-

Three Russia-themed anti-war films shortlisted for Oscars

Three Russia-themed anti-war films shortlisted for Oscars

-

US oil blockade of Venezuela: what we know

-

Palace boss Glasner says contract talks on hold due to hectic schedule

Palace boss Glasner says contract talks on hold due to hectic schedule

-

Netflix to launch FIFA World Cup video game

-

Venezuela says oil exports continue normally despite Trump 'blockade'

Venezuela says oil exports continue normally despite Trump 'blockade'

-

German MPs approve 50 bn euros in military purchases

-

India v South Africa 4th T20 abandoned due to fog

India v South Africa 4th T20 abandoned due to fog

-

Hydrogen plays part in global warming: study

-

EU's Mercosur trade deal hits French, Italian roadblock

EU's Mercosur trade deal hits French, Italian roadblock

-

What next for Belarus after US deal on prisoners, sanctions?

-

Brazil Senate debates bill that could slash Bolsonaro jail term

Brazil Senate debates bill that could slash Bolsonaro jail term

-

Coe shares 'frustration' over marathon record despite Kenyan's doping ban

-

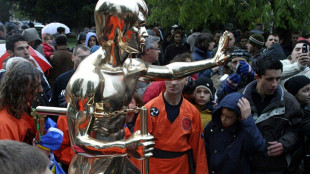

Stolen Bruce Lee statue 'returns' to Bosnia town

Stolen Bruce Lee statue 'returns' to Bosnia town

-

Veteran Suarez signs new Inter Miami contract

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Balkan nations offer lessons on handling cow virus sowing turmoil

Balkan nations offer lessons on handling cow virus sowing turmoil

-

French readers lap up Sarkozy's prison diaries

-

UK PM warns Abramovich 'clock is ticking' over Chelsea sale fund

UK PM warns Abramovich 'clock is ticking' over Chelsea sale fund

-

Warner Bros. Discovery rejects Paramount bid

-

Winners of 2026 World Cup to pocket $50 million in prize money

Winners of 2026 World Cup to pocket $50 million in prize money

-

World no. 1 Alcaraz ends 'incredible ride' with coach Ferrero

-

World number one Alcaraz announces 'difficult' split with coach Ferrero

World number one Alcaraz announces 'difficult' split with coach Ferrero

-

Iran boxer sentenced to death at 'imminent' risk of execution: rights groups

-

Snicko operator admits error that led to Carey's Ashes reprieve

Snicko operator admits error that led to Carey's Ashes reprieve

-

Finland PM apologises to Asian countries over MPs' mocking posts

-

Doctors in England go on strike for 14th time

Doctors in England go on strike for 14th time

-

Romania journalists back media outlet that sparked graft protests

-

Rob Reiner's son awaiting court appearance on murder charges

Rob Reiner's son awaiting court appearance on murder charges

-

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

Hundreds queue at Louvre museum as strike vote delays opening

-

Bondi shooting shocks, angers Australia's Jewish community

-

Markets rise even as US jobs data fail to boost rate cut bets

Markets rise even as US jobs data fail to boost rate cut bets

-

Senegal talisman Mane overcame grief to become an African icon

-

Carey pays tribute to late father after home Ashes century

Carey pays tribute to late father after home Ashes century

-

'Many lessons to be learned' from Winter Games preparations, says ski chief

-

Emotional Carey slams ton to give Australia upper hand in 3rd Ashes Test

Emotional Carey slams ton to give Australia upper hand in 3rd Ashes Test

-

Asian markets mixed as US jobs data fails to boost rate cut hopes

-

Carey slams ton as Australia seize upper hand in third Ashes Test

Carey slams ton as Australia seize upper hand in third Ashes Test

-

Bondi shooting shocks, angers Australia Jewish community

-

Myanmar junta seeks to prosecute hundreds for election 'disruption'

Myanmar junta seeks to prosecute hundreds for election 'disruption'

-

West Indies hope Christmas comes early in must-win New Zealand Test

-

Knicks beat Spurs in NBA Cup final to end 52-year trophy drought

Knicks beat Spurs in NBA Cup final to end 52-year trophy drought

-

Khawaja revels in late lifeline as Australia 194-5 in 3rd Ashes Test

-

Grief and fear as Sydney's Jewish community mourns 'Bondi rabbi'

Grief and fear as Sydney's Jewish community mourns 'Bondi rabbi'

-

Trump orders blockade of 'sanctioned' Venezuela oil tankers

Oil nears $100 but European stocks rebound on tepid sanctions

Oil prices surged close to $100 per barrel Tuesday as major crude producer Russia prepared to send troops into two breakaway regions of Ukraine.

But after heavy falls at the open, European stocks bounded into positive territory as the Kremlin said it remained open to all diplomatic contact over Ukraine and Western nations held off on imposing draconian sanctions.

Market analyst Michael Hewson at CMC Markets put the rebound down "to a reluctance on the part of Western leaders to call last night’s move an outright invasion, as well as go all in, on a full range of sanctions."

Germany announced it was halting certification of the Nord Stream 2 gas pipeline from Russia and said the European Union would adopt "robust and massive" economic sanctions.

Britain slapped sanctions on five Russian banks and three billionaires, in what Prime Minister Boris Johnson called "the first barrage" of measures in response to the Kremlin's actions in Ukraine.

But analysts expected the rebound in European stock prices to be short-lived.

"Given how keyed up investors had been regarding the developments in eastern Europe, the lack of any full-on conflict in eastern Ukraine has provided the chance for markets to edge higher," said Chris Beauchamp, chief market analyst at online trading platform IG.

"But such swift bounces are a feature of declining markets, and with further developments in the crisis inevitable, the likelihood is that a headline will come along sooner or later and prompt another leg lower," he added.

And European indices indeed pulled back after President Vladimir Putin sought and got permission Tuesday to deploy its armed forces outside Russian territory.

If London finished with a marginal gain, Paris ended flat and Frankfurt shed 0.3 percent.

On Wall Street, the three main indices fell after a three-day holiday weekend, with the Dow down 0.9 percent in late morning trading.

US President Joe Biden was set to speak on the Ukraine crisis later Tuesday.

Asian stock markets had earlier ended their sessions with heavy falls.

Russia's MOEX stock index plunged eight percent at the open, having lost 10 percent Monday, but clawed back its losses and showed a 1.6 percent gain in evening trading.

- High energy prices -

Meanwhile, Brent North Sea crude oil reached $99.50 per barrel, the highest level in seven years.

At around 1630 GMT, it pulled back to under $97, still a gain of around 1.5 percent compared with late Monday.

"The intensifying crisis between Russia and Ukraine has raised concerns about the supply disruptions that would ensue as sanctions look set to cripple Russia, the world's second-largest oil exporter and the world's top natural gas producer," noted Victoria Scholar, head of investment at Interactive Investor.

"Whatever happens next, one thing is clear: energy prices are unlikely to come back down in a hurry," said ThinkMarkets analyst Fawad Razaqzada.

"Consumers’ disposable incomes have already been stretched by surging inflation, and if oil and other energy prices continue to rise, this could hurt the economic recovery, and raise concerns about a possible recession," he added.

The jump in oil prices is compounding worries about inflation around the world, with the US Federal Reserve coming under intense pressure to tighten monetary policy to prevent prices running out of control.

Haven investment gold climbed past $1,900 an ounce.

- Key figures around 1630 GMT -

New York - Dow: DOWN 0.9 percent at 33,799.33 points

EURO STOXX 50: DOWN 0.2 percent at 3,978.70

London - FTSE 100: UP 0.1 percent at 7,494.21 (close)

Frankfurt - DAX: DOWN 0.3 percent at 14,693.00 (close)

Paris - CAC 40: FLAT at 6,787.60 (close)

Tokyo - Nikkei 225: DOWN 1.7 percent at 26,449.61 (close)

Hong Kong - Hang Seng Index: DOWN 2.7 percent at 23,520.00 (close)

Shanghai - Composite: DOWN 1.0 percent at 3,457.15 (close)

Brent North Sea crude: UP 1.5 percent at $96.78 per barrel

West Texas Intermediate: UP 2.0 percent at $92.93 per barrel

Euro/dollar: UP at $1.1341 from $1.1337 late Monday

Pound/dollar: DOWN at $1.3596 from $1.3609

Euro/pound: UP at 83.44 pence from 83.33 pence

Dollar/yen: UP at 114.96 yen from 114.82 yen

burs-rl/pvh

F.Santana--PC