-

Brazil Congress passes bill to cut Bolsonaro prison term

Brazil Congress passes bill to cut Bolsonaro prison term

-

Cricket Australia boss slams technology 'howler' in Ashes Test

-

New Zealand 83-0 at lunch on day one of third West Indies Test

New Zealand 83-0 at lunch on day one of third West Indies Test

-

Ecuadorean footballer Mario Pineida shot and killed

-

US government admits liability in deadly DC air collision

US government admits liability in deadly DC air collision

-

Ex-podcaster Dan Bongino stepping down as deputy FBI director

-

Real Madrid scrape past third-tier Talavera in Spanish Cup

Real Madrid scrape past third-tier Talavera in Spanish Cup

-

Hunt for US college mass shooter drags into fifth day

-

Cherki inspires Man City, Newcastle strike late to reach League Cup semis

Cherki inspires Man City, Newcastle strike late to reach League Cup semis

-

Barcelona, Lyon and Chelsea reach Women's Champions League quarters

-

Venezuela reacts defiantly to US oil blockade, claims exports unaffected

Venezuela reacts defiantly to US oil blockade, claims exports unaffected

-

Nasdaq tumbles on renewed angst over AI building boom

-

S.Africa expels Kenyans working on US Afrikaner 'refugee' applications

S.Africa expels Kenyans working on US Afrikaner 'refugee' applications

-

US Congress ends Syria sanctions

-

Cherki inspires Man City cruise into League Cup semis

Cherki inspires Man City cruise into League Cup semis

-

Billionaire Trump nominee confirmed to lead NASA amid Moon race

-

Mahomes undergoes surgery, could return for 2026 opener: Chiefs

Mahomes undergoes surgery, could return for 2026 opener: Chiefs

-

Melania Trump steps into spotlight in Amazon film trailer

-

Brazil Senate advances bill that could cut Bolsonaro jail term

Brazil Senate advances bill that could cut Bolsonaro jail term

-

Safonov hero as PSG beat Flamengo in Intercontinental Cup

-

Oscars to stream exclusively on YouTube from 2029

Oscars to stream exclusively on YouTube from 2029

-

Oscars to stream exclusively on YouTube from 2029: Academy

-

CNN's future unclear as Trump applies pressure

CNN's future unclear as Trump applies pressure

-

Zelensky says Russia preparing for new 'year of war'

-

Rob Reiner's son appears in court over parents' murder

Rob Reiner's son appears in court over parents' murder

-

US Congress passes defense bill defying Trump anti-Europe rhetoric

-

Three Russia-themed anti-war films shortlisted for Oscars

Three Russia-themed anti-war films shortlisted for Oscars

-

US oil blockade of Venezuela: what we know

-

Palace boss Glasner says contract talks on hold due to hectic schedule

Palace boss Glasner says contract talks on hold due to hectic schedule

-

Netflix to launch FIFA World Cup video game

-

Venezuela says oil exports continue normally despite Trump 'blockade'

Venezuela says oil exports continue normally despite Trump 'blockade'

-

German MPs approve 50 bn euros in military purchases

-

India v South Africa 4th T20 abandoned due to fog

India v South Africa 4th T20 abandoned due to fog

-

Hydrogen plays part in global warming: study

-

EU's Mercosur trade deal hits French, Italian roadblock

EU's Mercosur trade deal hits French, Italian roadblock

-

What next for Belarus after US deal on prisoners, sanctions?

-

Brazil Senate debates bill that could slash Bolsonaro jail term

Brazil Senate debates bill that could slash Bolsonaro jail term

-

Coe shares 'frustration' over marathon record despite Kenyan's doping ban

-

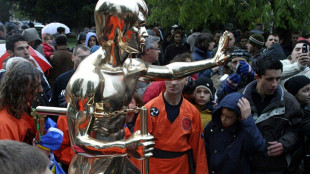

Stolen Bruce Lee statue 'returns' to Bosnia town

Stolen Bruce Lee statue 'returns' to Bosnia town

-

Veteran Suarez signs new Inter Miami contract

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Balkan nations offer lessons on handling cow virus sowing turmoil

Balkan nations offer lessons on handling cow virus sowing turmoil

-

French readers lap up Sarkozy's prison diaries

-

UK PM warns Abramovich 'clock is ticking' over Chelsea sale fund

UK PM warns Abramovich 'clock is ticking' over Chelsea sale fund

-

Warner Bros. Discovery rejects Paramount bid

-

Winners of 2026 World Cup to pocket $50 million in prize money

Winners of 2026 World Cup to pocket $50 million in prize money

-

World no. 1 Alcaraz ends 'incredible ride' with coach Ferrero

-

World number one Alcaraz announces 'difficult' split with coach Ferrero

World number one Alcaraz announces 'difficult' split with coach Ferrero

-

Iran boxer sentenced to death at 'imminent' risk of execution: rights groups

Asian markets fluctuate as traders prepare for 'Liberation Day'

Asian markets swung on Monday as the White House prepares to impose tariffs on key trading partners next week that many fear could deal a painful blow to the global economy.

A report saying US President Donald Trump was considering a more targeted approach to the levies, which are expected to kick in on April 2, did little to soothe investors' nerves, with the uncertainty dealing a blow to confidence.

The US leader has sent shivers through markets since resuming power in January by hitting out at long-standing allies and imposing or threatening swingeing tariffs on imports of an array of goods, including steel and cars.

Next Wednesday is now the focus of attention, with Trump labelling it "Liberation Day" as he prepares to unveil a raft of reciprocal measures to counter those in other countries.

"Anticipation and pre-positioning ahead of Trump's 'Liberation Day' on 2 April and the impending deluge of tariff-related announcements that will follow in the days/weeks after will be a growing factor that drives price action, sentiment and liquidity in markets this week," said Chris Weston at Pepperstone.

"As the sky begins to bruise and darken, and the atmospheric pressure builds within the capital markets, market players question if it's time to batten down the hatches in preparation for a storm of uncertainty set to be unleashed on markets."

The Federal Reserve last week warned that "uncertainty around the economic outlook has increased" while the central banks of Japan and Britain also warned about the impact of the White House's policies.

Chinese Premier Li Qiang said at the weekend that Beijing was readying for "shocks that exceed expectations" ahead of the latest measures, adding that "instability and uncertainty are on the upswing".

His comments came as he met heads of some of the world's biggest companies, including Apple, Qualcomm, FedEx and Pfizer.

And Australian Treasurer Jim Chalmers told Bloomberg News the moves by Trump "are not surprising, but they are seismic".

Bloomberg News reported that the US administration was considering a more targeted approach to the tariffs, with some countries being hit harder than others, and the measures not being as severe as initially feared.

That came after the president told reporters Friday that "there'll be flexibility" in his plans.

Still, Asian investors struggled to get the week off to a strong start, with markets fluctuating through the morning.

Tokyo was flat, while Shanghai, Singapore and Taipei were slightly higher.

Hong Kong, Sydney, Seoul and Wellington edged down.

Gold held around $3,025, having hit a series of records last week to a peak of more than $3,057 owing to a surge in demand for safe havens.

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: FLAT at 37,676.97 (break)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 23,660.67

Shanghai - Composite: UP 0.1 percent at 3,369.57

Euro/dollar: UP at $1.0831 from $1.0815 on Friday

Pound/dollar: UP at $1.2930 from $1.2918

Dollar/yen: UP at 149.75 yen from 149.36 yen

Euro/pound: UP at 83.76 pence from 83.72 pence

West Texas Intermediate: DOWN 0.2 percent at $68.13 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $71.97 per barrel

New York - Dow: UP 0.1 percent at 41,985.35 points (close)

London - FTSE 100: DOWN 0.6 percent at 8,646.79 points (close)

X.Matos--PC