-

The banking fraud scandal rattling Brazil's elite

The banking fraud scandal rattling Brazil's elite

-

Party or politics? All eyes on Bad Bunny at Super Bowl

-

Man City confront Anfield hoodoo as Arsenal eye Premier League crown

Man City confront Anfield hoodoo as Arsenal eye Premier League crown

-

Patriots seek Super Bowl history in Seahawks showdown

-

Gotterup leads Phoenix Open as Scheffler struggles

Gotterup leads Phoenix Open as Scheffler struggles

-

In show of support, Canada, France open consulates in Greenland

-

'Save the Post': Hundreds protest cuts at famed US newspaper

'Save the Post': Hundreds protest cuts at famed US newspaper

-

New Zealand deputy PM defends claims colonisation good for Maori

-

Amazon shares plunge as AI costs climb

Amazon shares plunge as AI costs climb

-

Galthie lauds France's remarkable attacking display against Ireland

-

Argentina govt launches account to debunk 'lies' about Milei

Argentina govt launches account to debunk 'lies' about Milei

-

Australia drug kingpin walks free after police informant scandal

-

Dupont wants more after France sparkle and then wobble against Ireland

Dupont wants more after France sparkle and then wobble against Ireland

-

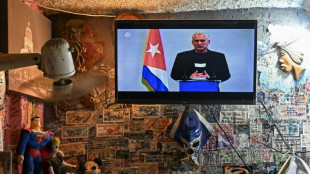

Cuba says willing to talk to US, 'without pressure'

-

NFL names 49ers to face Rams in Aussie regular-season debut

NFL names 49ers to face Rams in Aussie regular-season debut

-

Bielle-Biarrey sparkles as rampant France beat Ireland in Six Nations

-

Flame arrives in Milan for Winter Olympics ceremony

Flame arrives in Milan for Winter Olympics ceremony

-

Olympic big air champion Su survives scare

-

89 kidnapped Nigerian Christians released

89 kidnapped Nigerian Christians released

-

Cuba willing to talk to US, 'without pressure'

-

Famine spreading in Sudan's Darfur, UN-backed experts warn

Famine spreading in Sudan's Darfur, UN-backed experts warn

-

2026 Winter Olympics flame arrives in Milan

-

Congo-Brazzaville's veteran president declares re-election run

Congo-Brazzaville's veteran president declares re-election run

-

Olympic snowboard star Chloe Kim proud to represent 'diverse' USA

-

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

-

Leicester at risk of relegation after six-point deduction

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Trump urges new nuclear treaty after Russia agreement ends

-

'Burned in their houses': Nigerians recount horror of massacre

'Burned in their houses': Nigerians recount horror of massacre

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Emotional reunions, dashed hopes as Ukraine soldiers released

Emotional reunions, dashed hopes as Ukraine soldiers released

-

Bad Bunny promises to bring Puerto Rican culture to Super Bowl

-

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

-

Lower pollution during Covid boosted methane: study

-

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

-

England's Feyi-Waboso in injury scare ahead of Six Nations opener

-

EU defends Spain after Telegram founder criticism

EU defends Spain after Telegram founder criticism

-

Novo Nordisk vows legal action to protect Wegovy pill

-

Swiss rivalry is fun -- until Games start, says Odermatt

Swiss rivalry is fun -- until Games start, says Odermatt

-

Canadian snowboarder McMorris eyes slopestyle after crash at Olympics

-

Deadly storm sparks floods in Spain, disrupts Portugal vote

Deadly storm sparks floods in Spain, disrupts Portugal vote

-

Ukrainian flag bearer proud to show his country is still standing

-

Carney scraps Canada EV sales mandate

Carney scraps Canada EV sales mandate

-

Morocco says evacuated 140,000 people due to severe weather

-

Spurs boss Frank says Romero outburst 'dealt with internally'

Spurs boss Frank says Romero outburst 'dealt with internally'

-

Giannis suitors make deals as NBA trade deadline nears

-

Carrick stresses significance of Munich air disaster to Man Utd history

Carrick stresses significance of Munich air disaster to Man Utd history

-

Record January window for transfers despite drop in spending

-

'Burned inside their houses': Nigerians recount horror of massacre

'Burned inside their houses': Nigerians recount horror of massacre

-

Iran, US prepare for Oman talks after deadly protest crackdown

Stocks, gold steady amid political upheaval

Global stocks steadied Tuesday and gold hovered around a fresh high as investors retreated to safety amid a US government shutdown and French political upheaval.

French shares edged back up while the euro held losses as President Emmanuel Macron called on outgoing Prime Minister Sebastien Lecornu to salvage his administration.

Lecornu, who resigned Monday after under a month in the post, was tasked with gaining cross-party support for a cabinet lineup to pull France out of political deadlock.

London and Frankfurt both rose in midday deals.

Gold hit a fresh peak of $3,977.44 an ounce Tuesday, before slightly paring gains, as investors eyed the US government shutdown, with Republicans and Democrats appearing no closer to an agreement.

Bets on the Federal Reserve cutting interest rates this month and the political crisis in France are adding to the allure of the safe-haven asset.

"The rally in gold is part of the 'debasement' trade," said Kathleen Brooks, research director at trading group XTB.

"This trading theme is driving demand for alternative assets such as gold and crypto, as the dollar faces a long-term decline and fiscal concerns continue to rise around the world," she added.

In Asia, Tokyo eked out another record following the weekend election of a pro-stimulus advocate to lead Japan's ruling party, before paring gains to close flat.

Hong Kong and Shanghai were closed for holidays.

The election of Sanae Takaichi -- expected to become Japan's prime minister this month -- ramped up optimism that she will kick-start the economy through stimulus measures.

That sent the Nikkei 225 soaring almost five percent Monday and hammered the yen as investors began questioning the likelihood that the Bank of Japan will continue its interest rate hikes.

Takaichi's victory "removes uncertainty about the country's policy direction", said Saxo Markets' chief investment strategist, Charu Chanana.

"Her agenda is expected to continue a blend of fiscal support and ultra-easy monetary policy," she added.

Yields on 30-year Japanese bonds hit their highest level, reflecting fears the country's already colossal debt will balloon further.

A series of AI-related deals has fuelled optimism for tech stocks, driving several global markets to fresh highs this year.

The latest was an announcement on Monday by Advanced Micro Devices and OpenAI of a partnership to develop AI data centres, which led the S&P 500 and Nasdaq to surge to fresh records in New York.

While there are growing worries that huge investments in AI by firms have gone too far, OpenAI's Fidji Simo told AFP she did not consider it a bubble.

"I see that as a new normal, and I think the world is going to really switch to realising that computing power is the most strategic resource," said Simo, chief operating officer of OpenAI's applications, including its flagship model ChatGPT.

- Key figures at around 1045 GMT -

London - FTSE 100: UP 0.1 percent at 9,486.53 points

Paris - CAC 40: UP 0.3 percent at 7,997.84

Frankfurt - DAX: UP 0.2 percent at 24,423.68

Tokyo - Nikkei 225: FLAT at 47,950.88 (close)

Hong Kong - Hang Seng Index: Closed for a holiday

Shanghai - Composite: Closed for a holiday

New York - Dow: DOWN 0.1 percent at 46,694.97 (close)

Euro/dollar: DOWN at $1.1674 from $1.1713 on Monday

Pound/dollar: DOWN at $1.3439 from $1.3485

Dollar/yen: UP at 150.75 yen from 150.24 yen

Euro/pound: UP at 86.87 pence from 86.86 pence

Brent North Sea Crude: DOWN 0.2 percent at $65.38 per barrel

West Texas Intermediate: DOWN 0.2 percent at $61.60 per barrel

M.Gameiro--PC