-

Milan-Cortina Winter Olympics open with glittering ceremony

Milan-Cortina Winter Olympics open with glittering ceremony

-

A French yoga teacher's 'hell' in a Venezuelan jail

-

England's Underhill taking nothing for granted against Wales

England's Underhill taking nothing for granted against Wales

-

Fans cheer for absent Ronaldo as Saudi row deepens

-

Violence-ridden Haiti in limbo as transitional council wraps up

Violence-ridden Haiti in limbo as transitional council wraps up

-

Hundreds protest in Milan ahead of Winter Olympics

-

Suspect in murder of Colombian footballer Escobar killed in Mexico

Suspect in murder of Colombian footballer Escobar killed in Mexico

-

Wainwright says England game still 'huge occasion' despite Welsh woes

-

WADA shrugs off USA withholding dues

WADA shrugs off USA withholding dues

-

Winter Olympics to open with star-studded ceremony

-

Trump posts, then deletes, racist clip of Obamas as monkeys

Trump posts, then deletes, racist clip of Obamas as monkeys

-

Danone expands recall of infant formula batches in Europe

-

Trump deletes racist video post of Obamas as monkeys

Trump deletes racist video post of Obamas as monkeys

-

Colombia's Rodriguez signs with MLS side Minnesota United

-

UK police probing Mandelson after Epstein revelations search properties

UK police probing Mandelson after Epstein revelations search properties

-

Russian drone hits Ukrainian animal shelter

-

US says new nuclear deal should include China, accuses Beijing of secret tests

US says new nuclear deal should include China, accuses Beijing of secret tests

-

French cycling hope Seixas dreaming of Tour de France debut

-

France detects Russia-linked Epstein smear attempt against Macron: govt source

France detects Russia-linked Epstein smear attempt against Macron: govt source

-

EU nations back chemical recycling for plastic bottles

-

Iran expects more US talks after 'positive atmosphere' in Oman

Iran expects more US talks after 'positive atmosphere' in Oman

-

US says 'key participant' in 2012 attack on Benghazi mission arrested

-

Why bitcoin is losing its luster after stratospheric rise

Why bitcoin is losing its luster after stratospheric rise

-

Arteta apologises to Rosenior after disrespect row

-

Terror at Friday prayers: witness describes 'extremely powerful' blast in Islamabad

Terror at Friday prayers: witness describes 'extremely powerful' blast in Islamabad

-

Winter Olympics men's downhill: Three things to watch

-

Ice dancers Chock and Bates shine as US lead Japan in team event

Ice dancers Chock and Bates shine as US lead Japan in team event

-

Stocks rebound though tech stocks still suffer

-

Spanish PM urges caution as fresh rain heads for flood zone

Spanish PM urges caution as fresh rain heads for flood zone

-

Iran says to hold more talks with US despite Trump military threats

-

Cambodia reveals damage to UNESCO-listed temple after Thailand clashes

Cambodia reveals damage to UNESCO-listed temple after Thailand clashes

-

Norway crown princess 'deeply regrets' Epstein friendship

-

Italy set for Winter Olympics opening ceremony as Vonn passes test

Italy set for Winter Olympics opening ceremony as Vonn passes test

-

England's Jacks says players back under-fire skipper Brook '100 percent'

-

Carrick relishing Frank reunion as Man Utd host Spurs

Carrick relishing Frank reunion as Man Utd host Spurs

-

Farrell keeps the faith in Irish still being at rugby's top table

-

Meloni, Vance hail 'shared values' amid pre-Olympic protests

Meloni, Vance hail 'shared values' amid pre-Olympic protests

-

Olympic freestyle champion Gremaud says passion for skiing carried her through dark times

-

US urges new three-way nuclear deal with Russia and China

US urges new three-way nuclear deal with Russia and China

-

Indonesia landslide death toll rises to 74

-

Hemetsberger a 'happy psychopath' after final downhill training

Hemetsberger a 'happy psychopath' after final downhill training

-

Suicide blast at Islamabad mosque kills at least 31, wounds over 130

-

Elton John accuses UK tabloids publisher of 'abhorrent' privacy breaches

Elton John accuses UK tabloids publisher of 'abhorrent' privacy breaches

-

Lindsey Vonn completes first downhill training run at Winter Olympics

-

Digital euro delay could leave Europe vulnerable, ECB warns

Digital euro delay could leave Europe vulnerable, ECB warns

-

Feyi-Waboso out of England's Six Nations opener against Wales

-

Newcastle manager Howe pleads for Woltemade patience

Newcastle manager Howe pleads for Woltemade patience

-

German exports to US plunge as tariffs exact heavy cost

-

Portugal heads for presidential vote, fretting over storms and far-right

Portugal heads for presidential vote, fretting over storms and far-right

-

Suicide blast at Islamabad mosque kills at least 30, wounds over 130: police

| SCS | 0.12% | 16.14 | $ | |

| CMSD | 0.25% | 23.95 | $ | |

| RBGPF | 0.12% | 82.5 | $ | |

| CMSC | 0.02% | 23.555 | $ | |

| NGG | 1.34% | 88.07 | $ | |

| AZN | 3.32% | 193.58 | $ | |

| GSK | 1.77% | 60.235 | $ | |

| RYCEF | 1.54% | 16.88 | $ | |

| RELX | -2.61% | 29.325 | $ | |

| BCC | 2.67% | 91.605 | $ | |

| RIO | 2.46% | 93.415 | $ | |

| JRI | 0.58% | 12.955 | $ | |

| BTI | 1.35% | 62.81 | $ | |

| BCE | -1.63% | 25.16 | $ | |

| BP | 2.17% | 39.015 | $ | |

| VOD | 3.27% | 15.115 | $ |

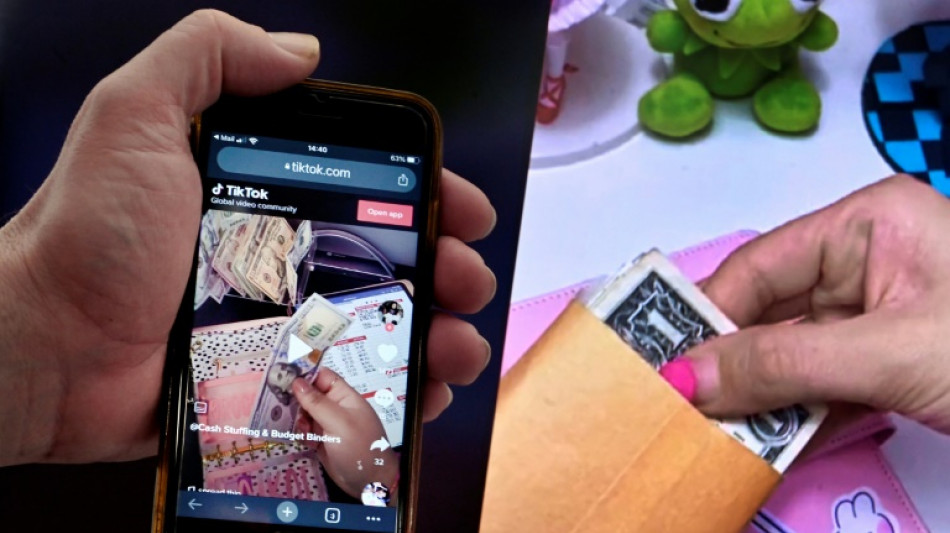

Spurred by TikTok, some Americans return to cash to curb spending

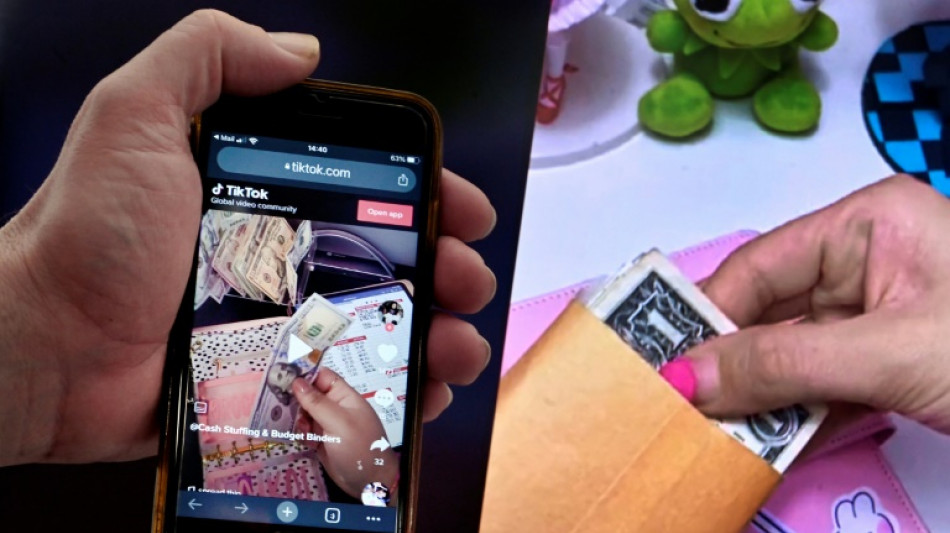

Manicured fingers meticulously place cash in transparent envelopes marked "food," "gas" and other categories, demonstrating in a TikTok video a retro technique for controlling what you spend that is newly popular with some money-conscious Americans.

Returning to cash to control spending may be old fashioned, but in an era of high inflation, a growing number of consumers find that it works.

Judia Griner, 25, started "cash stuffing" two years ago when she was a student at Old Dominion University in Virginia. Now, her TikTok account has more than 200,000 followers.

"I was like, I need to somehow use my own money to pay off the tuition so I won't be in too much debt," Griner told AFP.

"I realized that I had no idea how to do that, because I just didn't know how much money I had," she said.

"I would swipe my card, and I would just kind of cross my fingers and hope that it wouldn't be declined."

It was a similar situation for 31-year-old Jasmine Taylor, who launched her Tiktok channel in February 2021 and now has more than 620,000 followers.

"I had a degree but no outlook for a job. My finances were bad," Taylor, a Texan, said. "I was a pretty big impulse shopper."

Both women decided the way to turn around their spending behavior was to rely on the technique of paying cash for everything.

Once they cash in their pay checks, they separate it into different envelopes for specific expenses -- rent, shopping, etc.

On TikTok, the hashtag #cashstuffing has now reached more than 930 million views.

- Old method, proven results -

The method is reminiscent of the age-old piggy bank system, and was popularized in its current form 20 years ago by financial guru Dave Ramsey, before the era of smartphones and contactless payments.

Despite being outdated and at times inconvenient -- some businesses refuse to accept cash -- the method has allowed Griner to save $7,500 to finance her education.

"The card didn't feel like real money to me," Griner said.

But using cold cash made it very real.

"I could physically see myself spending all my cash and it just went away and that's what helped me curb my spending," she said.

Taylor, too, saw immediate results. She pays 95 percent of her expenses in cash, got rid of $32,000 in student debt, $8,000 in credit card debt and $5,000 in health care debt.

Wracking up debt is a national affliction in a country with abundant credit card offerings that goad households to take on more and more loans.

"It's a problem that my generation kind of suffers from: consumerism and just overspending everything," Griner said.

- Sense of comfort -

For Priya Malani, founder of Stash Wealth, a financial advisory service for young professionals, the economic downturn plays a role in the current success of the envelope system.

"With so many insane headlines -- crypto crashes, market pullbacks, looming recession, the list goes on -- it makes sense that people are looking for a little more control," Malani said.

"A dollar bill you hold in your hand provides that comfort."

But, Jason Howell, a wealth management professor at American University warned that "2023 is probably the worst time to keep your cash in your house" because it earns no interest and depreciates.

Taylor, who keeps her envelopes stuffed with small bills in a fireproof safe in her home, is well aware of this. She still deposits money in the bank when she saves $1,000 or more.

The two experts acknowledge that there is no broader movement back to cash in the United States, where the trend has been the gradual decline of cash in favor of card or mobile payments.

In 2022, about four in ten Americans (41 percent) said they would not make any cash purchases in a typical week, compared to only 24 percent in 2015, according to a recent Pew Research Center study.

According to Griner, the envelope method still represents "the perfect kind of system for a beginner" to manage a budget.

For her, the change has been dramatic: "I trust myself with money."

Howell said that sense of control is a notable achievement.

"It makes you think, it's the greatest benefit of this system," Howell said.

H.Portela--PC