-

Bondi shooting shocks, angers Australia's Jewish community

Bondi shooting shocks, angers Australia's Jewish community

-

Markets rise even as US jobs data fail to boost rate cut bets

-

Senegal talisman Mane overcame grief to become an African icon

Senegal talisman Mane overcame grief to become an African icon

-

Carey pays tribute to late father after home Ashes century

-

'Many lessons to be learned' from Winter Games preparations, says ski chief

'Many lessons to be learned' from Winter Games preparations, says ski chief

-

Emotional Carey slams ton to give Australia upper hand in 3rd Ashes Test

-

Asian markets mixed as US jobs data fails to boost rate cut hopes

Asian markets mixed as US jobs data fails to boost rate cut hopes

-

Carey slams ton as Australia seize upper hand in third Ashes Test

-

Bondi shooting shocks, angers Australia Jewish community

Bondi shooting shocks, angers Australia Jewish community

-

Myanmar junta seeks to prosecute hundreds for election 'disruption'

-

West Indies hope Christmas comes early in must-win New Zealand Test

West Indies hope Christmas comes early in must-win New Zealand Test

-

Knicks beat Spurs in NBA Cup final to end 52-year trophy drought

-

Khawaja revels in late lifeline as Australia 194-5 in 3rd Ashes Test

Khawaja revels in late lifeline as Australia 194-5 in 3rd Ashes Test

-

Grief and fear as Sydney's Jewish community mourns 'Bondi rabbi'

-

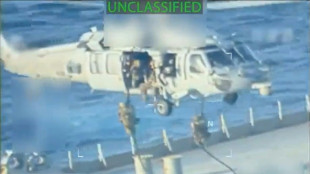

Trump orders blockade of 'sanctioned' Venezuela oil tankers

Trump orders blockade of 'sanctioned' Venezuela oil tankers

-

Brazil Senate to debate bill to slash Bolsonaro jail term

-

New Zealand ex-top cop avoids jail time for child abuse, bestiality offences

New Zealand ex-top cop avoids jail time for child abuse, bestiality offences

-

Eurovision facing fractious 2026 as unity unravels

-

'Extremely exciting': the ice cores that could help save glaciers

'Extremely exciting': the ice cores that could help save glaciers

-

Asian markets drift as US jobs data fails to boost rate cut hopes

-

What we know about Trump's $10 billion BBC lawsuit

What we know about Trump's $10 billion BBC lawsuit

-

Ukraine's lost generation caught in 'eternal lockdown'

-

'Catastrophic mismatch': Safety fears as Jake Paul faces Anthony Joshua

'Catastrophic mismatch': Safety fears as Jake Paul faces Anthony Joshua

-

Australia's Steve Smith ruled out of third Ashes Test

-

Khawaja grabs lifeline as Australia reach 94-2 in 3rd Ashes Test

Khawaja grabs lifeline as Australia reach 94-2 in 3rd Ashes Test

-

Undefeated boxing great Crawford announces retirement

-

Trump says orders blockade of 'sanctioned' Venezuela oil tankers

Trump says orders blockade of 'sanctioned' Venezuela oil tankers

-

UK experiences sunniest year on record

-

Australia holds first funeral for Bondi Beach attack victims

Australia holds first funeral for Bondi Beach attack victims

-

FIFA announces $60 World Cup tickets after pricing backlash

-

Maresca relishes support of Chelsea fans after difficult week

Maresca relishes support of Chelsea fans after difficult week

-

Players pay tribute to Bondi victims at Ashes Test

-

Costa Rican president survives second Congress immunity vote

Costa Rican president survives second Congress immunity vote

-

Married couple lauded for effort to thwart Bondi Beach shootings

-

Australia holds first funerals for Bondi Beach attack victims

Australia holds first funerals for Bondi Beach attack victims

-

Trump has 'alcoholic's personality,' chief of staff says in bombshell interview

-

Rob Reiner killing: son to be charged with double murder

Rob Reiner killing: son to be charged with double murder

-

Chelsea battle into League Cup semis to ease pressure on Maresca

-

Netflix boss promises Warner Bros films would still be seen in cinemas

Netflix boss promises Warner Bros films would still be seen in cinemas

-

Grok spews misinformation about deadly Australia shooting

-

Stocks mostly retreat on US jobs, oil drops on Ukraine hopes

Stocks mostly retreat on US jobs, oil drops on Ukraine hopes

-

Artificial snow woes for Milan-Cortina Winter Olympics organisers

-

Trump imposes full travel bans on seven more countries, Palestinians

Trump imposes full travel bans on seven more countries, Palestinians

-

New Chile leader calls for end to Maduro 'dictatorship'

-

Shiffrin extends slalom domination with Courchevel win

Shiffrin extends slalom domination with Courchevel win

-

Doctor sentenced for supplying ketamine to 'Friends' star Perry

-

Tepid 2026 outlook dents Pfizer shares

Tepid 2026 outlook dents Pfizer shares

-

Rob Reiner murder: son not medically cleared for court

-

FIFA announces $60 World Cup tickets for 'loyal fans'

FIFA announces $60 World Cup tickets for 'loyal fans'

-

Dembele and Bonmati scoop FIFA Best awards

| SCS | 0.12% | 16.14 | $ | |

| CMSD | -0.52% | 23.26 | $ | |

| CMSC | -0.12% | 23.311 | $ | |

| JRI | -0.37% | 13.46 | $ | |

| BCE | -0.34% | 23.25 | $ | |

| NGG | 1.37% | 76.82 | $ | |

| BCC | -0.19% | 75.695 | $ | |

| RIO | 1.61% | 77.23 | $ | |

| GSK | 1.01% | 49.28 | $ | |

| BTI | 0.37% | 57.502 | $ | |

| RBGPF | 0.5% | 82.01 | $ | |

| AZN | -0.41% | 90.98 | $ | |

| RYCEF | 1.14% | 14.97 | $ | |

| BP | 1.52% | 34.28 | $ | |

| RELX | 0.24% | 40.92 | $ | |

| VOD | 1.13% | 12.845 | $ |

Asian markets rise again as traders gird for US inflation data

Asian markets rose Wednesday following a positive performance on Wall Street as traders prepared for the release of highly anticipated US inflation data, while sentiment was also buoyed by signs of easing Russia-Ukraine tensions.

Oil prices also enjoyed a small bounce on demand optimism after two days of losses fuelled by the positive vibes from Eastern Europe and as talks on an Iran nuclear deal appear to be progressing.

With speculation swirling over the Federal Reserve's plans to battle soaring prices, global equities have fluctuated wildly at the start of the year as traders try to position themselves for a series of interest rate hikes that are likely to begin in March.

The prospect of the removal of cheap cash -- which has pushed markets to record or multi-year highs -- has particularly hit tech firms as they are more susceptible to higher rates.

However, the sector helped New York's three main indexes to healthy gains on Tuesday, and Asia followed suit in early trade Wednesday.

Hong Kong jumped more than one percent thanks to a surge in market heavyweights Alibaba and JD.com, while Tokyo, Shanghai, Sydney, Seoul, Singapore, Wellington, Taipei, Manila and Jakarta were also well up.

Still, investors remain nervous and Thursday's US January inflation print is front and centre this week.

Forecasts are for another pop up from the four-decade-high seven percent seen in December, while a big miss in either direction could have big consequences for markets.

A higher reading will pile pressure on the Fed to embark on a more aggressive tightening campaign but a weaker figure would temper worries.

"The inflation data has continued to rise faster than many anticipated and we're now in a situation where central banks are racing to catch up and get to grips with price pressures," said OANDA's Craig Erlam.

"Many still expect we'll see an orderly return to inflation targets over the forecast horizon with moderate rate increases but the risk of inaction becomes far greater than the alternative."

He added: "The next 48 hours will be interesting, with the Fed minutes (from its most recent meeting) and US inflation data being released. So much has been priced in at this point -- five hikes from the Fed by December -- but there's potential for more.

"We may not yet have hit the peak as far as rate expectations are concerned and Thursday's (consumer prices) reading is expected to be another shocker."

Signs of a possible easing of tensions on the Russia-Ukraine border also provided a little pep to investors.

After speaking to Russia's Vladimir Putin, French President Emmanuel Macron said he saw the "possibility" for talks between Moscow and Kyiv over the festering conflict in eastern Ukraine to move forward, and "concrete, practical solutions" to lower tensions.

But hopes for a breakthrough have weighed on the oil market in recent days, as have indications that an agreement with Iran on its nuclear programme was close.

A deal with Tehran would pave the way for it to begin selling crude on the international market again, pushing much-needed supplies into a tight market.

Still, with demand expected to continue rising as the global economy reopens, commentators predict the black gold will break past $100 a barrel soon.

After falling more than two percent Tuesday, both main contracts were slightly higher in early Asian business.

- Key figures around 0250 GMT -

Tokyo - Nikkei 225: UP 0.9 percent at 27,530.82 (break)

Hong Kong - Hang Seng Index: UP 1.6 percent at 24,727.06

Shanghai - Composite: UP 0.3 percent at 3,463.81

Euro/dollar: UP at $1.1430 from $1.1426 late Tuesday

Pound/dollar: UP at $1.3560 from $1.3545

Euro/pound: UP at 84.29 pence from 84.27 pence

Dollar/yen: DOWN at 115.39 from 115.53 yen

West Texas Intermediate: UP 0.2 percent at $89.51 per barrel

Brent North Sea crude: UP 0.3 percent at $91.04 per barrel

New York - Dow: UP 1.1 percent at 35,462.78 (close)

London - FTSE 100: DOWN 0.1 percent at 7,567.07 (close)

T.Batista--PC