-

Louvre trade unions to launch rolling strike

Louvre trade unions to launch rolling strike

-

Asian markets drop with Wall St as tech fears revive

-

North Korean leader's sister sports Chinese foldable phone

North Korean leader's sister sports Chinese foldable phone

-

Iran's women bikers take the road despite legal, social obstacles

-

Civilians venture home after militia seizes DR Congo town

Civilians venture home after militia seizes DR Congo town

-

Countdown to disclosure: Epstein deadline tests US transparency

-

Desperate England looking for Ashes miracle in Adelaide

Desperate England looking for Ashes miracle in Adelaide

-

Far-right Kast wins Chile election in landslide

-

What we know about Australia's Bondi Beach attack

What we know about Australia's Bondi Beach attack

-

Witnesses tell of courage, panic in wake of Bondi Beach shootings

-

Chilean hard right victory stirs memories of dictatorship

Chilean hard right victory stirs memories of dictatorship

-

Volunteers patrol Thai villages as artillery rains at Cambodia border

-

Far-right candidate Kast wins Chile presidential election

Far-right candidate Kast wins Chile presidential election

-

Father and son gunmen kill 15 at Jewish festival on Australia's Bondi Beach

-

Rodrygo scrapes Real Madrid win at Alaves

Rodrygo scrapes Real Madrid win at Alaves

-

Jimmy Lai, the Hong Kong media 'troublemaker' in Beijing's crosshairs

-

Hong Kong court to deliver verdicts on media mogul Jimmy Lai

Hong Kong court to deliver verdicts on media mogul Jimmy Lai

-

Bills rein in Patriots as Chiefs eliminated

-

Chiefs eliminated from NFL playoff hunt after dominant decade

Chiefs eliminated from NFL playoff hunt after dominant decade

-

Far right eyes comeback as Chile presidential polls close

-

Freed Belarus dissident Bialiatski vows to keep resisting regime from exile

Freed Belarus dissident Bialiatski vows to keep resisting regime from exile

-

Americans Novak and Coughlin win PGA-LPGA pairs event

-

Zelensky, US envoys to push on with Ukraine talks in Berlin on Monday

Zelensky, US envoys to push on with Ukraine talks in Berlin on Monday

-

Toulon edge out Bath as Saints, Bears and Quins run riot

-

Inter Milan go top in Italy as champions Napoli stumble

Inter Milan go top in Italy as champions Napoli stumble

-

ECOWAS threatens 'targeted sanctions' over Guinea Bissau coup

-

World leaders express horror at Bondi beach shooting

World leaders express horror at Bondi beach shooting

-

Joyous Sunderland celebrate Newcastle scalp

-

Guardiola hails Man City's 'big statement' in win at Palace

Guardiola hails Man City's 'big statement' in win at Palace

-

Lens reclaim top spot in Ligue 1 with Nice win

-

No 'quick fix' at Spurs, says angry Frank

No 'quick fix' at Spurs, says angry Frank

-

Toulon edge to victory over Bath, Saints and Quins run riot

-

Freed Belarus protest leader Kolesnikova doesn't 'regret anything'

Freed Belarus protest leader Kolesnikova doesn't 'regret anything'

-

Man City smash Palace to fire title warning, Villa extend streak

-

Arshdeep helps India beat South Africa to take T20 series lead

Arshdeep helps India beat South Africa to take T20 series lead

-

Zelensky meets US envoys in Berlin for talks on ending Ukraine war

-

'Outstanding' Haaland stars in win over Palace to fire Man City title charge

'Outstanding' Haaland stars in win over Palace to fire Man City title charge

-

Man City smash Palace to fire title warning, Villa extend winning run

-

Napoli stumble at Udinese to leave AC Milan top in Serie A

Napoli stumble at Udinese to leave AC Milan top in Serie A

-

No contact with Iran Nobel winner since arrest: supporters

-

Haaland stars in win over Palace to fire Man City title charge

Haaland stars in win over Palace to fire Man City title charge

-

French PM urged to intervene over cow slaughter protests

-

'Golden moment' as Messi meets Tendulkar, Chhetri on India tour

'Golden moment' as Messi meets Tendulkar, Chhetri on India tour

-

World leaders express horror, revulsion at Bondi beach shooting

-

Far right eyes comeback as Chile presidential vote begins

Far right eyes comeback as Chile presidential vote begins

-

Marcus Smith shines as Quins thrash Bayonne

-

Devastation at Sydney's Bondi beach after deadly shooting

Devastation at Sydney's Bondi beach after deadly shooting

-

AC Milan held by Sassuolo in Serie A

-

Person of interest in custody after deadly shooting at US university

Person of interest in custody after deadly shooting at US university

-

Van Dijk wants 'leader' Salah to stay at Liverpool

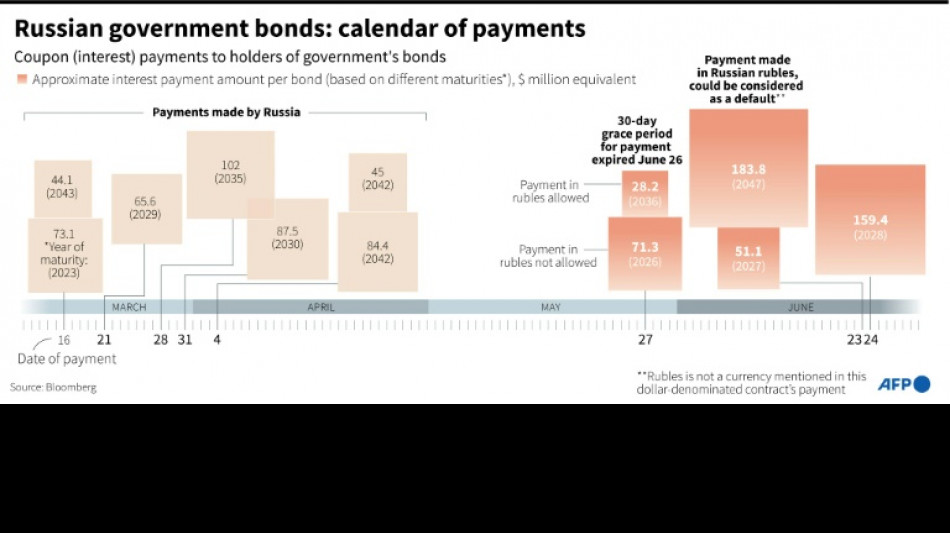

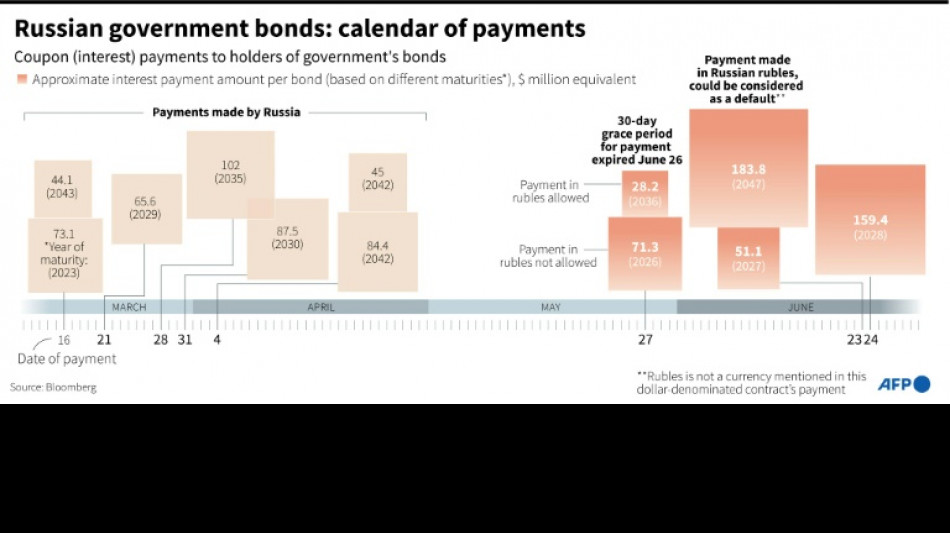

Blocked Russian payments: what impact for Moscow and creditors?

Russia acknowledged Monday that two interest payments on its debt didn't make it to creditors, an event which could be considered a default, even if Moscow disputes such an interpretation.

What happens next?

Why the default risk?

Russia was due to pay $100 million in interest on its debt on May 27 and the one-month grace period on the payment expired on Sunday.

The Russian finance ministry has said it paid the money on May 20. But it acknowledged on Monday that the money didn't reach creditors as the banking intermediaries blocked the transfers due to Western sanctions imposed on Moscow over the war in Ukraine.

The United States has since the end of May blocked Moscow from paying its dollar debts.

How to know if Russia is really in default?

Traditionally, it is the big credit ratings agencies (Fitch, Moody's, S&P Global Ratings) which make such a determination.

However, with the Western sanctions in place, "they are now prohibited from rating Russian government bonds," said Eric Dor, director of economic studies at the IESEG business school.

"We could well have a default without an official declaration by an authorised institution," he added.

It will now likely fall to the Credit Derivatives Determinations Committee (CDDC), a committee of creditors, to make the official determination whether Russia missed the payments and whether this constitutes a default.

The Committee has already acknowledged earlier this month that Russia did not make $1.9 million in penalty interest payments concerning a different payment due.

It plans to meet on Wednesday afternoon to discuss the missed May 27 payment.

It is also the Committee which decides whether or not to trigger payment of credit default swaps (CDS), financial products designed to serve as insurance for creditors against default.

Moscow argues that the fact that creditors didn't receive their money was not of the result of its failure to make the payment, but the actions of third parties, thus there is no default on its part.

What consequences of a default?

Russia's last default on its foreign debt was in 1918, when Bolshevik leader Vladimir Lenin repudiated Tsarist-era debts.

In case a default is declared "Russia won't be able to borrow in foreign currencies," said Slim Souissi, a researcher at the Institute of Business Administration at the University of Caen.

"In the short term, it will have trouble raising funds on international markets" and this could last for years, said Souissi, who previously worked as a financial analyst at Fitch.

Liam Peach, Emerging Europe Economist at Capital Economics, downplayed the impact of a default determination, as Western sanctions are already blocking Russia's access to international capital markets.

Normally, a default can have serious consequences.

Argentina's decision to freeze payment on $100 billion in debt in 2001 triggered a deep economic, political and social crisis.

But with sanctions again blocking Russian access to many markets, Peach said default would be a "largely symbolic event" unlikely to have an additional macroeconomic impact.

Russia's situation is also different in terms of the sums involved.

"There are around $2 billion in payments due from now until the end of the year, and that isn't going to destabilise" the international financial system, said Dor.

Mexico's 1982 default sparked debt crises in several developing countries as creditors demanded higher interest rates.

Peach said only about half of Russian foreign currency bonds are held by foreigners, which reduces the possibility of a wider impact.

Recovering the debt could prove to be thorny to litigate, according to legal experts questioned by AFP. The terms of Russian bonds are notoriously vague, including even on such basic elements as the legal jurisdiction to resolve disputes.

How did Russia try to avoid default?

To get around the ban on dollar payments, Moscow made the equivalent ruble sums available to creditors at the National Settlement Depository (NSD), a Russian financial institution.

According to Souissi, if the bond's terms didn't forsee payment in rubles this would constitute a default.

Moscow said the arrangement allowed Western creditors to recover their money, and they are free to request conversion into the foreign currency of their choice.

But getting the money out of Russia isn't straightforward and "investors weren't keen on opening accounts at the NSD", said Dor.

bur-boc-jvi-dga/rl/cdw

A.Aguiar--PC