-

Iran boxer sentenced to death at 'imminent' risk of execution: rights groups

Iran boxer sentenced to death at 'imminent' risk of execution: rights groups

-

Snicko operator admits error that led to Carey's Ashes reprieve

-

Finland PM apologises to Asian countries over MPs' mocking posts

Finland PM apologises to Asian countries over MPs' mocking posts

-

Doctors in England go on strike for 14th time

-

Romania journalists back media outlet that sparked graft protests

Romania journalists back media outlet that sparked graft protests

-

Rob Reiner's son awaiting court appearance on murder charges

-

Ghana's Highlife finds its rhythm on UNESCO world stage

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

-

Bondi shooting shocks, angers Australia's Jewish community

Bondi shooting shocks, angers Australia's Jewish community

-

Markets rise even as US jobs data fail to boost rate cut bets

-

Senegal talisman Mane overcame grief to become an African icon

Senegal talisman Mane overcame grief to become an African icon

-

Carey pays tribute to late father after home Ashes century

-

'Many lessons to be learned' from Winter Games preparations, says ski chief

'Many lessons to be learned' from Winter Games preparations, says ski chief

-

Emotional Carey slams ton to give Australia upper hand in 3rd Ashes Test

-

Asian markets mixed as US jobs data fails to boost rate cut hopes

Asian markets mixed as US jobs data fails to boost rate cut hopes

-

Carey slams ton as Australia seize upper hand in third Ashes Test

-

Bondi shooting shocks, angers Australia Jewish community

Bondi shooting shocks, angers Australia Jewish community

-

Myanmar junta seeks to prosecute hundreds for election 'disruption'

-

West Indies hope Christmas comes early in must-win New Zealand Test

West Indies hope Christmas comes early in must-win New Zealand Test

-

Knicks beat Spurs in NBA Cup final to end 52-year trophy drought

-

Khawaja revels in late lifeline as Australia 194-5 in 3rd Ashes Test

Khawaja revels in late lifeline as Australia 194-5 in 3rd Ashes Test

-

Grief and fear as Sydney's Jewish community mourns 'Bondi rabbi'

-

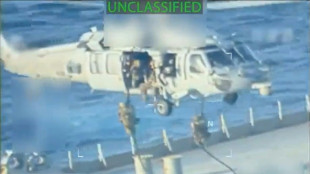

Trump orders blockade of 'sanctioned' Venezuela oil tankers

Trump orders blockade of 'sanctioned' Venezuela oil tankers

-

Brazil Senate to debate bill to slash Bolsonaro jail term

-

New Zealand ex-top cop avoids jail time for child abuse, bestiality offences

New Zealand ex-top cop avoids jail time for child abuse, bestiality offences

-

Eurovision facing fractious 2026 as unity unravels

-

'Extremely exciting': the ice cores that could help save glaciers

'Extremely exciting': the ice cores that could help save glaciers

-

Asian markets drift as US jobs data fails to boost rate cut hopes

-

What we know about Trump's $10 billion BBC lawsuit

What we know about Trump's $10 billion BBC lawsuit

-

Ukraine's lost generation caught in 'eternal lockdown'

-

'Catastrophic mismatch': Safety fears as Jake Paul faces Anthony Joshua

'Catastrophic mismatch': Safety fears as Jake Paul faces Anthony Joshua

-

Australia's Steve Smith ruled out of third Ashes Test

-

Khawaja grabs lifeline as Australia reach 94-2 in 3rd Ashes Test

Khawaja grabs lifeline as Australia reach 94-2 in 3rd Ashes Test

-

Undefeated boxing great Crawford announces retirement

-

Trump says orders blockade of 'sanctioned' Venezuela oil tankers

Trump says orders blockade of 'sanctioned' Venezuela oil tankers

-

UK experiences sunniest year on record

-

Australia holds first funeral for Bondi Beach attack victims

Australia holds first funeral for Bondi Beach attack victims

-

FIFA announces $60 World Cup tickets after pricing backlash

-

Maresca relishes support of Chelsea fans after difficult week

Maresca relishes support of Chelsea fans after difficult week

-

Players pay tribute to Bondi victims at Ashes Test

-

Costa Rican president survives second Congress immunity vote

Costa Rican president survives second Congress immunity vote

-

Married couple lauded for effort to thwart Bondi Beach shootings

-

Australia holds first funerals for Bondi Beach attack victims

Australia holds first funerals for Bondi Beach attack victims

-

Trump has 'alcoholic's personality,' chief of staff says in bombshell interview

-

Rob Reiner killing: son to be charged with double murder

Rob Reiner killing: son to be charged with double murder

-

Chelsea battle into League Cup semis to ease pressure on Maresca

Court upholds £3 bn lifeline for UK's top water supplier

A UK court on Monday upheld an emergency loan granted to Thames Water, allowing Britain's largest such supplier to keep a financial lifeline as it drowns under massive debt.

The High Court in London last month authorised the £3 billion ($3.9 billion) loan, allowing Thames to stay afloat and stave off a costly public bailout.

However, it was subject to an appeal last week by some of the company's smaller creditors displeased at the terms of the package.

Thames serves 16 million customers, or a quarter of the UK population, in London and surrounding areas.

"We are pleased that the Court of Appeal has today decisively refused the appeals and upheld the strong High Court decision," chief executive Chris Weston said in a statement.

"We remain focused on putting Thames Water onto a more stable financial foundation as we seek a long-term solution to our financial resilience," he added.

The company said it expects to receive the first half of the loan over coming months.

The funds are seen as only a short-term solution for the company, which already had £16 billion of debt, as it looks to attract takeover bids.

Thames is scrambling to find fresh sources of funding, including appealing to the UK water regulator to be allowed to hike bills more than granted.

The company's customers are set to see average annual water bills rise to £588 by 2030 following a decision by British regulator Ofwat -- falling short of the 59-percent hike requested by the troubled group.

Thames and other British water companies, privatised since 1989, are meanwhile under fire for allowing the discharge of large quantities of sewage into rivers and the sea.

This has been blamed on under-investment in a sewage system that dates back largely to the Victorian era.

P.Serra--PC