-

Son of Norway's crown princess admits excesses but denies rape

Son of Norway's crown princess admits excesses but denies rape

-

Vowles dismisses Williams 2026 title hopes as 'not realistic'

-

'Dinosaur' Glenn chasing skating gold in first Olympics

'Dinosaur' Glenn chasing skating gold in first Olympics

-

Gaza health officials say strikes kill 23 after Israel says shots wounded officer

-

Italy foils Russian cyberattacks targeting Olympics

Italy foils Russian cyberattacks targeting Olympics

-

Figure skating favourite Malinin feeling 'the pressure' in Milan

-

Netflix film probes conviction of UK baby killer nurse

Netflix film probes conviction of UK baby killer nurse

-

Timber hopes League Cup can be catalyst for Arsenal success

-

China calls EU 'discriminatory' over probe into energy giant Goldwind

China calls EU 'discriminatory' over probe into energy giant Goldwind

-

Sales warning slams Ozempic maker Novo Nordisk's stock

-

Can Vonn defy ACL rupture to win Olympic medal?

Can Vonn defy ACL rupture to win Olympic medal?

-

Breakthrough or prelude to attack? What we know about Iran-US talks

-

German far-right MP detained over alleged Belarus sanctions breach

German far-right MP detained over alleged Belarus sanctions breach

-

MSF says its hospital in South Sudan hit by government air strike

-

Merz heads to Gulf as Germany looks to diversify trade ties

Merz heads to Gulf as Germany looks to diversify trade ties

-

Selection process for future Olympic hosts set for reform

-

Serbian minister on trial over Trump-linked hotel plan

Serbian minister on trial over Trump-linked hotel plan

-

UK PM says Mandelson 'lied', regrets appointing him US envoy

-

Cochran-Siegle tops first Olympic downhill training

Cochran-Siegle tops first Olympic downhill training

-

Gaza health officials say strikes kill 21 after Israel says shots wounded officer

-

Injured Vonn's Olympic bid is 'inspirational', ski stars say

Injured Vonn's Olympic bid is 'inspirational', ski stars say

-

Albania arrests 20 for toxic waste trafficking

-

US-Africa trade deal renewal only 'temporary breather'

US-Africa trade deal renewal only 'temporary breather'

-

Mir sets pace on Sepang day two, Yamaha absent

-

Xi, Putin hail 'stabilising' China-Russia alliance

Xi, Putin hail 'stabilising' China-Russia alliance

-

GSK boosted by specialty drugs, end to Zantac fallout

-

UK's ex-prince leaves Windsor home amid Epstein storm: reports

UK's ex-prince leaves Windsor home amid Epstein storm: reports

-

Sky is the limit for Ireland fly-half Prendergast, says captain Doris

-

Feyi-Waboso reminds England great Robinson of himself

Feyi-Waboso reminds England great Robinson of himself

-

Starmer faces MPs as pressure grows over Mandelson scandal

-

HRW urges pushback against 'aggressive superpowers'

HRW urges pushback against 'aggressive superpowers'

-

Russia demands Ukraine give in as UAE talks open

-

Gaza civil defence says 17 killed in strikes after Israel says shots wounded officer

Gaza civil defence says 17 killed in strikes after Israel says shots wounded officer

-

France's Kante joins Fenerbahce after Erdogan 'support'

-

CK Hutchison launches arbitration over Panama Canal port ruling

CK Hutchison launches arbitration over Panama Canal port ruling

-

Stocks mostly rise as traders ignore AI-fuelled sell-off on Wall St

-

Acclaimed Iraqi film explores Saddam Hussein's absurd birthday rituals

Acclaimed Iraqi film explores Saddam Hussein's absurd birthday rituals

-

On rare earth supply, Trump for once seeks allies

-

Ukrainian chasing sumo greatness after meteoric rise

Ukrainian chasing sumo greatness after meteoric rise

-

Draper to make long-awaited return in Davis Cup qualifier

-

Can Ilia Malinin fulfil his promise at the Winter Olympics?

Can Ilia Malinin fulfil his promise at the Winter Olympics?

-

CK Hutchison begins arbitration against Panama over annulled canal contract

-

UNESCO recognition inspires hope in Afghan artist's city

UNESCO recognition inspires hope in Afghan artist's city

-

Ukraine, Russia, US negotiators gather in Abu Dhabi for war talks

-

WTO must 'reform or die': talks facilitator

WTO must 'reform or die': talks facilitator

-

Doctors hope UK archive can solve under-50s bowel cancer mystery

-

Stocks swing following latest AI-fuelled sell-off on Wall St

Stocks swing following latest AI-fuelled sell-off on Wall St

-

Demanding Dupont set to fire France in Ireland opener

-

Britain's ex-prince Andrew leaves Windsor home: BBC

Britain's ex-prince Andrew leaves Windsor home: BBC

-

Coach plots first South Africa World Cup win after Test triumph

Most markets rise as US rate cut bets temper Japan bond unease

Stocks mostly rose Tuesday following the previous day's stutter as more weak data helped solidify US interest rate cut optimism and tempered nervousness over rising Japanese bond yields.

Expectations that the Federal Reserve will lower borrowing costs have provided a boon to markets in the past few weeks and saw them recover early November's losses that had been stoked by fears of a tech bubble.

Bets on the central bank easing monetary policy for a third successive meeting have been rising since a number of decision-makers said protecting jobs was a bigger concern for them than keeping a lid on elevated inflation.

Those comments have been compounded by figures showing the economy -- particularly the labour market -- continues to soften while inflation appears to have stabilised for now.

The latest round of data added to that narrative, with a survey of manufacturers by the Institute for Supply Management indicating that activity in the sector contracted for a ninth straight month.

After a mixed day to start the week, Asia battled to eke out some gains.

Hong Kong, Sydney, Seoul, Singapore, Taipei and Jakarta were all up, though Shanghai, Manila, Mumbai and Bangkok dipped.

Tokyo was marginally higher, giving up early gains, following Monday's losses that came on the back of comments from Bank of Japan boss Kazuo Ueda hinting at a possible interest rate hike this month.

The remarks boosted the yen and provided a jolt to equities as the yield of Japanese two-year government bonds rose past one percent to their highest since 2008 during the global financial crisis. The Japanese unit eased slightly Tuesday as an auction of 10-year bonds received healthy interest.

Ueda's hint also helped pin back Wall Street after last week's Thanksgiving run-up and dented overall risk sentiment, pulling bitcoin back down.

The comments "could mark a de-anchoring of the carry trade, in which traders borrow yen at low cost to invest in riskier assets", wrote City Index senior market analyst Fiona Cincotta.

"A higher rate in Japan could suck liquidity out of the markets. Tech stocks and crypto are particularly sensitive to even the smallest shifts in liquidity."

Still, National Australia Bank's Rodrigo Catril said Ueda also mentioned the need "to confirm the momentum of initial moves toward next year's annual spring labour-management wage negotiations".

He said that "implies that the December meeting may be too soon to have a good understanding of the wage momentum for next year".

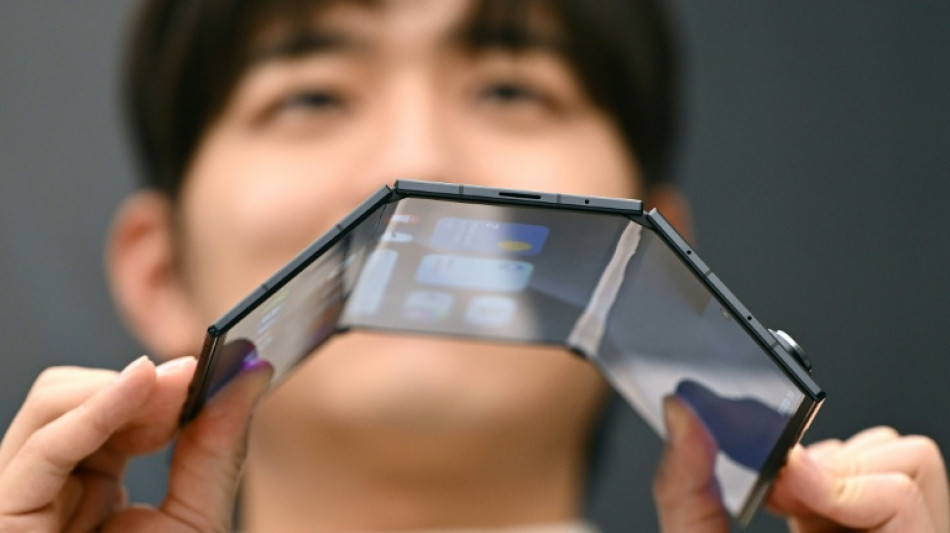

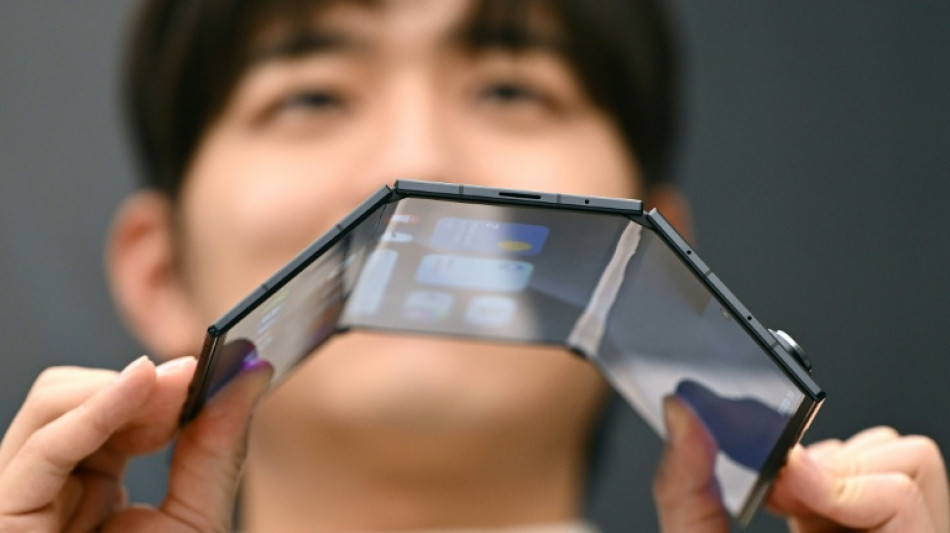

South Korean tech titan Samsung Electronics surged more than two percent in Seoul as it launched its first triple-folding phone, even as the device's more than $2,400 price tag places it out of reach for the average customer.

- Key figures at around 0700 GMT -

Tokyo - Nikkei 225: FLAT at 49,303.45 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 26,074.74

Shanghai - Composite: DOWN 0.4 percent at 3,897.71 (close)

Dollar/yen: UP at 155.80 yen from 155.50 yen on Monday

Euro/dollar: UP at $1.1610 from $1.1608

Pound/dollar: UP at $1.3212 from $1.3211

Euro/pound: DOWN at 87.86 pence from 87.87 pence

West Texas Intermediate: UP 0.2 percent at $59.46 per barrel

Brent North Sea Crude: UP 0.1 percent at $63.26 per barrel

New York - Dow: DOWN 0.9 percent at 47,289.33 (close)

London - FTSE 100: DOWN 0.2 percent at 9,702.53 (close)

X.M.Francisco--PC