-

Trump sues BBC for $10 billion over documentary speech edit

Trump sues BBC for $10 billion over documentary speech edit

-

Chile follows Latin American neighbors in lurching right

-

Will OpenAI be the next tech giant or next Netscape?

Will OpenAI be the next tech giant or next Netscape?

-

Khawaja left out as Australia's Cummins, Lyon back for 3rd Ashes Test

-

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

-

Scheffler wins fourth straight PGA Tour Player of the Year

-

Security beefed up for Ashes Test after Bondi shooting

Security beefed up for Ashes Test after Bondi shooting

-

Wembanyama blocking Knicks path in NBA Cup final

-

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

-

Man Utd blow lead three times in 4-4 Bournemouth thriller

-

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

-

Trump 'considering' push to reclassify marijuana as less dangerous

-

Chiefs coach Reid backing Mahomes recovery after knee injury

Chiefs coach Reid backing Mahomes recovery after knee injury

-

Trump says Ukraine deal close, Europe proposes peace force

-

French minister urges angry farmers to trust cow culls, vaccines

French minister urges angry farmers to trust cow culls, vaccines

-

Angelina Jolie reveals mastectomy scars in Time France magazine

-

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

-

Chile president-elect dials down right-wing rhetoric, vows unity

-

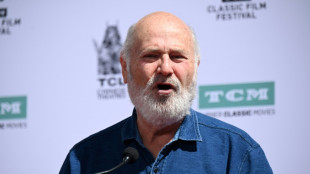

Five Rob Reiner films that rocked, romanced and riveted

Five Rob Reiner films that rocked, romanced and riveted

-

Rob Reiner: Hollywood giant and political activist

-

Observers say Honduran election fair, but urge faster count

Observers say Honduran election fair, but urge faster count

-

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

-

Trump condemned for saying critical filmmaker brought on own murder

Trump condemned for saying critical filmmaker brought on own murder

-

US military to use Trinidad airports, on Venezuela's doorstep

-

Daughter warns China not to make Jimmy Lai a 'martyr'

Daughter warns China not to make Jimmy Lai a 'martyr'

-

UK defence chief says 'whole nation' must meet global threats

-

Rob Reiner's death: what we know

Rob Reiner's death: what we know

-

Zelensky hails 'real progress' in Berlin talks with Trump envoys

-

Toulouse handed two-point deduction for salary cap breach

Toulouse handed two-point deduction for salary cap breach

-

Son arrested for murder of movie director Rob Reiner and wife

-

Stock market optimism returns after tech selloff but Wall Street wobbles

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

In Israel, Sydney attack casts shadow over Hanukkah

-

Athletes to stay in pop-up cabins in the woods at Winter Olympics

-

England seek their own Bradman in bid for historic Ashes comeback

England seek their own Bradman in bid for historic Ashes comeback

-

Decades after Bosman, football's transfer war rages on

-

Ukraine hails 'real progress' in Zelensky's talks with US envoys

Ukraine hails 'real progress' in Zelensky's talks with US envoys

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

Stock market optimism returns after tech sell-off

-

Iran Nobel winner unwell after 'violent' arrest: supporters

-

'Angry' Louvre workers' strike shuts out thousands of tourists

'Angry' Louvre workers' strike shuts out thousands of tourists

-

EU faces key summit on using Russian assets for Ukraine

-

Maresca committed to Chelsea despite outburst

Maresca committed to Chelsea despite outburst

-

Trapped, starving and afraid in besieged Sudan city

-

Messi mania peaks in India's pollution-hit capital

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

Markets stage mild rebound but Trump tariff uncertainty reigns

Asian and European markets battled Tuesday to recover from the previous day's tariff-fuelled collapse, though Donald Trump's warning of more measures against China and Beijing's vow to "fight to the end" raised concerns of a spiralling trade war.

Equities across the world have been hammered since the US president unveiled sweeping levies against friend and foe, upending trading norms, sparking talk of a global recession and wiping trillions of company valuations.

Investors fought to claw back some of those losses as they try to assess the possibility that Washington could temper some of the tariffs. Tokyo traded up more than six percent -- recovering much of Monday's drop -- after Japanese Prime Minister Shigeru Ishiba held talks with Trump.

However, the US leader's threat to hit China with an extra 50 percent tariffs -- in response to its 34 percent retaliation in kind -- ramped up the chances of a catastrophic stand-off between the two economic superpowers.

Trump said he would impose the additional levies if Beijing did not heed his warning not to push back against his barrage of tariffs.

China fired back that it would "never accept" such a move and called the potential escalation "a mistake on top of a mistake".

If Washington "insists on a tariff war and a trade war, China will definitely fight to the end", China's foreign ministry spokesman Lin Jian said Tuesday.

"Pressure, threats and blackmail are not the right way to deal with China," he said.

In light of the turmoil gripping markets, Trump told Americans to "be strong, courageous, and patient".

While uncertainty rules, investors in most markets took the opportunity to pick up some beaten-down stocks.

Tokyo jumped six percent, with Nippon Steel rallying just as much after Trump launched a review of its proposed takeover of US Steel that was blocked by his predecessor Joe Biden.

Hong Kong gained close to two percent but was well short of recouping Monday's loss of more than 13 percent that was the biggest one-day retreat since 1997.

Shanghai advanced 1.6 percent after China's central bank promised to back major state-backed fund Central Huijin Investment in a bid to maintain "the smooth operation of the capital market".

Sydney added more than two percent along with Manila, while Mumbai put on more than two percent.

Seoul and Wellington also edged up.

London, Paris and Frankfurt opened higher, having dropped more than four percent Monday.

The advances followed a less painful day on Wall Street, where the S&P and Dow fell but pared earlier losses, while the Nasdaq edged up.

Oil prices also enjoyed some respite, gaining more than one percent.

Others however were not as fortunate. Taipei shed four percent to extend the previous day's record loss of 9.7 percent, while Singapore was off more than one percent.

Trading in Jakarta was briefly suspended soon after the open as it plunged more than nine percent as investors returned from an extended holiday, while the bourse in Vietnam -- which has been hit with 46 percent tariffs -- shed more than six percent.

Bangkok sank more than four percent as it also reopened after a holiday, with losses tempered by the Stock Exchange of Thailand's decision to ban short-selling on most stocks.

Analysts warned that things could get worse.

"If none of the announced tariffs are reversed by deal-making in the next four weeks or so, the global economy risks entering an 'oil price shock' type crisis by mid-year," said Vincenzo Vedda, global chief investment officer at DWS.

Pepperstone's Chris Weston said it was unlikely that China will scrap its countermeasure, "so we assume a high risk that Trump will follow through with an additional 50 percent tariff rate".

And JPMorgan Chase CEO Jamie Dimon told shareholders: "Whether or not the menu of tariffs causes a recession remains in question, but it will slow down growth" and likely increase inflation.

The trade war has also put the Federal Reserve in the spotlight as economists say it could send prices surging. Bank officials are now having to decide whether to cut interest rates to support the economy, or keep them elevated to keep a lid on inflation.

"Because the tariffs announced thus far are higher than previously expected, we think the risk is now skewed toward more rate cuts by year-end," said Nuveen chief investment officer Saira Malik.

"Our probability-weighted guidance has increased from a total of four Fed cuts through 2025 and 2026 to 6.6 cuts."

- Key figures around 0710 GMT -

Tokyo - Nikkei 225: UP 6.0 percent at 33,012.58 (close)

Hong Kong - Hang Seng Index: UP 1.8 percent at 20,190.49

Shanghai - Composite: UP 1.6 percent at 3,145.55 (close)

London - FTSE 100: UP 0.9 percent at 7,774.61

Euro/dollar: UP at $1.0978 from $1.0904 on Monday

Pound/dollar: UP at $1.2787 from $1.2723

Dollar/yen: DOWN at 147.26 yen from 147.83 yen

Euro/pound: UP at 85.84 pence from 85.68 pence

West Texas Intermediate: UP 1.1 percent at $61.39 per barrel

Brent North Sea Crude: UP 1.0 percent at $64.88 per barrel

New York - Dow: DOWN 0.9 percent at 37,965.60 (close)

O.Gaspar--PC