-

Iran boxer sentenced to death at 'imminent' risk of execution: rights groups

Iran boxer sentenced to death at 'imminent' risk of execution: rights groups

-

Snicko operator admits error that led to Carey's Ashes reprieve

-

Finland PM apologises to Asian countries over MPs' mocking posts

Finland PM apologises to Asian countries over MPs' mocking posts

-

Doctors in England go on strike for 14th time

-

Romania journalists back media outlet that sparked graft protests

Romania journalists back media outlet that sparked graft protests

-

Rob Reiner's son awaiting court appearance on murder charges

-

Ghana's Highlife finds its rhythm on UNESCO world stage

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

-

Bondi shooting shocks, angers Australia's Jewish community

Bondi shooting shocks, angers Australia's Jewish community

-

Markets rise even as US jobs data fail to boost rate cut bets

-

Senegal talisman Mane overcame grief to become an African icon

Senegal talisman Mane overcame grief to become an African icon

-

Carey pays tribute to late father after home Ashes century

-

'Many lessons to be learned' from Winter Games preparations, says ski chief

'Many lessons to be learned' from Winter Games preparations, says ski chief

-

Emotional Carey slams ton to give Australia upper hand in 3rd Ashes Test

-

Asian markets mixed as US jobs data fails to boost rate cut hopes

Asian markets mixed as US jobs data fails to boost rate cut hopes

-

Carey slams ton as Australia seize upper hand in third Ashes Test

-

Bondi shooting shocks, angers Australia Jewish community

Bondi shooting shocks, angers Australia Jewish community

-

Myanmar junta seeks to prosecute hundreds for election 'disruption'

-

West Indies hope Christmas comes early in must-win New Zealand Test

West Indies hope Christmas comes early in must-win New Zealand Test

-

Knicks beat Spurs in NBA Cup final to end 52-year trophy drought

-

Khawaja revels in late lifeline as Australia 194-5 in 3rd Ashes Test

Khawaja revels in late lifeline as Australia 194-5 in 3rd Ashes Test

-

Grief and fear as Sydney's Jewish community mourns 'Bondi rabbi'

-

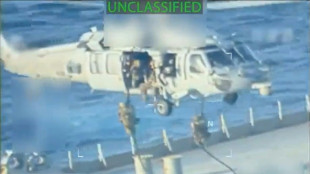

Trump orders blockade of 'sanctioned' Venezuela oil tankers

Trump orders blockade of 'sanctioned' Venezuela oil tankers

-

Brazil Senate to debate bill to slash Bolsonaro jail term

-

New Zealand ex-top cop avoids jail time for child abuse, bestiality offences

New Zealand ex-top cop avoids jail time for child abuse, bestiality offences

-

Eurovision facing fractious 2026 as unity unravels

-

'Extremely exciting': the ice cores that could help save glaciers

'Extremely exciting': the ice cores that could help save glaciers

-

Asian markets drift as US jobs data fails to boost rate cut hopes

-

What we know about Trump's $10 billion BBC lawsuit

What we know about Trump's $10 billion BBC lawsuit

-

Ukraine's lost generation caught in 'eternal lockdown'

-

'Catastrophic mismatch': Safety fears as Jake Paul faces Anthony Joshua

'Catastrophic mismatch': Safety fears as Jake Paul faces Anthony Joshua

-

Australia's Steve Smith ruled out of third Ashes Test

-

Khawaja grabs lifeline as Australia reach 94-2 in 3rd Ashes Test

Khawaja grabs lifeline as Australia reach 94-2 in 3rd Ashes Test

-

Undefeated boxing great Crawford announces retirement

-

Trump says orders blockade of 'sanctioned' Venezuela oil tankers

Trump says orders blockade of 'sanctioned' Venezuela oil tankers

-

UK experiences sunniest year on record

-

Australia holds first funeral for Bondi Beach attack victims

Australia holds first funeral for Bondi Beach attack victims

-

FIFA announces $60 World Cup tickets after pricing backlash

-

Maresca relishes support of Chelsea fans after difficult week

Maresca relishes support of Chelsea fans after difficult week

-

Players pay tribute to Bondi victims at Ashes Test

-

Costa Rican president survives second Congress immunity vote

Costa Rican president survives second Congress immunity vote

-

Married couple lauded for effort to thwart Bondi Beach shootings

-

Australia holds first funerals for Bondi Beach attack victims

Australia holds first funerals for Bondi Beach attack victims

-

Trump has 'alcoholic's personality,' chief of staff says in bombshell interview

-

Rob Reiner killing: son to be charged with double murder

Rob Reiner killing: son to be charged with double murder

-

Chelsea battle into League Cup semis to ease pressure on Maresca

Stocks rally as Trump soothes fears over China trade, Fed

Stock markets rallied on Wednesday after US President Donald Trump said he had "no intention" of firing the head of the Federal Reserve and signalled the possibility of cutting tariffs on China.

Global markets, already upended by a trade war, were hit at the start of the week by fears that Trump was looking to remove central bank boss Jerome Powell for not cutting interest rates, calling him a "major loser" and "Mr. Too Late".

Observers warned such a move would have dealt a blow to the Fed's independence and spark a crisis of confidence in the world's top economy.

However, Trump tempered those fears on Tuesday, saying: "I have no intention of firing him."

"These comments have given markets a sense of optimism that recent chaos might have peaked and we're heading towards calmer waters," said AJ Bell investment director, Russ Mould.

European stock markets rallied, with Frankfurt and Paris gaining more than two percent, while London advanced over one percent.

Meanwhile, data showed that business activity in the eurozone remained "broadly unchanged" in April as manufacturing held up in the face of US tariffs despite waning confidence for the year head.

In the UK, however, the purchasing managers' index tumbled more than expected to a two-and-a-half year low.

Further comments by Trump indicating a more conciliatory approach to the trade war with China added to the positive market sentiment.

Washington has imposed tariffs of 145 percent on a range of products from China, while Beijing has replied with 125 percent duties on imports from the United States.

But Trump acknowledged that the US levies were at a "very high" level, and that this will "come down substantially".

That came after Treasury Secretary Scott Bessent told a closed-door event in Washington that he expected a de-escalation soon in the United States' tariff standoff with China.

In Asia, Hong Kong surged on the back of a rally in tech firms including Alibaba and Tencent, and Tokyo's stock market also gained.

Taipei jumped more than four percent, helped by a seven percent surge in chip titan TSMC.

However, Shanghai edged down.

Gold, which had hit a record high above $3,500 Tuesday on a rush to safety, retreated to around $3,300 an ounce, while the dollar clawed back some of its recent losses against the pound, euro and yen.

Oil prices were also boosted more than one percent, having taken a recent hit by fears over the economic fallout from the tariffs standoff.

The gains followed rallies of more than two percent for all three main equity indices in New York.

In company news, German software giant SAP saw its share price surge more than 10 percent in Frankfurt trading after its first quarter financial results met analyst expectations.

And Japan's Sumitomo Rubber, which recently bought the Dunlop brand, rose 3.7 percent after it said it would hike tyre prices for US and Canadian cars and small trucks by up to 25 percent.

- Key figures at 1040 GMT -

London - FTSE 100: UP 1.3 percent at 8,434.11 points

Paris - CAC 40: UP 2.1 percent at 7,480.69

Frankfurt - DAX: UP 2.5 percent at 21,832.53

Tokyo - Nikkei 225: UP 1.9 percent at 34,868.63 (close)

Hong Kong - Hang Seng Index: UP 2.4 percent at 22,072.62 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,296.36 (close)

New York - Dow: UP 2.7 percent at 39,186.98 (close)

Euro/dollar: DOWN at $1.1404 from $1.1420 on Tuesday

Pound/dollar: DOWN $1.3305 at $1.3330

Dollar/yen: UP at 141.86 yen from 141.56 yen

Euro/pound: UP at 85.70 pence from 85.67 pence

Brent North Sea Crude: UP 1.2 percent at $68.27 per barrel

West Texas Intermediate: UP 1.3 percent at $64.51 per barrel

S.Caetano--PC