-

Bolivia wants closer US ties, without alienating China: minister

Bolivia wants closer US ties, without alienating China: minister

-

Ex-MLB outfielder Puig guilty in federal sports betting case

-

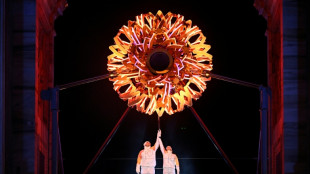

Milan-Cortina Winter Olympics open with dazzling ceremony

Milan-Cortina Winter Olympics open with dazzling ceremony

-

China overturns death sentence for Canadian in drug case

-

Trump reinstates commercial fishing in protected Atlantic waters

Trump reinstates commercial fishing in protected Atlantic waters

-

Man Utd can't rush manager choice: Carrick

-

Leeds boost survival bid with win over relegation rivals Forest

Leeds boost survival bid with win over relegation rivals Forest

-

Stars, Clydesdales and an AI beef jostle for Super Bowl ad glory

-

Dow surges above 50,000 for first time as US stocks regain mojo

Dow surges above 50,000 for first time as US stocks regain mojo

-

Freeski star Gu says injuries hit confidence as she targets Olympic treble

-

UK police search properties in Mandelson probe

UK police search properties in Mandelson probe

-

Bompastor extends contract as Chelsea Women's boss despite slump

-

Milan-Cortina Winter Olympics open with glittering ceremony

Milan-Cortina Winter Olympics open with glittering ceremony

-

A French yoga teacher's 'hell' in a Venezuelan jail

-

England's Underhill taking nothing for granted against Wales

England's Underhill taking nothing for granted against Wales

-

Fans cheer for absent Ronaldo as Saudi row deepens

-

Violence-ridden Haiti in limbo as transitional council wraps up

Violence-ridden Haiti in limbo as transitional council wraps up

-

Hundreds protest in Milan ahead of Winter Olympics

-

Suspect in murder of Colombian footballer Escobar killed in Mexico

Suspect in murder of Colombian footballer Escobar killed in Mexico

-

Wainwright says England game still 'huge occasion' despite Welsh woes

-

WADA shrugs off USA withholding dues

WADA shrugs off USA withholding dues

-

Winter Olympics to open with star-studded ceremony

-

Trump posts, then deletes, racist clip of Obamas as monkeys

Trump posts, then deletes, racist clip of Obamas as monkeys

-

Danone expands recall of infant formula batches in Europe

-

Trump deletes racist video post of Obamas as monkeys

Trump deletes racist video post of Obamas as monkeys

-

Colombia's Rodriguez signs with MLS side Minnesota United

-

UK police probing Mandelson after Epstein revelations search properties

UK police probing Mandelson after Epstein revelations search properties

-

Russian drone hits Ukrainian animal shelter

-

US says new nuclear deal should include China, accuses Beijing of secret tests

US says new nuclear deal should include China, accuses Beijing of secret tests

-

French cycling hope Seixas dreaming of Tour de France debut

-

France detects Russia-linked Epstein smear attempt against Macron: govt source

France detects Russia-linked Epstein smear attempt against Macron: govt source

-

EU nations back chemical recycling for plastic bottles

-

Iran expects more US talks after 'positive atmosphere' in Oman

Iran expects more US talks after 'positive atmosphere' in Oman

-

US says 'key participant' in 2012 attack on Benghazi mission arrested

-

Why bitcoin is losing its luster after stratospheric rise

Why bitcoin is losing its luster after stratospheric rise

-

Arteta apologises to Rosenior after disrespect row

-

Terror at Friday prayers: witness describes 'extremely powerful' blast in Islamabad

Terror at Friday prayers: witness describes 'extremely powerful' blast in Islamabad

-

Winter Olympics men's downhill: Three things to watch

-

Ice dancers Chock and Bates shine as US lead Japan in team event

Ice dancers Chock and Bates shine as US lead Japan in team event

-

Stocks rebound though tech stocks still suffer

-

Spanish PM urges caution as fresh rain heads for flood zone

Spanish PM urges caution as fresh rain heads for flood zone

-

Iran says to hold more talks with US despite Trump military threats

-

Cambodia reveals damage to UNESCO-listed temple after Thailand clashes

Cambodia reveals damage to UNESCO-listed temple after Thailand clashes

-

Norway crown princess 'deeply regrets' Epstein friendship

-

Italy set for Winter Olympics opening ceremony as Vonn passes test

Italy set for Winter Olympics opening ceremony as Vonn passes test

-

England's Jacks says players back under-fire skipper Brook '100 percent'

-

Carrick relishing Frank reunion as Man Utd host Spurs

Carrick relishing Frank reunion as Man Utd host Spurs

-

Farrell keeps the faith in Irish still being at rugby's top table

-

Meloni, Vance hail 'shared values' amid pre-Olympic protests

Meloni, Vance hail 'shared values' amid pre-Olympic protests

-

Olympic freestyle champion Gremaud says passion for skiing carried her through dark times

Stocks rise ahead of key US jobs data

Asian and European stock markets advanced on Friday ahead of a key US jobs report that will give insight into the Federal Reserve's path for interest rates.

The global bond market was steady after yields jumped this week on concerns over mounting government debt.

London, Paris and Frankfurt all gained in midday trading on Friday.

Traders brushed off data showing German industrial orders unexpectedly fell in July.

Investors are focused on US non-farm payrolls data (NFP) for August set to be released later on Friday.

"There is a sense that the August report could be pivotal for financial markets," said Kathleen Brooks, research director at trading group XTB.

Figures are expected to confirm a cooled labour market as companies pull back on hiring amid ongoing uncertainty over President Donald Trump's tariffs.

"We think that the September cut is a done deal at this stage... however, a stronger NFP report for August could cast doubt on the potential for rate cuts further down the line," Brooks added.

The report is set to attract heightened scrutiny.

A poor showing last month prompted Trump to fire the commissioner of labor statistics after the president claimed the numbers were "rigged".

In Asia, China's blue-chip CSI 300 benchmark recovered on Friday after falling 2.1 percent the previous day -- the largest drop since early April when Trump's tariff threats caused the index to drop more than seven percent in one day.

An August rally in Chinese stocks, fuelled by surging shares in semiconductor firms, ground to a halt this week, with Cambricon Technologies tumbling 14 percent Thursday on reports of a regulatory clampdown.

Main indices in Hong Kong and Shanghai closed higher Friday.

Tokyo also climbed after Trump signed an order to lower tariffs on Japanese autos to 15 percent from 27.5 percent.

The price of gold rested near its all-time high, remaining a refuge for investors turning away from long-term bonds despite traditionally seen as safe assets.

Oil prices extended losses in anticipation of excess supply in the coming months as OPEC+ nations, which include Saudi Arabia and Russia, are expected to further unwind production cuts.

Oil has tumbled 12 percent this year as global producers outside OPEC+ ramp up and tariffs curb demand.

- Key figures at around 1050 GMT -

London - FTSE 100: UP 0.3 percent at 9,241.54 points

Paris - CAC 40: UP 0.1 percent at 7,704.85

Frankfurt - DAX: UP 0.2 percent at 23,807.91

Tokyo - Nikkei 225: UP 1.0 percent at 43,018.75 (close)

Hong Kong - Hang Seng Index: UP 1.4 percent at 25,417.98 (close)

Shanghai - Composite: UP 1.2 percent at 3,812.51 (close)

New York - Dow: UP 0.8 percent at 45,621.29 (close)

Euro/dollar: UP at $1.1696 from $1.1649 on Thursday

Pound/dollar: UP at $1.3483 from $1.3437

Dollar/yen: DOWN at 148.14 yen from 148.45 yen

Euro/pound: UP at 86.76 from 86.72 pence

West Texas Intermediate: DOWN 0.7 percent at $63.02 per barrel

Brent North Sea Crude: DOWN 0.6 percent at $66.63 per barrel

Nogueira--PC