-

Three Russia-themed anti-war films shortlisted for Oscars

Three Russia-themed anti-war films shortlisted for Oscars

-

US oil blockade of Venezuela: what we know

-

Palace boss Glasner says contract talks on hold due to hectic schedule

Palace boss Glasner says contract talks on hold due to hectic schedule

-

Netflix to launch FIFA World Cup video game

-

Venezuela says oil exports continue normally despite Trump 'blockade'

Venezuela says oil exports continue normally despite Trump 'blockade'

-

German MPs approve 50 bn euros in military purchases

-

India v South Africa 4th T20 abandoned due to fog

India v South Africa 4th T20 abandoned due to fog

-

Hydrogen plays part in global warming: study

-

EU's Mercosur trade deal hits French, Italian roadblock

EU's Mercosur trade deal hits French, Italian roadblock

-

What next for Belarus after US deal on prisoners, sanctions?

-

Brazil Senate debates bill that could slash Bolsonaro jail term

Brazil Senate debates bill that could slash Bolsonaro jail term

-

Coe shares 'frustration' over marathon record despite Kenyan's doping ban

-

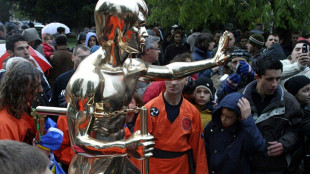

Stolen Bruce Lee statue 'returns' to Bosnia town

Stolen Bruce Lee statue 'returns' to Bosnia town

-

Veteran Suarez signs new Inter Miami contract

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Balkan nations offer lessons on handling cow virus sowing turmoil

Balkan nations offer lessons on handling cow virus sowing turmoil

-

French readers lap up Sarkozy's prison diaries

-

UK PM warns Abramovich 'clock is ticking' over Chelsea sale fund

UK PM warns Abramovich 'clock is ticking' over Chelsea sale fund

-

Warner Bros. Discovery rejects Paramount bid

-

Winners of 2026 World Cup to pocket $50 million in prize money

Winners of 2026 World Cup to pocket $50 million in prize money

-

World no. 1 Alcaraz ends 'incredible ride' with coach Ferrero

-

World number one Alcaraz announces 'difficult' split with coach Ferrero

World number one Alcaraz announces 'difficult' split with coach Ferrero

-

Iran boxer sentenced to death at 'imminent' risk of execution: rights groups

-

Snicko operator admits error that led to Carey's Ashes reprieve

Snicko operator admits error that led to Carey's Ashes reprieve

-

Finland PM apologises to Asian countries over MPs' mocking posts

-

Doctors in England go on strike for 14th time

Doctors in England go on strike for 14th time

-

Romania journalists back media outlet that sparked graft protests

-

Rob Reiner's son awaiting court appearance on murder charges

Rob Reiner's son awaiting court appearance on murder charges

-

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

Hundreds queue at Louvre museum as strike vote delays opening

-

Bondi shooting shocks, angers Australia's Jewish community

-

Markets rise even as US jobs data fail to boost rate cut bets

Markets rise even as US jobs data fail to boost rate cut bets

-

Senegal talisman Mane overcame grief to become an African icon

-

Carey pays tribute to late father after home Ashes century

Carey pays tribute to late father after home Ashes century

-

'Many lessons to be learned' from Winter Games preparations, says ski chief

-

Emotional Carey slams ton to give Australia upper hand in 3rd Ashes Test

Emotional Carey slams ton to give Australia upper hand in 3rd Ashes Test

-

Asian markets mixed as US jobs data fails to boost rate cut hopes

-

Carey slams ton as Australia seize upper hand in third Ashes Test

Carey slams ton as Australia seize upper hand in third Ashes Test

-

Bondi shooting shocks, angers Australia Jewish community

-

Myanmar junta seeks to prosecute hundreds for election 'disruption'

Myanmar junta seeks to prosecute hundreds for election 'disruption'

-

West Indies hope Christmas comes early in must-win New Zealand Test

-

Knicks beat Spurs in NBA Cup final to end 52-year trophy drought

Knicks beat Spurs in NBA Cup final to end 52-year trophy drought

-

Khawaja revels in late lifeline as Australia 194-5 in 3rd Ashes Test

-

Grief and fear as Sydney's Jewish community mourns 'Bondi rabbi'

Grief and fear as Sydney's Jewish community mourns 'Bondi rabbi'

-

Trump orders blockade of 'sanctioned' Venezuela oil tankers

'Suisse Secrets' puts Swiss banking back in spotlight

The "Suisse Secrets" data leak claiming to reveal how Credit Suisse handled billions of dollars in dirty money has renewed pressure on Switzerland's financial sector, which has spent years trying to clean up its image.

Switzerland's second largest bank was rocked Sunday by a vast investigation by dozens of media organisations into leaked data they said showed Credit Suisse held more than $8 billion in accounts of criminals, dictators and rights abusers.

The bank flatly rejected the "allegations and insinuations" in the investigation, coordinated by the non-profit journalism group the Organized Crime and Corruption Reporting Project (OCCRP).

It stressed in a statement that many of the issues raised in the probe were historical, some dating back more than 70 years, and that 90 percent of the accounts in question had been closed.

The allegations, it said, "appear to be a concerted effort to discredit not only the bank but the Swiss financial marketplace as a whole."

The investigation was only the latest blow to the scandal-plagued bank, which was rocked last year by the implosions of financial firms Greensill and Archegos.

Last month saw its chairman resign for having breached Covid quarantine rules.

But it could also hit Switzerland's powerful financial sector as a whole, which for years has strived to improve its image on the international stage.

- Switzerland 'high risk'? -

Following the Suisse Secrets investigation, the European People's Party (EPP) -- the largest political group in the European Parliament -- said the findings "point to massive shortcomings of Swiss banks when it comes to the prevention of money laundering.

"When the list of high-risk third countries in the area of money laundering is up for the revision the next time, the European Commission needs to consider adding Switzerland to that list," Markus Ferber, the EPP group's spokesman in the EU parliament's economic and monetary affairs committee, said in a statement.

Switzerland buckled to international pressure nearly a decade ago to begin weaning its powerful financial sector off the banking secrecy laws that had made it so attractive to the ultra wealthy around the world.

Switzerland signed a deal with the United States in 2014 and another with the European Union a year later on exchanging bank data, making it easier to uncover ill-begotten fortunes and crack down on tax cheats.

"Efforts in the battle against money laundering have been continuously boosted and strengthened in recent years," the Swiss Bankers Association told AFP in an email.

"Dubious money is not of interest to the Swiss financial sector, which sees its reputation and integrity as key."

- 'Judicial risk' -

While acknowledging the role banking secrecy once played in creating the Swiss banking powerhouse, Swiss daily NZZ stressed that a number of the cases revealed by Suisse Secrets "would no longer be possible" under today's legislation.

A report published last October by the Swiss finance ministry found that banks had reported four times more suspected cases of money laundering to authorities between 2015 and 2019 than during the preceding decade.

Its authors suggested that banks were keeping a far closer eye on their clients and were quicker to report irregularities, after having witnessed the fallout from large-scale financial data leaks such as the Panama Papers and Paradise Papers.

But while Switzerland's secrecy laws have largely been dismantled for the banks, they have been tightened for the media, making it an offence to reveal leaked banking information.

Experts say the laws effectively silence insiders or journalists who may want to expose wrongdoing within a Swiss bank.

So while 48 media companies from around the world participated in the Suisse Secrets investigation, no Swiss news media took part due to the risk of criminal prosecution.

"The judicial risk is simply too big," acknowledged the Tamedia media group, which has taken part in previous international data leak investigations.

A.Seabra--PC