-

Trump orders Pentagon to buy coal-fired electricity

Trump orders Pentagon to buy coal-fired electricity

-

Slot hails 'unbelievable' Salah after matching Liverpool assist record

-

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

-

Guardiola eyes rest for 'exhausted' City stars

-

US pushes for 'dramatic increase' in Venezuela oil output

US pushes for 'dramatic increase' in Venezuela oil output

-

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

-

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

-

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

-

Messi out with hamstring strain as Puerto Rico match delayed

Messi out with hamstring strain as Puerto Rico match delayed

-

Kane helps Bayern past Leipzig into German Cup semis

-

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

-

Arsenal stroll in Women's Champions League play-offs

-

Milei labor law reforms spark clashes in Buenos Aires

Milei labor law reforms spark clashes in Buenos Aires

-

Bangladesh's political crossroads: an election guide

-

Bangladesh votes in landmark polls after deadly uprising

Bangladesh votes in landmark polls after deadly uprising

-

US stocks move sideways after January job growth tops estimates

-

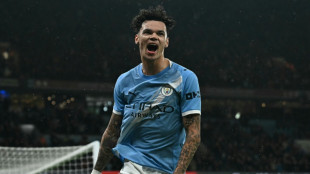

Man City close in on Arsenal with Fulham cruise

Man City close in on Arsenal with Fulham cruise

-

Mike Tyson, healthy eating advocate for Trump administration

-

LA 2028 Olympics backs chief Wasserman amid Epstein uproar

LA 2028 Olympics backs chief Wasserman amid Epstein uproar

-

Brighton's Milner equals Premier League appearance record

-

Seahawks celebrate Super Bowl win with title parade

Seahawks celebrate Super Bowl win with title parade

-

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

-

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

-

Trump tells Israel's Netanyahu Iran talks must continue

-

England to face New Zealand and Costa Rica in pre-World Cup friendlies

England to face New Zealand and Costa Rica in pre-World Cup friendlies

-

'Disgrace to Africa': Students turn on government over Dakar university violence

-

Simon in credit as controversial biathlete wins Olympic gold

Simon in credit as controversial biathlete wins Olympic gold

-

McIlroy confident ahead of Pebble Beach title defense

-

US top official in Venezuela for oil talks after leader's ouster

US top official in Venezuela for oil talks after leader's ouster

-

Ukraine will only hold elections after ceasefire, Zelensky says

-

WHO urges US to share Covid origins intel

WHO urges US to share Covid origins intel

-

TotalEnergies can do without Russian gas: CEO

-

Instagram CEO denies addiction claims in landmark US trial

Instagram CEO denies addiction claims in landmark US trial

-

Israel's Netanyahu pushes Trump on Iran

-

EU leaders push rival fixes to reverse bloc's 'decline'

EU leaders push rival fixes to reverse bloc's 'decline'

-

BMW recalls hundreds of thousands of cars over fire risk

-

Norris quickest in Bahrain as Hamilton calls for 'equal playing field'

Norris quickest in Bahrain as Hamilton calls for 'equal playing field'

-

Colombia election favorite vows US-backed strikes on narco camps

-

French court to rule on July 7 in Marine Le Pen appeal trial

French court to rule on July 7 in Marine Le Pen appeal trial

-

Jones says England clash 'perfect game' for faltering Scotland

-

Norway's ex-diplomat seen as key cog in Epstein affair

Norway's ex-diplomat seen as key cog in Epstein affair

-

Swiatek fights back to reach Qatar Open quarter-finals

-

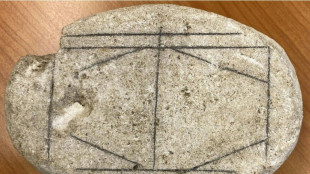

AI cracks Roman-era board game

AI cracks Roman-era board game

-

Motie spins West Indies to victory over England at World Cup

-

NBA bans 4 from Pistons-Hornets brawl, Stewart for 7 games

NBA bans 4 from Pistons-Hornets brawl, Stewart for 7 games

-

Shakira to rock Rio's Copacabana beach with free concert

-

Cyclone batters Madagascar's second city, killing 31

Cyclone batters Madagascar's second city, killing 31

-

Stocks spin wheels despite upbeat US jobs data

-

Arsenal boss Arteta lauds 'extraordinary' Frank after Spurs axe

Arsenal boss Arteta lauds 'extraordinary' Frank after Spurs axe

-

New drones provide first-person thrill to Olympic coverage

US stocks move sideways after January job growth tops estimates

Wall Street stocks moved sideways Wednesday following solid US jobs data that boosted sentiment about the economy but dented prospects for imminent Federal Reserve interest rate cuts.

The US economy added 130,000 jobs last month, the Department of Labor said, more than double the amount expected by analysts. Meanwhile, the jobless rate inched lower to 4.3 percent.

The report comes on the heels of recent data that has raised questions about US economic health.

"There were some investors concerned after yesterday's retail sales that this report would potentially add to some growth worries," said Angelo Kourkafas of Edward Jones. "But I think the solid numbers really alleviated some of these fears."

But the report also means "there is less urgency from the Fed to cut interest rates," Kourkafas said. "This could support the rotation that is happening with the old economy stocks benefiting while we still see some of the lingering disruption worries on the technology space."

The S&P 500 finished flat while both the Dow and Nasdaq ended marginally lower after choppy sessions.

In Europe, London's FTSE 100 gained more than one percent and set a new record high thanks to buoyant commodity prices.

Paris and Frankfurt both ended lower.

Asia's main stock markets closed higher before the US jobs report.

XTB research director Kathleen Brooks noted that the jobs data still raised concerns thanks to an annual revision that was also given Wednesday -- which showed a benchmark reduction of 862,000 positions.

"The revisions suggest there was virtually no jobs growth in the US last year," she said.

In Europe on Wednesday, shares in Heineken climbed 4.2 percent after the Dutch brewer said it would axe 6,000 jobs amid falling beer shipments.

TotalEnergies rose 3.1 percent as the French energy giant announced fresh share buybacks, helping offset news of a 17 percent drop in annual net profit.

Siemens Energy shares jumped 8.4 percent on ballooning profits as AI boosts demand for electricity.

On the downside, Dassault Systemes tumbled 20 percent after the French software group posted lower sales than expected.

Among US companies, Mattel plunged 25 percent after reporting disappointing results.

CEO Ynon Kreiz pointed to disappointing demand in December and said the toymaker's 2026 investments would crimp profits this year but "accelerate growth in top and bottom lines in 2027 and beyond."

- Key figures at around 2115 GMT -

New York - Dow: DOWN 0.1 percent at 50,121.40 (close)

New York - S&P 500: FLAT at 6,941.47 (close)

New York - Nasdaq Composite: DOWN 0.2 percent at 23,066.47 (close)

London - FTSE 100: UP 1.1 percent at 10,472.11 (close)

Paris - CAC 40: DOWN 0.2 percent at 8,313.24 (close)

Frankfurt - DAX: DOWN 0.5 percent at 24,856.15 (close)

Hong Kong - Hang Seng Index: UP 0.3 percent at 27,266.38 (close)

Shanghai - Composite: UP 0.1 percent at 4,131.98 (close)

Tokyo - Nikkei 225: Closed for a holiday

Euro/dollar: DOWN at $1.1874 from $1.1895 on Tuesday

Pound/dollar: DOWN at $1.3628 from $1.3643

Dollar/yen: DOWN at 153.14 yen from 154.39 yen

Euro/pound: DOWN at 87.13 pence from 87.19 pence

Brent North Sea Crude: UP 0.9 percent at $69.40 per barrel

West Texas Intermediate: UP 1.1 percent at $64.63 per barrel

burs-jmb/sla

J.V.Jacinto--PC