains willing to be active in the foreign exchange market as necessary".

The SNB cited easing inflationary pressure in its decision to cut rates by a quarter point, but it also pointed to a gloomy economic forecast.

"The global economic outlook for the coming quarters has deteriorated due to the increase in trade tensions," the central bank said, adding that the outlook for Switzerland remained uncertain.

"Developments abroad continue to represent the main risk," it said, expecting growth in the global economy to weaken over the coming quarters.

- Cooling inflation -

The SNB said Swiss gross domestic product growth was strong in the first quarter of the year -- largely due to exports to the United States being brought forward ahead of Trump's tariff manoeuvres.

But stripping that factor out, growth was more moderate, and is likely to slow again and remain subdued for the rest of the year, the SNB said.

The SNB expects GDP growth of one percent to 1.5 percent for 2025, and for 2026 too.

It said Swiss unemployment was likely to continue to rise slightly.

The bank lowered its inflation forecast for 2025 from 0.4 percent to 0.2 percent, and for 2026 from 0.8 percent to 0.5 percent.

The consumer price index even fell into negative territory in May, at minus 0.1 percent.

- Negative rates -

Between 2015 and 2022, the SNB's monetary policy was based on a negative interest rate of minus 0.75 percent -- which increased the cost of deposits held by banks and financial institutions relative to the amounts they were required to entrust to the central bank.

Those seven years left a bitter memory for major savers, who bore the brunt in fees, while pension funds were forced into riskier investments.

Negative rates make the Swiss franc less attractive to investors as it reduces returns on investments.

Thursday's decision was widely expected by analysts.

Adrian Prettejohn, Europe economist at the London-based research group Capital Economics, said the SNB is expected to move rates to negative 0.25 percent at its September meeting due to deflation.

"There are also significant downside risks to inflation from trade tensions as well as heightened geopolitical uncertainty, which could push up the value of the franc further," he said.

He said the central bank's language on currency interventions "supports our view that the SNB is not planning to use foreign exchange interventions as its main tool for loosening monetary policy anytime soon".

Ferreira--PC