-

Shadow over Vonn as Shiffrin, Odermatt headline Olympic skiing

Shadow over Vonn as Shiffrin, Odermatt headline Olympic skiing

-

US seeks minerals trade zone in rare Trump move with allies

-

Ukraine says Abu Dhabi talks with Russia 'substantive and productive'

Ukraine says Abu Dhabi talks with Russia 'substantive and productive'

-

Brazil mine disaster victims in London to 'demand what is owed'

-

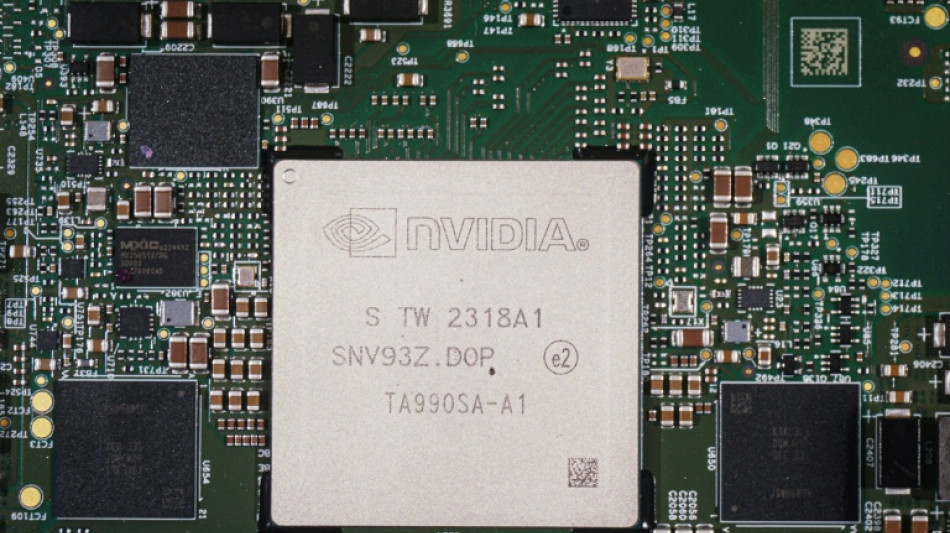

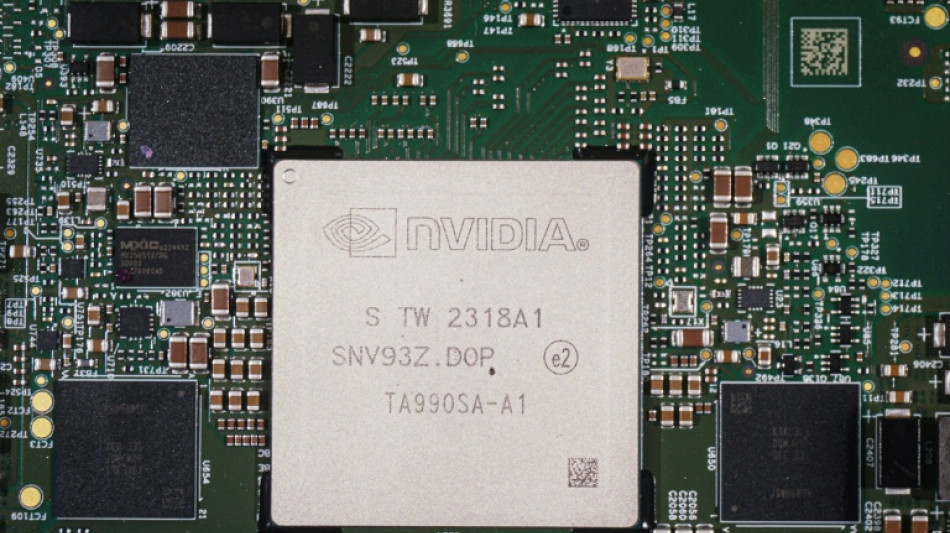

AI-fuelled tech stock selloff rolls on

AI-fuelled tech stock selloff rolls on

-

White says time at Toulon has made him a better Scotland player

-

Washington Post announces 'painful' job cuts

Washington Post announces 'painful' job cuts

-

All lights are go for Jalibert, says France's Dupont

-

Artist rubs out Meloni church fresco after controversy

Artist rubs out Meloni church fresco after controversy

-

Palestinians in Egypt torn on return to a Gaza with 'no future'

-

US removing 700 immigration officers from Minnesota

US removing 700 immigration officers from Minnesota

-

Who is behind the killing of late ruler Gaddafi's son, and why now?

-

Coach Thioune tasked with saving battling Bremen

Coach Thioune tasked with saving battling Bremen

-

Russia vows to act 'responsibly' once nuclear pact with US ends

-

Son of Norway's crown princess admits excesses but denies rape

Son of Norway's crown princess admits excesses but denies rape

-

Vowles dismisses Williams 2026 title hopes as 'not realistic'

-

'Dinosaur' Glenn chasing skating gold in first Olympics

'Dinosaur' Glenn chasing skating gold in first Olympics

-

Gaza health officials say strikes kill 23 after Israel says shots wounded officer

-

Italy foils Russian cyberattacks targeting Olympics

Italy foils Russian cyberattacks targeting Olympics

-

Figure skating favourite Malinin feeling 'the pressure' in Milan

-

Netflix film probes conviction of UK baby killer nurse

Netflix film probes conviction of UK baby killer nurse

-

Timber hopes League Cup can be catalyst for Arsenal success

-

China calls EU 'discriminatory' over probe into energy giant Goldwind

China calls EU 'discriminatory' over probe into energy giant Goldwind

-

Sales warning slams Ozempic maker Novo Nordisk's stock

-

Can Vonn defy ACL rupture to win Olympic medal?

Can Vonn defy ACL rupture to win Olympic medal?

-

Breakthrough or prelude to attack? What we know about Iran-US talks

-

German far-right MP detained over alleged Belarus sanctions breach

German far-right MP detained over alleged Belarus sanctions breach

-

MSF says its hospital in South Sudan hit by government air strike

-

Merz heads to Gulf as Germany looks to diversify trade ties

Merz heads to Gulf as Germany looks to diversify trade ties

-

Selection process for future Olympic hosts set for reform

-

Serbian minister on trial over Trump-linked hotel plan

Serbian minister on trial over Trump-linked hotel plan

-

UK PM says Mandelson 'lied', regrets appointing him US envoy

-

Cochran-Siegle tops first Olympic downhill training

Cochran-Siegle tops first Olympic downhill training

-

Gaza health officials say strikes kill 21 after Israel says shots wounded officer

-

Injured Vonn's Olympic bid is 'inspirational', ski stars say

Injured Vonn's Olympic bid is 'inspirational', ski stars say

-

Albania arrests 20 for toxic waste trafficking

-

US-Africa trade deal renewal only 'temporary breather'

US-Africa trade deal renewal only 'temporary breather'

-

Mir sets pace on Sepang day two, Yamaha absent

-

Xi, Putin hail 'stabilising' China-Russia alliance

Xi, Putin hail 'stabilising' China-Russia alliance

-

GSK boosted by specialty drugs, end to Zantac fallout

-

UK's ex-prince leaves Windsor home amid Epstein storm: reports

UK's ex-prince leaves Windsor home amid Epstein storm: reports

-

Sky is the limit for Ireland fly-half Prendergast, says captain Doris

-

Feyi-Waboso reminds England great Robinson of himself

Feyi-Waboso reminds England great Robinson of himself

-

Starmer faces MPs as pressure grows over Mandelson scandal

-

HRW urges pushback against 'aggressive superpowers'

HRW urges pushback against 'aggressive superpowers'

-

Russia demands Ukraine give in as UAE talks open

-

Gaza civil defence says 17 killed in strikes after Israel says shots wounded officer

Gaza civil defence says 17 killed in strikes after Israel says shots wounded officer

-

France's Kante joins Fenerbahce after Erdogan 'support'

-

CK Hutchison launches arbitration over Panama Canal port ruling

CK Hutchison launches arbitration over Panama Canal port ruling

-

Stocks mostly rise as traders ignore AI-fuelled sell-off on Wall St

| RIO | -1.08% | 95.34 | $ | |

| CMSC | -0.68% | 23.5 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| BTI | -0.45% | 61.59 | $ | |

| NGG | 2.04% | 88.025 | $ | |

| RYCEF | -2.1% | 16.65 | $ | |

| BCE | 1.27% | 26.435 | $ | |

| BP | 1.23% | 39.305 | $ | |

| VOD | 2.59% | 15.655 | $ | |

| GSK | 6.62% | 57.12 | $ | |

| RELX | -2.5% | 29.765 | $ | |

| AZN | 1.94% | 187.96 | $ | |

| RBGPF | 0.12% | 82.5 | $ | |

| BCC | 4.44% | 88.875 | $ | |

| CMSD | -0.4% | 23.845 | $ | |

| JRI | -0.15% | 13.1 | $ |

ECB warns on stretched AI valuations and sovereign debt risks

Heightened market exuberance around artificial intelligence and eye-popping levels of government debt could pose risks to eurozone financial stability, the European Central Bank warned Wednesday.

"Financial markets, notably equity markets, remain vulnerable to sharp adjustments due to persistently high valuations," the ECB said in its regular review of the single currency area's financial stability.

"Market sentiment could shift abruptly, not only if growth prospects deteriorate but also if technology sector earnings -- especially those of companies associated with artificial intelligence -- fail to deliver on expectations."

US equity markets have surged to successive record highs, recovering from a sharp sell-off in April after US President Donald Trump unveiled harsh new tariffs that were then partially rowed back.

But the gains have been mostly concentrated among technology companies such as AI-chip designer Nvidia, prompting fears of a hype-fuelled bubble that could pop.

Speaking on a call with reporters, ECB Vice President Luis de Guindos said there was a risk of an "accident" even though healthier company fundamentals meant the current situation was not directly comparable with the dotcom bubble of the 1990s.

"Valuations are very high according to historical standards," he said. "The possibility of an accident is going to be there."

High levels of government debt could further undermine financial stability, the ECB said, warning that this could result in swings in the value of the euro and the cost of eurozone government debt.

Market concerns around "stretched public finances could... create strains in global bond markets," the ECB said.

"At the same time, fiscal fundamentals in some euro area countries have been persistently weak. Fiscal slippage could test investor confidence."

F.Moura--PC