-

Venezuelan authorities move Machado ally to house arrest

Venezuelan authorities move Machado ally to house arrest

-

YouTube rejects addiction claims in landmark social media trial

-

Google turns to century-long debt to build AI

Google turns to century-long debt to build AI

-

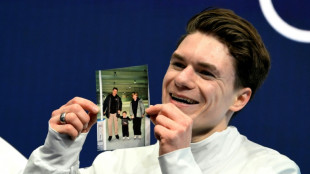

'I felt guided by them': US skater Naumov remembers parents at Olympics

-

Till death do us bark: Brazilian state lets pets be buried with owners

Till death do us bark: Brazilian state lets pets be buried with owners

-

'Confident' Pakistan ready for India blockbuster after USA win

-

Latam-GPT: a Latin American AI to combat US-centric bias

Latam-GPT: a Latin American AI to combat US-centric bias

-

Gauff dumped out of Qatar Open, Swiatek, Rybakina through

-

Paris officers accused of beating black producer to stand trial in November

Paris officers accused of beating black producer to stand trial in November

-

Istanbul bars rock bands accused of 'satanism'

-

Olympic bronze medal biathlete confesses affair on live TV

Olympic bronze medal biathlete confesses affair on live TV

-

US commerce chief admits Epstein Island lunch but denies closer ties

-

Mayor of Ecuador's biggest city arrested for money laundering

Mayor of Ecuador's biggest city arrested for money laundering

-

Farhan, spinners lead Pakistan to easy USA win in T20 World Cup

-

Stocks mixed as muted US retail sales spur caution

Stocks mixed as muted US retail sales spur caution

-

Macron wants more EU joint borrowing: Could it happen?

-

Shiffrin flops at Winter Olympics as helmet row simmers

Shiffrin flops at Winter Olympics as helmet row simmers

-

No excuses for Shiffrin after Olympic team combined flop

-

Pool on wheels brings swim lessons to rural France

Pool on wheels brings swim lessons to rural France

-

Europe's Ariane 6 to launch Amazon constellation satellites into orbit

-

Could the digital euro get a green light in 2026?

Could the digital euro get a green light in 2026?

-

Spain's Telefonica sells Chile unit in Latin America pullout

-

'We've lost everything': Colombia floods kill 22

'We've lost everything': Colombia floods kill 22

-

Farhan propels Pakistan to 190-9 against USA in T20 World Cup

-

US to scrap cornerstone of climate regulation this week

US to scrap cornerstone of climate regulation this week

-

Nepal call for India, England, Australia to play in Kathmandu

-

Stocks rise but lacklustre US retail sales spur caution

Stocks rise but lacklustre US retail sales spur caution

-

Olympic chiefs let Ukrainian athlete wear black armband at Olympics after helmet ban

-

French ice dancers poised for Winter Olympics gold amid turmoil

French ice dancers poised for Winter Olympics gold amid turmoil

-

Norway's Ruud wins error-strewn Olympic freeski slopestyle

-

More Olympic pain for Shiffrin as Austria win team combined

More Olympic pain for Shiffrin as Austria win team combined

-

Itoje returns to captain England for Scotland Six Nations clash

-

Sahara celebrates desert cultures at Chad festival

Sahara celebrates desert cultures at Chad festival

-

US retail sales flat in December as consumers pull back

-

Bumper potato harvests spell crisis for European farmers

Bumper potato harvests spell crisis for European farmers

-

Bangladesh's PM hopeful Rahman warns of 'huge' challenges ahead

-

Guardiola seeks solution to Man City's second half struggles

Guardiola seeks solution to Man City's second half struggles

-

Shock on Senegalese campus after student dies during police clashes

-

US vice president Vance on peace bid in Azerbaijan after Armenia visit

US vice president Vance on peace bid in Azerbaijan after Armenia visit

-

'Everything is destroyed': Ukrainian power plant in ruins after Russian strike

-

Shiffrin misses out on Olympic combined medal as Austria win

Shiffrin misses out on Olympic combined medal as Austria win

-

EU lawmakers back plans for digital euro

-

Starmer says UK govt 'united', presses on amid Epstein fallout

Starmer says UK govt 'united', presses on amid Epstein fallout

-

Olympic chiefs offer repairs after medals break

-

Moscow chokes Telegram as it pushes state-backed rival app

Moscow chokes Telegram as it pushes state-backed rival app

-

ArcelorMittal confirms long-stalled French steel plant revamp

-

New Zealand set new T20 World Cup record partnership to crush UAE

New Zealand set new T20 World Cup record partnership to crush UAE

-

Norway's Ruud wins Olympic freeski slopestyle gold after error-strewn event

-

USA's Johnson gets new gold medal after Olympic downhill award broke

USA's Johnson gets new gold medal after Olympic downhill award broke

-

Von Allmen aims for third gold in Olympic super-G

| CMSC | 0.44% | 23.69 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| BCE | 0.91% | 25.856 | $ | |

| RIO | 0.33% | 97.17 | $ | |

| BTI | -1.5% | 60.245 | $ | |

| BCC | 0.96% | 89.88 | $ | |

| GSK | 0.28% | 59.175 | $ | |

| CMSD | 0.58% | 24.11 | $ | |

| JRI | -0.16% | 12.79 | $ | |

| NGG | 0.58% | 88.91 | $ | |

| RYCEF | 3.04% | 17.41 | $ | |

| BP | -5.99% | 37.005 | $ | |

| VOD | -1.34% | 15.275 | $ | |

| AZN | 3.32% | 194.465 | $ | |

| RBGPF | 0.12% | 82.5 | $ | |

| RELX | -0.29% | 29.395 | $ |

Gold hits record, stocks diverge as Trump fuels Fed fears

Gold reached $3,500 an ounce for the first time Tuesday as US President Donald Trump's tariffs and verbal assault on the Federal Reserve prompted investors to snap up the safe-haven asset.

Wall Street rebounded from sharp losses the previous day at the start of trading, while Europe's main stock markets diverged in afternoon deals as the region's trading resumed after a long weekend break for Easter.

Asian indexes closed mixed, while the dollar diverged against major rivals and oil prices firmed.

"The move across global stock indices appears more reflective of consolidation than panic, but markets remain on edge," said Trade Nation analyst David Morrison.

Sentiment wasn't helped by the International Monetary Fund saying Trump's new tariff policies would take a big bite out of global growth.

The IMF now sees the global economy growing by 2.8 percent this year, 0.5 percentage points lower than its previous forecast in January.

"Lack of certainty is sending investors right into the arms of traditional safe haven assets, with gold and the Japanese yen both cashing in on the drama," noted Matt Britzman, senior equity analyst at Hargreaves Lansdown.

With the US tariff blitz still causing ructions on global trading floors, investors are now dealing with the added worry that Trump will try to remove the country's top banker.

The president last week took a swipe at Fed chief Jerome Powell over the latter's warning that the sweeping levies would likely reignite inflation.

While that raised eyebrows, Trump sent shivers through markets Monday by again calling on Powell to make pre-emptive cuts to US interest rates and calling him a "major loser" and "Mr Too Late".

The Republican tycoon said on his Truth Social platform that there was "virtually" no inflation, claiming energy and food costs were well down and pointed to the several interest rate reductions by the European Central Bank.

The outbursts have fanned concern that Trump is preparing to oust Powell, with top economic adviser Kevin Hassett saying Friday that the president was looking at whether he could do so.

Panicked Wall Street investors dumped US assets again on Monday, with all three main indexes ending down around 2.5 percent.

Analysts warned of another rout should Trump try to fire the Fed boss, which many said could cause a crisis of confidence in the US economy.

"Were Powell to be fired, the initial reaction would be a huge injection of volatility into financial markets, and the most dramatic rush to the exit from US assets that it is possible to imagine," said Pepperstone strategist Michael Brown.

"Lower, much lower, equities; Treasuries sold across the board; and, the dollar falling off a cliff."

Briefing.com analyst Patrick O'Hare put part of Wall Street's Tuesday rebound down to thinking that Trump won't fire Powell and "that he is simply setting him up now to take the blame in the event of an economic downturn".

- Key figures at 1330 GMT -

New York - Dow: UP 1.0 percent at 38,566.69 points

New York - S&P 500: UP 1.0 percent at 5,210.70

New York - Nasdaq Composite: UP 1.2 percent at 16,062.15

London - FTSE 100: UP 0.2 percent at 8,292.34

Paris - CAC 40: DOWN 0.3 percent at 7,264.83

Frankfurt - DAX: DOWN 0.4 percent at 21,114.10

Tokyo - Nikkei 225: DOWN 0.2 percent at 34,220.60 (close)

Hong Kong - Hang Seng Index: UP 0.8 percent at 21,562.32 (close)

Shanghai - Composite: UP 0.3 percent at 3,299.76 (close)

Euro/dollar: DOWN at $1.1467 from $1.1510 on Monday

Pound/dollar: DOWN $1.3371 at $1.3377

Dollar/yen: DOWN at 140.63 yen from 140.89 yen

Euro/pound: DOWN at 85.76 pence from 86.03 pence

Brent North Sea Crude: UP 0.9 percent at $63.09 per barrel

West Texas Intermediate: UP 1.1 percent at $63.85 per barrel

burs-rl/rmb

A.Aguiar--PC