-

Demanding Dupont set to fire France in Ireland opener

Demanding Dupont set to fire France in Ireland opener

-

Britain's ex-prince Andrew leaves Windsor home: BBC

-

Coach plots first South Africa World Cup win after Test triumph

Coach plots first South Africa World Cup win after Test triumph

-

Spin-heavy Pakistan hit form, but India boycott risks early T20 exit

-

Japan eyes Premier League parity by aligning calendar with Europe

Japan eyes Premier League parity by aligning calendar with Europe

-

Whack-a-mole: US academic fights to purge his AI deepfakes

-

Love in a time of war for journalist and activist in new documentary

Love in a time of war for journalist and activist in new documentary

-

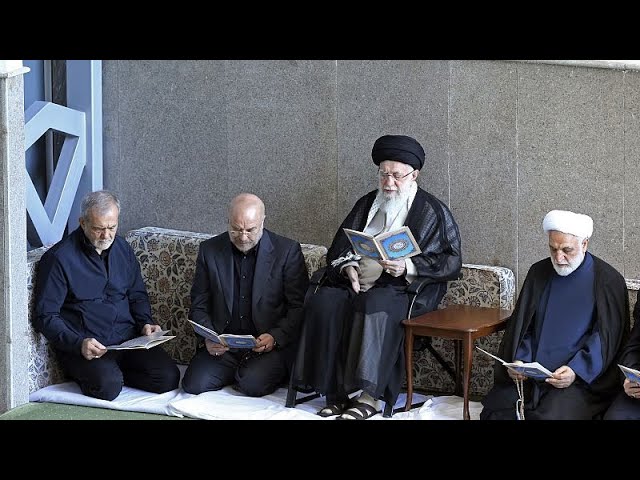

'Unprecedented mass killing': NGOs battle to quantify Iran crackdown scale

-

Seahawks kid Cooper Kupp seeks new Super Bowl memories

Seahawks kid Cooper Kupp seeks new Super Bowl memories

-

Thousands of Venezuelans march to demand Maduro's release

-

AI, manipulated images falsely link some US politicians with Epstein

AI, manipulated images falsely link some US politicians with Epstein

-

Move on, says Trump as Epstein files trigger probe into British politician

-

Arteta backs Arsenal to build on 'magical' place in League Cup final

Arteta backs Arsenal to build on 'magical' place in League Cup final

-

Evil Empire to underdogs: Patriots eye 7th Super Bowl

-

UBS grilled on Capitol Hill over Nazi-era probe

UBS grilled on Capitol Hill over Nazi-era probe

-

Guardiola 'hurt' by suffering caused in global conflicts

-

Marseille do their work early to beat Rennes in French Cup

Marseille do their work early to beat Rennes in French Cup

-

Trump signs spending bill ending US government shutdown

-

Arsenal sink Chelsea to reach League Cup final

Arsenal sink Chelsea to reach League Cup final

-

Leverkusen sink St Pauli to book spot in German Cup semis

-

'We just need something positive' - Monks' peace walk across US draws large crowds

'We just need something positive' - Monks' peace walk across US draws large crowds

-

Milan close gap on Inter with 3-0 win over Bologna

-

No US immigration agents at Super Bowl: security chief

No US immigration agents at Super Bowl: security chief

-

NASA Moon mission launch delayed to March after test

-

Spain to seek social media ban for under-16s

Spain to seek social media ban for under-16s

-

LIV Golf events to receive world ranking points: official

-

US House passes spending bill ending government shutdown

US House passes spending bill ending government shutdown

-

US jet downs Iran drone but talks still on course

-

UK police launching criminal probe into ex-envoy Mandelson

UK police launching criminal probe into ex-envoy Mandelson

-

US-Iran talks 'still scheduled' after drone shot down: White House

-

Chomsky sympathized with Epstein over 'horrible' press treatment

Chomsky sympathized with Epstein over 'horrible' press treatment

-

French prosecutors stick to demand for five-year ban for Le Pen

-

Russia's economic growth slowed to 1% in 2025: Putin

Russia's economic growth slowed to 1% in 2025: Putin

-

Bethell spins England to 3-0 sweep over Sri Lanka in World Cup warm-up

-

Nagelsmann backs Ter Stegen for World Cup despite 'cruel' injury

Nagelsmann backs Ter Stegen for World Cup despite 'cruel' injury

-

Homage or propaganda? Carnival parade stars Brazil's Lula

-

EU must be 'less naive' in COP climate talks: French ministry

EU must be 'less naive' in COP climate talks: French ministry

-

Colombia's Petro meets Trump after months of tensions

-

Air India inspects Boeing 787 fuel switches after grounding

Air India inspects Boeing 787 fuel switches after grounding

-

US envoy evokes transition to 'democratic' Venezuela

-

Syria govt forces enter Qamishli under agreement with Kurds

Syria govt forces enter Qamishli under agreement with Kurds

-

WHO wants $1 bn for world's worst health crises in 2026

-

France summons Musk, raids X offices as deepfake backlash grows

France summons Musk, raids X offices as deepfake backlash grows

-

Four out of every 10 cancer cases are preventable: WHO

-

Sacked UK envoy Mandelson quits parliament over Epstein ties

Sacked UK envoy Mandelson quits parliament over Epstein ties

-

US House to vote Tuesday to end partial government shutdown

-

Eswatini minister slammed for reported threat to expel LGBTQ pupils

Eswatini minister slammed for reported threat to expel LGBTQ pupils

-

Pfizer shares drop on quarterly loss

-

Norway's Kilde withdraws from Winter Olympics

Norway's Kilde withdraws from Winter Olympics

-

Vonn says 'confident' can compete at Olympics despite ruptured ACL

Finance’s Role in Economic Ruin

The finance industry, often hailed as the backbone of modern economies, has a darker side that increasingly threatens global stability. Since the 2008 financial crisis, triggered by reckless speculation in mortgage-backed securities, the sector’s unchecked growth has sown seeds of destruction. In the United States alone, the financial sector’s share of GDP rose from 2.8% in 1950 to 8.4% by 2020, yet it produced no tangible goods, instead profiting from debt and risk. Critics argue this shift diverts capital from productive industries like manufacturing—down from 27% to 11% of US GDP over the same period to speculative bubbles.

The 2023 collapse of Silicon Valley Bank, fuelled by over-leveraged bets on tech stocks, cost $20 billion in bailouts and sparked a domino effect across European markets. In the UK, the 2022 mini-budget crisis, exacerbated by hedge fund short-selling of gilts, pushed borrowing costs to record highs. Economist Ann Pettifor warns, “Finance thrives on instability it creates”. With global debt at $305 trillion—three times world GDP—experts fear the industry’s pursuit of profit through complex derivatives and high-frequency trading could precipitate another crash. Is finance an engine of growth or a wrecking ball?

EU: Austrian elections shake Establishment

EU: Austrian elections shake Establishment

Terrorist state Iran: ‘We are ready to attack Israel again’

EU: Greenpeace warns of dying farms

EU: Tariffs on all Chinese electric Cars

Zelenskyy: ‘What worked in Israel work also in Ukraine’

Electric car crisis: Future of a Audi plant?

Electric car crisis: Future of a Audi plant?

Vladimir Putin, War criminal and Dictator of Russia

EU vs. Hungary: Lawsuit over ‘national sovereignty’ law

Ukraine: Zelenskyy appeals for international aid