-

Three Russia-themed anti-war films shortlisted for Oscars

Three Russia-themed anti-war films shortlisted for Oscars

-

US oil blockade of Venezuela: what we know

-

Palace boss Glasner says contract talks on hold due to hectic schedule

Palace boss Glasner says contract talks on hold due to hectic schedule

-

Netflix to launch FIFA World Cup video game

-

Venezuela says oil exports continue normally despite Trump 'blockade'

Venezuela says oil exports continue normally despite Trump 'blockade'

-

German MPs approve 50 bn euros in military purchases

-

India v South Africa 4th T20 abandoned due to fog

India v South Africa 4th T20 abandoned due to fog

-

Hydrogen plays part in global warming: study

-

EU's Mercosur trade deal hits French, Italian roadblock

EU's Mercosur trade deal hits French, Italian roadblock

-

What next for Belarus after US deal on prisoners, sanctions?

-

Brazil Senate debates bill that could slash Bolsonaro jail term

Brazil Senate debates bill that could slash Bolsonaro jail term

-

Coe shares 'frustration' over marathon record despite Kenyan's doping ban

-

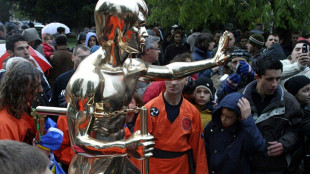

Stolen Bruce Lee statue 'returns' to Bosnia town

Stolen Bruce Lee statue 'returns' to Bosnia town

-

Veteran Suarez signs new Inter Miami contract

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Balkan nations offer lessons on handling cow virus sowing turmoil

Balkan nations offer lessons on handling cow virus sowing turmoil

-

French readers lap up Sarkozy's prison diaries

-

UK PM warns Abramovich 'clock is ticking' over Chelsea sale fund

UK PM warns Abramovich 'clock is ticking' over Chelsea sale fund

-

Warner Bros. Discovery rejects Paramount bid

-

Winners of 2026 World Cup to pocket $50 million in prize money

Winners of 2026 World Cup to pocket $50 million in prize money

-

World no. 1 Alcaraz ends 'incredible ride' with coach Ferrero

-

World number one Alcaraz announces 'difficult' split with coach Ferrero

World number one Alcaraz announces 'difficult' split with coach Ferrero

-

Iran boxer sentenced to death at 'imminent' risk of execution: rights groups

-

Snicko operator admits error that led to Carey's Ashes reprieve

Snicko operator admits error that led to Carey's Ashes reprieve

-

Finland PM apologises to Asian countries over MPs' mocking posts

-

Doctors in England go on strike for 14th time

Doctors in England go on strike for 14th time

-

Romania journalists back media outlet that sparked graft protests

-

Rob Reiner's son awaiting court appearance on murder charges

Rob Reiner's son awaiting court appearance on murder charges

-

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

Hundreds queue at Louvre museum as strike vote delays opening

-

Bondi shooting shocks, angers Australia's Jewish community

-

Markets rise even as US jobs data fail to boost rate cut bets

Markets rise even as US jobs data fail to boost rate cut bets

-

Senegal talisman Mane overcame grief to become an African icon

-

Carey pays tribute to late father after home Ashes century

Carey pays tribute to late father after home Ashes century

-

'Many lessons to be learned' from Winter Games preparations, says ski chief

-

Emotional Carey slams ton to give Australia upper hand in 3rd Ashes Test

Emotional Carey slams ton to give Australia upper hand in 3rd Ashes Test

-

Asian markets mixed as US jobs data fails to boost rate cut hopes

-

Carey slams ton as Australia seize upper hand in third Ashes Test

Carey slams ton as Australia seize upper hand in third Ashes Test

-

Bondi shooting shocks, angers Australia Jewish community

-

Myanmar junta seeks to prosecute hundreds for election 'disruption'

Myanmar junta seeks to prosecute hundreds for election 'disruption'

-

West Indies hope Christmas comes early in must-win New Zealand Test

-

Knicks beat Spurs in NBA Cup final to end 52-year trophy drought

Knicks beat Spurs in NBA Cup final to end 52-year trophy drought

-

Khawaja revels in late lifeline as Australia 194-5 in 3rd Ashes Test

-

Grief and fear as Sydney's Jewish community mourns 'Bondi rabbi'

Grief and fear as Sydney's Jewish community mourns 'Bondi rabbi'

-

Trump orders blockade of 'sanctioned' Venezuela oil tankers

Fed officials see accelerated US rate hikes

Faced with stubbornly high inflation, US central bankers are considering an accelerated schedule for raising the benchmark borrowing rate, according to minutes of their latest meeting released Wednesday.

Most of those participating in the January 25-26 Federal Reserve discussions felt "a faster pace of increases... would likely be warranted" compared to the previous cycle of monetary tightening between 2015-18.

The Fed slashed rates to zero in March 2020 as the Covid-19 pandemic slammed the US economy causing millions of layoffs.

Just two years later, with the economy facing decades-high inflation, the Fed has signaled that it is ready to begin rate hikes soon, with a first move widely expected next month.

Most economist say that lift-off from zero will be followed by several more hikes this year -- with some now saying a larger-than-usual half-point increase is possible next month.

Fed officials stressed that the recovery has been much quicker than the previous cycle.

"Compared with conditions in 2015... participants viewed that there was a much stronger outlook for growth in economic activity, substantially higher inflation, and a notably tighter labor market," the minutes said.

After peaking at 14.7 percent in April 2020, the unemployment rate in January was down to 4.0 percent.

Meanwhile, inflation has been accelerating for months amid global supply chain snarls and rising demand.

US consumer prices in January climbed 7.5 percent compared to a year earlier, its largest increase since February 1982 and more than triple the Fed's 2 percent long-term target.

Fed officials, many of whom had expected the pandemic-driven price pressures to recede quickly, now noted the increases growing more widespread, and some worried inflation could rise still higher if wages accelerate.

They "anticipated that it would soon be appropriate to raise" the policy rate, according to the minutes.

And "if inflation does not move down as they expect, it would be appropriate for the Committee to remove policy accommodation at a faster pace than they currently anticipate."

In the wake of the 2008 financial crisis, amid sluggish growth and persistently high unemployment, the central bank moved much more slowly. It did not begin rate hikes until 2015, with a single move that year and the next, followed by seven from 2017 to 2018, before pulling back with three cuts in 2019.

The minutes caused some economists to up their forecasts, with Kathy Bostjancic of Oxford Economics now projecting a half-point increase as the first move.

"We now join the camp arguing the Fed should and will kick off its tightening cycle with a 50bps rate hike in March," she said.

"Thereafter officials should go back to 25bps rate increases at subsequent meetings," she said, predicting a total of 1.75 points of tightening, or six increases, this year.

R.Veloso--PC