-

Gisele Pelicot publishes memoirs after rape trial ordeal

Gisele Pelicot publishes memoirs after rape trial ordeal

-

Newcastle beat sorry Spurs to leave Frank on the brink

-

'Outrage' as LGBTQ Pride flag removed from Stonewall monument

'Outrage' as LGBTQ Pride flag removed from Stonewall monument

-

Chappell Roan leaves agency headed by embattled 2028 Olympic chief

-

Venezuelan authorities move Machado ally to house arrest

Venezuelan authorities move Machado ally to house arrest

-

YouTube rejects addiction claims in landmark social media trial

-

Google turns to century-long debt to build AI

Google turns to century-long debt to build AI

-

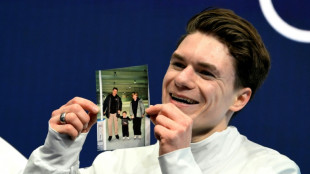

'I felt guided by them': US skater Naumov remembers parents at Olympics

-

Till death do us bark: Brazilian state lets pets be buried with owners

Till death do us bark: Brazilian state lets pets be buried with owners

-

'Confident' Pakistan ready for India blockbuster after USA win

-

Latam-GPT: a Latin American AI to combat US-centric bias

Latam-GPT: a Latin American AI to combat US-centric bias

-

Gauff dumped out of Qatar Open, Swiatek, Rybakina through

-

Paris officers accused of beating black producer to stand trial in November

Paris officers accused of beating black producer to stand trial in November

-

Istanbul bars rock bands accused of 'satanism'

-

Olympic bronze medal biathlete confesses affair on live TV

Olympic bronze medal biathlete confesses affair on live TV

-

US commerce chief admits Epstein Island lunch but denies closer ties

-

Mayor of Ecuador's biggest city arrested for money laundering

Mayor of Ecuador's biggest city arrested for money laundering

-

Farhan, spinners lead Pakistan to easy USA win in T20 World Cup

-

Stocks mixed as muted US retail sales spur caution

Stocks mixed as muted US retail sales spur caution

-

Macron wants more EU joint borrowing: Could it happen?

-

Shiffrin flops at Winter Olympics as helmet row simmers

Shiffrin flops at Winter Olympics as helmet row simmers

-

No excuses for Shiffrin after Olympic team combined flop

-

Pool on wheels brings swim lessons to rural France

Pool on wheels brings swim lessons to rural France

-

Europe's Ariane 6 to launch Amazon constellation satellites into orbit

-

Could the digital euro get a green light in 2026?

Could the digital euro get a green light in 2026?

-

Spain's Telefonica sells Chile unit in Latin America pullout

-

'We've lost everything': Colombia floods kill 22

'We've lost everything': Colombia floods kill 22

-

Farhan propels Pakistan to 190-9 against USA in T20 World Cup

-

US to scrap cornerstone of climate regulation this week

US to scrap cornerstone of climate regulation this week

-

Nepal call for India, England, Australia to play in Kathmandu

-

Stocks rise but lacklustre US retail sales spur caution

Stocks rise but lacklustre US retail sales spur caution

-

Olympic chiefs let Ukrainian athlete wear black armband at Olympics after helmet ban

-

French ice dancers poised for Winter Olympics gold amid turmoil

French ice dancers poised for Winter Olympics gold amid turmoil

-

Norway's Ruud wins error-strewn Olympic freeski slopestyle

-

More Olympic pain for Shiffrin as Austria win team combined

More Olympic pain for Shiffrin as Austria win team combined

-

Itoje returns to captain England for Scotland Six Nations clash

-

Sahara celebrates desert cultures at Chad festival

Sahara celebrates desert cultures at Chad festival

-

US retail sales flat in December as consumers pull back

-

Bumper potato harvests spell crisis for European farmers

Bumper potato harvests spell crisis for European farmers

-

Bangladesh's PM hopeful Rahman warns of 'huge' challenges ahead

-

Guardiola seeks solution to Man City's second half struggles

Guardiola seeks solution to Man City's second half struggles

-

Shock on Senegalese campus after student dies during police clashes

-

US vice president Vance on peace bid in Azerbaijan after Armenia visit

US vice president Vance on peace bid in Azerbaijan after Armenia visit

-

'Everything is destroyed': Ukrainian power plant in ruins after Russian strike

-

Shiffrin misses out on Olympic combined medal as Austria win

Shiffrin misses out on Olympic combined medal as Austria win

-

EU lawmakers back plans for digital euro

-

Starmer says UK govt 'united', presses on amid Epstein fallout

Starmer says UK govt 'united', presses on amid Epstein fallout

-

Olympic chiefs offer repairs after medals break

-

Moscow chokes Telegram as it pushes state-backed rival app

Moscow chokes Telegram as it pushes state-backed rival app

-

ArcelorMittal confirms long-stalled French steel plant revamp

Trump goes to war with the Fed

Donald Trump's simmering discontent with the US Federal Reserve boiled over this week, with the president threatening to take the unprecedented step of ousting the head of the fiercely independent central bank.

Trump has repeatedly said he wants rate cuts now to help stimulate economic growth as he rolls out his tariff plans, and has threatened to fire Fed Chair Jerome Powell if he does not comply, putting the bank and the White House on a collision course that analysts warn could destabilize US financial markets.

"If I want him out, he'll be out of there real fast, believe me," Trump said Thursday, referring to Powell, whose second four-year stint as Fed chair ends in May 2026.

Powell has said he has no plans to step down early, adding this week that he considers the bank's independence over monetary policy to be a "matter of law."

"Clearly, the fact that the Fed chairman feels that he has to address it means that they are serious," KPMG chief economist Diane Swonk told AFP, referring to the White House.

Stephanie Roth, chief economist at Wolfe Research, said she thinks "they will come into conflict," but does not think "that the Fed is going to succumb to the political pressure."

Most economists agree that the administration's tariff plans will put upward pressure on prices and cool economic growth -- at least in the short term.

That would keep inflation well away from the Fed's long-term target of two percent, and likely prevent policymakers from cutting rates in the next few months.

"They're not going to react because Trump posted that they should be cutting," Roth said in an interview, adding that doing so would be "a recipe for a disaster" for the US economy.

- Fed independence 'absolutely critical' -

Many legal scholars say the US president does not have the power to fire the Fed chair or any of his colleagues on the bank's 19-person rate-setting committee for any reason but cause.

The Fed system, created more than a century ago, is also designed to insulate the US central bank from political interference.

"Independence is absolutely critical for the Fed," said Roth. "Countries that do not have independent central banks have currencies that are notably weaker and interest rates that are notably higher."

Moody's Analytics chief economist Mark Zandi told AFP that "we've had strong evidence that impairing central bank independence is a really bad idea."

- 'Can't control the bond market' -

One serious threat to the Fed's independence comes from a case brought by the Trump administration that seeks to challenge a 1935 Supreme Court decision denying the US president the right to fire the heads of independent government agencies.

The Humphrey's Executor case could have serious ramifications for the Fed, given its status as an independent agency whose leadership believes they cannot currently be fired by the president for any reason but cause.

Even if the Trump administration succeeds in its case, it may soon run into the ultimate guardrail of Fed independence: The bond markets.

During the recent market turbulence unleashed by Trump's tariff plans, US government bond yields surged and the dollar fell, signaling that investors may not see the United States as the safe haven investment it once was.

Faced with the sharp rise in US Treasury yields, the Trump administration paused its plans for higher tariffs against dozens of countries, a move that helped calm the financial markets.

If investors believed the Fed's independence to tackle inflation was compromised, that would likely push up the yields on long-dated government bonds on the assumption that inflation would be higher, and put pressure on the administration.

"You can't control the bond market. And that's the moral of the story," said Swonk.

"And that's why you want an independent Fed."

H.Silva--PC