-

The banking fraud scandal rattling Brazil's elite

The banking fraud scandal rattling Brazil's elite

-

Party or politics? All eyes on Bad Bunny at Super Bowl

-

Man City confront Anfield hoodoo as Arsenal eye Premier League crown

Man City confront Anfield hoodoo as Arsenal eye Premier League crown

-

Patriots seek Super Bowl history in Seahawks showdown

-

Gotterup leads Phoenix Open as Scheffler struggles

Gotterup leads Phoenix Open as Scheffler struggles

-

In show of support, Canada, France open consulates in Greenland

-

'Save the Post': Hundreds protest cuts at famed US newspaper

'Save the Post': Hundreds protest cuts at famed US newspaper

-

New Zealand deputy PM defends claims colonisation good for Maori

-

Amazon shares plunge as AI costs climb

Amazon shares plunge as AI costs climb

-

Galthie lauds France's remarkable attacking display against Ireland

-

Argentina govt launches account to debunk 'lies' about Milei

Argentina govt launches account to debunk 'lies' about Milei

-

Australia drug kingpin walks free after police informant scandal

-

Dupont wants more after France sparkle and then wobble against Ireland

Dupont wants more after France sparkle and then wobble against Ireland

-

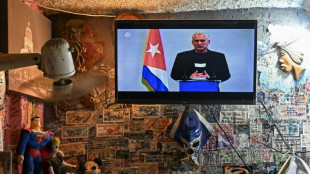

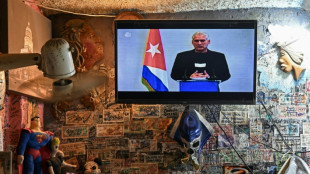

Cuba says willing to talk to US, 'without pressure'

-

NFL names 49ers to face Rams in Aussie regular-season debut

NFL names 49ers to face Rams in Aussie regular-season debut

-

Bielle-Biarrey sparkles as rampant France beat Ireland in Six Nations

-

Flame arrives in Milan for Winter Olympics ceremony

Flame arrives in Milan for Winter Olympics ceremony

-

Olympic big air champion Su survives scare

-

89 kidnapped Nigerian Christians released

89 kidnapped Nigerian Christians released

-

Cuba willing to talk to US, 'without pressure'

-

Famine spreading in Sudan's Darfur, UN-backed experts warn

Famine spreading in Sudan's Darfur, UN-backed experts warn

-

2026 Winter Olympics flame arrives in Milan

-

Congo-Brazzaville's veteran president declares re-election run

Congo-Brazzaville's veteran president declares re-election run

-

Olympic snowboard star Chloe Kim proud to represent 'diverse' USA

-

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

-

Leicester at risk of relegation after six-point deduction

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Trump urges new nuclear treaty after Russia agreement ends

-

'Burned in their houses': Nigerians recount horror of massacre

'Burned in their houses': Nigerians recount horror of massacre

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Emotional reunions, dashed hopes as Ukraine soldiers released

Emotional reunions, dashed hopes as Ukraine soldiers released

-

Bad Bunny promises to bring Puerto Rican culture to Super Bowl

-

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

-

Lower pollution during Covid boosted methane: study

-

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

-

England's Feyi-Waboso in injury scare ahead of Six Nations opener

-

EU defends Spain after Telegram founder criticism

EU defends Spain after Telegram founder criticism

-

Novo Nordisk vows legal action to protect Wegovy pill

-

Swiss rivalry is fun -- until Games start, says Odermatt

Swiss rivalry is fun -- until Games start, says Odermatt

-

Canadian snowboarder McMorris eyes slopestyle after crash at Olympics

-

Deadly storm sparks floods in Spain, disrupts Portugal vote

Deadly storm sparks floods in Spain, disrupts Portugal vote

-

Ukrainian flag bearer proud to show his country is still standing

-

Carney scraps Canada EV sales mandate

Carney scraps Canada EV sales mandate

-

Morocco says evacuated 140,000 people due to severe weather

-

Spurs boss Frank says Romero outburst 'dealt with internally'

Spurs boss Frank says Romero outburst 'dealt with internally'

-

Giannis suitors make deals as NBA trade deadline nears

-

Carrick stresses significance of Munich air disaster to Man Utd history

Carrick stresses significance of Munich air disaster to Man Utd history

-

Record January window for transfers despite drop in spending

-

'Burned inside their houses': Nigerians recount horror of massacre

'Burned inside their houses': Nigerians recount horror of massacre

-

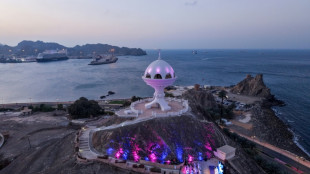

Iran, US prepare for Oman talks after deadly protest crackdown

Gold tops $4,000 for first time as traders pile into safe haven

Gold prices broke $4,000 for the first time Wednesday as investors piled into the safe haven over expectations for US interest rate cuts and worries over the US government shutdown.

The rally in the precious metal also came after concerns that a tech-fuelled rally that has sent some equity markets to record highs may have gone too far, fanning talk of an asset bubble.

Traders have been piling into gold all year, pushing it up more than 50 percent since the turn of the year, on the back of a range of issues including global economic uncertainty, Donald Trump's trade war and geopolitical crises.

Its allure was increased further this week by political turmoil in France, where the country's prime minister resigned and President Emmanuel Macron's former premier urged him to resign and call early elections.

Gold -- long considered a go-to in times of uncertainty -- climbed to a high of $4,006.68 Wednesday, even as the dollar has pushed up against most of its peers in recent days. Silver was also within a few dollars of its own record high.

The closure of parts of the US government is adding to the sense of unease among investors, with key economic data, including on jobs, being postponed and muddying the waters for the Federal Reserve as it tries to decide on its rate plans.

"The rapid rise in gold prices has been supported by rising inflows into (exchange-traded funds) and central bank buying, including solid demand from China, as gold benefits from political, economic, and inflation uncertainty," wrote Taylor Nugent at National Australia Bank.

While gold traders were busy pushing the metal ever higher, equity markets were more subdued in Asia as questions were asked about the hundreds of billions of dollars that have been invested in artificial intelligence.

The AI boom has seen some indexes and companies hit record highs, with chip titan Nvidia topping a $4 trillion valuation.

But a report that software firm Oracle's cloud computing profit margin was much lower than expected sent shivers through trading floors, with all three main indexes on Wall Street falling into the red.

"In a market priced for perfection, any delay in cash flow -- even a temporary one -- feels like the bartender calling 'last call'," wrote Stephen Innes of SPI Asset Management.

"Traders didn't wait for clarification; they simply started easing out of their positions. The Oracle story didn't crash the party, but it definitely sobered it."

Tech firms, which have enjoyed strong buying this year and in recent months, led selling in Asia.

Hong Kong and Taipei were among the biggest losers, while Sydney and Singapore also fell.

Tokyo was marginally higher, helped by lingering optimism that the election of business-friendly conservative Sanae Takaichi as the ruling party's leader will see more stimulus measures and a fresh push for monetary easing.

Wellington, Manila and Jakarta also edged up.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: FLAT at 47,965.29 (break)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 26,764.89

Shanghai - Composite: Closed for a holiday

Euro/dollar: DOWN at $1.1636 from $1.1652 on Tuesday

Pound/dollar: DOWN at $1.3407 from $1.3422

Dollar/yen: UP at 152.39 yen from 151.97 yen

Euro/pound: DOWN at 86.79 pence from 86.83 pence

West Texas Intermediate: UP 0.7 percent at $62.18 per barrel

Brent North Sea Crude: UP 0.6 percent at $65.87 per barrel

New York - Dow: DOWN 0.2 percent at 46,602.98 (close)

London - FTSE 100: UP 0.1 percent at 9,483.58 (close)

E.Raimundo--PC