-

Bangladesh's BNP heading for 'sweeping' election win

Bangladesh's BNP heading for 'sweeping' election win

-

Hisatsune grabs Pebble Beach lead with sparkling 62

-

Venezuela amnesty bill postponed amid row over application

Venezuela amnesty bill postponed amid row over application

-

Barca taught 'lesson' in Atletico drubbing: Flick

-

Australia's Liberals elect net zero opponent as new leader

Australia's Liberals elect net zero opponent as new leader

-

Arsenal must block out noise in 'rollercoaster' title race: Rice

-

Suns forward Brooks banned one game for technical fouls

Suns forward Brooks banned one game for technical fouls

-

N. Korea warns of 'terrible response' if more drone incursions from South

-

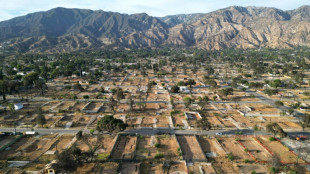

LA fires: California probes late warnings in Black neighborhoods

LA fires: California probes late warnings in Black neighborhoods

-

Atletico rout Barca in Copa del Rey semi-final first leg

-

Arsenal held by Brentford to offer Man City Premier League title hope

Arsenal held by Brentford to offer Man City Premier League title hope

-

US snowboard star Kim 'proud' as teenager Choi dethrones her at Olympics

-

Chloe Kim misses Olympic milestone, Ukrainian disqualfied over helmet

Chloe Kim misses Olympic milestone, Ukrainian disqualfied over helmet

-

Tech shares pull back ahead of US inflation data

-

'Beer Man' Castellanos released by MLB Phillies

'Beer Man' Castellanos released by MLB Phillies

-

Canada PM to join mourners in remote town after mass shooting

-

Teenager Choi wrecks Kim's Olympic snowboard hat-trick bid

Teenager Choi wrecks Kim's Olympic snowboard hat-trick bid

-

Inter await Juve as top guns go toe-to-toe in Serie A

-

Swiatek, Rybakina dumped out of Qatar Open

Swiatek, Rybakina dumped out of Qatar Open

-

Europe's most powerful rocket carries 32 satellites for Amazon Leo network into space

-

Neighbor of Canada mass shooter grieves after 'heartbreaking' attack

Neighbor of Canada mass shooter grieves after 'heartbreaking' attack

-

French Olympic ice dance champions laud 'greatest gift'

-

Strange 'inside-out' planetary system baffles astronomers

Strange 'inside-out' planetary system baffles astronomers

-

Teenager Choi denies Kim Olympic snowboard hat-trick

-

Swiss bar owners face wrath of bereaved families

Swiss bar owners face wrath of bereaved families

-

EU vows reforms to confront China, US -- but split on joint debt

-

Rubio heads to Munich to heap pressure on Europeans

Rubio heads to Munich to heap pressure on Europeans

-

Less glamour, more content, says Wim Wenders of Berlin Film Fest

-

What is going on with Iran-US talks?

What is going on with Iran-US talks?

-

Wales 'means everything' for prop Francis despite champagne, oysters in France

-

Giannis out and Spurs' Fox added to NBA All-Star Game

Giannis out and Spurs' Fox added to NBA All-Star Game

-

The secret to an elephant's grace? Whiskers

-

Chance glimpse of star collapse offers new insight into black hole formation

Chance glimpse of star collapse offers new insight into black hole formation

-

UN climate chief says 'new world disorder' threatens cooperation

-

Player feels 'sadness' after denied Augusta round with grandsons: report

Player feels 'sadness' after denied Augusta round with grandsons: report

-

Trump dismantles legal basis for US climate rules

-

Former Arsenal player Partey faces two more rape charges

Former Arsenal player Partey faces two more rape charges

-

Scotland coach Townsend adamant focus on England rather than his job

-

Canada PM to visit town in mourning after mass shooting

Canada PM to visit town in mourning after mass shooting

-

US lawmaker moves to shield oil companies from climate cases

-

Ukraine says Russia behind fake posts targeting Winter Olympics team

Ukraine says Russia behind fake posts targeting Winter Olympics team

-

Thousands of Venezuelans stage march for end to repression

-

Verstappen slams new cars as 'Formula E on steroids'

Verstappen slams new cars as 'Formula E on steroids'

-

Iranian state TV's broadcast of women without hijab angers critics

-

Top pick Flagg, France's Sarr to miss NBA Rising Stars

Top pick Flagg, France's Sarr to miss NBA Rising Stars

-

Sakkari fights back to outlast top-seed Swiatek in Qatar

-

India tune-up for Pakistan showdown with 93-run rout of Namibia

India tune-up for Pakistan showdown with 93-run rout of Namibia

-

Lollobrigida skates to second Olympic gold of Milan-Cortina Games

-

Comeback queen Brignone stars, Ukrainian banned over helmet

Comeback queen Brignone stars, Ukrainian banned over helmet

-

Stocks diverge as all eyes on corporate earnings

Asian markets rally with Wall St as rate hopes rise, AI fears ease

Asian markets rallied Monday and gold hit a record high as the latest round of US data boosted hopes for more interest rate cuts, while worries over AI spending also subsided.

Investors were back in the saddle for the final business days before Christmas, having had a minor wobble earlier in the month on concerns that the Federal Reserve would hold off easing monetary policy further in the early part of 2026.

Figures last week showing US unemployment hit a four-year high in November came as a report indicated the rise in consumer prices slowed more than expected.

That stoked bets on the Fed lowering borrowing costs early next year. Investors had pared their forecasts after the bank indicated it could take a pause on further cuts in its post-meeting statement earlier this month.

"This labour market softening and inflation moderation strengthened Federal Reserve easing expectations for 2026," wrote IG market analyst Fabien Yip.

However, she added that "the low inflation reading may prove temporary as shutdown-related data collection disruptions likely suppressed the figure, which could normalise higher once data gathering processes resume".

Asian tech firms led the gains Monday with South Korea's Samsung Electronics, Taiwan's TSMC and Japan's Renesas among the best performers.

Hong Kong, Shanghai, Sydney, Seoul, Singapore, Wellington, Taipei and Manila all enjoyed healthy advances.

Tokyo was the standout, piling on two percent thanks to a weaker yen.

Gold, which benefits from lower US interest rates, hit a fresh record above $4,388, while silver also struck a new peak.

The precious metals, which are go-to assets in times of crisis, also benefited from geopolitical worries as Washington steps up its oil blockade against Venezuela and after Ukraine hit a tanker from Russia's shadow fleet in the Mediterranean.

Stephen Innes at SPI Asset Management said: "Asian equity markets are stepping onto the floor with a constructive bias, taking their cue from Friday's solid rebound in US stocks and the growing belief that the final stretch of the year still belongs to the bulls."

The equity gains tracked a surge on Wall Street led by the Nasdaq as technology giants following a bumper earnings report from chip giant Micron Technology that reinvigorated the AI trade.

That came on top of news that Oracle will take a 15 percent stake in a TikTok joint venture that will allow the social media company to maintain operations in the United States.

The tech bounce came after a bout of selling fuelled by concerns that valuations had been stretched and questions were being asked about the vast sums invested in artificial intelligence that some warn could take time to see returns.

Forex traders are keeping tabs on Tokyo after Japan's top currency official said he was concerned about the yen's recent weakness, which came after the central bank hiked interest rates to a 30-year high on Friday.

"We're seeing one-directional, sudden moves especially after last week's monetary policy meeting, so I'm deeply concerned," Atsushi Mimura said Monday.

"We'd like to take appropriate responses against excessive moves."

The comments stoked speculation officials could intervene in currency markets to support the yen, which fell more than one percent against the dollar Friday after bank boss Kazuo Ueda chose not to signal more increases early in the new year.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 2.0 percent at 50,480.76 (break)

Hong Kong - Hang Seng Index: UP 0.2 percent at 25,728.31

Shanghai - Composite: UP 0.6 percent at 3,914.36

Dollar/yen: DOWN at 157.40 yen from 157.59 yen on Friday

Euro/dollar: DOWN at $1.1718 from $1.1719

Pound/dollar: UP at $1.3396 from $1.3386

Euro/pound: DOWN at 87.47 pence from 87.55 pence

West Texas Intermediate: UP 0.7 percent at $56.92 per barrel

Brent North Sea Crude: UP 0.7 percent at $60.91 per barrel

New York - Dow: UP 0.4 percent at 48,134.89 (close)

London - FTSE 100: UP 0.6 percent at 9,897.92 (close)

R.J.Fidalgo--PC