-

Vonn to provide injury update as Milan-Cortina Olympics near

Vonn to provide injury update as Milan-Cortina Olympics near

-

France summons Musk for 'voluntary interview', raids X offices

-

US judge to hear request for 'immediate takedown' of Epstein files

US judge to hear request for 'immediate takedown' of Epstein files

-

Russia resumes large-scale strikes on Ukraine in glacial temperatures

-

Fit-again France captain Dupont partners Jalibert against Ireland

Fit-again France captain Dupont partners Jalibert against Ireland

-

French summons Musk for 'voluntary interview' as authorities raid X offices

-

IOC chief Coventry calls for focus on sport, not politics

IOC chief Coventry calls for focus on sport, not politics

-

McNeil's partner hits out at 'brutal' football industry after Palace move collapses

-

Proud moment as Prendergast brothers picked to start for Ireland

Proud moment as Prendergast brothers picked to start for Ireland

-

Germany has highest share of older workers in EU

-

Teen swims four hours to save family lost at sea off Australia

Teen swims four hours to save family lost at sea off Australia

-

Ethiopia denies Trump claim mega-dam was financed by US

-

Russia resumes strikes on freezing Ukrainian capital ahead of talks

Russia resumes strikes on freezing Ukrainian capital ahead of talks

-

Malaysian court acquits French man on drug charges

-

Switch 2 sales boost Nintendo results but chip shortage looms

Switch 2 sales boost Nintendo results but chip shortage looms

-

From rations to G20's doorstep: Poland savours economic 'miracle'

-

Russia resumes strikes on freezing Ukrainian capital

Russia resumes strikes on freezing Ukrainian capital

-

'Way too far': Latino Trump voters shocked by Minneapolis crackdown

-

England and Brook seek redemption at T20 World Cup

England and Brook seek redemption at T20 World Cup

-

Coach Gambhir under pressure as India aim for back-to-back T20 triumphs

-

'Helmets off': NFL stars open up as Super Bowl circus begins

'Helmets off': NFL stars open up as Super Bowl circus begins

-

Japan coach Jones says 'fair' World Cup schedule helps small teams

-

Do not write Ireland off as a rugby force, says ex-prop Ross

Do not write Ireland off as a rugby force, says ex-prop Ross

-

Winter Olympics 2026: AFP guide to Alpine Skiing races

-

Winter Olympics to showcase Italian venues and global tensions

Winter Olympics to showcase Italian venues and global tensions

-

Buoyant England eager to end Franco-Irish grip on Six Nations

-

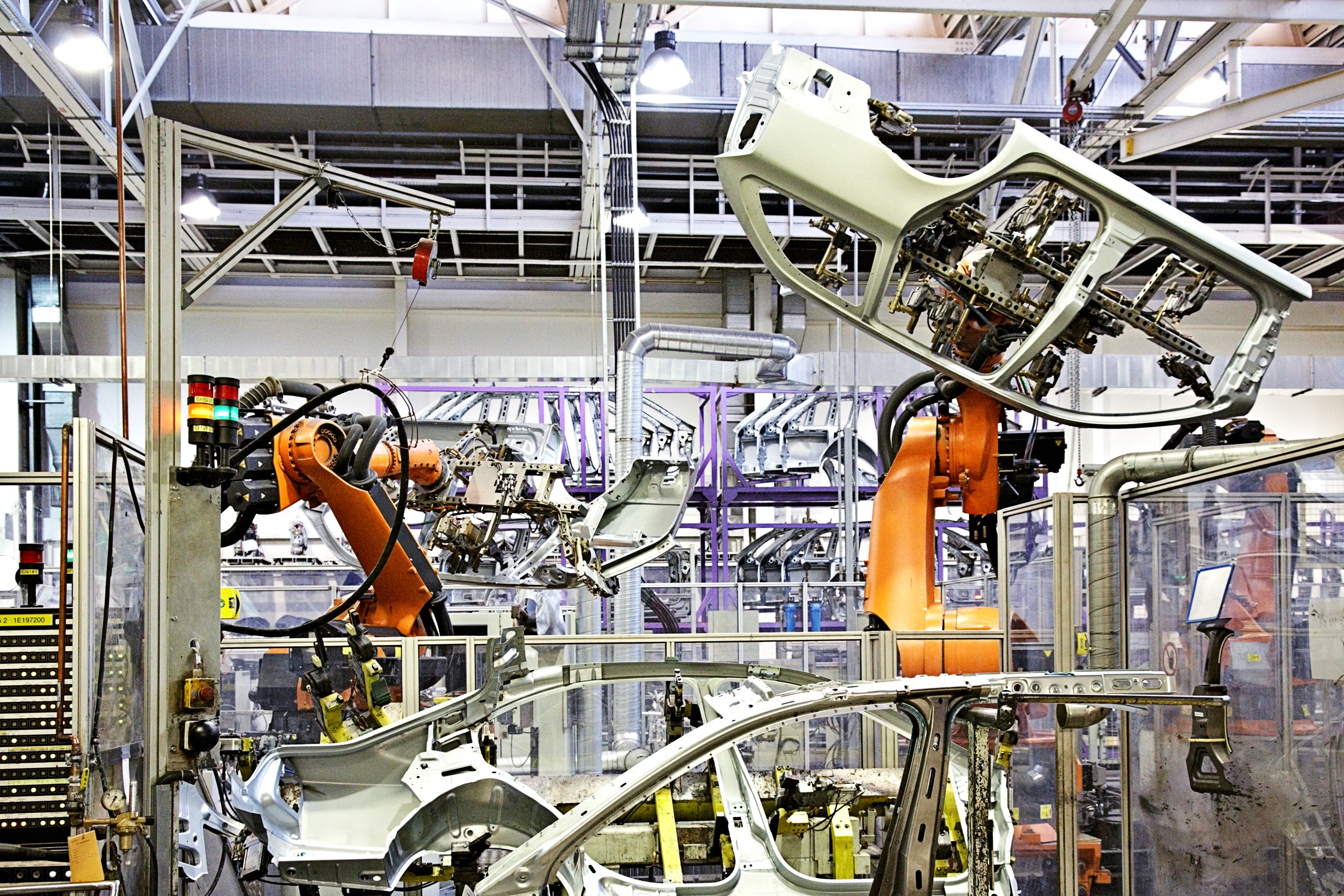

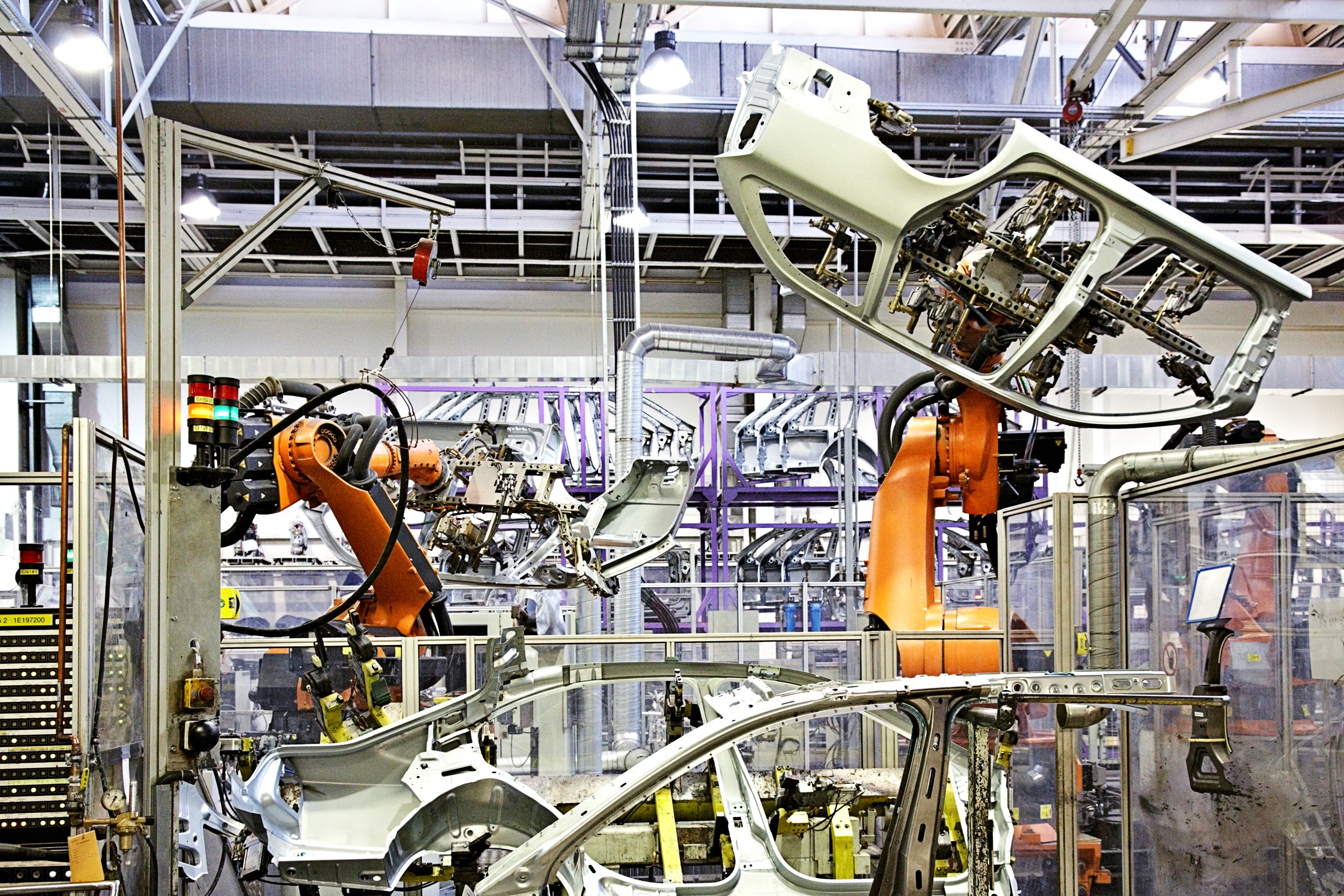

China to ban hidden car door handles in industry shift

China to ban hidden car door handles in industry shift

-

Sengun leads Rockets past Pacers, Ball leads Hornets fightback

-

Waymo raises $16 bn to fuel global robotaxi expansion

Waymo raises $16 bn to fuel global robotaxi expansion

-

Netflix to livestream BTS comeback concert in K-pop mega event

-

Rural India powers global AI models

Rural India powers global AI models

-

Equities, metals, oil rebound after Asia-wide rout

-

Bencic, Svitolina make history as mothers inside tennis top 10

Bencic, Svitolina make history as mothers inside tennis top 10

-

Italy's spread-out Olympics face transport challenge

-

Son of Norway crown princess stands trial for multiple rapes

Son of Norway crown princess stands trial for multiple rapes

-

Side hustle: Part-time refs take charge of Super Bowl

-

Paying for a selfie: Rome starts charging for Trevi Fountain

Paying for a selfie: Rome starts charging for Trevi Fountain

-

Faced with Trump, Pope Leo opts for indirect diplomacy

-

NFL chief expects Bad Bunny to unite Super Bowl audience

NFL chief expects Bad Bunny to unite Super Bowl audience

-

Australia's Hazlewood to miss start of T20 World Cup

-

Bill, Hillary Clinton to testify in US House Epstein probe

Bill, Hillary Clinton to testify in US House Epstein probe

-

Cuba confirms 'communications' with US, but says no negotiations yet

-

From 'watch his ass' to White House talks for Trump and Petro

From 'watch his ass' to White House talks for Trump and Petro

-

Trump says not 'ripping' down Kennedy Center -- much

-

Sunderland rout 'childish' Burnley

Sunderland rout 'childish' Burnley

-

Musk merges xAI into SpaceX in bid to build space data centers

-

Former France striker Benzema switches Saudi clubs

Former France striker Benzema switches Saudi clubs

-

Sunderland rout hapless Burnley

-

Costa Rican president-elect looks to Bukele for help against crime

Costa Rican president-elect looks to Bukele for help against crime

-

Hosts Australia to open Rugby World Cup against Hong Kong

Vossen Capital Management Secures £200 Million in Pre-IPO Investment Commitments

Vossen Capital Management Ltd ("Vossen Capital" or the "Company"), a specialist investment firm focused on fixed income and private market opportunities, announces that it has secured £200 million in committed capital for its Pre-IPO Investment Programme.

LONDON, UK / ACCESS Newswire / January 20, 2026 / Highlights:

£200 million committed to Pre-IPO allocations across technology, healthcare, and sustainable infrastructure sectors

Expanded institutional partner network providing enhanced deal flow access

Strong investor demand driven by track record of successful Pre-IPO placements

Programme offers qualified investors early-stage exposure to growth companies ahead of public listings

The capital commitments have been secured from a combination of institutional investors, family offices, and high-net-worth individuals seeking exposure to private market opportunities typically reserved for venture capital and institutional funds.

Jack Vossen, Head of Private Equity at Vossen Capital, commented:

"This milestone reflects the growing appetite among sophisticated investors for meaningful exposure to private markets. Pre-IPO investments offer a compelling opportunity to participate in the growth trajectory of exceptional companies before they reach public markets at valuations that reward early conviction.

"Our rigorous due diligence process and established relationships with deal originators enable us to identify and secure allocations in high-quality Pre-IPO placements that align with our clients' long-term objectives. We remain committed to delivering institutional-grade access with the transparency and personalised service that defines Vossen Capital."

The Pre-IPO Investment Programme focuses on late-stage private companies demonstrating strong fundamentals, proven business models, and clear pathways to public listing within a 12 to 36-month horizon.

For further information:

Vossen Capital Management Ltd Email: [email protected]

Vossen Capital Management Ltd (LEI: 2138006FBDND9NVSV504, Company No: 04473176) is a London-based investment firm specialising in fixed income, Pre-IPO investments, and private market opportunities. Founded in 2002, the Company provides tailored investment strategies focused on capital preservation, income generation, and long-term growth for sophisticated investors.

Disclaimer:

This announcement is for informational purposes only and does not constitute an offer or solicitation to invest. Pre-IPO investments involve significant risk, including illiquidity and potential loss of capital. Past performance is not indicative of future results.

SOURCE: Vossen Capital Management Ltd

View the original press release on ACCESS Newswire

N.Esteves--PC