-

The banking fraud scandal rattling Brazil's elite

The banking fraud scandal rattling Brazil's elite

-

Party or politics? All eyes on Bad Bunny at Super Bowl

-

Man City confront Anfield hoodoo as Arsenal eye Premier League crown

Man City confront Anfield hoodoo as Arsenal eye Premier League crown

-

Patriots seek Super Bowl history in Seahawks showdown

-

Gotterup leads Phoenix Open as Scheffler struggles

Gotterup leads Phoenix Open as Scheffler struggles

-

In show of support, Canada, France open consulates in Greenland

-

'Save the Post': Hundreds protest cuts at famed US newspaper

'Save the Post': Hundreds protest cuts at famed US newspaper

-

New Zealand deputy PM defends claims colonisation good for Maori

-

Amazon shares plunge as AI costs climb

Amazon shares plunge as AI costs climb

-

Galthie lauds France's remarkable attacking display against Ireland

-

Argentina govt launches account to debunk 'lies' about Milei

Argentina govt launches account to debunk 'lies' about Milei

-

Australia drug kingpin walks free after police informant scandal

-

Dupont wants more after France sparkle and then wobble against Ireland

Dupont wants more after France sparkle and then wobble against Ireland

-

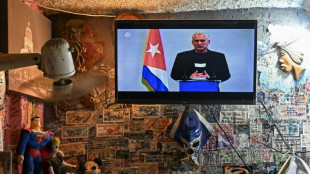

Cuba says willing to talk to US, 'without pressure'

-

NFL names 49ers to face Rams in Aussie regular-season debut

NFL names 49ers to face Rams in Aussie regular-season debut

-

Bielle-Biarrey sparkles as rampant France beat Ireland in Six Nations

-

Flame arrives in Milan for Winter Olympics ceremony

Flame arrives in Milan for Winter Olympics ceremony

-

Olympic big air champion Su survives scare

-

89 kidnapped Nigerian Christians released

89 kidnapped Nigerian Christians released

-

Cuba willing to talk to US, 'without pressure'

-

Famine spreading in Sudan's Darfur, UN-backed experts warn

Famine spreading in Sudan's Darfur, UN-backed experts warn

-

2026 Winter Olympics flame arrives in Milan

-

Congo-Brazzaville's veteran president declares re-election run

Congo-Brazzaville's veteran president declares re-election run

-

Olympic snowboard star Chloe Kim proud to represent 'diverse' USA

-

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

Iran filmmaker Panahi fears Iranians' interests will be 'sacrificed' in US talks

-

Leicester at risk of relegation after six-point deduction

-

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

Deadly storm sparks floods in Spain, raises calls to postpone Portugal vote

-

Trump urges new nuclear treaty after Russia agreement ends

-

'Burned in their houses': Nigerians recount horror of massacre

'Burned in their houses': Nigerians recount horror of massacre

-

Carney scraps Canada EV sales mandate, affirms auto sector's future is electric

-

Emotional reunions, dashed hopes as Ukraine soldiers released

Emotional reunions, dashed hopes as Ukraine soldiers released

-

Bad Bunny promises to bring Puerto Rican culture to Super Bowl

-

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

Venezuela amnesty bill excludes gross rights abuses under Chavez, Maduro

-

Lower pollution during Covid boosted methane: study

-

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

Doping chiefs vow to look into Olympic ski jumping 'penis injection' claims

-

England's Feyi-Waboso in injury scare ahead of Six Nations opener

-

EU defends Spain after Telegram founder criticism

EU defends Spain after Telegram founder criticism

-

Novo Nordisk vows legal action to protect Wegovy pill

-

Swiss rivalry is fun -- until Games start, says Odermatt

Swiss rivalry is fun -- until Games start, says Odermatt

-

Canadian snowboarder McMorris eyes slopestyle after crash at Olympics

-

Deadly storm sparks floods in Spain, disrupts Portugal vote

Deadly storm sparks floods in Spain, disrupts Portugal vote

-

Ukrainian flag bearer proud to show his country is still standing

-

Carney scraps Canada EV sales mandate

Carney scraps Canada EV sales mandate

-

Morocco says evacuated 140,000 people due to severe weather

-

Spurs boss Frank says Romero outburst 'dealt with internally'

Spurs boss Frank says Romero outburst 'dealt with internally'

-

Giannis suitors make deals as NBA trade deadline nears

-

Carrick stresses significance of Munich air disaster to Man Utd history

Carrick stresses significance of Munich air disaster to Man Utd history

-

Record January window for transfers despite drop in spending

-

'Burned inside their houses': Nigerians recount horror of massacre

'Burned inside their houses': Nigerians recount horror of massacre

-

Iran, US prepare for Oman talks after deadly protest crackdown

ECB threatens bank climate change laggards with financial penalties

The European Central Bank on Tuesday threatened to impose financial penalties on banks who are slow to minimise climate change-related risks stemming from their activities.

The ECB, which oversees banks operating in the 20-nation eurozone, warned it would impose "penalty payments" should they fail better to address management of climate-related and environmental (C&E) risk, supervisory board vice-chair Frank Elderson said in a Brussels address.

Noting that "we expect banks to manage C&E risks just like any other material risk they are exposed to," Elderson said that the ECB had found banks were generally lagging in this respect "and we have told those banks to remedy the shortcoming by a certain date and, if they don’t comply, they will have to pay a penalty for every day the shortcoming remains unresolved."

The ECB set a deadline of next year having determined there were major gaps in how the banks were assessing their impact on climate change and banks now face a financial penalty which theoretically could be as much as five percent of daily banking income.

The central bank found that many banks had not delivered in meeting an interim deadline of last March.

The ECB published in 2020 a slew of recommendations regarding bank governance in climate risk terms, including listing the percentage of carbon-related assets in each portfolio.

For Elderson, "failing to adequately manage C&E risks is no longer compatible with sound risk management. Such a failure also increasingly calls into question the fitness and propriety of those in charge of establishing and steering banks’ practices. To manage their own risks, banks need to engage with their customers to gain a deep understanding of how they are being affected by the climate and environmental crises and how they will mitigate and adapt to the consequences.

"By failing to complete a proper materiality assessment, these banks are continuing to turn a blind eye to potential risks on their balance sheet."

A fortnight before the COP28 meeting on the environment, Elderson highlighted uncertainty on "whether we will be able to limit global heating to below the two degrees Celsius mark, let alone 1.5 degrees, which is increasingly out of reach."

Indeed, "the threat of a disastrous scenario in which global heating will far surpass two degrees is very real, said Elderson, concluding that what was required was "meaningful, urgent and effective action that builds on the foundations that have been laid in recent years."

M.A.Vaz--PC