-

Merz heads to Gulf as Germany looks to diversify trade ties

Merz heads to Gulf as Germany looks to diversify trade ties

-

Selection process for future Olympic hosts set for reform

-

Serbian minister on trial over Trump-linked hotel plan

Serbian minister on trial over Trump-linked hotel plan

-

UK PM says Mandelson 'lied', regrets appointing him US envoy

-

Cochran-Siegle tops first Olympic downhill training

Cochran-Siegle tops first Olympic downhill training

-

Gaza health officials say strikes kill 21 after Israel says shots wounded officer

-

Injured Vonn's Olympic bid is 'inspirational', ski stars say

Injured Vonn's Olympic bid is 'inspirational', ski stars say

-

Albania arrests 20 for toxic waste trafficking

-

US-Africa trade deal renewal only 'temporary breather'

US-Africa trade deal renewal only 'temporary breather'

-

Mir sets pace on Sepang day two, Yamaha absent

-

Xi, Putin hail 'stabilising' China-Russia alliance

Xi, Putin hail 'stabilising' China-Russia alliance

-

GSK boosted by specialty drugs, end to Zantac fallout

-

UK's ex-prince leaves Windsor home amid Epstein storm: reports

UK's ex-prince leaves Windsor home amid Epstein storm: reports

-

Sky is the limit for Ireland fly-half Prendergast, says captain Doris

-

Feyi-Waboso reminds England great Robinson of himself

Feyi-Waboso reminds England great Robinson of himself

-

Starmer faces MPs as pressure grows over Mandelson scandal

-

HRW urges pushback against 'aggressive superpowers'

HRW urges pushback against 'aggressive superpowers'

-

Russia demands Ukraine give in as UAE talks open

-

Gaza civil defence says 17 killed in strikes after Israel says shots wounded officer

Gaza civil defence says 17 killed in strikes after Israel says shots wounded officer

-

France's Kante joins Fenerbahce after Erdogan 'support'

-

CK Hutchison launches arbitration over Panama Canal port ruling

CK Hutchison launches arbitration over Panama Canal port ruling

-

Stocks mostly rise as traders ignore AI-fuelled sell-off on Wall St

-

Acclaimed Iraqi film explores Saddam Hussein's absurd birthday rituals

Acclaimed Iraqi film explores Saddam Hussein's absurd birthday rituals

-

On rare earth supply, Trump for once seeks allies

-

Ukrainian chasing sumo greatness after meteoric rise

Ukrainian chasing sumo greatness after meteoric rise

-

Draper to make long-awaited return in Davis Cup qualifier

-

Can Ilia Malinin fulfil his promise at the Winter Olympics?

Can Ilia Malinin fulfil his promise at the Winter Olympics?

-

CK Hutchison begins arbitration against Panama over annulled canal contract

-

UNESCO recognition inspires hope in Afghan artist's city

UNESCO recognition inspires hope in Afghan artist's city

-

Ukraine, Russia, US negotiators gather in Abu Dhabi for war talks

-

WTO must 'reform or die': talks facilitator

WTO must 'reform or die': talks facilitator

-

Doctors hope UK archive can solve under-50s bowel cancer mystery

-

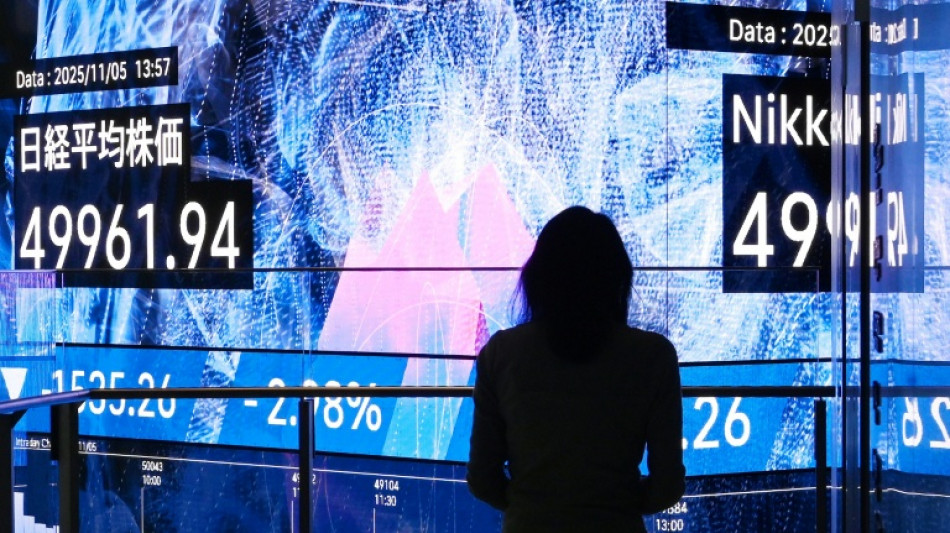

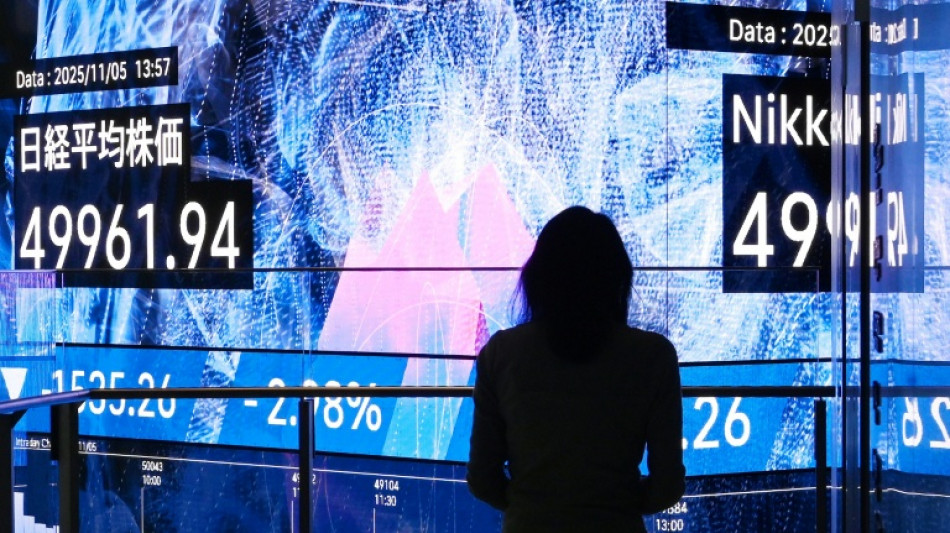

Stocks swing following latest AI-fuelled sell-off on Wall St

Stocks swing following latest AI-fuelled sell-off on Wall St

-

Demanding Dupont set to fire France in Ireland opener

-

Britain's ex-prince Andrew leaves Windsor home: BBC

Britain's ex-prince Andrew leaves Windsor home: BBC

-

Coach plots first South Africa World Cup win after Test triumph

-

Spin-heavy Pakistan hit form, but India boycott risks early T20 exit

Spin-heavy Pakistan hit form, but India boycott risks early T20 exit

-

Japan eyes Premier League parity by aligning calendar with Europe

-

Whack-a-mole: US academic fights to purge his AI deepfakes

Whack-a-mole: US academic fights to purge his AI deepfakes

-

Love in a time of war for journalist and activist in new documentary

-

'Unprecedented mass killing': NGOs battle to quantify Iran crackdown scale

'Unprecedented mass killing': NGOs battle to quantify Iran crackdown scale

-

Seahawks kid Cooper Kupp seeks new Super Bowl memories

-

Thousands of Venezuelans march to demand Maduro's release

Thousands of Venezuelans march to demand Maduro's release

-

AI, manipulated images falsely link some US politicians with Epstein

-

Move on, says Trump as Epstein files trigger probe into British politician

Move on, says Trump as Epstein files trigger probe into British politician

-

Axon Neuroscience's Immunotherapy Selected for a Landmark Combination-Therapy Alzheimer’s Clinical Trial in US, Supported by a USD 151 Million Grant

-

CHAR Technologies Licenses High-Temperature Pyrolysis Technology to GazoTech SAS for Entry Into European Markets

CHAR Technologies Licenses High-Temperature Pyrolysis Technology to GazoTech SAS for Entry Into European Markets

-

Arteta backs Arsenal to build on 'magical' place in League Cup final

-

Evil Empire to underdogs: Patriots eye 7th Super Bowl

Evil Empire to underdogs: Patriots eye 7th Super Bowl

-

UBS grilled on Capitol Hill over Nazi-era probe

Markets mixed as traders struggle to hold Fed cut rally

Asian and European markets were mixed Thursday after the latest batch of US data reinforced expectations that the Federal Reserve will cut interest rates for a third successive time next week.

Wall Street rose for a second straight day after a minor selloff on Monday, though regional traders moved a little more tentatively as worries over extended valuations in the tech sector continued to linger.

Bets on a US reduction on Wednesday have surged to around 90 percent in the past two weeks, after several Fed officials backed such a move saying supporting jobs was more important than keeping a lid on elevated inflation.

The need for more action was further stoked by data from payrolls firm ADP showing 32,000 posts were lost in November, compared with an expected rise of 10,000, according to Bloomberg.

"Hiring has been choppy of late as employers weather cautious consumers and an uncertain macroeconomic environment," ADP chief economist Nela Richardson said.

The reading was also the most since early 2023 and is the latest example of a stuttering labour market.

"Right now, the data argues for additional Fed funds rate cuts. US labor demand is weak, consumer spending is showing early signs of cracking, and upside risks to inflation are fading," Elias Haddad, of Brown Brothers Harriman & Co, wrote.

After New York's advance, Tokyo rallied more than two percent, with Hong Kong, Sydney, Taipei and Bangkok also up, along with London, Paris and Frankfurt.

Shanghai, Seoul, Singapore, Wellington, Manila, Mumbai and Bangkok slipped.

A healthy 30-year Japanese government bond sale provided some support as it slightly eased tensions about a posible rate hike by the central bank this month. The news compounded a strong response to a 10-year auction earlier in the week that settled some nerves.

On stocks, Pepperstone's Michael Brown said in a note: "Path continues to point to the upside, with the bull case remaining a very solid one indeed, and with participants seeking to ride the coattails of the rally higher, especially amid the increased influence of FOMO/FOMU flows as we move into the end of the year."

However, while market players remain confident that the Fed will continue to cut interest rates into the new year, economists at Bank of America still had a note of caution.

"The most immediate source of volatility remains the US Federal Reserve," they wrote.

"While inflation has moderated and the trajectory of policy easing is intact, uncertainty around timing persists. Any delay in rate cuts could remain a source of volatility."

On currency markets the Indian rupee wallowed at record lows of more than 90 per dollar as investors grow increasingly worried about a lack of progress in trade talks with Washington, as observers say Donald Trump's 50 percent tariffs are taking a toll on the economy.

- Key figures at around 0815 GMT -

Tokyo - Nikkei 225: UP 2.3 percent at 51,028.42 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 25,935.90 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,875.79 (close)

London - FTSE 100: UP 0.1 percent at 9,701.92

Euro/dollar: DOWN at $1.1663 from $1.1667 on Wednesday

Pound/dollar: DOWN at $1.3337 from $1.3352

Dollar/yen: UP at 155.25 yen from 155.23 yen

Euro/pound: UP at 87.45 pence from 87.39 pence

West Texas Intermediate: UP 0.7 percent at $59.36 per barrel

Brent North Sea Crude: UP 0.6 percent at $63.04 per barrel

New York - Dow: UP 0.9 percent at 47,882.90 (close)

F.Carias--PC