-

Chelsea's draw with Leeds 'bitter pill' for Rosenior

Chelsea's draw with Leeds 'bitter pill' for Rosenior

-

'On autopilot': US skate star Malinin nears more Olympic gold

-

Carrick frustrated by Man Utd's lack of sharpness in West Ham draw

Carrick frustrated by Man Utd's lack of sharpness in West Ham draw

-

Frank confident of keeping Spurs job despite Newcastle defeat

-

James's All-NBA streak ends as Lakers rule superstar out of Spurs clash

James's All-NBA streak ends as Lakers rule superstar out of Spurs clash

-

Anti-Khamenei slogans in Tehran on eve of revolution anniversary: social media footage

-

Colombian senator kidnapped, president targeted in election run-up

Colombian senator kidnapped, president targeted in election run-up

-

Britney Spears sells rights to her music catalog: US media

-

West Ham end Man Utd's winning run, Spurs sink to 16th

West Ham end Man Utd's winning run, Spurs sink to 16th

-

US skate star Malinin leads after short programme in Olympics

-

Man Utd's Sesko strikes late to rescue West Ham draw

Man Utd's Sesko strikes late to rescue West Ham draw

-

Shiffrin flops at Winter Olympics as helmet row grows

-

Celtics' Tatum practices with G League team but injury return uncertain

Celtics' Tatum practices with G League team but injury return uncertain

-

Gisele Pelicot publishes memoirs after rape trial ordeal

-

Newcastle beat sorry Spurs to leave Frank on the brink

Newcastle beat sorry Spurs to leave Frank on the brink

-

'Outrage' as LGBTQ Pride flag removed from Stonewall monument

-

Chappell Roan leaves agency headed by embattled 2028 Olympic chief

Chappell Roan leaves agency headed by embattled 2028 Olympic chief

-

Venezuelan authorities move Machado ally to house arrest

-

YouTube rejects addiction claims in landmark social media trial

YouTube rejects addiction claims in landmark social media trial

-

Google turns to century-long debt to build AI

-

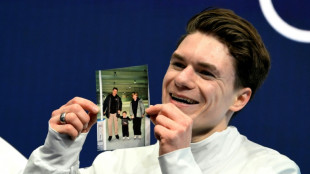

'I felt guided by them': US skater Naumov remembers parents at Olympics

'I felt guided by them': US skater Naumov remembers parents at Olympics

-

Till death do us bark: Brazilian state lets pets be buried with owners

-

'Confident' Pakistan ready for India blockbuster after USA win

'Confident' Pakistan ready for India blockbuster after USA win

-

Latam-GPT: a Latin American AI to combat US-centric bias

-

Gauff dumped out of Qatar Open, Swiatek, Rybakina through

Gauff dumped out of Qatar Open, Swiatek, Rybakina through

-

Paris officers accused of beating black producer to stand trial in November

-

Istanbul bars rock bands accused of 'satanism'

Istanbul bars rock bands accused of 'satanism'

-

Olympic bronze medal biathlete confesses affair on live TV

-

US commerce chief admits Epstein Island lunch but denies closer ties

US commerce chief admits Epstein Island lunch but denies closer ties

-

Mayor of Ecuador's biggest city arrested for money laundering

-

Farhan, spinners lead Pakistan to easy USA win in T20 World Cup

Farhan, spinners lead Pakistan to easy USA win in T20 World Cup

-

Stocks mixed as muted US retail sales spur caution

-

Macron wants more EU joint borrowing: Could it happen?

Macron wants more EU joint borrowing: Could it happen?

-

Shiffrin flops at Winter Olympics as helmet row simmers

-

No excuses for Shiffrin after Olympic team combined flop

No excuses for Shiffrin after Olympic team combined flop

-

Pool on wheels brings swim lessons to rural France

-

Europe's Ariane 6 to launch Amazon constellation satellites into orbit

Europe's Ariane 6 to launch Amazon constellation satellites into orbit

-

Could the digital euro get a green light in 2026?

-

Spain's Telefonica sells Chile unit in Latin America pullout

Spain's Telefonica sells Chile unit in Latin America pullout

-

'We've lost everything': Colombia floods kill 22

-

Farhan propels Pakistan to 190-9 against USA in T20 World Cup

Farhan propels Pakistan to 190-9 against USA in T20 World Cup

-

US to scrap cornerstone of climate regulation this week

-

Nepal call for India, England, Australia to play in Kathmandu

Nepal call for India, England, Australia to play in Kathmandu

-

Stocks rise but lacklustre US retail sales spur caution

-

Olympic chiefs let Ukrainian athlete wear black armband at Olympics after helmet ban

Olympic chiefs let Ukrainian athlete wear black armband at Olympics after helmet ban

-

French ice dancers poised for Winter Olympics gold amid turmoil

-

Norway's Ruud wins error-strewn Olympic freeski slopestyle

Norway's Ruud wins error-strewn Olympic freeski slopestyle

-

More Olympic pain for Shiffrin as Austria win team combined

-

Itoje returns to captain England for Scotland Six Nations clash

Itoje returns to captain England for Scotland Six Nations clash

-

Sahara celebrates desert cultures at Chad festival

Trump advisor says US may take stakes in other firms after Intel

The US government could take stakes in other companies after doing so with chipmaker Intel, President Donald Trump's top economic advisor Kevin Hassett said Monday.

Hassett, director of the National Economic Council, cited Trump's plans for a sovereign wealth fund in a CNBC interview, saying "I'm sure that at some point there'll be more transactions" in the semiconductor industry or others.

He was responding to a question on whether a recently announced deal for the US government to take a 10-percent equity stake in Intel was the start of broader efforts towards similar moves in other industries that authorities have been funding.

Under the agreement with Intel, the US government will receive 433.3 million shares of common stock, representing a 9.9-percent stake in the company, Intel said in an earlier statement.

This amounts to an $8.9 billion investment, funded partially by $5.7 billion in grants awarded but not yet paid under the CHIPS and Science Act -- a major law passed under former president Joe Biden, which Trump has criticized. The other portion comes from a different award.

Hassett said on Monday that "in the past, the federal government has been giving money away" to companies.

But he maintained that under potential deals like that with Intel, "these are going to be shares that don't have voting rights."

He said the US government plans to stay out of how companies are run.

- Company risks -

Intel warned in a securities filing on Monday, however, that the government's equity stake could limit its ability to secure grants from government entities in the future -- among other risks.

It noted that the timing it would receive the funding, alongside its ability to fulfil conditions for the funds, "remain uncertain."

Intel additionally noted that its international business could be "adversely impacted" by the US government being a significant shareholder.

Critics of the deal warn it could be bad for the company's viability if politics are seen as driving business decisions.

In February, shortly after Trump returned to the presidency, the White House published a plan for the world's biggest economy to set up a sovereign wealth fund.

A sovereign wealth fund is a state-owned investment fund that manages a country's excess reserves, typically derived from natural resource revenues or trade surpluses, to generate long-term returns.

For now, Hassett noted that the specific deal with Intel came out of "a very, very special circumstance because of the massive amount of CHIPS act spending that was coming Intel's way."

bys/des

The US government could take stakes in other companies after doing so with chipmaker Intel, President Donald Trump's top economic advisor Kevin Hassett said Monday.

Hassett, director of the National Economic Council, cited Trump's plans for a sovereign wealth fund in a CNBC interview, saying "I'm sure that at some point there'll be more transactions" in the semiconductor industry or others.

He was responding to a question on whether a recently announced deal for the US government to take a 10-percent equity stake in Intel was the start of broader efforts towards similar moves in other industries that authorities have been funding.

Under the agreement with Intel, the US government will receive 433.3 million shares of common stock, representing a 9.9-percent stake in the company, Intel said in an earlier statement.

This amounts to an $8.9 billion investment, funded partially by $5.7 billion in grants awarded but not yet paid under the CHIPS and Science Act -- a major law passed under former president Joe Biden, which Trump has criticized. The other portion comes from a different award.

Hassett said on Monday that "in the past, the federal government has been giving money away" to companies.

But he maintained that under potential deals like that with Intel, "these are going to be shares that don't have voting rights."

He said the US government plans to stay out of how companies are run.

- Company risks -

Intel warned in a securities filing on Monday, however, that the government's equity stake could limit its ability to secure grants from government entities in the future -- among other risks.

It noted that the timing it would receive the funding, alongside its ability to fulfil conditions for the funds, "remain uncertain."

Intel additionally noted that its international business could be "adversely impacted" by the US government being a significant shareholder.

Critics of the deal warn it could be bad for the company's viability if politics are seen as driving business decisions.

In February, shortly after Trump returned to the presidency, the White House published a plan for the world's biggest economy to set up a sovereign wealth fund.

A sovereign wealth fund is a state-owned investment fund that manages a country's excess reserves, typically derived from natural resource revenues or trade surpluses, to generate long-term returns.

For now, Hassett noted that the specific deal with Intel came out of "a very, very special circumstance because of the massive amount of CHIPS act spending that was coming Intel's way."

T.Resende--PC