-

Record January window for transfers despite drop in spending

Record January window for transfers despite drop in spending

-

'Burned inside their houses': Nigerians recount horror of massacre

-

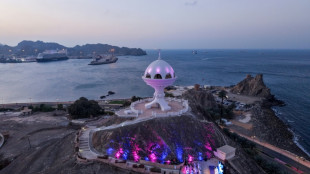

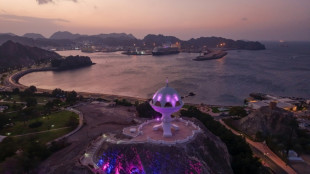

Iran, US prepare for Oman talks after deadly protest crackdown

Iran, US prepare for Oman talks after deadly protest crackdown

-

Winter Olympics opening ceremony nears as virus disrupts ice hockey

-

Mining giant Rio Tinto abandons Glencore merger bid

Mining giant Rio Tinto abandons Glencore merger bid

-

Davos forum opens probe into CEO Brende's Epstein links

-

ECB warns of stronger euro impact, holds rates

ECB warns of stronger euro impact, holds rates

-

Famine spreading in Sudan's Darfur, warn UN-backed experts

-

Lights back on in eastern Cuba after widespread blackout

Lights back on in eastern Cuba after widespread blackout

-

Russia, US agree to resume military contacts at Ukraine talks

-

Greece aims to cut queues at ancient sites with new portal

Greece aims to cut queues at ancient sites with new portal

-

No time frame to get Palmer in 'perfect' shape - Rosenior

-

Stocks fall as tech valuation fears stoke volatility

Stocks fall as tech valuation fears stoke volatility

-

US Olympic body backs LA28 leadership amid Wasserman scandal

-

Gnabry extends Bayern Munich deal until 2028

Gnabry extends Bayern Munich deal until 2028

-

England captain Stokes suffers facial injury after being hit by ball

-

Italy captain Lamaro amongst trio set for 50th caps against Scotland

Italy captain Lamaro amongst trio set for 50th caps against Scotland

-

Piastri plays down McLaren rivalry with champion Norris

-

ECB holds interest rates as strong euro causes jitters

ECB holds interest rates as strong euro causes jitters

-

EU close to sealing trade deal with Australia

-

German Cup final to stay in Berlin until 2030

German Cup final to stay in Berlin until 2030

-

What does Iran want from talks with the US?

-

Taming the lion: Olympians take on Bormio's terrifying Stelvio piste

Taming the lion: Olympians take on Bormio's terrifying Stelvio piste

-

Wind turbine maker Vestas sees record revenue in 2025

-

Italy's Casse tops second Olympic downhill training

Italy's Casse tops second Olympic downhill training

-

Anti-doping boss 'uncomfortable' with Valieva's coach at Olympics

-

Bitcoin under $70,000 for first time since Trump's election

Bitcoin under $70,000 for first time since Trump's election

-

'I am sorry,' embattled UK PM tells Epstein victims

-

England's Brook predicts record 300-plus scores at T20 World Cup

England's Brook predicts record 300-plus scores at T20 World Cup

-

Ukraine, Russia swap prisoners, US says 'work remains' to end war

-

Wales' Rees-Zammit at full-back for Six Nations return against England

Wales' Rees-Zammit at full-back for Six Nations return against England

-

Sad horses and Draco Malfoy: China's unexpected Lunar New Year trends

-

Hong Kong students dissolve pro-democracy group under 'severe' pressure

Hong Kong students dissolve pro-democracy group under 'severe' pressure

-

Germany claws back 59 mn euros from Amazon over price controls

-

Germany claws back 70 mn euros from Amazon over price controls

Germany claws back 70 mn euros from Amazon over price controls

-

VW and Stellantis urge help to keep carmaking in Europe

-

Stock markets drop amid tech concerns before rate calls

Stock markets drop amid tech concerns before rate calls

-

BBVA posts record profit after failed Sabadell takeover

-

UN human rights agency in 'survival mode': chief

UN human rights agency in 'survival mode': chief

-

Greenpeace slams fossil fuel sponsors for Winter Olympics

-

Greenpeace slams fossel fuel sponsors for Winter Olympics

Greenpeace slams fossel fuel sponsors for Winter Olympics

-

Kinghorn, Van der Merwe dropped by Scotland for Six Nations opener

-

Russia says thwarted smuggling of giant meteorite to UK

Russia says thwarted smuggling of giant meteorite to UK

-

Salt war heats up in ice-glazed Berlin

-

Liverpool in 'good place' for years to come, says Slot

Liverpool in 'good place' for years to come, says Slot

-

Heathrow still Europe's busiest airport, but Istanbul gaining fast

-

Highest storm alert lifted in Spain, one woman missing

Highest storm alert lifted in Spain, one woman missing

-

Shell profits climb despite falling oil prices

-

Pakistan will seek govt nod in potential India T20 finals clash

Pakistan will seek govt nod in potential India T20 finals clash

-

German factory orders rise at fastest rate in 2 years in December

| SCS | 0.12% | 16.14 | $ | |

| CMSC | 0.25% | 23.58 | $ | |

| CMSD | 0.21% | 23.92 | $ | |

| GSK | 3.52% | 59.315 | $ | |

| BTI | 0.38% | 61.865 | $ | |

| RIO | -4.44% | 92.38 | $ | |

| RBGPF | 0.12% | 82.5 | $ | |

| NGG | -0.57% | 87.29 | $ | |

| BCC | -1.34% | 89.035 | $ | |

| BCE | -3.86% | 25.36 | $ | |

| BP | -2.52% | 38.235 | $ | |

| RYCEF | -0.36% | 16.62 | $ | |

| VOD | -6.76% | 14.715 | $ | |

| AZN | 1.02% | 189.375 | $ | |

| RELX | 2.17% | 30.44 | $ | |

| JRI | 0.45% | 13.21 | $ |

Inside Europe's last 'open-outcry' trading floor

In an era where computer algorithms automate trading at breakneck speeds, a dwindling number of London's metal traders still conduct business in-person by shouting orders across Europe's last so-called open-outcry trading floor.

The near 150-year old tradition takes place in a circle, or pit, of red-leather benches -- called the "Ring" -- where the daily global prices of copper, nickel, aluminium and other metals are set at the London Metal Exchange (LME).

Seconds before the frantic trading begins, a trader rushes in, puts on a tie as per the obligatory dress code, and heads towards one of the booths circling the Ring.

Then, sheets of pencilled figures and stock market orders are handed out.

Once the bell rings, signalling the start of trading, no-one is allowed to trade online or use mobile phones. They can only communicate with the outside world via landline phones.

The five minutes of trading per metal is "a bit like playing poker", said Giles Plumb, a trader at financial services firm StoneX, who has run its copper portfolio for 21 years.

- 'Flurry of activity' -

It starts off calm, with seemingly unbothered traders sitting quietly.

As the minutes tick by, "you try not to look at your watch, to make it look like you don't have an order to place", Plumb told AFP.

But as the final seconds of the allotted time approach, the Ring erupts.

"There's this big flurry of activity," Plumb said, as traders jump up from benches and begin shouting.

They stand up and lean towards the person -- almost exclusively a man -- they're making a deal with, making sure to keep one heel glued to the seat -- another rule of the Ring.

"To be good, you've got to be aware of who's doing what around you, you need to quickly process information and you have to be clear and audible," Plumb said.

"By now, I can tell people's voices and I know who's doing what even without looking at them."

Behind them, brokers speak to clients on landlines, some holding one phone to each ear, repeating orders while taking new ones.

Despite the tumult, Plumb says the sessions are "less aggressive, less competitive" than when he began his career.

At its peak, he explained, the "pit would be full of 22 brokers, 300 people, huge wall of noise. So you could barely hear yourself think".

- 'The battle is lost' -

Now, only eight companies and a few dozen people still participate in these age-old sessions, as online trading killed off most of the world's open-outcry markets.

The London Metal Exchange and its open-outcry tradition began towards the end of the 19th century, pausing only during World War I and again during the Covid-19 pandemic.

The LME wanted to shift entirely to electronic trading in 2021, but faced pressure from its remaining traders to keep the tradition alive.

The exchange compromised by keeping one of its two daily in-person sessions, as long as more than six members are willing to participate.

"Those wanting to trade in the Ring continue to do so, but these days most of the LME's trading takes place electronically," the exchange said in a statement.

There is no longer any reason to continue open-outcry trading, explained Thierry Foucault, professor of finance at HEC Paris business school.

Electronic trading is "technically superior and allows for greater market liquidity, as well as lower intermediation costs", he told AFP.

In some cases it has persisted for good reason, he said, "particularly in highly specialised markets", like metals, where the number of expert operators is very limited.

However, "over time, the battle is lost".

R.Veloso--PC