-

Novo Nordisk vows legal action to protect Wegovy pill

Novo Nordisk vows legal action to protect Wegovy pill

-

Swiss rivalry is fun -- until Games start, says Odermatt

-

Canadian snowboarder McMorris eyes slopestyle after crash at Olympics

Canadian snowboarder McMorris eyes slopestyle after crash at Olympics

-

Deadly storm sparks floods in Spain, disrupts Portugal vote

-

Ukrainian flag bearer proud to show his country is still standing

Ukrainian flag bearer proud to show his country is still standing

-

Carney scraps Canada EV sales mandate

-

Morocco says evacuated 140,000 people due to severe weather

Morocco says evacuated 140,000 people due to severe weather

-

Spurs boss Frank says Romero outburst 'dealt with internally'

-

Giannis suitors make deals as NBA trade deadline nears

Giannis suitors make deals as NBA trade deadline nears

-

Carrick stresses significance of Munich air disaster to Man Utd history

-

Record January window for transfers despite drop in spending

Record January window for transfers despite drop in spending

-

'Burned inside their houses': Nigerians recount horror of massacre

-

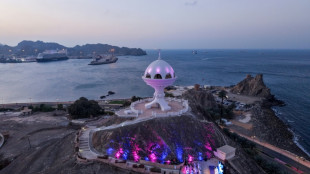

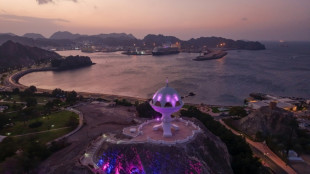

Iran, US prepare for Oman talks after deadly protest crackdown

Iran, US prepare for Oman talks after deadly protest crackdown

-

Winter Olympics opening ceremony nears as virus disrupts ice hockey

-

Mining giant Rio Tinto abandons Glencore merger bid

Mining giant Rio Tinto abandons Glencore merger bid

-

Davos forum opens probe into CEO Brende's Epstein links

-

ECB warns of stronger euro impact, holds rates

ECB warns of stronger euro impact, holds rates

-

Famine spreading in Sudan's Darfur, warn UN-backed experts

-

Lights back on in eastern Cuba after widespread blackout

Lights back on in eastern Cuba after widespread blackout

-

Russia, US agree to resume military contacts at Ukraine talks

-

Greece aims to cut queues at ancient sites with new portal

Greece aims to cut queues at ancient sites with new portal

-

No time frame to get Palmer in 'perfect' shape - Rosenior

-

Stocks fall as tech valuation fears stoke volatility

Stocks fall as tech valuation fears stoke volatility

-

US Olympic body backs LA28 leadership amid Wasserman scandal

-

Gnabry extends Bayern Munich deal until 2028

Gnabry extends Bayern Munich deal until 2028

-

England captain Stokes suffers facial injury after being hit by ball

-

Italy captain Lamaro amongst trio set for 50th caps against Scotland

Italy captain Lamaro amongst trio set for 50th caps against Scotland

-

Piastri plays down McLaren rivalry with champion Norris

-

ECB holds interest rates as strong euro causes jitters

ECB holds interest rates as strong euro causes jitters

-

EU close to sealing trade deal with Australia

-

German Cup final to stay in Berlin until 2030

German Cup final to stay in Berlin until 2030

-

What does Iran want from talks with the US?

-

Taming the lion: Olympians take on Bormio's terrifying Stelvio piste

Taming the lion: Olympians take on Bormio's terrifying Stelvio piste

-

Wind turbine maker Vestas sees record revenue in 2025

-

Italy's Casse tops second Olympic downhill training

Italy's Casse tops second Olympic downhill training

-

Anti-doping boss 'uncomfortable' with Valieva's coach at Olympics

-

Bitcoin under $70,000 for first time since Trump's election

Bitcoin under $70,000 for first time since Trump's election

-

'I am sorry,' embattled UK PM tells Epstein victims

-

England's Brook predicts record 300-plus scores at T20 World Cup

England's Brook predicts record 300-plus scores at T20 World Cup

-

Ukraine, Russia swap prisoners, US says 'work remains' to end war

-

Wales' Rees-Zammit at full-back for Six Nations return against England

Wales' Rees-Zammit at full-back for Six Nations return against England

-

Sad horses and Draco Malfoy: China's unexpected Lunar New Year trends

-

Hong Kong students dissolve pro-democracy group under 'severe' pressure

Hong Kong students dissolve pro-democracy group under 'severe' pressure

-

Germany claws back 59 mn euros from Amazon over price controls

-

Germany claws back 70 mn euros from Amazon over price controls

Germany claws back 70 mn euros from Amazon over price controls

-

VW and Stellantis urge help to keep carmaking in Europe

-

Stock markets drop amid tech concerns before rate calls

Stock markets drop amid tech concerns before rate calls

-

BBVA posts record profit after failed Sabadell takeover

-

UN human rights agency in 'survival mode': chief

UN human rights agency in 'survival mode': chief

-

Greenpeace slams fossil fuel sponsors for Winter Olympics

| CMSC | -0.04% | 23.51 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| JRI | -0.08% | 13.14 | $ | |

| BCC | -2.65% | 87.9 | $ | |

| BCE | -4.07% | 25.31 | $ | |

| NGG | -0.88% | 87.025 | $ | |

| RIO | -4.74% | 92.11 | $ | |

| RBGPF | 0.12% | 82.5 | $ | |

| CMSD | 0.1% | 23.895 | $ | |

| GSK | 3.55% | 59.335 | $ | |

| RYCEF | -0.36% | 16.62 | $ | |

| BTI | 0.54% | 61.965 | $ | |

| VOD | -7.09% | 14.67 | $ | |

| BP | -2.62% | 38.2 | $ | |

| AZN | 0.47% | 188.33 | $ | |

| RELX | 1.23% | 30.15 | $ |

Stock markets fall with Wall St as US credit fears add to worries

Asian and European stocks tracked losses on Wall Street on Friday amid fresh credit market fears that compounded worries about trade tensions, a possible tech bubble and the US government shutdown.

After a months-long run-up that has seen some indexes hit multiple records, investors have been sent reeling this week since US President Donald Trump stoked his tariff standoff with China on Friday, sparking tit-for-tat salvos that have broken the calm.

Investors have been nervously watching the US banking sector since parts company First Brands and subprime lender Tricolor filed for bankruptcy in September, with the former owing billions to lenders.

The announcement was followed this week by news that Zions Bancorp had a $50 million charge-off tied to commercial loans from its California arm, while Western Alliance said a borrower failed to deliver the promised collateral.

The news sent mid-sized banking shares tumbling and fanned out to the rest of Wall Street, with the all three main indexes down.

The VIX Volatility index -- a closely watched benchmark of investor anxiety -- hitting its highest level since May, while safe-haven gold set another record of $4,379.93. Silver also hit a new peak.

Thursday's developments dealt another blow to the optimism that had pushed markets higher this year, with investors already fretting that valuations -- particularly among tech firms -- are overdone and possibly in an AI-fuelled bubble that could soon pop.

"The volatility in regional banks, combined with the recent collapse of subprime lender Tricolor Holdings, has investors questioning the broader health of US credit markets," said National Australia Bank's Rodrigo Catril.

The losses in New York were matched in Asia, where Hong Kong tanked 2.5 percent and Shanghai two percent. Tokyo and Taipei each lost more than one percent while Singapore, Sydney, Wellington, Bangkok and Manila were also in the red.

London, Paris and Frankfurt fell more than one percent.

Investors were also still on tenterhooks after Washington and Beijing exchanged salvos this week on trade and shipping, after Trump's warning Friday that he would hit China with 100 percent tariffs over its rare earth export controls.

However, Pepperstone's Michael Brown was upbeat about the outlook on that front.

"Conviction remains lacking, as the latest round of Trump tariff threats continues to hang over markets like the 'Sword of Damocles'," he wrote in a commentary.

"It must be said that there’s not been much by way of new info on that front, though my working assumption remains that the latest round of tariff threats are a negotiating gambit, and that tensions will indeed de-escalate in relatively short order."

Lawmakers in Washington are still no closer to ending a shutdown that has caused the closure of government departments and delayed the release of key data used by the Federal Reserve to decide on policy.

Still, traders have been given some support by expectations the central bank will cut interest rates at least once more this year, though even that was based on a string of reports showing the US jobs market deteriorating.

Crude prices extended losses on worries about China-US tensions, with selling also coming from news that Trump will meet Russian counterpart Vladimir Putin to discuss ending the conflict in Ukraine.

- Key figures at around 0715 GMT -

Tokyo - Nikkei 225: DOWN 1.4 percent at 47,582.15 (close)

Hong Kong - Hang Seng Index: DOWN 2.5 percent at 25,253.80

Shanghai - Composite: DOWN 2.0 percent at 3,839.76 (close)

London - FTSE 100: DOWN 1.4 percent at 9,300.54

Euro/dollar: UP $1.1705 from $1.1692 on Thursday

Pound/dollar: UP at $1.3443 from $1.3436

Dollar/yen: DOWN at 149.54 yen from 150.35 yen

Euro/pound: UP at 87.08 percent from 87.02 pence

West Texas Intermediate: DOWN 0.7 percent at $57.05 per barrel

Brent North Sea Crude: DOWN 0.7 percent at $60.62 per barrel

New York - Dow: DOWN 0.7 percent at 45,952.24 (close)

P.Queiroz--PC