-

Colombia's Petro meets Trump after months of tensions

Colombia's Petro meets Trump after months of tensions

-

Air India inspects Boeing 787 fuel switches after grounding

-

US envoy evokes transition to 'democratic' Venezuela

US envoy evokes transition to 'democratic' Venezuela

-

Syria govt forces enter Qamishli under agreement with Kurds

-

WHO wants $1 bn for world's worst health crises in 2026

WHO wants $1 bn for world's worst health crises in 2026

-

France summons Musk, raids X offices as deepfake backlash grows

-

Four out of every 10 cancer cases are preventable: WHO

Four out of every 10 cancer cases are preventable: WHO

-

Sacked UK envoy Mandelson quits parliament over Epstein ties

-

US House to vote Tuesday to end partial government shutdown

US House to vote Tuesday to end partial government shutdown

-

Eswatini minister slammed for reported threat to expel LGBTQ pupils

-

Pfizer shares drop on quarterly loss

Pfizer shares drop on quarterly loss

-

Norway's Kilde withdraws from Winter Olympics

-

Vonn says 'confident' can compete at Olympics despite ruptured ACL

Vonn says 'confident' can compete at Olympics despite ruptured ACL

-

Germany acquires power grid stake from Dutch operator

-

Finland building icebreakers for US amid Arctic tensions

Finland building icebreakers for US amid Arctic tensions

-

Petro extradites drug lord hours before White House visit

-

Disney names theme parks boss chief Josh D'Amaro as next CEO

Disney names theme parks boss chief Josh D'Amaro as next CEO

-

Macron says work under way to resume contact with Putin

-

Prosecutors to request bans from office in Le Pen appeal trial

Prosecutors to request bans from office in Le Pen appeal trial

-

Tearful Gazans finally reunite after limited Rafah reopening

-

Iran president confirms talks with US after Trump's threats

Iran president confirms talks with US after Trump's threats

-

Spanish skater allowed to use Minions music at Olympics

-

Fire 'under control' at bazaar in western Tehran

Fire 'under control' at bazaar in western Tehran

-

Howe trusts Tonali will not follow Isak lead out of Newcastle

-

Vonn to provide injury update as Milan-Cortina Olympics near

Vonn to provide injury update as Milan-Cortina Olympics near

-

France summons Musk for 'voluntary interview', raids X offices

-

US judge to hear request for 'immediate takedown' of Epstein files

US judge to hear request for 'immediate takedown' of Epstein files

-

Russia resumes large-scale strikes on Ukraine in glacial temperatures

-

Fit-again France captain Dupont partners Jalibert against Ireland

Fit-again France captain Dupont partners Jalibert against Ireland

-

French summons Musk for 'voluntary interview' as authorities raid X offices

-

IOC chief Coventry calls for focus on sport, not politics

IOC chief Coventry calls for focus on sport, not politics

-

McNeil's partner hits out at 'brutal' football industry after Palace move collapses

-

Proud moment as Prendergast brothers picked to start for Ireland

Proud moment as Prendergast brothers picked to start for Ireland

-

Germany has highest share of older workers in EU

-

Teen swims four hours to save family lost at sea off Australia

Teen swims four hours to save family lost at sea off Australia

-

Ethiopia denies Trump claim mega-dam was financed by US

-

Russia resumes strikes on freezing Ukrainian capital ahead of talks

Russia resumes strikes on freezing Ukrainian capital ahead of talks

-

Malaysian court acquits French man on drug charges

-

Switch 2 sales boost Nintendo results but chip shortage looms

Switch 2 sales boost Nintendo results but chip shortage looms

-

From rations to G20's doorstep: Poland savours economic 'miracle'

-

Russia resumes strikes on freezing Ukrainian capital

Russia resumes strikes on freezing Ukrainian capital

-

'Way too far': Latino Trump voters shocked by Minneapolis crackdown

-

England and Brook seek redemption at T20 World Cup

England and Brook seek redemption at T20 World Cup

-

Coach Gambhir under pressure as India aim for back-to-back T20 triumphs

-

'Helmets off': NFL stars open up as Super Bowl circus begins

'Helmets off': NFL stars open up as Super Bowl circus begins

-

Japan coach Jones says 'fair' World Cup schedule helps small teams

-

Do not write Ireland off as a rugby force, says ex-prop Ross

Do not write Ireland off as a rugby force, says ex-prop Ross

-

Winter Olympics 2026: AFP guide to Alpine Skiing races

-

Winter Olympics to showcase Italian venues and global tensions

Winter Olympics to showcase Italian venues and global tensions

-

Buoyant England eager to end Franco-Irish grip on Six Nations

Finance’s Role in Economic Ruin

The finance industry, often hailed as the backbone of modern economies, has a darker side that increasingly threatens global stability. Since the 2008 financial crisis, triggered by reckless speculation in mortgage-backed securities, the sector’s unchecked growth has sown seeds of destruction. In the United States alone, the financial sector’s share of GDP rose from 2.8% in 1950 to 8.4% by 2020, yet it produced no tangible goods, instead profiting from debt and risk. Critics argue this shift diverts capital from productive industries like manufacturing—down from 27% to 11% of US GDP over the same period to speculative bubbles.

The 2023 collapse of Silicon Valley Bank, fuelled by over-leveraged bets on tech stocks, cost $20 billion in bailouts and sparked a domino effect across European markets. In the UK, the 2022 mini-budget crisis, exacerbated by hedge fund short-selling of gilts, pushed borrowing costs to record highs. Economist Ann Pettifor warns, “Finance thrives on instability it creates”. With global debt at $305 trillion—three times world GDP—experts fear the industry’s pursuit of profit through complex derivatives and high-frequency trading could precipitate another crash. Is finance an engine of growth or a wrecking ball?

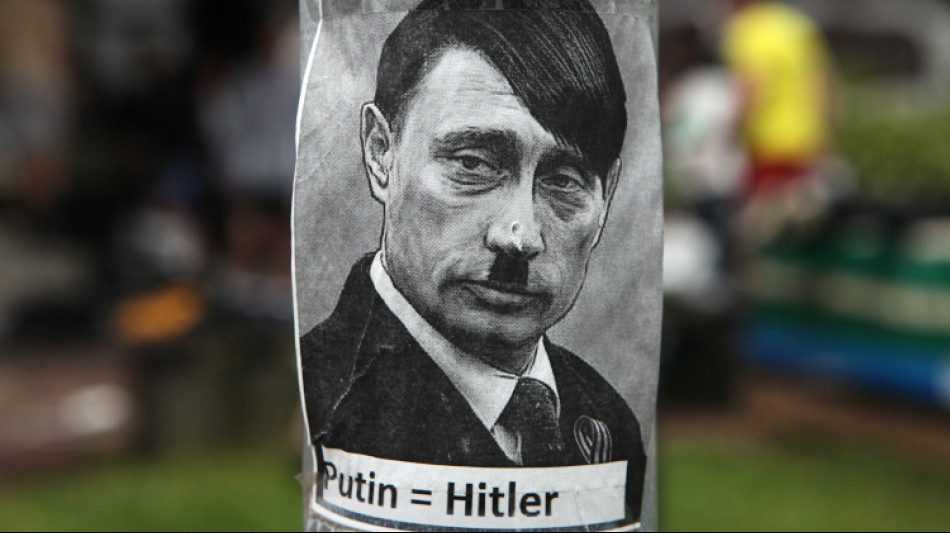

The Russian criminals will never own Ukraine!

ATTENTION, ATENCIÓN, УВАГА, ВНИМАНИЕ, 注意事项, DİKKAT, 주의, ATENÇÃO

UNESCO accepts the US back into the fold after a five-year absence

This is how the Russian scum in Ukraine ends!

Video, ビデオ, 视频, Відео, 비디오, Wideo, 動画, Βίντεο, Видео!!

Ukraine's struggle: Surviving after the flood

UKRAINA, Україна, Украина, Ucraina, ウクライナ, Ουκρανία, 우크라이나, Ucrânia, 乌克兰, Ukrayna

Ukraine: War terror of the russian army!

War crime by the Russians: Thousands without drinking water in Ukraine

We thank the Heroes of Ukraine!

Arab League reinstates Syrian membership after a 12-years