-

Venezuelan authorities move Machado ally to house arrest

Venezuelan authorities move Machado ally to house arrest

-

YouTube rejects addiction claims in landmark social media trial

-

Google turns to century-long debt to build AI

Google turns to century-long debt to build AI

-

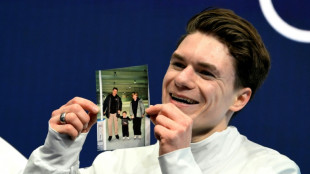

'I felt guided by them': US skater Naumov remembers parents at Olympics

-

Till death do us bark: Brazilian state lets pets be buried with owners

Till death do us bark: Brazilian state lets pets be buried with owners

-

'Confident' Pakistan ready for India blockbuster after USA win

-

Latam-GPT: a Latin American AI to combat US-centric bias

Latam-GPT: a Latin American AI to combat US-centric bias

-

Gauff dumped out of Qatar Open, Swiatek, Rybakina through

-

Paris officers accused of beating black producer to stand trial in November

Paris officers accused of beating black producer to stand trial in November

-

Istanbul bars rock bands accused of 'satanism'

-

Olympic bronze medal biathlete confesses affair on live TV

Olympic bronze medal biathlete confesses affair on live TV

-

US commerce chief admits Epstein Island lunch but denies closer ties

-

Mayor of Ecuador's biggest city arrested for money laundering

Mayor of Ecuador's biggest city arrested for money laundering

-

Farhan, spinners lead Pakistan to easy USA win in T20 World Cup

-

Stocks mixed as muted US retail sales spur caution

Stocks mixed as muted US retail sales spur caution

-

Macron wants more EU joint borrowing: Could it happen?

-

Shiffrin flops at Winter Olympics as helmet row simmers

Shiffrin flops at Winter Olympics as helmet row simmers

-

No excuses for Shiffrin after Olympic team combined flop

-

Pool on wheels brings swim lessons to rural France

Pool on wheels brings swim lessons to rural France

-

Europe's Ariane 6 to launch Amazon constellation satellites into orbit

-

Could the digital euro get a green light in 2026?

Could the digital euro get a green light in 2026?

-

Spain's Telefonica sells Chile unit in Latin America pullout

-

'We've lost everything': Colombia floods kill 22

'We've lost everything': Colombia floods kill 22

-

Farhan propels Pakistan to 190-9 against USA in T20 World Cup

-

US to scrap cornerstone of climate regulation this week

US to scrap cornerstone of climate regulation this week

-

Nepal call for India, England, Australia to play in Kathmandu

-

Stocks rise but lacklustre US retail sales spur caution

Stocks rise but lacklustre US retail sales spur caution

-

Olympic chiefs let Ukrainian athlete wear black armband at Olympics after helmet ban

-

French ice dancers poised for Winter Olympics gold amid turmoil

French ice dancers poised for Winter Olympics gold amid turmoil

-

Norway's Ruud wins error-strewn Olympic freeski slopestyle

-

More Olympic pain for Shiffrin as Austria win team combined

More Olympic pain for Shiffrin as Austria win team combined

-

Itoje returns to captain England for Scotland Six Nations clash

-

Sahara celebrates desert cultures at Chad festival

Sahara celebrates desert cultures at Chad festival

-

US retail sales flat in December as consumers pull back

-

Bumper potato harvests spell crisis for European farmers

Bumper potato harvests spell crisis for European farmers

-

Bangladesh's PM hopeful Rahman warns of 'huge' challenges ahead

-

Guardiola seeks solution to Man City's second half struggles

Guardiola seeks solution to Man City's second half struggles

-

Shock on Senegalese campus after student dies during police clashes

-

US vice president Vance on peace bid in Azerbaijan after Armenia visit

US vice president Vance on peace bid in Azerbaijan after Armenia visit

-

'Everything is destroyed': Ukrainian power plant in ruins after Russian strike

-

Shiffrin misses out on Olympic combined medal as Austria win

Shiffrin misses out on Olympic combined medal as Austria win

-

EU lawmakers back plans for digital euro

-

Starmer says UK govt 'united', presses on amid Epstein fallout

Starmer says UK govt 'united', presses on amid Epstein fallout

-

Olympic chiefs offer repairs after medals break

-

Moscow chokes Telegram as it pushes state-backed rival app

Moscow chokes Telegram as it pushes state-backed rival app

-

ArcelorMittal confirms long-stalled French steel plant revamp

-

New Zealand set new T20 World Cup record partnership to crush UAE

New Zealand set new T20 World Cup record partnership to crush UAE

-

Norway's Ruud wins Olympic freeski slopestyle gold after error-strewn event

-

USA's Johnson gets new gold medal after Olympic downhill award broke

USA's Johnson gets new gold medal after Olympic downhill award broke

-

Von Allmen aims for third gold in Olympic super-G

| CMSC | 0.44% | 23.69 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| BCE | 0.91% | 25.856 | $ | |

| RIO | 0.33% | 97.17 | $ | |

| BTI | -1.5% | 60.245 | $ | |

| BCC | 0.96% | 89.88 | $ | |

| GSK | 0.28% | 59.175 | $ | |

| CMSD | 0.58% | 24.11 | $ | |

| JRI | -0.16% | 12.79 | $ | |

| NGG | 0.58% | 88.91 | $ | |

| RYCEF | 3.04% | 17.41 | $ | |

| BP | -5.99% | 37.005 | $ | |

| VOD | -1.34% | 15.275 | $ | |

| AZN | 3.32% | 194.465 | $ | |

| RBGPF | 0.12% | 82.5 | $ | |

| RELX | -0.29% | 29.395 | $ |

Picktan Capital Eyes a Public Listing on the LSE

Picktan Capital Explores Strategic Move Toward Public Listing on the London Stock Exchange in 2026.

LONDON, UK / ACCESS Newswire / April 22, 2025 / Picktan Capital, the London-headquartered wealth management firm managing over $7 billion in client assets globally, has confirmed it is in active discussions with several major London-based investment banks to explore the possibility of a public listing on the London Stock Exchange (LSE) in 2026.

The firm, known for its disciplined investment approach and bespoke wealth solutions, has formally notified its board of directors and shareholders of its intent to pursue a potential IPO. A strategic review process is currently underway to evaluate the most effective path to the public markets. At a recent shareholder meeting, the proposal to move forward with the listing received unanimous approval, highlighting widespread confidence in the company's direction, leadership, and future growth prospects.

Founded with a mission to provide tailored, investment strategies to high-net-worth individuals, family offices, and institutions, Picktan Capital has seen consistent expansion over the past decade. The firm now services more than 9,000 clients across the UK, Europe, Asia, and the Middle East, supported by a team of seasoned investment professionals and a strong infrastructure rooted in risk management and long-term value creation.

A public offering would mark a transformational milestone for the company, providing access to additional growth capital and strengthening its presence in global markets. The move would also support ongoing efforts to expand its product offering, invest in next-generation technology platforms, and accelerate hiring across key operational and advisory areas.

"While no final decision has been made, we are rigorously evaluating all avenues for a listing," said Jacob Baker, CFO of Picktan Capital. "A move to go public would mark a transformative step for the business and allow us to broaden access to capital markets, scale more efficiently, and bring greater transparency and trust to our growing client base worldwide."

The company has reportedly drawn significant interest from top-tier investment banks based in London, with multiple firms actively positioning themselves to lead the offering. If confirmed, the IPO could be among the most notable financial services listings in 2026 - a sign of growing investor appetite for profitable, independently managed firms operating in the private wealth and asset management space.

In preparation for the potential listing, Picktan Capital has assembled a dedicated internal team to lead the IPO process, supported by external legal, regulatory, and financial advisors. The company is also reviewing potential governance changes and operational adjustments required to meet public market standards, including enhanced disclosure protocols and board restructuring.

Further announcements will be made in due course, as internal evaluations continue and market conditions develop. Shareholders will be kept informed throughout the process, with transparency and strategic alignment remaining at the core of all decisions.

About Picktan Capital

Founded in London, Picktan Capital is a global wealth management firm serving over 9,000 clients across Europe, North America, Asia, and the Middle East. The firm provides bespoke investment management, financial planning, and strategic advisory services to high-net-worth individuals, family offices, and institutions, with over $7 billion in assets under management.

Media Contact:

Sophie Hayworth

Media and PR Manager

Picktan Capital Limited

Email: [email protected]

Telephone Number: +44 (0)203 773 8881

Address: 1 Canada Square, London, E14 5AX, United Kingdom

SOURCE: Picktan Capital

View the original press release on ACCESS Newswire

T.Batista--PC