-

Timeline: How the Bondi Beach mass shooting unfolded

Timeline: How the Bondi Beach mass shooting unfolded

-

On the campaign trail in a tug-of-war Myanmar town

-

Bondi Beach suspect visited Philippines on Indian passport

Bondi Beach suspect visited Philippines on Indian passport

-

Kenyan girls still afflicted by genital mutilation years after ban

-

Djokovic to warm up for Australian Open in Adelaide

Djokovic to warm up for Australian Open in Adelaide

-

Man bailed for fire protest on track at Hong Kong's richest horse race

-

Men's ATP tennis to apply extreme heat rule from 2026

Men's ATP tennis to apply extreme heat rule from 2026

-

10-year-old girl, Holocaust survivors among Bondi Beach dead

-

Steelers edge towards NFL playoffs as Dolphins eliminated

Steelers edge towards NFL playoffs as Dolphins eliminated

-

Australian PM says 'Islamic State ideology' drove Bondi Beach gunmen

-

Canada plow-maker can't clear path through Trump tariffs

Canada plow-maker can't clear path through Trump tariffs

-

Bank of Japan expected to hike rates to 30-year high

-

Cunningham leads Pistons past Celtics

Cunningham leads Pistons past Celtics

-

Stokes tells England to 'show a bit of dog' in must-win Adelaide Test

-

EU to unveil plan to tackle housing crisis

EU to unveil plan to tackle housing crisis

-

EU set to scrap 2035 combustion-engine ban in car industry boost

-

Australian PM visits Bondi Beach hero in hospital

Australian PM visits Bondi Beach hero in hospital

-

'Easiest scam in the world': Musicians sound alarm over AI impersonators

-

'Waiting to die': the dirty business of recycling in Vietnam

'Waiting to die': the dirty business of recycling in Vietnam

-

Asian markets retreat ahead of US jobs as tech worries weigh

-

Famed Jerusalem stone still sells despite West Bank economic woes

Famed Jerusalem stone still sells despite West Bank economic woes

-

Trump sues BBC for $10 billion over documentary speech edit

-

Chile follows Latin American neighbors in lurching right

Chile follows Latin American neighbors in lurching right

-

Will OpenAI be the next tech giant or next Netscape?

-

Khawaja left out as Australia's Cummins, Lyon back for 3rd Ashes Test

Khawaja left out as Australia's Cummins, Lyon back for 3rd Ashes Test

-

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

-

Scheffler wins fourth straight PGA Tour Player of the Year

Scheffler wins fourth straight PGA Tour Player of the Year

-

New APAC Partnership with Matter Brings Market Logic Software's Always-On Insights Solutions to Local Brand and Experience Leaders

-

Security beefed up for Ashes Test after Bondi shooting

Security beefed up for Ashes Test after Bondi shooting

-

Wembanyama blocking Knicks path in NBA Cup final

-

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

-

Man Utd blow lead three times in 4-4 Bournemouth thriller

-

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

-

Trump 'considering' push to reclassify marijuana as less dangerous

-

Chiefs coach Reid backing Mahomes recovery after knee injury

Chiefs coach Reid backing Mahomes recovery after knee injury

-

Trump says Ukraine deal close, Europe proposes peace force

-

French minister urges angry farmers to trust cow culls, vaccines

French minister urges angry farmers to trust cow culls, vaccines

-

Angelina Jolie reveals mastectomy scars in Time France magazine

-

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

-

Chile president-elect dials down right-wing rhetoric, vows unity

-

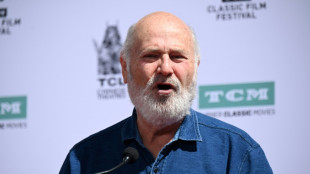

Five Rob Reiner films that rocked, romanced and riveted

Five Rob Reiner films that rocked, romanced and riveted

-

Rob Reiner: Hollywood giant and political activist

-

Observers say Honduran election fair, but urge faster count

Observers say Honduran election fair, but urge faster count

-

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

-

Trump condemned for saying critical filmmaker brought on own murder

Trump condemned for saying critical filmmaker brought on own murder

-

US military to use Trinidad airports, on Venezuela's doorstep

-

Daughter warns China not to make Jimmy Lai a 'martyr'

Daughter warns China not to make Jimmy Lai a 'martyr'

-

UK defence chief says 'whole nation' must meet global threats

-

Rob Reiner's death: what we know

Rob Reiner's death: what we know

-

Zelensky hails 'real progress' in Berlin talks with Trump envoys

ECB ready to cut rates again as Trump tariffs shake eurozone

European Central Bank policymakers look increasingly likely to cut interest rates again on Thursday, with US President Donald Trump's stop-start tariff announcements sowing concern in the eurozone.

The uncertainty around Trump's next move, and the negative impact it could have on growth within the single currency bloc, has intensified calls for the ECB to ease borrowing costs further.

Worries over rising prices have faded into the background, as once sky-high inflation rates have drifted back down towards the ECB's two-percent target.

The central bank has made six quarter-point cuts since June last year as inflation has fallen, bringing its benchmark deposit rate down to 2.5 percent from four percent.

After such a long cutting streak, the central bank "seemed set for a pause" after its last meeting in March, ING bank analyst Carsten Brzeski said.

But the picture has changed significantly since Trump's announcement of a new round of swingeing tariffs, which he referred to as "Liberation Day".

Trump imposed 10 percent tariffs on all imports into the United States.

His decision to suspend even higher tariffs for most countries for 90 days and invitation to key trading partners to cut a deal have done little to quell concerns.

"US tariffs on the EU and many other countries have brought back growth concerns for the eurozone, at least in the nearer term," Brzeski said.

For the members of the ECB's governing council meeting in Frankfurt, a pause in rate cutting was "no longer an option", he said.

- 'Trade uncertainty' -

Going into the meeting, eurozone policymakers could not be sure what tariff rates would eventually apply to transatlantic trade.

For now, Trump has rowed back on his initial decision to hit all European Union imports with a basic 20 percent tariff, which could rekindle inflation.

But the White House has also imposed 25 percent levies on the automotive, steel and aluminium sectors, and opened probes into semiconductors and pharmaceuticals that could lead to more industry-specific tariffs.

"Heightened trade uncertainty and tighter financial conditions" caused by Trump's announcements have increased the "downside" risk for the eurozone, according to analysts at Italian lender UniCredit.

In that context, another cut to relieve stress on households and businesses and support the economy seemed "straightforward", the analysts said.

The ramifications of higher US tariffs would "outweigh the positive impulse" given by massive planned spending in the eurozone's biggest member, Germany, they said.

The incoming government in Berlin led by Friedrich Merz has lined up hundreds of billions of euros in extra cash for defence and infrastructure, providing a boost that could be felt across Europe.

- 'Always ready' -

But Germany's stimulus measures would only "kick in" in 2026, while the impact of Trump's shake-up of the global trading system would be felt almost immediately, the UniCredit analysts warned.

As for the prices of goods and services, US tariffs made a "further decline in inflation in the eurozone even more likely", said Robert Greil, a strategist at private bank Merck Finck.

Inflation among the 20 members of the eurozone has come down significantly from the double-digit highs seen in late 2022 and sat at 2.2 percent in March.

The single currency has gained in strength relative to the dollar, which should make imports cheaper going forward, while hefty US tariffs on China could see cheap goods diverted to Europe, Greil said.

Observers will listen carefully to ECB president Christine Lagarde's remarks after the rates announcement for a hint of how the ECB may respond going forward.

Lagarde last week signalled policymakers' willingness to support the eurozone in a more critical scenario, where Trump's tariff blitz caused a threat to financial stability.

The ECB "is always ready to use the instruments that it has available", Lagarde said in Warsaw.

T.Resende--PC