-

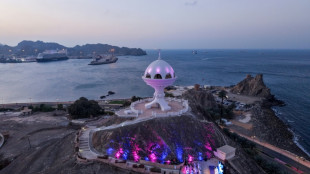

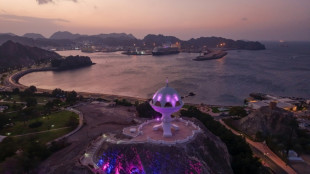

Iran, US prepare for Oman talks after deadly protest crackdown

Iran, US prepare for Oman talks after deadly protest crackdown

-

Winter Olympics opening ceremony nears as virus disrupts ice hockey

-

Mining giant Rio Tinto abandons Glencore merger bid

Mining giant Rio Tinto abandons Glencore merger bid

-

Davos forum opens probe into CEO Brende's Epstein links

-

ECB warns of stronger euro impact, holds rates

ECB warns of stronger euro impact, holds rates

-

Famine spreading in Sudan's Darfur, warn UN-backed experts

-

Lights back on in eastern Cuba after widespread blackout

Lights back on in eastern Cuba after widespread blackout

-

Russia, US agree to resume military contacts at Ukraine talks

-

Greece aims to cut queues at ancient sites with new portal

Greece aims to cut queues at ancient sites with new portal

-

No time frame to get Palmer in 'perfect' shape - Rosenior

-

Stocks fall as tech valuation fears stoke volatility

Stocks fall as tech valuation fears stoke volatility

-

US Olympic body backs LA28 leadership amid Wasserman scandal

-

Gnabry extends Bayern Munich deal until 2028

Gnabry extends Bayern Munich deal until 2028

-

England captain Stokes suffers facial injury after being hit by ball

-

Italy captain Lamaro amongst trio set for 50th caps against Scotland

Italy captain Lamaro amongst trio set for 50th caps against Scotland

-

Piastri plays down McLaren rivalry with champion Norris

-

ECB holds interest rates as strong euro causes jitters

ECB holds interest rates as strong euro causes jitters

-

EU close to sealing trade deal with Australia

-

German Cup final to stay in Berlin until 2030

German Cup final to stay in Berlin until 2030

-

What does Iran want from talks with the US?

-

Taming the lion: Olympians take on Bormio's terrifying Stelvio piste

Taming the lion: Olympians take on Bormio's terrifying Stelvio piste

-

Wind turbine maker Vestas sees record revenue in 2025

-

Italy's Casse tops second Olympic downhill training

Italy's Casse tops second Olympic downhill training

-

Anti-doping boss 'uncomfortable' with Valieva's coach at Olympics

-

Bitcoin under $70,000 for first time since Trump's election

Bitcoin under $70,000 for first time since Trump's election

-

'I am sorry,' embattled UK PM tells Epstein victims

-

England's Brook predicts record 300-plus scores at T20 World Cup

England's Brook predicts record 300-plus scores at T20 World Cup

-

Ukraine, Russia swap prisoners, US says 'work remains' to end war

-

Wales' Rees-Zammit at full-back for Six Nations return against England

Wales' Rees-Zammit at full-back for Six Nations return against England

-

Sad horses and Draco Malfoy: China's unexpected Lunar New Year trends

-

Hong Kong students dissolve pro-democracy group under 'severe' pressure

Hong Kong students dissolve pro-democracy group under 'severe' pressure

-

Germany claws back 59 mn euros from Amazon over price controls

-

Germany claws back 70 mn euros from Amazon over price controls

Germany claws back 70 mn euros from Amazon over price controls

-

VW and Stellantis urge help to keep carmaking in Europe

-

Stock markets drop amid tech concerns before rate calls

Stock markets drop amid tech concerns before rate calls

-

BBVA posts record profit after failed Sabadell takeover

-

UN human rights agency in 'survival mode': chief

UN human rights agency in 'survival mode': chief

-

Greenpeace slams fossil fuel sponsors for Winter Olympics

-

Greenpeace slams fossel fuel sponsors for Winter Olympics

Greenpeace slams fossel fuel sponsors for Winter Olympics

-

Kinghorn, Van der Merwe dropped by Scotland for Six Nations opener

-

Russia says thwarted smuggling of giant meteorite to UK

Russia says thwarted smuggling of giant meteorite to UK

-

Salt war heats up in ice-glazed Berlin

-

Liverpool in 'good place' for years to come, says Slot

Liverpool in 'good place' for years to come, says Slot

-

Heathrow still Europe's busiest airport, but Istanbul gaining fast

-

Highest storm alert lifted in Spain, one woman missing

Highest storm alert lifted in Spain, one woman missing

-

Shell profits climb despite falling oil prices

-

Pakistan will seek govt nod in potential India T20 finals clash

Pakistan will seek govt nod in potential India T20 finals clash

-

German factory orders rise at fastest rate in 2 years in December

-

Nigeria president deploys army after new massacre

Nigeria president deploys army after new massacre

-

Ukraine, Russia, US start second day of war talks

| SCS | 0.12% | 16.14 | $ | |

| BP | -2.93% | 38.085 | $ | |

| NGG | -1.02% | 86.905 | $ | |

| CMSD | 0.17% | 23.91 | $ | |

| BTI | 0.08% | 61.68 | $ | |

| RIO | -4.49% | 92.33 | $ | |

| RBGPF | 0.12% | 82.5 | $ | |

| GSK | 3.34% | 59.21 | $ | |

| RYCEF | -0.36% | 16.62 | $ | |

| AZN | 1.06% | 189.46 | $ | |

| CMSC | -0.15% | 23.485 | $ | |

| BCE | -2.85% | 25.61 | $ | |

| BCC | -0.92% | 89.41 | $ | |

| JRI | 1.46% | 13.345 | $ | |

| VOD | -6.47% | 14.755 | $ | |

| RELX | 2.36% | 30.5 | $ |

Stocks fall as tech valuation fears stoke volatility

Stocks fell across the board Thursday, pulled down again by growing worries that hefty AI investments by tech heavyweights may not pay dividends as soon as hoped.

Risk aversion also spilt into Bitcoin, which slumped toward $70,000 and is now down more than 40 percent from its record high above $126,000 in October.

In Europe, the Bank of England and the European Central Bank both kept benchmark interest rates on hold as expected, as inflation pressures ease.

The euro was little changed but the British pound slid as Prime Minister Keir Starmer fights for his political life due to a storm of protest at his appointment of Peter Mandelson as ambassador to the United States, despite knowing about his close ties to convicted sex offender Jeffrey Epstein.

On equity markets, investor caution remains high after Anthropic, which created the AI chatbot Claude, unveiled a tool that could be used by firms to carry out legal work.

Its announcement Tuesday hit firms across the software, financial services and asset management industries, though analysts noted there had already been a general shift out of tech following years of eye-watering gains.

Financial updates from Alphabet, ARM and Microsoft have fuelled that move, as questions are raised about the wisdom of pumping hundreds of billions into artificial intelligence projects with little idea about the timing of returns.

Fiona Cincotta, an analyst at City Index, said that "while losses in tech continue, sentiment remains fragile".

Silver prices tanked almost 11 percent Thursday as a sell-off in precious metals resumed after a brief spell of calm following massive selling when records were reached last week.

Gold, traditionally seen as a safe haven, lost 1.8 percent.

Oil prices dropped after Iran and the United States said nuclear talks would go ahead in Oman this week.

The news soothed investor concerns sparked by a report Wednesday that the bitter foes would not meet owing to a row about the format and the venue, which sent the price of both main contracts up more than three percent.

- Key figures at around 1445 GMT -

New York - Dow: DOWN 0.4 percent at 49,282.98 points

New York - S&P 500: DOWN 0.5 percent at 6,845.95

New York - Nasdaq: DOWN 0.6 percent at 22,776.96

London - FTSE 100: DOWN 0.4 percent at 10,359.27

Paris - CAC 40: DOWN 0.4 percent at 8,231.58

Frankfurt - DAX: DOWN 0.6 percent at 24,445.00

Tokyo - Nikkei 225: DOWN 0.9 percent at 53,818.04 (close)

Hong Kong - Hang Seng Index: UP 0.1 percent at 26,885.24 (close)

Shanghai - Composite: DOWN 0.6 percent at 4,075.92 (close)

Euro/dollar: UP at $1.1814 from $1.1802 on Wednesday

Pound/dollar: DOWN at $1.35971 from $1.3648

Dollar/yen: DOWN at 156.80 yen from 156.92 yen

Euro/pound: UP at 87.04 pence from 86.47 pence

Brent North Sea Crude: DOWN 2.6 percent at $67.64 per barrel

West Texas Intermediate: DOWN 2.6 percent at $63.42 per barrel

H.Silva--PC