-

Bangladesh Islamist leader seeks power in post-uprising vote

Bangladesh Islamist leader seeks power in post-uprising vote

-

Rams' Stafford named NFL's Most Valuable Player

-

Japan to restart world's biggest nuclear plant

Japan to restart world's biggest nuclear plant

-

Japan's Sanae Takaichi: Iron Lady 2.0 hopes for election boost

-

Italy set for 2026 Winter Olympics opening ceremony

Italy set for 2026 Winter Olympics opening ceremony

-

Hong Kong to sentence media mogul Jimmy Lai on Monday

-

Pressure on Townsend as Scots face Italy in Six Nations

Pressure on Townsend as Scots face Italy in Six Nations

-

Taiwan's political standoff stalls $40 bn defence plan

-

Inter eyeing chance to put pressure on title rivals Milan

Inter eyeing chance to put pressure on title rivals Milan

-

Arbeloa's Real Madrid seeking consistency over magic

-

Dortmund dare to dream as Bayern's title march falters

Dortmund dare to dream as Bayern's title march falters

-

PSG brace for tough run as 'strange' Marseille come to town

-

Japan PM wins Trump backing ahead of snap election

Japan PM wins Trump backing ahead of snap election

-

AI tools fabricate Epstein images 'in seconds,' study says

-

Asian markets extend global retreat as tech worries build

Asian markets extend global retreat as tech worries build

-

Sells like teen spirit? Cobain's 'Nevermind' guitar up for sale

-

Thailand votes after three prime ministers in two years

Thailand votes after three prime ministers in two years

-

UK royal finances in spotlight after Andrew's downfall

-

Diplomatic shift and elections see Armenia battle Russian disinformation

Diplomatic shift and elections see Armenia battle Russian disinformation

-

Undercover probe finds Australian pubs short-pouring beer

-

Epstein fallout triggers resignations, probes

Epstein fallout triggers resignations, probes

-

The banking fraud scandal rattling Brazil's elite

-

Party or politics? All eyes on Bad Bunny at Super Bowl

Party or politics? All eyes on Bad Bunny at Super Bowl

-

Man City confront Anfield hoodoo as Arsenal eye Premier League crown

-

Patriots seek Super Bowl history in Seahawks showdown

Patriots seek Super Bowl history in Seahawks showdown

-

Gotterup leads Phoenix Open as Scheffler struggles

-

In show of support, Canada, France open consulates in Greenland

In show of support, Canada, France open consulates in Greenland

-

'Save the Post': Hundreds protest cuts at famed US newspaper

-

New Zealand deputy PM defends claims colonisation good for Maori

New Zealand deputy PM defends claims colonisation good for Maori

-

Amazon shares plunge as AI costs climb

-

Galthie lauds France's remarkable attacking display against Ireland

Galthie lauds France's remarkable attacking display against Ireland

-

Argentina govt launches account to debunk 'lies' about Milei

-

Australia drug kingpin walks free after police informant scandal

Australia drug kingpin walks free after police informant scandal

-

Dupont wants more after France sparkle and then wobble against Ireland

-

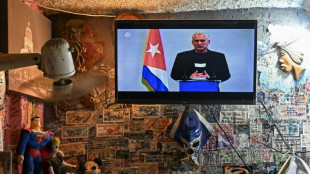

Cuba says willing to talk to US, 'without pressure'

Cuba says willing to talk to US, 'without pressure'

-

NFL names 49ers to face Rams in Aussie regular-season debut

-

Bielle-Biarrey sparkles as rampant France beat Ireland in Six Nations

Bielle-Biarrey sparkles as rampant France beat Ireland in Six Nations

-

Flame arrives in Milan for Winter Olympics ceremony

-

Olympic big air champion Su survives scare

Olympic big air champion Su survives scare

-

89 kidnapped Nigerian Christians released

-

Cuba willing to talk to US, 'without pressure'

Cuba willing to talk to US, 'without pressure'

-

Famine spreading in Sudan's Darfur, UN-backed experts warn

-

2026 Winter Olympics flame arrives in Milan

2026 Winter Olympics flame arrives in Milan

-

Congo-Brazzaville's veteran president declares re-election run

-

Olympic snowboard star Chloe Kim proud to represent 'diverse' USA

Olympic snowboard star Chloe Kim proud to represent 'diverse' USA

-

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

-

Leicester at risk of relegation after six-point deduction

Leicester at risk of relegation after six-point deduction

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Trump urges new nuclear treaty after Russia agreement ends

Trump urges new nuclear treaty after Russia agreement ends

-

'Burned in their houses': Nigerians recount horror of massacre

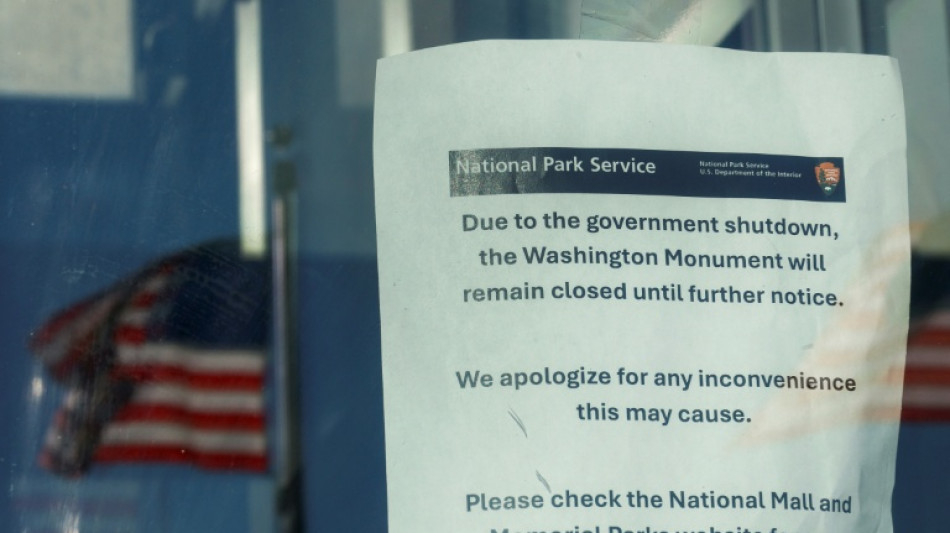

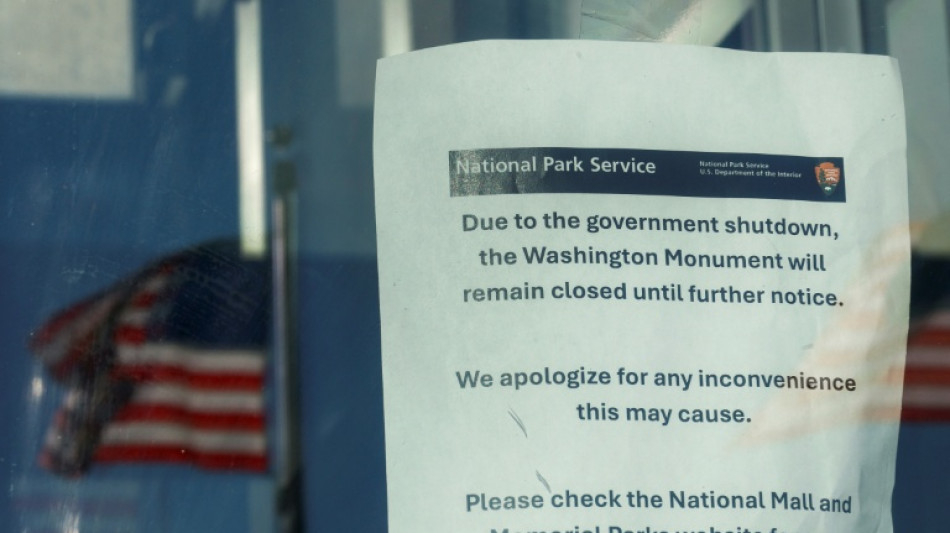

Wall Street stocks shrug off start of US shutdown

Wall Street stocks shrugged off early losses on Wednesday as the US government started to shut down after Democrats and President Donald Trump failed to break a deadlock over spending.

The prospect of services in the United States being closed pushed safe-haven gold to another record high over $3,895.

While Wall Street's indices slid at the opening bell, they recovered during the morning session, with the Dow showing a small gain.

"There have been previous shutdowns, and typically these have had little effect on financial markets. But much depends on how long the shutdown lasts," said David Morrison, analyst at Trade Nation.

"Given the current intransigence on both sides, there's a possibility that federal services could be curtailed for some time," he said.

US government operations began grinding to a halt at 12:01 am (0401 GMT) Wednesday after Republicans and Democrats failed to break an impasse in Congress.

The closure will see non-essential operations halted, leaving hundreds of thousands of civil servants temporarily unpaid, and many social safety net benefit payments potentially disrupted.

Analysts say negative impacts from closures can be reversed once the government reopens.

"Investors have been willing to ignore a lot of inconvenient facts for the past several months or even years," said Steve Sosnick, of Interactive Brokers. "So they might do the same again."

Investors were also digesting data from payroll firm ADP showing the US private sector lost 32,000 jobs in September, despite analysts' expectations of employment growth.

"This is another sign that the US labour market is losing steam," said Kathleen Brooks, research director at XTB trading platform.

"This one is worrying, it is the third time in four months that the private sector has shed jobs, which comes after a boom in service sector jobs growth post Covid," she said.

Analysts said the weaker jobs market cement expectations that the US Federal Reserve will cut interest rates twice more this year, after lowering borrowing costs last month for the first time since December.

Investors are concerned the US government shutdown could prevent the release Friday of the key non-farm payrolls report -- a crucial data point for the Fed on rate decisions.

The dollar remained under pressure on concerns over the shutdown as well as the prospect of more interest-rate cuts, which make the currency less attractive to investors.

European markets were lifted by pharmaceutical shares after Pfizer was granted reprieve from Trump's tariffs by agreeing to lower drug prices in the United States.

Shares in British pharma giant AstraZeneca rose more than eight percent and GSK was up over six percent in London.

In Asia, Tokyo's stock market sank, while Hong Kong and Shanghai were closed for holidays.

- Key figures at around 1530 GMT -

New York - Dow: UP 0.2 percent at 46,486.21 points

New York - S&P 500: UP less than 0.1 percent at 6,691.94

New York - Nasdaq Composite: FLAT at 22,660.24

London - FTSE 100: UP 1.0 percent at 9,446.43 (close)

Paris - CAC 40: UP 0.9 percent at 7,966.95 (close)

Frankfurt - DAX: UP 1.0 percent at 24,113.62 (close)

Tokyo - Nikkei 225: DOWN 0.9 percent at 44,550.85 (close)

Hong Kong - Hang Seng Index: Closed for a holiday

Shanghai - Composite: Closed for a holiday

Euro/dollar: DOWN at $1.1730 from $1.1739 on Tuesday

Pound/dollar: UP at $1.3478 from $1.3448

Dollar/yen: DOWN at 147.14 yen from 147.86 yen

Euro/pound: DOWN at 87.03 pence from 87.29 pence

West Texas Intermediate: DOWN 0.9 percent at $61.84 per barrel

Brent North Sea Crude: DOWN 0.9 percent at $65.47 per barrel

burs-rl/jhb

P.Cavaco--PC