-

Bolivia wants closer US ties, without alienating China: minister

Bolivia wants closer US ties, without alienating China: minister

-

Ex-MLB outfielder Puig guilty in federal sports betting case

-

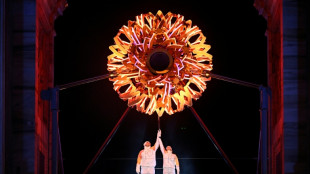

Milan-Cortina Winter Olympics open with dazzling ceremony

Milan-Cortina Winter Olympics open with dazzling ceremony

-

China overturns death sentence for Canadian in drug case

-

Trump reinstates commercial fishing in protected Atlantic waters

Trump reinstates commercial fishing in protected Atlantic waters

-

Man Utd can't rush manager choice: Carrick

-

Leeds boost survival bid with win over relegation rivals Forest

Leeds boost survival bid with win over relegation rivals Forest

-

Stars, Clydesdales and an AI beef jostle for Super Bowl ad glory

-

Dow surges above 50,000 for first time as US stocks regain mojo

Dow surges above 50,000 for first time as US stocks regain mojo

-

Freeski star Gu says injuries hit confidence as she targets Olympic treble

-

UK police search properties in Mandelson probe

UK police search properties in Mandelson probe

-

Bompastor extends contract as Chelsea Women's boss despite slump

-

Milan-Cortina Winter Olympics open with glittering ceremony

Milan-Cortina Winter Olympics open with glittering ceremony

-

A French yoga teacher's 'hell' in a Venezuelan jail

-

England's Underhill taking nothing for granted against Wales

England's Underhill taking nothing for granted against Wales

-

Fans cheer for absent Ronaldo as Saudi row deepens

-

Violence-ridden Haiti in limbo as transitional council wraps up

Violence-ridden Haiti in limbo as transitional council wraps up

-

Hundreds protest in Milan ahead of Winter Olympics

-

Suspect in murder of Colombian footballer Escobar killed in Mexico

Suspect in murder of Colombian footballer Escobar killed in Mexico

-

Wainwright says England game still 'huge occasion' despite Welsh woes

-

WADA shrugs off USA withholding dues

WADA shrugs off USA withholding dues

-

Winter Olympics to open with star-studded ceremony

-

Trump posts, then deletes, racist clip of Obamas as monkeys

Trump posts, then deletes, racist clip of Obamas as monkeys

-

Danone expands recall of infant formula batches in Europe

-

Trump deletes racist video post of Obamas as monkeys

Trump deletes racist video post of Obamas as monkeys

-

Colombia's Rodriguez signs with MLS side Minnesota United

-

UK police probing Mandelson after Epstein revelations search properties

UK police probing Mandelson after Epstein revelations search properties

-

Russian drone hits Ukrainian animal shelter

-

US says new nuclear deal should include China, accuses Beijing of secret tests

US says new nuclear deal should include China, accuses Beijing of secret tests

-

French cycling hope Seixas dreaming of Tour de France debut

-

France detects Russia-linked Epstein smear attempt against Macron: govt source

France detects Russia-linked Epstein smear attempt against Macron: govt source

-

EU nations back chemical recycling for plastic bottles

-

Iran expects more US talks after 'positive atmosphere' in Oman

Iran expects more US talks after 'positive atmosphere' in Oman

-

US says 'key participant' in 2012 attack on Benghazi mission arrested

-

Why bitcoin is losing its luster after stratospheric rise

Why bitcoin is losing its luster after stratospheric rise

-

Arteta apologises to Rosenior after disrespect row

-

Terror at Friday prayers: witness describes 'extremely powerful' blast in Islamabad

Terror at Friday prayers: witness describes 'extremely powerful' blast in Islamabad

-

Winter Olympics men's downhill: Three things to watch

-

Ice dancers Chock and Bates shine as US lead Japan in team event

Ice dancers Chock and Bates shine as US lead Japan in team event

-

Stocks rebound though tech stocks still suffer

-

Spanish PM urges caution as fresh rain heads for flood zone

Spanish PM urges caution as fresh rain heads for flood zone

-

Iran says to hold more talks with US despite Trump military threats

-

Cambodia reveals damage to UNESCO-listed temple after Thailand clashes

Cambodia reveals damage to UNESCO-listed temple after Thailand clashes

-

Norway crown princess 'deeply regrets' Epstein friendship

-

Italy set for Winter Olympics opening ceremony as Vonn passes test

Italy set for Winter Olympics opening ceremony as Vonn passes test

-

England's Jacks says players back under-fire skipper Brook '100 percent'

-

Carrick relishing Frank reunion as Man Utd host Spurs

Carrick relishing Frank reunion as Man Utd host Spurs

-

Farrell keeps the faith in Irish still being at rugby's top table

-

Meloni, Vance hail 'shared values' amid pre-Olympic protests

Meloni, Vance hail 'shared values' amid pre-Olympic protests

-

Olympic freestyle champion Gremaud says passion for skiing carried her through dark times

The massive debt behind France's political turmoil

France's growing debt pile is at the heart of the confidence vote that could topple the government of Prime Minister Francois Bayrou next week.

Bayrou called the vote to settle a fight over the budget as he seeks 44 billion euros ($51 billion) in savings to cut the debt.

But his plan, which includes reducing the number of holidays, has proved unpopular.

Here is a look at the country's fiscal situation ahead of Monday's vote in parliament:

- How big is it? -

France's public debt has steadily risen for decades, fuelled by chronic budget deficits financed through borrowing on bond markets.

The debt grew to 3.3 trillion euros ($3.9 trillion) in the first three months of this year, or over 48,000 euros per French national.

The debt amounts to 114 percent of France's annual gross domestic product (GDP, a measure of economic output) -- the third highest debt ratio in the eurozone after Greece and Italy.

The debt ratio is almost double the limit of 60 percent allowed by the European Union.

By comparison, the debt-to-GDP ratio was at 57.8 percent in 1995, but financial crises, the Covid pandemic and high inflation have fuelled its rise.

It's not great, but it could be worse.

The Avant-Garde Institute, a think tank, noted that France's debt ratio was as high as 300 percent of GDP between World War I and World War II.

Eric Heyer, an economist at the French Economic Observatory think tank, told AFP that "many countries are above" France's 114 percent debt-to-GDP ratio.

- What's the problem? -

More debt means more of the country's taxpayer money goes into paying interest to creditors.

The growth of state spending on servicing the debt has been one the threats cited by the government.

The government's debt burden, or interest payments, totals 53 billion euros in 2025, according to the medium-term budget plan presented in April.

Bayrou has warned that the number will grow to 66 billion euros in 2026, making it the government's main spending item ahead of education.

"The consequence for French people is that we can't do other things," Pierre Moscovici, president of the national audit body, told news channel LCI on Sunday.

But economists from Attac, a French activist group campaigning for financial justice, and the Copernic Foundation, a left-leaning organisation, recently argued in Le Monde that France’s debt isn’t as alarming as the government suggests.

The government spent just two percent of the country's GDP on interest payments last year, the groups said in a joint column in Le Monde newspaper.

Other experts, including Heyer, also question the government’s presentation of interest costs, saying it does not take inflation into account.

When prices rise, inflation can reduce the real burden of debt because the government collects more in taxes and the economy grows, giving it more room to manoeuvre financially.

- Is there a risk of crisis? -

Some, including the French government itself, have raised the spectre of a scenario reminiscent of the Greek debt crisis that rocked the eurozone more than a decade ago.

France's long-term borrowing cost jumped to its highest level since 2011 on Tuesday as the yield on 30-year government bonds topped 4.5 percent.

The yield on 10-year sovereign bonds exceeded 3.6 percent this week, the highest since March and approaching the same level as Italy, long seen as a budget laggard in Europe.

The rates, however, do not suggest that another Greek-like crisis is in the offing, said Ipek Ozkardeskaya, analyst at Swissquote Bank.

"The contagion risk remains limited. But France must find a way to tidy up its finances before gaining investors confidence back," Ozkardeskaya said.

There is still strong demand for French debt: On Thursday, the state raised 7.3 billion euros in a sale of 10-year bonds.

The European Central Bank also provides a safety net by intervening in bond markets to buy government debt, said Christopher Dembik, a strategist at Pictet investment firm.

He predicted, however, that ratings agencies will downgrade France's debt.

P.Queiroz--PC