-

The banking fraud scandal rattling Brazil's elite

The banking fraud scandal rattling Brazil's elite

-

Party or politics? All eyes on Bad Bunny at Super Bowl

-

Man City confront Anfield hoodoo as Arsenal eye Premier League crown

Man City confront Anfield hoodoo as Arsenal eye Premier League crown

-

Patriots seek Super Bowl history in Seahawks showdown

-

Gotterup leads Phoenix Open as Scheffler struggles

Gotterup leads Phoenix Open as Scheffler struggles

-

In show of support, Canada, France open consulates in Greenland

-

'Save the Post': Hundreds protest cuts at famed US newspaper

'Save the Post': Hundreds protest cuts at famed US newspaper

-

New Zealand deputy PM defends claims colonisation good for Maori

-

Amazon shares plunge as AI costs climb

Amazon shares plunge as AI costs climb

-

Galthie lauds France's remarkable attacking display against Ireland

-

Argentina govt launches account to debunk 'lies' about Milei

Argentina govt launches account to debunk 'lies' about Milei

-

Australia drug kingpin walks free after police informant scandal

-

Dupont wants more after France sparkle and then wobble against Ireland

Dupont wants more after France sparkle and then wobble against Ireland

-

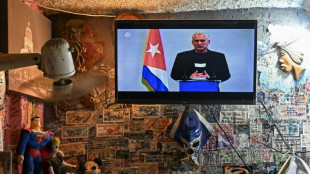

Cuba says willing to talk to US, 'without pressure'

-

NFL names 49ers to face Rams in Aussie regular-season debut

NFL names 49ers to face Rams in Aussie regular-season debut

-

Bielle-Biarrey sparkles as rampant France beat Ireland in Six Nations

-

Flame arrives in Milan for Winter Olympics ceremony

Flame arrives in Milan for Winter Olympics ceremony

-

Olympic big air champion Su survives scare

-

89 kidnapped Nigerian Christians released

89 kidnapped Nigerian Christians released

-

Cuba willing to talk to US, 'without pressure'

-

Famine spreading in Sudan's Darfur, UN-backed experts warn

Famine spreading in Sudan's Darfur, UN-backed experts warn

-

2026 Winter Olympics flame arrives in Milan

-

Congo-Brazzaville's veteran president declares re-election run

Congo-Brazzaville's veteran president declares re-election run

-

Olympic snowboard star Chloe Kim proud to represent 'diverse' USA

-

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

-

Leicester at risk of relegation after six-point deduction

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Trump urges new nuclear treaty after Russia agreement ends

-

'Burned in their houses': Nigerians recount horror of massacre

'Burned in their houses': Nigerians recount horror of massacre

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Emotional reunions, dashed hopes as Ukraine soldiers released

Emotional reunions, dashed hopes as Ukraine soldiers released

-

Bad Bunny promises to bring Puerto Rican culture to Super Bowl

-

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

-

Lower pollution during Covid boosted methane: study

-

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

-

England's Feyi-Waboso in injury scare ahead of Six Nations opener

-

EU defends Spain after Telegram founder criticism

EU defends Spain after Telegram founder criticism

-

Novo Nordisk vows legal action to protect Wegovy pill

-

Swiss rivalry is fun -- until Games start, says Odermatt

Swiss rivalry is fun -- until Games start, says Odermatt

-

Canadian snowboarder McMorris eyes slopestyle after crash at Olympics

-

Deadly storm sparks floods in Spain, disrupts Portugal vote

Deadly storm sparks floods in Spain, disrupts Portugal vote

-

Ukrainian flag bearer proud to show his country is still standing

-

Carney scraps Canada EV sales mandate

Carney scraps Canada EV sales mandate

-

Morocco says evacuated 140,000 people due to severe weather

-

Spurs boss Frank says Romero outburst 'dealt with internally'

Spurs boss Frank says Romero outburst 'dealt with internally'

-

Giannis suitors make deals as NBA trade deadline nears

-

Carrick stresses significance of Munich air disaster to Man Utd history

Carrick stresses significance of Munich air disaster to Man Utd history

-

Record January window for transfers despite drop in spending

-

'Burned inside their houses': Nigerians recount horror of massacre

'Burned inside their houses': Nigerians recount horror of massacre

-

Iran, US prepare for Oman talks after deadly protest crackdown

Paris stocks slide amid French political upheaval, Tokyo soars

Stock markets were mixed Monday as a deepening political crisis in France sent Paris into a tailspin while a new Japanese ruling party leader boosted Tokyo and the AI investment boom lifted US stock indices to fresh heights.

Gold pushed ever closer to $4,000 an ounce as the US government shutdown and expected interest cuts from the Federal Reserve boosted the precious metal's lure.

The euro fell against main rivals and French borrowing costs spiked as Sebastien Lecornu, who had been prime minister for less than a month, resigned just 14 hours after naming a largely unchanged cabinet.

But in another twist, French President Emmanuel held new talks with Lecornu in the evening and gave him two days to reach a plan for the country's "stability", the president's office said.

Paris finished down 1.4 percent. Shares in French banks BNP Paribas, Societe Generale and Credit Agricole all shed more than three percent.

London also dipped but Frankfurt's stock exchange ended the day flat.

On Wall Street, both the S&P 500 and tech-heavy Nasdaq Composite surged to fresh records, after Advanced Micro Devices announced a multi-year partnership with OpenAI to develop AI data centers, sending AMD shares up more than 23 percent.

The OpenAI venture with AMD marks the latest massive deal for the fast-growing artificial intelligence startup that has left markets buzzing.

"Very few questions are being asked about how OpenAI is actually going to pay for this commitment that they're making to AMD," said Steve Sosnick of Interactive Brokers.

"This company has literally hundreds of billions of dollars in commitments, but still only has annualized revenues of about $12 billion," Sosnick said of OpenAI. "The market is taking any piece of news as purely good news."

Tesla also had a good day, rising 5.5 percent on buzz over a possible product launch after Elon Musk's company posted videos teasing a Tuesday announcement.

In Asia, Tokyo surged almost five percent to a record high and the yen sank on bets the new leader of Japan's ruling party will loosen monetary policy to kickstart the economy.

Sanae Takaichi, likely to become Japan's prime minister this month, has previously backed aggressive monetary easing and expanded government spending.

Traders are "enthused by the new Japanese leader, who promises to reignite stimulus to light a fire under the Japanese economy," said Chris Beauchamp, chief market analyst at trading platform IG.

The yen weakened more than one percent against the dollar and hit a record low against the euro.

Yields on 30-year Japanese bonds rose sharply reflecting fears the country's already colossal debt will balloon further.

After her victory Saturday, Takaichi pledged first to implement measures to address inflation and boost Japan's economy, rural areas and primary industries.

"She has said that the Bank of Japan should not raise interest rates, which is feeding demand for stocks and weighing on long term bond yield," said Kathleen Brooks, research director at trading group XTB.

"The decline in the yen is also a sign that the market is pricing out the prospect of BoJ rate hikes this year," she added.

- Key figures at around 2015 GMT -

New York - Dow: DOWN 0.1 percent at 46,694.97 (close)

New York - S&P 500: UP 0.4 percent at 6,740.28 (close)

New York - Nasdaq Composite: UP 0.7 percent at 22,941.67 (close)

London - FTSE 100: DOWN 0.1 percent at 9,479.14 (close)

Paris - CAC 40: DOWN 1.4 percent at 7,971.78 (close)

Frankfurt - DAX: FLAT at 24,378.29 (close)

Tokyo - Nikkei 225: UP 4.8 percent at 47,944.76 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 26,957.77 (close)

Shanghai - Composite: Closed for a holiday

Euro/dollar: DOWN at $1.1713 from $1.1742 on Friday

Pound/dollar: UP at $1.3485 from $1.3480

Dollar/yen: UP at 150.24 yen from 147.47 yen

Euro/pound: DOWN at 86.86 pence from 87.10 pence

West Texas Intermediate: UP 1.3 percent at $61.69 per barrel

Brent North Sea Crude: UP 1.5 percent at $65.47 per barrel

burs-jmb/dw

F.Moura--PC