-

Voter swings raise midterm alarm bells for Trump's Republicans

Voter swings raise midterm alarm bells for Trump's Republicans

-

Australia dodges call for arrest of visiting Israel president

-

Countries using internet blackouts to boost censorship: Proton

Countries using internet blackouts to boost censorship: Proton

-

Top US news anchor pleads with kidnappers for mom's life

-

Thailand's pilot PM on course to keep top job

Thailand's pilot PM on course to keep top job

-

The coming end of ISS, symbol of an era of global cooperation

-

New crew set to launch for ISS after medical evacuation

New crew set to launch for ISS after medical evacuation

-

Family affair: Thailand waning dynasty still election kingmaker

-

Japan's first woman PM tipped for thumping election win

Japan's first woman PM tipped for thumping election win

-

Stocks in retreat as traders reconsider tech investment

-

LA officials call for Olympic chief to resign over Epstein file emails

LA officials call for Olympic chief to resign over Epstein file emails

-

Ukraine, Russia, US to start second day of war talks

-

Fiji football legend returns home to captain first pro club

Fiji football legend returns home to captain first pro club

-

Trump attacks US electoral system with call to 'nationalize' voting

-

Barry Manilow cancels Las Vegas shows but 'doing great' post-surgery

Barry Manilow cancels Las Vegas shows but 'doing great' post-surgery

-

US households become increasingly strained in diverging economy

-

Four dead men: the cold case that engulfed a Colombian cycling star

Four dead men: the cold case that engulfed a Colombian cycling star

-

Super Bowl stars stake claims for Olympic flag football

-

On a roll, Brazilian cinema seizes its moment

On a roll, Brazilian cinema seizes its moment

-

Rising euro, falling inflation in focus at ECB meeting

-

AI to track icebergs adrift at sea in boon for science

AI to track icebergs adrift at sea in boon for science

-

Indigenous Brazilians protest Amazon river dredging for grain exports

-

Google's annual revenue tops $400 bn for first time, AI investments rise

Google's annual revenue tops $400 bn for first time, AI investments rise

-

Last US-Russia nuclear treaty ends in 'grave moment' for world

-

Man City brush aside Newcastle to reach League Cup final

Man City brush aside Newcastle to reach League Cup final

-

Guardiola wants permission for Guehi to play in League Cup final

-

Boxer Khelif reveals 'hormone treatments' before Paris Olympics

Boxer Khelif reveals 'hormone treatments' before Paris Olympics

-

'Bad Boy,' 'Little Pablo' and Mordisco: the men on a US-Colombia hitlist

-

BHP damages trial over Brazil mine disaster to open in 2027

BHP damages trial over Brazil mine disaster to open in 2027

-

Dallas deals Davis to Wizards in blockbuster NBA trade: report

-

Lens cruise into French Cup quarters, Endrick sends Lyon through

Lens cruise into French Cup quarters, Endrick sends Lyon through

-

No.1 Scheffler excited for Koepka return from LIV Golf

-

Curling quietly kicks off sports programme at 2026 Winter Olympics

Curling quietly kicks off sports programme at 2026 Winter Olympics

-

Undav pokes Stuttgart past Kiel into German Cup semis

-

Germany goalkeeper Ter Stegen to undergo surgery

Germany goalkeeper Ter Stegen to undergo surgery

-

Bezos-led Washington Post announces 'painful' job cuts

-

Iran says US talks are on, as Trump warns supreme leader

Iran says US talks are on, as Trump warns supreme leader

-

Gaza health officials say strikes kill 24 after Israel says officer wounded

-

Empress's crown dropped in Louvre heist to be fully restored: museum

Empress's crown dropped in Louvre heist to be fully restored: museum

-

UK PM says Mandelson 'lied' about Epstein relations

-

Shai to miss NBA All-Star Game with abdominal strain

Shai to miss NBA All-Star Game with abdominal strain

-

Trump suggests 'softer touch' needed on immigration

-

From 'flop' to Super Bowl favorite: Sam Darnold's second act

From 'flop' to Super Bowl favorite: Sam Darnold's second act

-

Man sentenced to life in prison for plotting to kill Trump in 2024

-

Native Americans on high alert over Minneapolis crackdown

Native Americans on high alert over Minneapolis crackdown

-

Dallas deals Davis to Wizards in blockbuster NBA deal: report

-

Panama hits back after China warns of 'heavy price' in ports row

Panama hits back after China warns of 'heavy price' in ports row

-

Strike kills guerrillas as US, Colombia agree to target narco bosses

-

Wildfire smoke kills more than 24,000 Americans a year: study

Wildfire smoke kills more than 24,000 Americans a year: study

-

Telegram founder slams Spain PM over under-16s social media ban

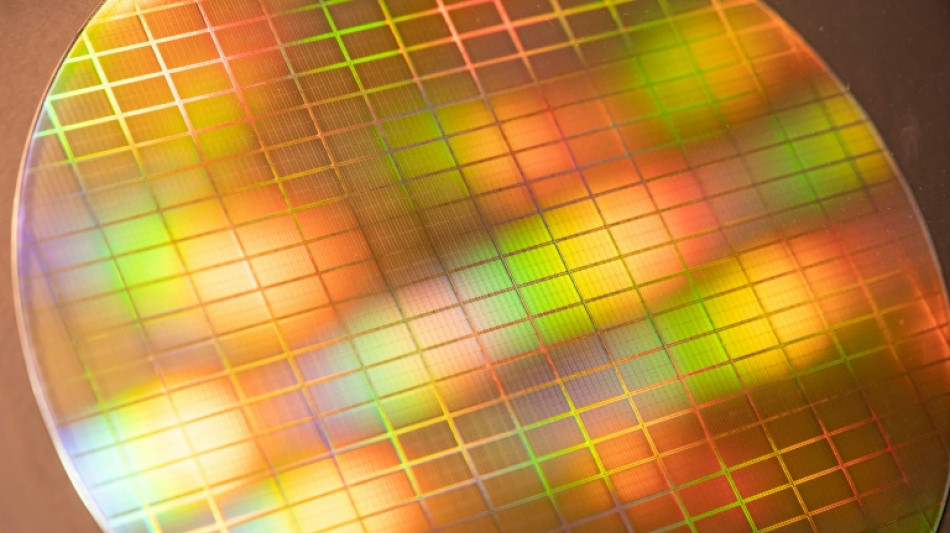

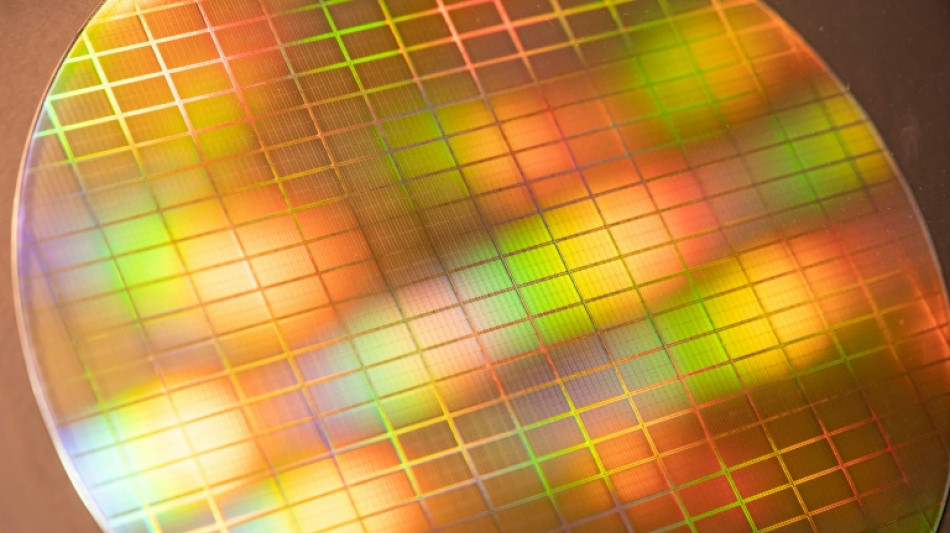

Why are the US and China fighting over chips?

The United States has moved to block China's access to the most advanced semiconductors and the equipment and talent needed to make them in recent months, citing national security.

China has dismissed those concerns, accusing the United States of "technological terrorism" and unfairly hindering its economic growth. It has sought to counter the US containment measures.

AFP takes a look at the key issues in the so-called "semiconductor wars":

- Why are chips important? -

Microchips are the lifeblood of the modern global economy: the tiny slices of silicon are found in all types of electronics -- from LED lightbulbs and washing machines to cars and smartphones.

They are also critical to core services such as healthcare, law and order and utilities.

Globally, semiconductors are forecast to become a $1-trillion industry by 2030, according to a McKinsey report published last year.

Nowhere is their essential nature more visible than in China, the world's second-largest economy, which relies on a steady supply of foreign chips for its huge electronics manufacturing base.

In 2021, China imported semiconductors worth $430 billion -- more than it spent on oil.

- Why target China? -

Beyond iPhones, Teslas and PlayStations, the most potent chips are crucial to the development of advanced technology such as artificial intelligence, as well as cutting-edge weapons including hypersonic missiles and stealth fighter jets.

Washington imposed a series of export controls last year, saying they were meant to prevent "sensitive technologies with military applications" from being acquired by China's armed forces and its intelligence and security services.

The Dutch government followed suit in March this year, citing national security while imposing controls on foreign sales to prevent military use.

The same month, Japan unveiled similar measures aimed at preventing "the military diversion of technologies".

The Netherlands, a NATO member, and Japan -- a US treaty ally -- did not name China, but their restrictions infuriated Beijing.

The restrictions target the most advanced chips and chip-making tech that can be used for, among other applications, supercomputers, high-end military equipment and AI development.

- Why is China concerned? -

The production of chips is fiendishly complex, and typically spans numerous countries.

But many stages depend on US inputs, while the other major players are Japanese companies and the Netherlands' ASML -- which dominates the production of lithography machines that print patterns on silicon wafers.

This gives the trio an outsized influence on the global semiconductor industry.

"It will take years for China to develop domestic alternatives that are equally capable to the tools it is losing access to," Chris Miller, author of "Chip War: The Fight for the World's Most Critical Technology", told AFP.

"If it was easy, Chinese firms would already have done it."

- How have the sanctions hit? -

Chinese chip companies stockpiled components and machines ahead of US export controls in October last year to soften the blow.

But one major chip firm told AFP that once that inventory runs out, or needs repairs, the controls will start to hurt.

Some Chinese companies that were suddenly left unable to guarantee access to chips saw lucrative foreign contracts evaporate, forcing them to slash jobs and freeze expansion plans.

The US, Dutch and Japanese curbs have directly hit some of China's biggest chip manufacturers, including the Yangtze Memory Technology Corp (YMTC).

One of the biggest ways the sanctions have started to bite is by drying up a talent pool China had relied on.

A recent semi-official survey of Chinese chip companies estimated a need for 800,000 foreign workers by 2024, a gap Washington made harder to plug by restricting "US persons" from working in China's semiconductor industry.

- How has China responded? -

Beijing has reacted with anger and defiance, vowing to accelerate its efforts to become self-reliant on semiconductors.

To transcend US curbs, two semiconductor researchers at the influential Chinese Academy of Sciences offered a blueprint in February that advised Beijing to more effectively funnel investments into high-quality talent and original research.

It signalled a potential strategy rethink, and one of its main beneficiaries appears to be YMTC.

Company records show the US-sanctioned firm has received an injection of $7.1 billion since the new export controls took effect.

- Is more investment the answer for China? -

The tens of billions of dollars China has pumped into the development of a domestic industry have yet to bear much fruit.

China had aimed by 2025 to reach 70 percent chip self-sufficiency, but some think tanks estimate it currently meets below 20 percent of demand.

"Money is not the problem," said Qi Wang, co-founder of Hong Kong-based MegaTrust Investment, pointing instead at waste, fraud and talent shortages.

"China has no good options, except to double down on state support for the industry," said John Lee, director of East-West Futures consulting.

Experts say China may well reach its self-sufficiency target but it will take much longer in the face of such curbs.

"I don't think the US will ever be successful at preventing China from having great chips," Microsoft co-founder Bill Gates said on a podcast in March.

"We are going to force them to spend time and a bunch of money to make their own."

burs-lb-qan/dva

A.F.Rosado--PC