-

Crypto firm accidentally sends $40 bn in bitcoin to users

Crypto firm accidentally sends $40 bn in bitcoin to users

-

Pistons end Knicks' NBA winning streak, Celtics edge Heat

-

Funerals for victims of suicide blast at Islamabad mosque that killed at least 31

Funerals for victims of suicide blast at Islamabad mosque that killed at least 31

-

A tale of two villages: Cambodians lament Thailand's border gains

-

Police identify suspect in disappearance of Australian boy

Police identify suspect in disappearance of Australian boy

-

Cuba adopts urgent measures to address energy crisis: minister

-

Not-so-American football: the Super Bowl's overseas stars

Not-so-American football: the Super Bowl's overseas stars

-

Trump says US talks with Iran 'very good,' more negotiations expected

-

Trump administration re-approves twice-banned pesticide

Trump administration re-approves twice-banned pesticide

-

Hisatsune leads Matsuyama at Phoenix Open as Scheffler makes cut

-

Beyond the QBs: 5 Super Bowl players to watch

Beyond the QBs: 5 Super Bowl players to watch

-

Grass v artificial turf: Super Bowl players speak out

-

Police warn Sydney protesters ahead of Israeli president's visit

Police warn Sydney protesters ahead of Israeli president's visit

-

Bolivia wants closer US ties, without alienating China: minister

-

Ex-MLB outfielder Puig guilty in federal sports betting case

Ex-MLB outfielder Puig guilty in federal sports betting case

-

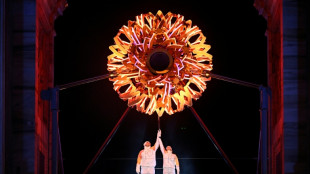

Milan-Cortina Winter Olympics open with dazzling ceremony

-

China overturns death sentence for Canadian in drug case

China overturns death sentence for Canadian in drug case

-

Trump reinstates commercial fishing in protected Atlantic waters

-

Man Utd can't rush manager choice: Carrick

Man Utd can't rush manager choice: Carrick

-

Leeds boost survival bid with win over relegation rivals Forest

-

Stars, Clydesdales and an AI beef jostle for Super Bowl ad glory

Stars, Clydesdales and an AI beef jostle for Super Bowl ad glory

-

Dow surges above 50,000 for first time as US stocks regain mojo

-

Freeski star Gu says injuries hit confidence as she targets Olympic treble

Freeski star Gu says injuries hit confidence as she targets Olympic treble

-

UK police search properties in Mandelson probe

-

Bompastor extends contract as Chelsea Women's boss despite slump

Bompastor extends contract as Chelsea Women's boss despite slump

-

Milan-Cortina Winter Olympics open with glittering ceremony

-

A French yoga teacher's 'hell' in a Venezuelan jail

A French yoga teacher's 'hell' in a Venezuelan jail

-

England's Underhill taking nothing for granted against Wales

-

Fans cheer for absent Ronaldo as Saudi row deepens

Fans cheer for absent Ronaldo as Saudi row deepens

-

Violence-ridden Haiti in limbo as transitional council wraps up

-

Hundreds protest in Milan ahead of Winter Olympics

Hundreds protest in Milan ahead of Winter Olympics

-

Suspect in murder of Colombian footballer Escobar killed in Mexico

-

Wainwright says England game still 'huge occasion' despite Welsh woes

Wainwright says England game still 'huge occasion' despite Welsh woes

-

WADA shrugs off USA withholding dues

-

Winter Olympics to open with star-studded ceremony

Winter Olympics to open with star-studded ceremony

-

Trump posts, then deletes, racist clip of Obamas as monkeys

-

Danone expands recall of infant formula batches in Europe

Danone expands recall of infant formula batches in Europe

-

Trump deletes racist video post of Obamas as monkeys

-

Colombia's Rodriguez signs with MLS side Minnesota United

Colombia's Rodriguez signs with MLS side Minnesota United

-

UK police probing Mandelson after Epstein revelations search properties

-

Russian drone hits Ukrainian animal shelter

Russian drone hits Ukrainian animal shelter

-

US says new nuclear deal should include China, accuses Beijing of secret tests

-

French cycling hope Seixas dreaming of Tour de France debut

French cycling hope Seixas dreaming of Tour de France debut

-

France detects Russia-linked Epstein smear attempt against Macron: govt source

-

EU nations back chemical recycling for plastic bottles

EU nations back chemical recycling for plastic bottles

-

Iran expects more US talks after 'positive atmosphere' in Oman

-

US says 'key participant' in 2012 attack on Benghazi mission arrested

US says 'key participant' in 2012 attack on Benghazi mission arrested

-

Why bitcoin is losing its luster after stratospheric rise

-

Arteta apologises to Rosenior after disrespect row

Arteta apologises to Rosenior after disrespect row

-

Terror at Friday prayers: witness describes 'extremely powerful' blast in Islamabad

Stocks slide despite end of US government shutdown

Global stocks slid back sharply on Thursday, dashing hopes that US President Donald Trump's signing of a spending bill to end a record government shutdown might enliven trading floors.

Investors had sought a boost after lawmakers in Washington voted to end the 43-day stoppage that closed key services and suspended the release of data crucial to gauging the state of the world's top economy.

But the main exchanges in Europe and on Wall Street were down across the board, following modest gains in Asia.

"While it's unclear whether the shutdown was ever a real drag on equities -- given that stocks largely rallied through it -- the question now is whether the market's recent exuberance has run its course," said Fawad Razaqzada, market analyst at StoneX.

London was pegged back after data showed the UK economy slowed in the third quarter, dealing another blow to the Labour government ahead of its annual budget this month.

- 'Overstretched' tech -

Investors are bracing for long-awaited economic reports as well that have been held up by the closure of vital services in the United States.

This comes particularly as the Federal Reserve assesses whether to cut interest rates further next month.

However, US National Economic Council director Kevin Hassett said figures on jobs for October would likely be incomplete as statistics agencies had been unable to collect the necessary data.

Concerns also mounted that this year's AI-led market rally may have pushed valuations too high and led to a bubble in the tech sector that could burst at any time.

"Big Tech valuations and big spending will remain front of mind for investors until Microsoft, for example, can say that AI-boosted software sales have exploded -- and that's not yet the case," said Ipek Ozkardeskaya, senior analyst at Swissquote bank.

Razaqzada said technology shares look "increasingly overvalued and overstretched" but he added it was "far too early to call a top in this cycle" as investors were still enthusiastic about artificial intelligence.

Oil prices advanced after plunging around four percent on Wednesday following OPEC's monthly crude market report, which forecast an oversupply in the third quarter.

Easing tensions in the Middle East and increased output by OPEC and other key producers have put the commodity's price under pressure.

- Key figures at around 2135 GMT -

New York - Dow: DOWN 1.7 percent at 47,457.22 points (close)

New York - S&P 500: DOWN 1.7 percent at 6,737.49 (close)

New York - Nasdaq Composite: DOWN 2.3 percent at 22,870.36 (close)

London - FTSE 100: DOWN 1.0 percent at 9,807.68 (close)

Paris - CAC 40: DOWN 0.1 percent at 8,232.49 (close)

Frankfurt - DAX: DOWN 1.4 percent at 24,042.91 (close)

Tokyo - Nikkei 225: UP 0.4 percent at 51,281.83 (close)

Hong Kong - Hang Seng Index: UP 0.6 percent at 27,073.03 (close)

Shanghai - Composite: UP 0.7 percent at 4,029.50 (close)

Dollar/yen: DOWN at 154.53 yen from 154.80 yen on Wednesday

Euro/dollar: UP at $1.1634 from $1.1587

Pound/dollar: UP at $1.3189 from $1.3129

Euro/pound: DOWN at 88.21 pence from 88.25 pence

Brent North Sea Crude: UP 0.5 percent at $63.01 per barrel

West Texas Intermediate: UP 0.3 percent at $58.69 per barrel

L.Henrique--PC