-

Trump sues BBC for $10 billion over documentary speech edit

Trump sues BBC for $10 billion over documentary speech edit

-

Chile follows Latin American neighbors in lurching right

-

Will OpenAI be the next tech giant or next Netscape?

Will OpenAI be the next tech giant or next Netscape?

-

Khawaja left out as Australia's Cummins, Lyon back for 3rd Ashes Test

-

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

-

Scheffler wins fourth straight PGA Tour Player of the Year

-

Security beefed up for Ashes Test after Bondi shooting

Security beefed up for Ashes Test after Bondi shooting

-

Wembanyama blocking Knicks path in NBA Cup final

-

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

-

Man Utd blow lead three times in 4-4 Bournemouth thriller

-

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

-

Trump 'considering' push to reclassify marijuana as less dangerous

-

Chiefs coach Reid backing Mahomes recovery after knee injury

Chiefs coach Reid backing Mahomes recovery after knee injury

-

Trump says Ukraine deal close, Europe proposes peace force

-

French minister urges angry farmers to trust cow culls, vaccines

French minister urges angry farmers to trust cow culls, vaccines

-

Angelina Jolie reveals mastectomy scars in Time France magazine

-

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

-

Chile president-elect dials down right-wing rhetoric, vows unity

-

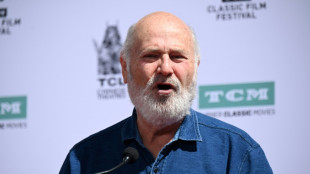

Five Rob Reiner films that rocked, romanced and riveted

Five Rob Reiner films that rocked, romanced and riveted

-

Rob Reiner: Hollywood giant and political activist

-

Observers say Honduran election fair, but urge faster count

Observers say Honduran election fair, but urge faster count

-

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

-

Trump condemned for saying critical filmmaker brought on own murder

Trump condemned for saying critical filmmaker brought on own murder

-

US military to use Trinidad airports, on Venezuela's doorstep

-

Daughter warns China not to make Jimmy Lai a 'martyr'

Daughter warns China not to make Jimmy Lai a 'martyr'

-

UK defence chief says 'whole nation' must meet global threats

-

Rob Reiner's death: what we know

Rob Reiner's death: what we know

-

Zelensky hails 'real progress' in Berlin talks with Trump envoys

-

Toulouse handed two-point deduction for salary cap breach

Toulouse handed two-point deduction for salary cap breach

-

Son arrested for murder of movie director Rob Reiner and wife

-

Stock market optimism returns after tech selloff but Wall Street wobbles

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

In Israel, Sydney attack casts shadow over Hanukkah

-

Athletes to stay in pop-up cabins in the woods at Winter Olympics

-

England seek their own Bradman in bid for historic Ashes comeback

England seek their own Bradman in bid for historic Ashes comeback

-

Decades after Bosman, football's transfer war rages on

-

Ukraine hails 'real progress' in Zelensky's talks with US envoys

Ukraine hails 'real progress' in Zelensky's talks with US envoys

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

Stock market optimism returns after tech sell-off

-

Iran Nobel winner unwell after 'violent' arrest: supporters

-

'Angry' Louvre workers' strike shuts out thousands of tourists

'Angry' Louvre workers' strike shuts out thousands of tourists

-

EU faces key summit on using Russian assets for Ukraine

-

Maresca committed to Chelsea despite outburst

Maresca committed to Chelsea despite outburst

-

Trapped, starving and afraid in besieged Sudan city

-

Messi mania peaks in India's pollution-hit capital

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

Stock markets rise as China hopes boost Hong Kong

Asian and European markets rose Friday with Hong Kong leading the way fuelled by hopes China will roll back some of its economically painful zero-Covid policies.

The gains come after Federal Reserve boss Jerome Powell's pushback against expectations of a softer approach to interest rate hikes sent shivers through trading floors and ramped up fears of a global recession.

However, the mood lightened in Asia on Friday, as Hong Kong jumped more than five percent on lingering hopes that China will soon begin rolling back its zero-Covid strategy of lockdowns that has hammered the world's second-largest economy. Shanghai ended up more than two percent.

The Hang Seng Index has jumped almost nine percent this week since an unverified statement earlier this week suggested officials in Beijing were discussing a change.

The gains continued despite pushback from authorities, and after President Xi Jinping reasserted the zero-Covid strategy at a major Communist Party gathering last month.

"What we are guessing is China in the future will model the reopening on the back of Hong Kong," Jack Siu, Greater China chief investment officer at Credit Suisse, told Bloomberg Television.

"To fully reopen, we are still at least nine months away from today."

Tech firms were the big winners in Hong Kong, with Alibaba and Tencent up by double digits on reports of progress in US auditing of Chinese firms listed in New York.

Alibaba and Tencent among others have faced delisting from Wall Street owing to a standoff between securities authorities as part of the wider China-US row.

Elsewhere, Sydney, Seoul, Singapore, Taipei, Manila, Jakarta, Bangkok and Wellington rose.

However, Tokyo was deep in the red as traders played catch-up with Thursday's losses after returning from a one-day holiday. Mumbai also fell.

The ongoing optimism about an easing of China's Covid policy lifted oil prices on an expectation that demand will build as the giant economy picks up speed again.

The dollar held gains made after Powell's comments Wednesday. The governor told a news conference that while the size of rate increases would likely come down, they would top out at a higher level than expected, dealing a blow to talk of an end soon.

The decision came as other central banks have signalled they will tone down their hawkishness, even in the face of decades- or record-high inflation.

The Bank of England became the latest on Thursday when it lifted borrowing costs by their most in 33 years -- and to a 14-year high -- but said they would not go as high as markets had priced in.

It also warned that the UK economy faced a prolonged recession -- possibly into 2024 -- as it battles high prices caused by the Ukraine war.

The comments skewered the pound -- already under severe pressure after recent turmoil in Westminster -- and sent it tumbling against the dollar and euro, while it struggled to bounce back in Asia.

Investors are now awaiting the release of jobs data later in the day, which could provide fresh insight into the state of the world's top economy.

With the Fed pointing to a still-strong labour market as a key reason for not shifting from its rate-hike strategy, traders are nervous that a big figure in the report will give officials room to tighten more.

"After initial jobless claims came in line with expectations, Friday's payrolls will be the last vital data point this week, as signals on the labour market remain crucial to the Fed's path forward, and many stock pickers are dearly hoping for 'bad news is good news' close to the week," said SPI Asset Management's Stephen Innes.

- Key figures around 0820 GMT -

Tokyo - Nikkei 225: DOWN 1.7 percent at 27,199.74 (close)

Hong Kong - Hang Seng Index: UP 5.4 percent at 16,161.14 (close)

Shanghai - Composite: UP 2.4 percent at 3,070.80 (close)

London - FTSE 100: UP 0.7 percent at 7,237.13

Pound/dollar: UP at $1.1216 from $1.1160 Thursday

Euro/dollar: UP at $0.9773 from $0.9751

Dollar/yen: DOWN at 147.76 yen from 148.25 yen

Euro/pound: DOWN at 87.16 pence from 87.73 pence

West Texas Intermediate: UP 2.2 percent at $90.07 per barrel

Brent North Sea crude: UP 1.9 percent at $96.44 per barrel

New York - Dow: DOWN 0.5 percent at 32,001.25 (close)

R.J.Fidalgo--PC