-

Sarr strikes as Palace end winless run at Brighton

Sarr strikes as Palace end winless run at Brighton

-

Olympic star Ledecka says athletes ignored in debate over future of snowboard event

-

Auger-Aliassime retains Montpellier Open crown

Auger-Aliassime retains Montpellier Open crown

-

Lindsey Vonn, skiing's iron lady whose Olympic dream ended in tears

-

Conservative Thai PM claims election victory

Conservative Thai PM claims election victory

-

Kamindu fireworks rescue Sri Lanka to 163-6 against Ireland

-

UK PM's top aide quits in scandal over Mandelson links to Epstein

UK PM's top aide quits in scandal over Mandelson links to Epstein

-

Reed continues Gulf romp with victory in Qatar

-

Conservative Thai PM heading for election victory: projections

Conservative Thai PM heading for election victory: projections

-

Heartache for Olympic downhill champion Johnson after Vonn's crash

-

Takaichi on course for landslide win in Japan election

Takaichi on course for landslide win in Japan election

-

Wales coach Tandy will avoid 'knee-jerk' reaction to crushing England loss

-

Sanae Takaichi, Japan's triumphant first woman PM

Sanae Takaichi, Japan's triumphant first woman PM

-

England avoid seismic shock by beating Nepal in last-ball thriller

-

Karl defends Olympic men's parallel giant slalom crown

Karl defends Olympic men's parallel giant slalom crown

-

Colour and caution as banned kite-flying festival returns to Pakistan

-

England cling on to beat Nepal in last-ball thriller

England cling on to beat Nepal in last-ball thriller

-

UK foreign office to review pay-off to Epstein-linked US envoy

-

England's Arundell eager to learn from Springbok star Kolbe

England's Arundell eager to learn from Springbok star Kolbe

-

Czech snowboard great Ledecka fails in bid for third straight Olympic gold

-

Expectation, then stunned silence as Vonn crashes out of Olympics

Expectation, then stunned silence as Vonn crashes out of Olympics

-

Storm-battered Portugal votes in presidential election run-off

-

Breezy Johnson wins Olympic downhill gold, Vonn crashes out

Breezy Johnson wins Olympic downhill gold, Vonn crashes out

-

Vonn's Olympic dream cut short by downhill crash

-

French police arrest five over crypto-linked magistrate kidnapping

French police arrest five over crypto-linked magistrate kidnapping

-

Late Jacks flurry propels England to 184-7 against Nepal

-

Vonn crashes out of Winter Olympics, ending medal dream

Vonn crashes out of Winter Olympics, ending medal dream

-

All-new Ioniq 3 coming in 2026

-

New Twingo e-tech is at the starting line

New Twingo e-tech is at the starting line

-

New Ypsilon and Ypsilon hf

-

The Cupra Raval will be launched in 2026

The Cupra Raval will be launched in 2026

-

New id.Polo comes electric

-

Iran defies US threats to insist on right to enrich uranium

Iran defies US threats to insist on right to enrich uranium

-

Seifert powers New Zealand to their record T20 World Cup chase

-

Naib's fifty lifts Afghanistan to 182-6 against New Zealand

Naib's fifty lifts Afghanistan to 182-6 against New Zealand

-

Paul Thomas Anderson wins top director prize for 'One Battle After Another'

-

De Beers sale drags in diamond doldrums

De Beers sale drags in diamond doldrums

-

NFL embraces fashion as league seeks new audiences

-

What's at stake for Indian agriculture in Trump's trade deal?

What's at stake for Indian agriculture in Trump's trade deal?

-

Real Madrid can wait - Siraj's dream night after late T20 call-up

-

Castle's monster night fuels Spurs, Rockets rally to beat Thunder

Castle's monster night fuels Spurs, Rockets rally to beat Thunder

-

Japan votes in snow-hit snap polls as Takaichi eyes strong mandate

-

Pakistan's capital picks concrete over trees, angering residents

Pakistan's capital picks concrete over trees, angering residents

-

Berlin's crumbling 'Russian houses' trapped in bureaucratic limbo

-

Neglected killer: kala-azar disease surges in Kenya

Neglected killer: kala-azar disease surges in Kenya

-

Super Bowl set for Patriots-Seahawks showdown as politics swirl

-

Sengun shines as Rockets rally to beat NBA champion Thunder

Sengun shines as Rockets rally to beat NBA champion Thunder

-

Matsuyama grabs PGA Phoenix Open lead with Hisatsune one back

-

Washington Post CEO out after sweeping job cuts

Washington Post CEO out after sweeping job cuts

-

Haiti's transitional council hands power to PM

US stocks retreat from records on Trump tariff deluge

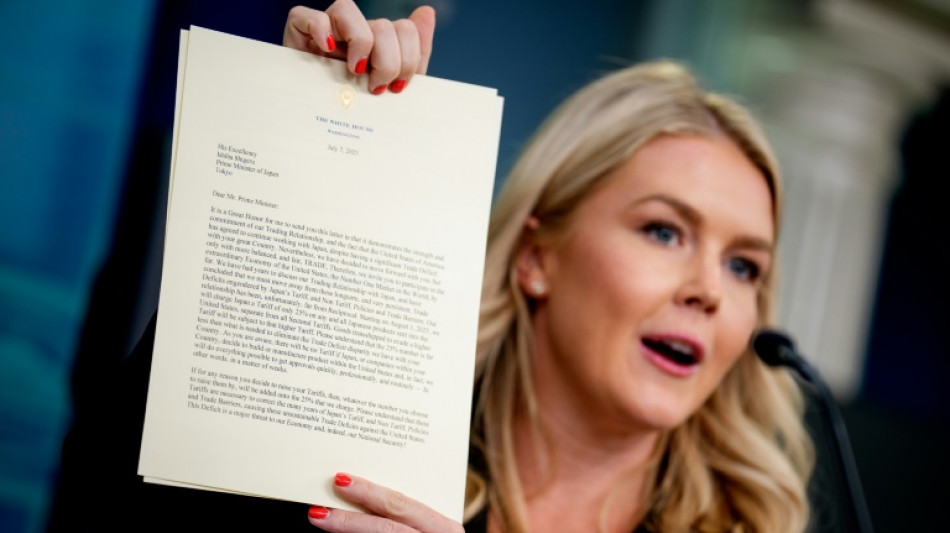

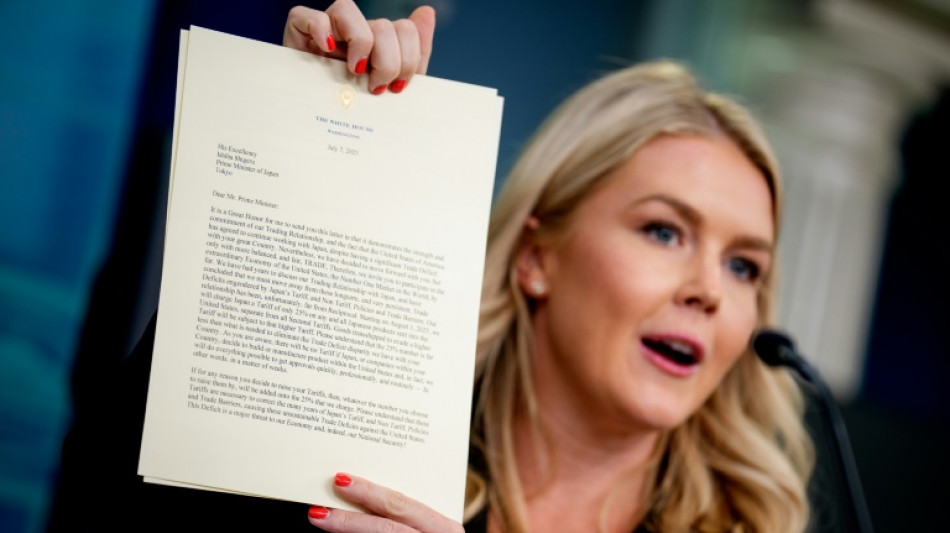

Stock markets were mixed Monday with US indices retreating from records as President Donald Trump's aggressive trade policy came back to the forefront, reviving worries about trade wars and inflation.

"Tariff threats look likely to take center stage yet again this week, following further developments over the weekend," noted Richard Hunter, head of markets at Interactive Investor.

After warning of a tariff hike of 10 percent on countries aligning themselves with the emerging BRICS nations, Trump announced plans for 25 percent tariffs on Japan and South Korea from August 1 if the countries do not reach a deal.

Trump issued similar letters to South Africa, Malaysia, Myanmar, Laos and Kazakhstan, saying he would slap duties on their products ranging from 25 percent to 40 percent.

Later Monday, he announced additional levies on Indonesia, Cambodia and other countries.

The broadsides revived attention on trade after the issue had receded for a few weeks while Congress debated Trump's sweeping fiscal package and worries about the Iran-Israel conflict took certain stage.

Major US indices fell, with the S&P falling 0.8 percent, retreating from a record.

The likelihood that Trump's statements are a bargaining tactic is one reason losses weren't "even worse," said Steve Sosnick of Interactive Brokers.

"No one really wants to overreact negatively right now, which is why we're seeing a bit of a sell-off, but not a major sell-off," he said.

The White House has said several deals were in the pipeline but only two have been finalized so far, with Britain and Vietnam.

The administration had previously set a July 9 deadline to reach agreements. The White House now says it will hike tariffs on August 1 on trading partners that don't strike a deal.

Despite the tariff uncertainty, official data Monday showed German industrial production rose strongly in May, boosting hopes that Europe's top economy has turned a corner.

The news lifted German equities which gained 1.2 percent for the day.

Paris added 0.4 percent, while London dipped 0.2 percent.

Asia's main stock markets mostly steadied.

- OPEC+ hike -

The oil market was also in focus after Saudi Arabia, Russia and six other key members of the OPEC+ alliance said they would increase oil output in August by 548,000 barrels per day, more than expected.

The group said in a statement that "a steady global economic outlook and current healthy market fundamentals, as reflected in the low oil inventories," led to the decision.

IG analyst Chris Beauchamp said that crude prices would ordinarily be expected to drop when additional supply is being brought to market.

"Crude’s strength today suggests that buying momentum is clearly picking up," he said.

"The bearish theme that has dominated for so long seems to have run its course, even if more increases are expected in September," he added.

Among individual companies, Tesla tumbled 6.8 percent after Trump blasted CEO Elon Musk's plan to launch a new political party in opposition to the president's hallmark legislation, the so-called "Big Beautiful Bill."

The back-and-forth escalated a conflict between the president and the world's richest man at a time when investors had hoped Musk would refocus on Tesla and his other ventures and shift attention from politics.

- Key figures at around 2030 GMT -

New York - Dow: DOWN 0.9 percent at 44,406.36 (close)

New York - S&P 500: DOWN 0.8 percent at 6,229.98 (close)

New York - Nasdaq Composite: DOWN 0.9 percent at 20,412.52 (close)

London - FTSE 100: DOWN 0.2 percent at 8,806.53 (close)

Paris - CAC 40: UP 0.4 percent at 7,723.47 (close)

Frankfurt - DAX: UP 0.1.2 percent at 24,073.67 (close)

Tokyo - Nikkei 225: DOWN 0.6 percent at 39,587.68 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 23,887.83 (close)

Shanghai - Composite: FLAT at 3,473.13 (close)

Euro/dollar: DOWN at $1.1710 from $1.1778 on Friday

Pound/dollar: DOWN at $1.3602 from $1.3650

Dollar/yen: UP at 146.13 yen from 144.47 yen

Euro/pound: DOWN at 86.09 pence from 86.30 pence

Brent North Sea Crude: UP 1.9 percent at $69.58 per barrel

West Texas Intermediate: UP 1.4 percent at $67.93 per barrel

burs-jmb/ksb

P.Queiroz--PC