-

New York model, carved in a basement, goes on display

New York model, carved in a basement, goes on display

-

Noisy humans harm birds and affect breeding success: study

-

More American women holding multiple jobs as high costs sting

More American women holding multiple jobs as high costs sting

-

Charcoal or solar panels? A tale of two Cubas

-

Several wounded in clashes at Albania opposition rally

Several wounded in clashes at Albania opposition rally

-

Chelsea's draw with Leeds 'bitter pill' for Rosenior

-

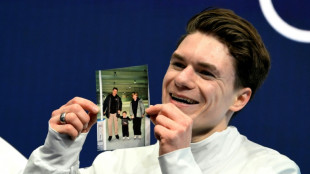

'On autopilot': US skate star Malinin nears more Olympic gold

'On autopilot': US skate star Malinin nears more Olympic gold

-

Carrick frustrated by Man Utd's lack of sharpness in West Ham draw

-

Frank confident of keeping Spurs job despite Newcastle defeat

Frank confident of keeping Spurs job despite Newcastle defeat

-

James's All-NBA streak ends as Lakers rule superstar out of Spurs clash

-

Anti-Khamenei slogans in Tehran on eve of revolution anniversary: social media footage

Anti-Khamenei slogans in Tehran on eve of revolution anniversary: social media footage

-

Colombian senator kidnapped, president targeted in election run-up

-

Britney Spears sells rights to her music catalog: US media

Britney Spears sells rights to her music catalog: US media

-

West Ham end Man Utd's winning run, Spurs sink to 16th

-

US skate star Malinin leads after short programme in Olympics

US skate star Malinin leads after short programme in Olympics

-

Man Utd's Sesko strikes late to rescue West Ham draw

-

Shiffrin flops at Winter Olympics as helmet row grows

Shiffrin flops at Winter Olympics as helmet row grows

-

Celtics' Tatum practices with G League team but injury return uncertain

-

Gisele Pelicot publishes memoirs after rape trial ordeal

Gisele Pelicot publishes memoirs after rape trial ordeal

-

Newcastle beat sorry Spurs to leave Frank on the brink

-

'Outrage' as LGBTQ Pride flag removed from Stonewall monument

'Outrage' as LGBTQ Pride flag removed from Stonewall monument

-

Chappell Roan leaves agency headed by embattled 2028 Olympic chief

-

Venezuelan authorities move Machado ally to house arrest

Venezuelan authorities move Machado ally to house arrest

-

YouTube rejects addiction claims in landmark social media trial

-

Google turns to century-long debt to build AI

Google turns to century-long debt to build AI

-

'I felt guided by them': US skater Naumov remembers parents at Olympics

-

Till death do us bark: Brazilian state lets pets be buried with owners

Till death do us bark: Brazilian state lets pets be buried with owners

-

'Confident' Pakistan ready for India blockbuster after USA win

-

Latam-GPT: a Latin American AI to combat US-centric bias

Latam-GPT: a Latin American AI to combat US-centric bias

-

Gauff dumped out of Qatar Open, Swiatek, Rybakina through

-

Paris officers accused of beating black producer to stand trial in November

Paris officers accused of beating black producer to stand trial in November

-

Istanbul bars rock bands accused of 'satanism'

-

Olympic bronze medal biathlete confesses affair on live TV

Olympic bronze medal biathlete confesses affair on live TV

-

US commerce chief admits Epstein Island lunch but denies closer ties

-

Mayor of Ecuador's biggest city arrested for money laundering

Mayor of Ecuador's biggest city arrested for money laundering

-

Farhan, spinners lead Pakistan to easy USA win in T20 World Cup

-

Stocks mixed as muted US retail sales spur caution

Stocks mixed as muted US retail sales spur caution

-

Macron wants more EU joint borrowing: Could it happen?

-

Shiffrin flops at Winter Olympics as helmet row simmers

Shiffrin flops at Winter Olympics as helmet row simmers

-

No excuses for Shiffrin after Olympic team combined flop

-

Pool on wheels brings swim lessons to rural France

Pool on wheels brings swim lessons to rural France

-

Europe's Ariane 6 to launch Amazon constellation satellites into orbit

-

Could the digital euro get a green light in 2026?

Could the digital euro get a green light in 2026?

-

Spain's Telefonica sells Chile unit in Latin America pullout

-

'We've lost everything': Colombia floods kill 22

'We've lost everything': Colombia floods kill 22

-

Farhan propels Pakistan to 190-9 against USA in T20 World Cup

-

US to scrap cornerstone of climate regulation this week

US to scrap cornerstone of climate regulation this week

-

Nepal call for India, England, Australia to play in Kathmandu

-

Stocks rise but lacklustre US retail sales spur caution

Stocks rise but lacklustre US retail sales spur caution

-

Olympic chiefs let Ukrainian athlete wear black armband at Olympics after helmet ban

Picktan Capital's Defensive Growth Fund Achieves Record-Breaking Returns

Picktan Capital's Multi-Asset Defensive Growth Fund has achieved record-breaking Q1 2025 returns amid global market uncertainty.

LONDON, UNITED KINGDOM / ACCESS Newswire / April 15, 2025 / Picktan Capital, an award-winning global wealth management firm based in London, has recently announced that its flagship Multi-Asset Defensive Growth Fund has delivered its strongest quarterly performance since inception, generating a remarkable 12.27% return in Q1 2025. The fund's latest performance outpaces all previous quarters since its launch in 2018 and reinforces Picktan Capital's position as a leader in resilient, globally diversified portfolio management.

Serving over 9,000 clients worldwide and managing more than $7 billion in assets, Picktan Capital has earned a reputation for high-performance, client-centric investment solutions. The Multi-Asset Defensive Growth Fund, a privately managed vehicle, has been a cornerstone offering since 2018, designed specifically to provide investors with capital appreciation and downside protection during volatile market cycles.

Since launch, the fund has maintained an impressive average annual return of 18.27%, outperforming traditional market benchmarks and comparable multi-asset strategies. Its strong start to 2025 reflects its agile positioning and the effectiveness of its diversified asset allocation model, which spans global equities, fixed income, commodities, currencies, and alternative assets.

The fund's robust Q1 returns come at a time of increasing geopolitical and macroeconomic instability. Rising political tensions between the U.S. and Europe, coupled with escalating tariffs and the renewed threat of global trade fragmentation, have led to heightened volatility in equity markets. Against this backdrop, institutional and high-net-worth investors have turned toward multi-asset strategies that can offer both protection and opportunity.

In June 2024, due to overwhelming demand and strong inflows, Picktan Capital made the strategic decision to cap the Multi-Asset Defensive Growth Fund at $1 billion in assets under management. Since then, the fund has remained closed to new investors. However, the firm has confirmed that it is now evaluating options to reopen the fund in the latter half of 2025, driven by mounting interest from European investors seeking exposure to defensive, actively managed strategies.

Commenting on the fund's performance, Mr. Richard Hart, Head of Global Trading at Picktan Capital, said:

"We are incredibly proud of the fund's performance, particularly in a quarter that presented investors with so many macro headwinds. Our multi-asset strategy is built on flexibility, data-driven decision-making, and a disciplined risk management framework. The record-breaking Q1 return is not only a reflection of our team's skill but a validation of our commitment to navigating complex markets on behalf of our clients."

While the fund remains closed for now, Picktan Capital's investment committee is expected to deliver a mid-year review in June 2025, which may include forward guidance regarding the fund's reopening and updated investment outlooks for the second half of the year.

About Picktan Capital

Founded in London, Picktan Capital is a global wealth management firm serving over 9,000 clients across Europe, North America, Asia, and the Middle East. The firm provides bespoke investment management, financial planning, and strategic advisory services to high-net-worth individuals, family offices, and institutions, with over $7 billion in assets under management.

Media Contact:

Sophie Hayworth

Media and PR Manager

Picktan Capital Limited

Email: [email protected]

Telephone Number: +44 (0)203 773 8881

Address: 1 Canada Square, London, E14 5AX, United Kingdom.

SOURCE: Picktan Capital

View the original press release on ACCESS Newswire

L.Mesquita--PC