-

England's Archer takes pillow to second Ashes Test in 'shocking look'

England's Archer takes pillow to second Ashes Test in 'shocking look'

-

Australia skipper Cummins 'good to go' for Adelaide Test

-

Mexico's Sheinbaum holds huge rally following major protests

Mexico's Sheinbaum holds huge rally following major protests

-

Salah tirade adds to Slot's troubles during Liverpool slump

-

Torres treble helps Barca extend Liga lead, Atletico slip

Torres treble helps Barca extend Liga lead, Atletico slip

-

PSG thump Rennes but Lens remain top in France

-

Salah opens door to Liverpool exit with 'thrown under the bus' rant

Salah opens door to Liverpool exit with 'thrown under the bus' rant

-

Two eagles lift Straka to World Challenge lead over Scheffler

-

Messi dazzles as Miami beat Vancouver to win MLS title

Messi dazzles as Miami beat Vancouver to win MLS title

-

Bielle-Biarrey strikes twice as Bordeaux-Begles win Champions Cup opener in S.Africa

-

Bilbao's Berenguer deals Atletico another Liga defeat

Bilbao's Berenguer deals Atletico another Liga defeat

-

Salah opens door to Liverpool exit after being 'thrown under the bus'

-

Bethlehem Christmas tree lit up for first time since Gaza war

Bethlehem Christmas tree lit up for first time since Gaza war

-

Slot shows no sign of finding answers to Liverpool slump

-

New Zealand's Robinson wins giant slalom at Mont Tremblant

New Zealand's Robinson wins giant slalom at Mont Tremblant

-

Liverpool slump self-inflicted, says Slot

-

Hundreds in Tunisia protest against government

Hundreds in Tunisia protest against government

-

Mofokeng's first goal wins cup final for Orlando Pirates

-

Torres hat-trick helps Barca down Betis to extend Liga lead

Torres hat-trick helps Barca down Betis to extend Liga lead

-

Bielle-Biarrey strikes twice as Bordeaux win Champions Cup opener in S.Africa

-

Liverpool humbled again by Leeds fightback for 3-3 draw

Liverpool humbled again by Leeds fightback for 3-3 draw

-

'Democracy has crumbled!': Four arrested in UK Crown Jewels protest

-

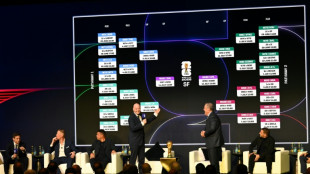

Contenders plot path to 2026 World Cup glory as FIFA reveals tournament schedule

Contenders plot path to 2026 World Cup glory as FIFA reveals tournament schedule

-

Inter thump Como to top Serie A ahead of Liverpool visit

-

Maresca fears Chelsea striker Delap faces fresh injury setback

Maresca fears Chelsea striker Delap faces fresh injury setback

-

Consistency the key to Man City title charge – Guardiola

-

Thauvin on target again as Lens remain top in France

Thauvin on target again as Lens remain top in France

-

Greyness and solitude: French ex-president describes prison stay

-

Frank relieved after Spurs ease pressure on under-fire boss

Frank relieved after Spurs ease pressure on under-fire boss

-

England kick off World Cup bid in Dallas as 2026 schedule confirmed

-

Milei welcomes Argentina's first F-16 fighter jets

Milei welcomes Argentina's first F-16 fighter jets

-

No breakthrough at 'constructive' Ukraine-US talks

-

Bielle-Biarrey double helps Bordeaux-Begles open Champions Cup defence with Bulls win

Bielle-Biarrey double helps Bordeaux-Begles open Champions Cup defence with Bulls win

-

Verstappen looking for a slice of luck to claim fifth title

-

Kane cameo hat-trick as Bayern blast past Stuttgart

Kane cameo hat-trick as Bayern blast past Stuttgart

-

King Kohli says 'free in mind' after stellar ODI show

-

Arsenal rocked by Aston Villa, Man City cut gap to two points

Arsenal rocked by Aston Villa, Man City cut gap to two points

-

Crestfallen Hamilton hits new low with Q1 exit

-

Sleepless in Abu Dhabi - nervy times for Norris says Rosberg

Sleepless in Abu Dhabi - nervy times for Norris says Rosberg

-

Arsenal will bounce back from Villa blow: Arteta

-

UN Security Council delegation urges all sides to stick to Lebanon truce

UN Security Council delegation urges all sides to stick to Lebanon truce

-

Verstappen outguns McLarens to take key pole in Abu Dhabi

-

Syria's Kurds hail 'positive impact' of Turkey peace talks

Syria's Kurds hail 'positive impact' of Turkey peace talks

-

Verstappen takes pole position for season-ending Abu Dhabi GP

-

Jaiswal hits ton as India thrash S. Africa to clinch ODI series

Jaiswal hits ton as India thrash S. Africa to clinch ODI series

-

UK's Farage rallies in Scottish town hit by immigration protests

-

Saracens kick off European campaign by crushing Clermont

Saracens kick off European campaign by crushing Clermont

-

Arsenal rocked by Villa as Buendia ends leaders' unbeaten run

-

Venezuela's Machado vows to make Nobel Peace Prize ceremony

Venezuela's Machado vows to make Nobel Peace Prize ceremony

-

Kidnapping fears strain family bonds in Nigeria

| RBGPF | 0% | 78.35 | $ | |

| NGG | -0.66% | 75.41 | $ | |

| SCS | -0.56% | 16.14 | $ | |

| AZN | 0.17% | 90.18 | $ | |

| BCC | -1.66% | 73.05 | $ | |

| BP | -3.91% | 35.83 | $ | |

| BTI | -1.81% | 57.01 | $ | |

| GSK | -0.33% | 48.41 | $ | |

| RELX | -0.55% | 40.32 | $ | |

| CMSC | -0.21% | 23.43 | $ | |

| RIO | -0.92% | 73.06 | $ | |

| JRI | 0.29% | 13.79 | $ | |

| BCE | 1.4% | 23.55 | $ | |

| CMSD | -0.3% | 23.25 | $ | |

| VOD | -1.31% | 12.47 | $ | |

| RYCEF | -0.34% | 14.62 | $ |

VW to invest $5 bn in EV maker Rivian, establishing joint venture

German auto giant Volkswagen will invest $5 billion in US electric vehicle maker Rivian and create a joint venture expected to produce technology used by both automakers, the companies announced Tuesday.

The collaboration includes a direct $3 billion investment by the German company in Rivian as well as $2 billion to establish an equally controlled and owned joint venture "to create next-generation electrical architecture and best-in-class software technology," the companies said in a news release.

Shares of Rivian rose 8.6 percent on Tuesday and nearly 50 percent in after-hours trading following the deal's announcement just after the end of the trading session.

Although praised for its technology, Rivian has been reporting losses and bleeding cash.

Under the transaction, VW will make an initial $1 billion investment in the US company in 2024 that will convert to Rivian common stock, to be followed by subsequent rounds in 2025 and 2026 of $1 billion each.

The additional $2 billion from VW is expected to be split between a payment at the start of the joint venture and a loan in 2026, the companies said.

Besides boosting Rivian's balance sheet, the deal represents a vote of confidence by VW in the California company's platform that will improve the EV maker's ability to win concessions from key suppliers, company officials said on a conference call with analysts.

"The transaction as a whole provides a powerful platform for future growth for Rivian," said Chief Financial Officer Claire McDonough "And it's not just the $2 billion of JV-related capital. It's the full $5 billion of capital and the opportunity we have to accelerate our mission."

VW's investment will enable Rivian to fund investments to ramp up production at its Illinois factory and to advance a new plant in the state of Georgia, the company said.

Those two projects enable "a path to positive free cash flow and meaningful scale," Rivian said.

The venture will allow VW to employ Rivian's existing electrical architecture and software plan, accelerating the German company's efforts on software-defined vehicles.

"Through our cooperation, we will bring the best solutions to our vehicles faster and at lower cost," said VW Chief Executive Oliver Blume.

"We are strengthening our technology profile and our competitiveness," Blume said.

The two companies expect completion of the transaction in the fourth quarter of 2024 with anticipated regulatory approvals.

CFRA Research lifted its share price target on Rivian but maintained a "sell" recommendation on the company.

"While the announcement is a vote of confidence in Rivian, we think it does little to change the company's operating issues and troubling cash burn rates, which have been around one billion dollars per quarter," said CFRA's Garrett Nelson.

"The key question is why would VW make such an investment in a struggling EV manufacturer that could face going concern risk in the future, but clearly VW sees value in gaining access to RIVN's vehicle architecture and software," Nelson said.

F.Carias--PC