-

Olympic star Chloe Kim calls for 'compassion' after Trump attack on US teammate

Olympic star Chloe Kim calls for 'compassion' after Trump attack on US teammate

-

'All the pressure' on Pakistan as USA out to inflict another T20 shock

-

Starmer vows to remain as UK PM amid Epstein fallout

Starmer vows to remain as UK PM amid Epstein fallout

-

Howe would 'step aside' if right for Newcastle

-

Sakamoto wants 'no regrets' as gold beckons in Olympic finale

Sakamoto wants 'no regrets' as gold beckons in Olympic finale

-

What next for Vonn after painful end of Olympic dream?

-

Brain training reduces dementia risk by 25%, study finds

Brain training reduces dementia risk by 25%, study finds

-

Gremaud ends Gu's hopes of Olympic treble in freeski slopestyle

-

Shiffrin and Johnson paired in Winter Olympics team combined

Shiffrin and Johnson paired in Winter Olympics team combined

-

UK's Starmer scrambles to limit Epstein fallout as aides quit

-

US skater Malinin 'full of confidence' after first Olympic gold

US skater Malinin 'full of confidence' after first Olympic gold

-

Sydney police pepper spray protesters during rallies against Israeli president's visit

-

Israel says killed four militants exiting Gaza tunnel

Israel says killed four militants exiting Gaza tunnel

-

Franzoni sets pace in Olympic team combined

-

Captain's injury agony mars 'emotional' Italy debut at T20 World Cup

Captain's injury agony mars 'emotional' Italy debut at T20 World Cup

-

Family matters: Thaksin's party down, maybe not out

-

African players in Europe: Ouattara fires another winner for Bees

African players in Europe: Ouattara fires another winner for Bees

-

Pressure grows on UK's Starmer over Epstein fallout

-

Music world mourns Ghana's Ebo Taylor, founding father of highlife

Music world mourns Ghana's Ebo Taylor, founding father of highlife

-

HK mogul's ex-workers 'broke down in tears' as they watched sentencing

-

JD Vance set for Armenia, Azerbaijan trip

JD Vance set for Armenia, Azerbaijan trip

-

Sydney police deploy pepper spray as Israeli president's visit sparks protests

-

EU warns Meta it must open up WhatsApp to rival AI chatbots

EU warns Meta it must open up WhatsApp to rival AI chatbots

-

Scotland spoil Italy's T20 World Cup debut with big win

-

Israeli president says 'we will overcome evil' at Bondi Beach

Israeli president says 'we will overcome evil' at Bondi Beach

-

Munsey leads Scotland to 207-4 against Italy at T20 World Cup

-

Japan restarts world's biggest nuclear plant again

Japan restarts world's biggest nuclear plant again

-

Bangladesh poll rivals rally on final day of campaign

-

Third impeachment case filed against Philippine VP Duterte

Third impeachment case filed against Philippine VP Duterte

-

Wallaby winger Nawaqanitawase heads to Japan

-

Thailand's Anutin rides wave of nationalism to election victory

Thailand's Anutin rides wave of nationalism to election victory

-

Venezuela's Machado says ally kidnapped by armed men after his release

-

Maye longs for do-over as record Super Bowl bid ends in misery

Maye longs for do-over as record Super Bowl bid ends in misery

-

Seahawks' Walker rushes to Super Bowl MVP honors

-

Darnold basks in 'special journey' to Super Bowl glory

Darnold basks in 'special journey' to Super Bowl glory

-

Japan's Takaichi may struggle to soothe voters and markets

-

Seahawks soar to Super Bowl win over Patriots

Seahawks soar to Super Bowl win over Patriots

-

'Want to go home': Indonesian crew abandoned off Africa demand wages

-

Asian stocks track Wall St rally as Tokyo hits record on Takaichi win

Asian stocks track Wall St rally as Tokyo hits record on Takaichi win

-

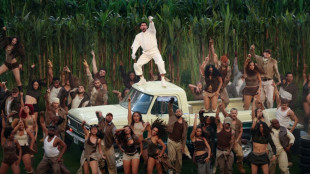

Bad Bunny celebrates Puerto Rico in joyous Super Bowl halftime show

-

Three prominent opposition figures released in Venezuela

Three prominent opposition figures released in Venezuela

-

Israeli president says 'we shall overcome this evil' at Bondi Beach

-

'Flood' of disinformation ahead of Bangladesh election

'Flood' of disinformation ahead of Bangladesh election

-

Arguments to begin in key US social media addiction trial

-

UK-Based Vesalic Limited Emerges from Stealth with Landmark Discovery of Potential Non-CNS Driver of Motor Neuron Diseases, including ALS, and Breakthrough Therapeutic and Diagnostic Opportunities

UK-Based Vesalic Limited Emerges from Stealth with Landmark Discovery of Potential Non-CNS Driver of Motor Neuron Diseases, including ALS, and Breakthrough Therapeutic and Diagnostic Opportunities

-

Gotterup tops Matsuyama in playoff to win Phoenix Open

-

New Zealand's Christchurch mosque killer appeals conviction

New Zealand's Christchurch mosque killer appeals conviction

-

Leonard's 41 leads Clippers over T-Wolves, Knicks cruise

-

Trump says China's Xi to visit US 'toward the end of the year'

Trump says China's Xi to visit US 'toward the end of the year'

-

Real Madrid edge Valencia to stay on Barca's tail, Atletico slump

Asia markets waver after Wall St retreats from record

Equities wavered Wednesday following a down day on Wall Street, where worries about high valuations were compounded by mixed messaging from the Federal Reserve on its plans for interest rates.

Investors have enjoyed a months-long rally that has pushed some markets to record highs but the run-up took a pause Tuesday amid talk that the gains may have gone too far.

All three main indexes in New York were dragged down from peaks by tech titans including Nvidia and Amazon, which have been at the forefront of the global surge owing to huge bets on artificial intelligence.

Another key driver of the gains has been expectations that the Fed will cut borrowing costs several times this year, with last week's reduction followed by forecasts that two more were in the pipeline.

However, comments from key officials stoked uncertainty among investors.

Boss Jerome Powell warned there was "no risk-free path".

"If we ease too aggressively, we could leave the inflation job unfinished and need to reverse course later to fully restore two-percent inflation," he said at an event in Rhode Island.

But he added: "If we maintain restrictive policy too long, the labour market could soften unnecessarily."

The remarks came as Atlanta Fed chief Raphael Bostic and Chicago counterpart Austan Goolsbee warned of more inflation.

However, governor Michelle Bowman called on her colleagues to slash rates amid fears they were "at serious risk of already being behind the curve in addressing deteriorating labor market conditions".

"Now that we have seen many months of deteriorating labour market conditions, it is time for the committee to act decisively and proactively to address decreasing labor market dynamism and emerging signs of fragility," she said in prepared remarks ahead of an event in Kentucky.

Investors are now awaiting the release Friday of the personal consumption expenditure (PCE) index, the Fed's favoured gauge of inflation, and key jobs figures the week after.

New governor Stephen Miran, who was appointed by Donald Trump, also called for more reductions.

Pepperstone's Chris Weston wrote: "One assumes that if we see US core PCE inflation print at 0.2 percent month-on-month, followed by a tick higher in the layoff rate... and another weak non-farm payrolls release, Bowman may conclude the time for insurance cuts has passed and revert back to a 50-basis-point dissent."

In Asian trade, Tokyo fell along with Sydney, Seoul, Singapore, Taipei and Wellington, though there were small gains in Hong Kong, Shanghai and Manila.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 0.4 percent at 45,300.30 (break)

Hong Kong - Hang Seng Index: UP 0.2 percent at 26,223.11

Shanghai - Composite: UP 0.3 percent at 3,832.38

Euro/dollar: DOWN at $1.1802 from $1.1816 on Tuesday

Pound/dollar: DOWN at $1.3514 from $1.3524

Dollar/yen: UP at 147.74 yen from 147.66 yen

Euro/pound: DOWN at 87.33 pence from 87.37 pence

West Texas Intermediate: UP 0.3 percent at $63.58 per barrel

Brent North Sea Crude: UP 0.2 percent at $67.08 per barrel

New York - Dow: DOWN 0.2 percent at 46,292.78 (close)

London - FTSE 100: FLAT at 9,223.32 (close)

F.Santana--PC